United States Automotive Air Suspension Market – Vehicle Trends & Forecast 2025–2033

Buy NowUnited States Automotive Air Suspension Market Size and Forecast 2025-2033

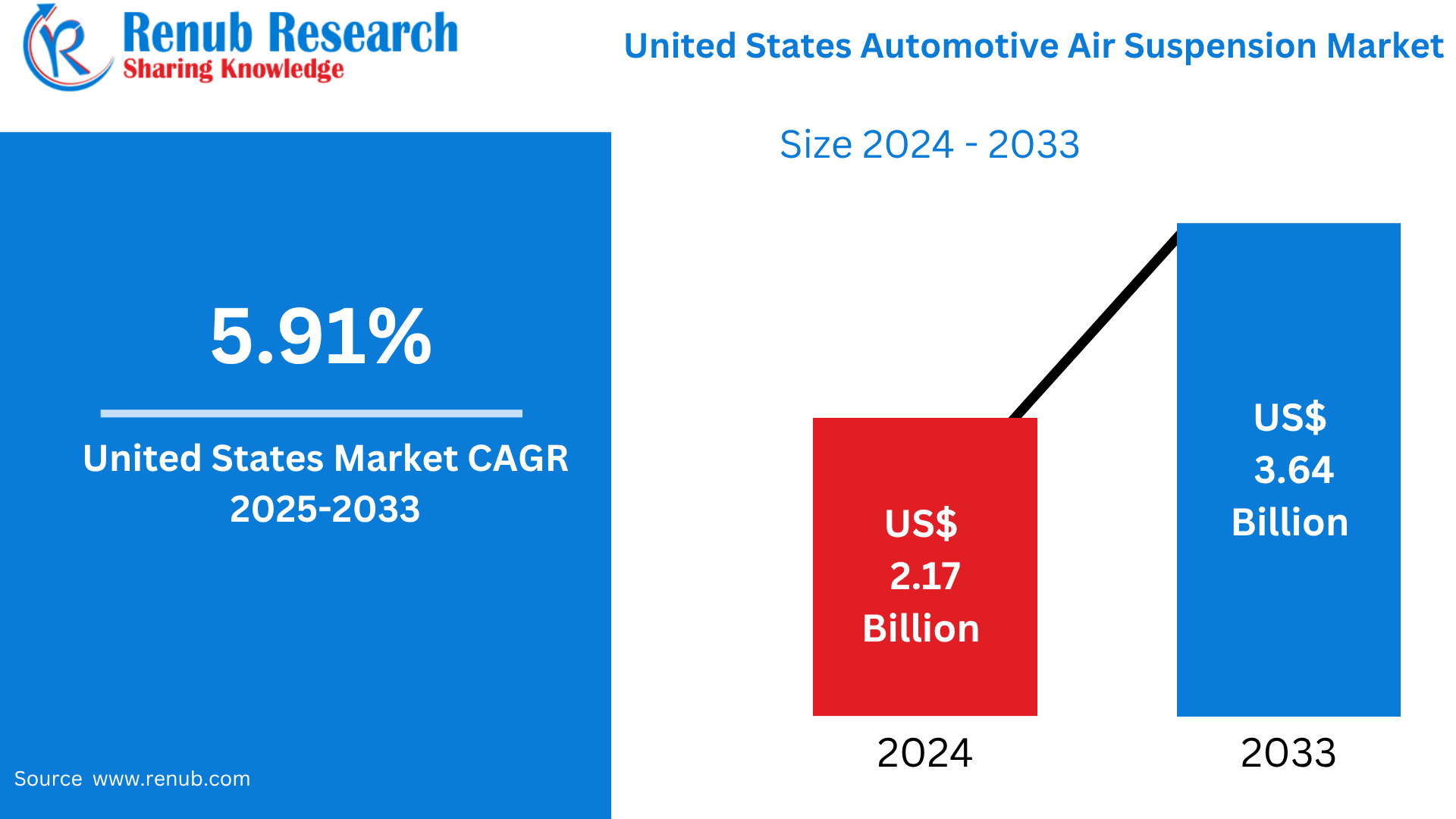

United States Automotive Air Suspension Market is expected to reach US$ 3.64 billion by 2033 from US$ 2.17 billion in 2024, with a CAGR of 5.91% from 2025 to 2033. Rising demand for luxury cars, improvements in air suspension technology, integration with electric and driverless vehicles, the appeal of SUVs, and government incentives for electric vehicles are the main factors propelling the growth of the US automotive air suspension market.

