Asia-Pacific Automotive Paint Market, Growth & Forecast, COVID-19 Impact, Industry Trends, By Products Type, Opportunity Company Analysis

Buy NowGet Free Customization in This Report

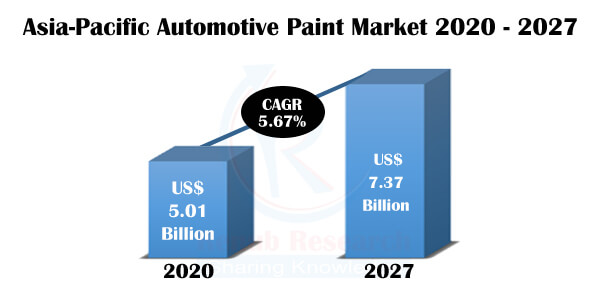

Asia-Pacific economies are surging fast, boosting growth in the demand for many automobiles sector. China is by far the most significant automotive paint market in the Asia-Pacific region, followed by India, and Japan. Automotive paint is a water-based mixture that is sprayed on the surface of automobiles with the help of spray guns. Vehicle coatings that are creative and environmentally friendly are in high demand in the Asia automotive industry. As a result, a shift in consumer preference toward eco-friendly paints over traditional paints is crucial in market expansion. In the market, most eco-friendly paints are water-borne, whereas traditional paints are solvent-borne. The market share of water-borne systems has grown rapidly, owing to their favourable properties, such as mild odour, increased availability, and fast-drying. Furthermore, Powder coating and High-Solid are also receiving widespread attention in industrial research. According to Renub Research, the Asia-Pacific Automotive Paint Market will reach US$ 7.37 Billion by 2027.

The paints are made up of polyurethane-based enamel, which preserves the car's surface from environmental harm while also improving its appearance. Low volatile organic compounds are found in automotive paints (VOCs). In the Asia Pacific, automotive paints are in high demand in the automobile industry due to the reduced exposure to pollutants. In Asia- Pacific, demand for automobiles has fueled the rise of the automotive paints industry. The Asia-Pacific Automotive Paint Market will grow with a CAGR of 5.67 % during 2021-2027.

Automotive paints are generally used to finish a wide range of automobiles for personal, commercial, and industrial use in the Asia-Pacific’s region. Applying paint to a car consists typically of three processes: the primer, the basecoat, and the clear coat. Basecoat is most widely applied as the primary color coat to the surface. In this report, the Asia Pacific automotive paint market is segmented by vehicle type comprised of passenger cars, light commercial vehicles and heavy commercial vehicles. The passenger cars market has witnessed a rise in its revenue among all types due to surging vehicle production, rising disposable income, and purchasing power of consumers.

Asia Pacific automotive paint market is one market, but it is an amalgamation of several markets. China is the most significant part of the Asian market, comprising lion’s market share. China is the world's largest manufacturer of automobiles. However, in 2018, the country's car production fell to 27.8 Million automobiles; due to economic developments and China's trade conflict with the US impact the car industry's performance. Other than China India and Japan are largest markets. The factors which are surging Asia Pacific automotive paint market are the presence of both developed and developing economies. As per our study the Asia-Pacific Automotive Paint Market Size was US$ 5.01 Billion in 2020.

Consumers are adopting advanced coatings to achieve better protection from extreme heat, acid rains, and UV radiation, which are supposed to further expand market. On the flip side, the market is facing various challenges like increased environmental concerns and regulations in India. A slowdown in vehicle production is anticipated to influence the market negatively.

COVID-19 Impact on Automotive Paint Industry of Asia

COVID-19 has harmed the Asia Pacific automotive paint market. As a result of the epidemic, numerous countries in the region went into lockdown, halting all production and building activity, negatively impacting demand in the paints and coatings sector. However, it is projected that the situation would improve in 2021, resuming the market's growth trajectory.

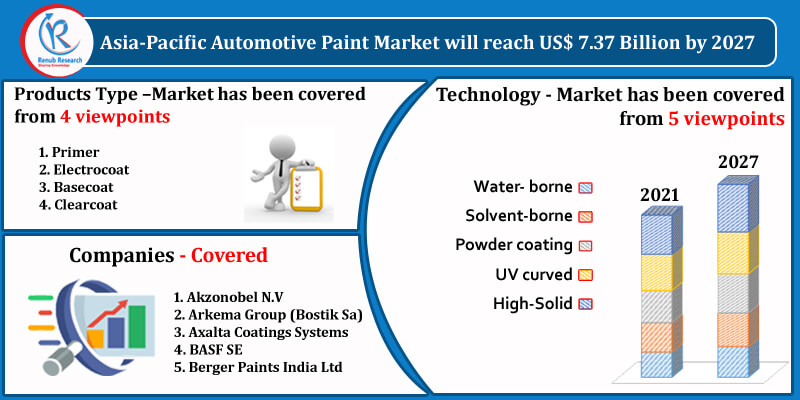

Renub Research report titled “Asia-Pacific Automotive Paint Market” is segmented on the basis of Product type (Primer, Base coat, Electro coat, And Clear coat) Technology type (Water-borne, Solvent-borne, Powder coatings, UV curing, and High solid), Application type (Light, Passenger, Heavy commercial), and countries (India, China, Japan, South Korea, Asian Countries, Australia & New Zealand, and Others)” provides a complete analysis of Asia-Pacific Automotive Paint Industry.

Products Type –Market has been covered from 4 view points

1. Primer

2. Electrocoat

3. Basecoat

4. Clearcoat

Technology - Market has been covered from 5 view points

1. Water- borne

2. Solvent-borne

3. Powder coating

4. UV curved

5. High-Solid

By Application - Market has been covered from 3 view points

1. Light Commercial Vehicle

2. Passenger Car

3. Heavy Commercial Vehicle

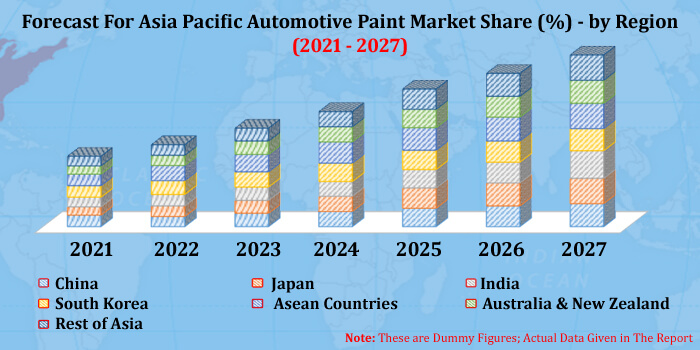

By Region - Market has been covered from 7 view points

1. China

2. Japan

3. India

4. South Korea

5. Asean Countries

6. Australia & New Zealand

7. Rest of Asia

All companies have been covered from 2 view points

• Overview

• Initiatives

Comany Covered in this Report

1. Akzonobel N.V

2. Arkema Group (Bostik Sa)

3. Axalta Coatings Systems

4. BASF SE

5. Berger Paints India Ltd

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Market Drivers

4.2 Challenges

5. Asia Pacific Automotive Paints Market

6. Market Share – Asia Pacific Automotive Paints Market

6.1 By Products Type

6.2 By Technology

6.3 By Application

6.4 By Region

7. Products Type - Asia Pacific Automotive Paints Market

7.1 Primer

7.2 Electrocoat

7.3 Basecoat

7.4 Clearcoat

8. Technology - Asia Pacific Automotive Paints Market

8.1 Water- borne

8.2 Solvent-borne

8.3 Powder coating

8.4 UV curved

8.5 High-Solid

9. Application - Asia Pacific Automotive Paints Market

9.1 Light Commercial Vehicle

9.2 Passenger Car

9.3 Heavy Commercial Vehicle

10. Region - Asia Pacific Automotive Paints Market

10.1 China

10.2 Japan

10.3 India

10.4 South Korea

10.5 Asean Countries

10.6 Australia & New Zealand

10.7 Rest of Asia

11. Company Analysis

11.1 AKZONOBEL N.V

11.1.1 Overview

11.1.2 Initiatives

11.2 ARKEMA GROUP (BOSTIK SA)

11.2.1 Overview

11.2.2 Initiatives

11.3 AXALTA COATINGS SYSTEMS

11.3.1 Overview

11.3.2 Initiatives

11.4 BASF SE.

11.4.1 Overview

11.4.2 Initiatives

11.5 BERGER PAINTS INDIA LTD.

11.5.1 Overview

11.5.2 Initiatives

List Of Figures:

Figure-01: Asia Pacific Automotive Paints Market (Billion US$), 2017 – 2020

Figure-02: Forecast for – Asia Pacific Automotive Paints Market (Billion US$), 2021 – 2027

Figure-03: Product – Primer Market (Million US$), 2017 – 2020

Figure-04: Product – Forecast for Primer Market (Million US$), 2021 – 2027

Figure-05: Product – Electrocoat Market (Million US$), 2017 – 2020

Figure-06: Product – Forecast for Electrocoat Market (Million US$), 2021 – 2027

Figure-07: Product – Basecoat Market (Million US$), 2017 – 2020

Figure-08: Product – Forecast for Basecoat Market (Million US$), 2021 – 2027

Figure-09: Product – Clearcoat Market (Million US$), 2017 – 2020

Figure-10: Product – Forecast for Clearcoat Market (Million US$), 2021 – 2027

Figure-11: Technology – Water - Borne Market (Million US$), 2017 – 2020

Figure-12: Technology – Forecast for Water - Borne Market (Million US$), 2021 – 2027