United States Automotive Air Suspension Market Report by Technology (Electronically Controlled Air Suspension, Non-Electronically Controlled Air Suspension), Component (Air Spring, Shock Absorber, Compressor, Electronic Control Module, Tank, Solenoid Valve, Height and Pressure Sensors, Others), Application (Light Commercial Vehicles, Truck, Bus), Sales Channel (Oems, Aftermarket Products) and Company Analysis, 2025-2033.

United States Automotive Air Suspension Market Overview

The desire from consumers for improved vehicle performance and comfort is driving a number of significant developments in the US automotive air suspension system market at the moment. The growing popularity of electric and hybrid cars, which often have lighter and more adaptable suspension systems to maximize performance and efficiency, is a major market driver. Further attractive to buyers looking for cutting-edge features in their cars are more complex air suspension systems that can automatically adapt to changing driving conditions thanks to continuous technological advancements. Aftermarket items have also been more popular recently as more buyers choose to increase the ride quality of their current cars. Manufacturers now have a great chance to appeal to the expanding group of auto enthusiasts who value performance improvements and personalization.

In addition, the US's stricter fuel economy laws are pushing manufacturers to develop and adopt air suspension systems as a practical way to satisfy these requirements, supporting environmental initiatives. As businesses seek to include cutting-edge technologies like linked car technology and Internet of Things capabilities into air suspension settings, cooperation between automakers and IT firms is another noteworthy development. This is in line with the movement toward intelligent automotive systems, where data analytics enhances safety and performance. To keep a competitive advantage in the US market, automakers are probably going to investigate and invest in these cutting-edge technologies as demand keeps rising. Overall, there are many chances for expansion and development in the US automobile air suspension system market due to changing customer preferences and regulatory requirements.

One of the main factors propelling the US automotive air suspension system market has been the rising consumer preference for cars with better handling and ride comfort. More than 70% of buyers place ride comfort as a top priority when buying a car, according to research released by the American Automobile Association (AAA), indicating a strong demand for air suspension systems. In order to satisfy these customer demands, a number of automakers, including Ford and General Motors, are also progressively adding air suspension systems to their inventory. As more buyers choose luxury cars with cutting-edge suspension systems that improve overall driving comfort, this trend is anticipated to have a beneficial impact on market expansion.

Key Factors Driving the United States Automotive Air Suspension Market Growth

Advancements in Air Suspension Technology

The expansion of the vehicle air suspension market in the United States has been greatly impacted by recent developments in air suspension technology. By enabling real-time ride height and damping adjustments based on road conditions and driving modes, innovations like electrically controlled systems enhance handling, comfort, and safety. By automatically adjusting to load weight, these systems can improve passenger comfort and vehicle performance. Vehicles with air suspension now operate more efficiently and consume less fuel because to the use of lightweight materials, which also lowers the system weight overall. These cutting-edge technologies are becoming more widely available in both luxury and mid-range automobiles as production costs come down. The market is expanding and usage is growing as a result of this technical advancement.

Integration with Electric and Autonomous Vehicles

Air suspension systems are becoming more and more popular in the US market as a result of the rising trend toward electric and driverless cars. Because of the location of their batteries, electric vehicles (EVs) sometimes have unusual weight distributions, necessitating flexible suspension systems to maintain ride comfort and vehicle balance. The exact flexibility required to preserve stability and maximize performance is provided by air suspension systems. These technologies are increasingly more important in driverless cars, where a smooth ride improves passenger safety and comfort. They are also perfect for inclusion in next-generation cars because to their interoperability with cutting-edge driver-assistance technology. The need for high-performance, adaptable suspension systems is growing along with the EV and driverless car industries.

Increasing Popularity of SUVs and Crossovers

One of the main factors propelling the air suspension industry in the US is the growing customer desire for SUVs and crossover cars. The performance improvements offered by air suspension systems are particularly advantageous for these vehicle types, which are preferred for their roominess, road visibility, and adaptability. In bigger cars, air suspension improves the driving and passenger experience with features including load management, handling, and ride height adjustment. Additionally, it offers improved highway driving aerodynamics and off-road performance. Air suspension is becoming more and more common as a standard or optional feature in modern cars as manufacturers work to increase comfort and usefulness, which is driving up demand for the product and the market as a whole.

Challenges in the United States Automotive Air Suspension Market

Limited Penetration in Budget and Mass-Market Vehicles

Air suspension systems are becoming more common in high-end and high-performance cars, although they are still mostly missing from mass-market and low-cost models. Their use in lower-cost cars, where profit margins are narrower and consumers are more price sensitive, is limited by the comparatively high production and integration costs. Because of this, air suspension is sometimes seen as a luxury feature, which restricts its use to particular car types including SUVs, trucks, and high-end cars. Air suspension technology could find it difficult to expand its market reach in the absence of affordable and scalable mass-market deployment alternatives. In order to assure affordability and practicality, producers will need to innovate and optimize costs in order to expand their presence across various pricing tiers.

Market Competition from Alternative Technologies

Alternative suspension technologies that provide comparable performance advantages at a lower cost and complexity are becoming a bigger threat to air suspension systems. Without the need for complicated control units or pressurized air, options like magnetic ride control, multi-link systems, and adaptive dampers offer improved handling and comfort. These substitutes are frequently less expensive, simpler to maintain, and already included in a variety of automobiles, even mid-range ones. These technologies are becoming even more appealing to customers and automakers as manufacturers continue to improve them. Unless distinct cost or performance benefits are discovered and successfully conveyed to the wider market, this increasing competition may cause the market share of air suspension systems to decline.

Market Segmentations

Technology

- Electronically Controlled Air Suspension

- Non-Electronically Controlled Air Suspension

Component

- Air Spring

- Shock Absorber

- Compressor

- Electronic Control Module

- Tank

- Solenoid Valve

- Height and Pressure Sensors

- Others

Application

- Light Commercial Vehicles

- Truck

- Bus

Sales Channel

- Oems

- Aftermarket Products

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Hitachi, Ltd.

- AB Volvo

- Continental AG

- ThyssenKrupp AG

- Wabco Holdings Inc.

- Dunlop Systems and Components Ltd.

- Accuair Suspension

- Firestone Industrial Products Company, LLC

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Technology,By Component, By Application and By Sales Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Automotive Air Suspension Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Technology

6.2 By Component

6.3 By Application

6.4 By Sales Channel

7. Technology

7.1 Electronically Controlled Air Suspension

7.2 Non-Electronically Controlled Air Suspension

8. Component

8.1 Air Spring

8.2 Shock Absorber

8.3 Compressor

8.4 Electronic Control Module

8.5 Tank

8.6 Solenoid Valve

8.7 Height and Pressure Sensors

8.8 Others

9. Application

9.1 Light Commercial Vehicles

9.2 Truck

9.3 Bus

10. Sales Channel

10.1 Oems

10.2 Aftermarket Products

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Hitachi, Ltd. (Japan)

13.1.1 Overviews

13.1.2 Key Persons

13.1.3 Recent Developments

13.1.4 Revenues

13.2 AB Volvo (Sweden)

13.2.1 Overviews

13.2.2 Key Persons

13.2.3 Recent Developments

13.2.4 Revenues

13.3 Continental AG (Germany)

13.3.1 Overviews

13.3.2 Key Persons

13.3.3 Recent Developments

13.3.4 Revenues

13.4 ThyssenKrupp AG (Germany)

13.4.1 Overviews

13.4.2 Key Persons

13.4.3 Recent Developments

13.4.4 Revenues

13.5 Wabco Holdings Inc. (France)

13.5.1 Overviews

13.5.2 Key Persons

13.5.3 Recent Developments

13.5.4 Revenues

13.6 Dunlop Systems and Components Ltd. (U.K.)

13.6.1 Overviews

13.6.2 Key Persons

13.6.3 Recent Developments

13.6.4 Revenues

13.7 Accuair Suspension (U.S.)

13.7.1 Overviews

13.7.2 Key Persons

13.7.3 Recent Developments

13.7.4 Revenues

13.8 Firestone Industrial Products Company, LLC (U.S.)

13.8.1 Overviews

13.8.2 Key Persons

13.8.3 Recent Developments

13.8.4 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com