Figure-13: Technology – Solvent - Borne Market (Million US$), 2017 – 2020

Figure-14: Technology – Forecast for Solvent - Borne Market (Million US$), 2021 – 2027

Figure-15: Technology – Powder Coating Market (Million US$), 2017 – 2020

Figure-16: Technology – Forecast for Powder Coating Market (Million US$), 2021 – 2027

Figure-17: Technology – UV Curved Market (Million US$), 2017 – 2020

Figure-18: Technology – Forecast for UV Curved Market (Million US$), 2021 – 2027

Figure-19: Technology – High - Solid Market (Million US$), 2017 – 2020

Figure-20: Technology – Forecast for High - Solid Market (Million US$), 2021 – 2027

Figure-21: Application – Light Commercial Vehicle Market (Million US$), 2017 – 2020

Figure-22: Application – Forecast for Light Commercial Vehicle Market (Million US$), 2021 – 2027

Figure-23: Application – Passenger Car Market (Million US$), 2017 – 2020

Figure-24: Application – Forecast for Passenger Car Market (Million US$), 2021 – 2027

Figure-25: Application – Heavy Commercial Vehicle Market (Million US$), 2017 – 2020

Figure-26: Application – Forecast for Heavy Commercial Vehicle Market (Million US$), 2021 – 2027

Figure-27: China – Asia Pacific Automotive Paints Market (Million US$), 2017 – 2020

Figure-28: China – Forecast for Automotive Paints Market (Million US$), 2021 – 2027

Figure-29: Japan – Asia Pacific Automotive Paints Market (Million US$), 2017 – 20203

Figure-30: Japan – Forecast for Automotive Paints Market (Million US$), 2021 – 2027

Figure-31: India – Asia Pacific Automotive Paints Market (Million US$), 2017 – 2020

Figure-32: India – Forecast for Automotive Paints Market (Million US$), 2021 – 2027

Figure-33: South Korea – Asia Pacific Automotive Paints Market (Million US$), 2017 – 2020

Figure-34: South Korea – Forecast for Automotive Paints Market (Million US$), 2021 – 2027

Figure-35: ASEAN Countries – Asia Pacific Automotive Paints Market (Million US$), 2017 – 2020

Figure-36: ASEAN Countries – Forecast for Automotive Paints Market (Million US$), 2021 – 2027

Figure-37: Australia & New Zealand – Asia Pacific Automotive Paints Market (Million US$), 2017 – 2020

Figure-38: Australia & New Zealand – Forecast for Asia Pacific Automotive Paints Market (Million US$), 2021 – 2027

Figure-39: Rest of Asia Pacific – Asia Pacific Automotive Paints Market (Million US$), 2017 – 2020

Figure-40: Rest of Asia Pacific – Forecast for Asia Pacific Automotive Paints Market (Million US$), 2021 – 2027

Figure-41: AKZONOBEL N.V – Global Revenue (Million US$), 2017 – 2020

Figure-42: AKZONOBEL N.V – Forecast for Global Revenue (Million US$), 2021 – 2027

Figure-43: ARKEMA GROUP (BOSTIK SA) – Global Revenue (Million US$), 2017 – 2020

Figure-44: ARKEMA GROUP (BOSTIK SA) – Forecast for Global Revenue (Million US$), 2021 – 2027

Figure-45: AXALTA COATINGS SYSTEMS – Global Revenue (Million US$), 2017 – 2020

Figure-46: AXALTA COATINGS SYSTEMS – Forecast for Global Revenue (Million US$), 2021 – 2027

Figure-47: BASF SE – Global Revenue (Million US$), 2017 – 2020

Figure-48: BASF SE – Forecast for Global Revenue (Million US$), 2021 – 2027

Figure-49: BERGER PAINTS INDIA LTD. – Global Revenue (Million US$), 2017 – 2020

Figure-50: BERGER PAINTS INDIA LTD. – Forecast for Global Revenue (Million US$), 2021 – 2027

List Of Tables:

Table-01: Asia Pacific Automotive Paints Market Share by Product (Percent), 2017 – 2020

Table-02: Forecast for – Asia Pacific Automotive Paints Market Share by Product (Percent), 2021 – 2027

Table-03: Asia Pacific Automotive Paints Market Share by Technology (Percent), 2017 – 2020

Table-04: Forecast for – Asia Pacific Automotive Paints Market Share by Technology (Percent), 2021 – 2027

Table-05: Asia Pacific Automotive Paints Market Share by Application (Percent), 2017 – 2020

Table-06: Forecast for – Asia Pacific Automotive Paints Market Share by Application (Percent), 2021 – 2027

Table-07: Asia Pacific Automotive Paints Market Share by Region (Percent), 2017 – 2020

Table-08: Forecast for – Asia Pacific Automotive Paints Market Share by Region (Percent), 2021 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com