Global Automotive Paint Market Size, Share & Forecast 2025–2033

Buy NowGlobal Automotive Paints Market Size

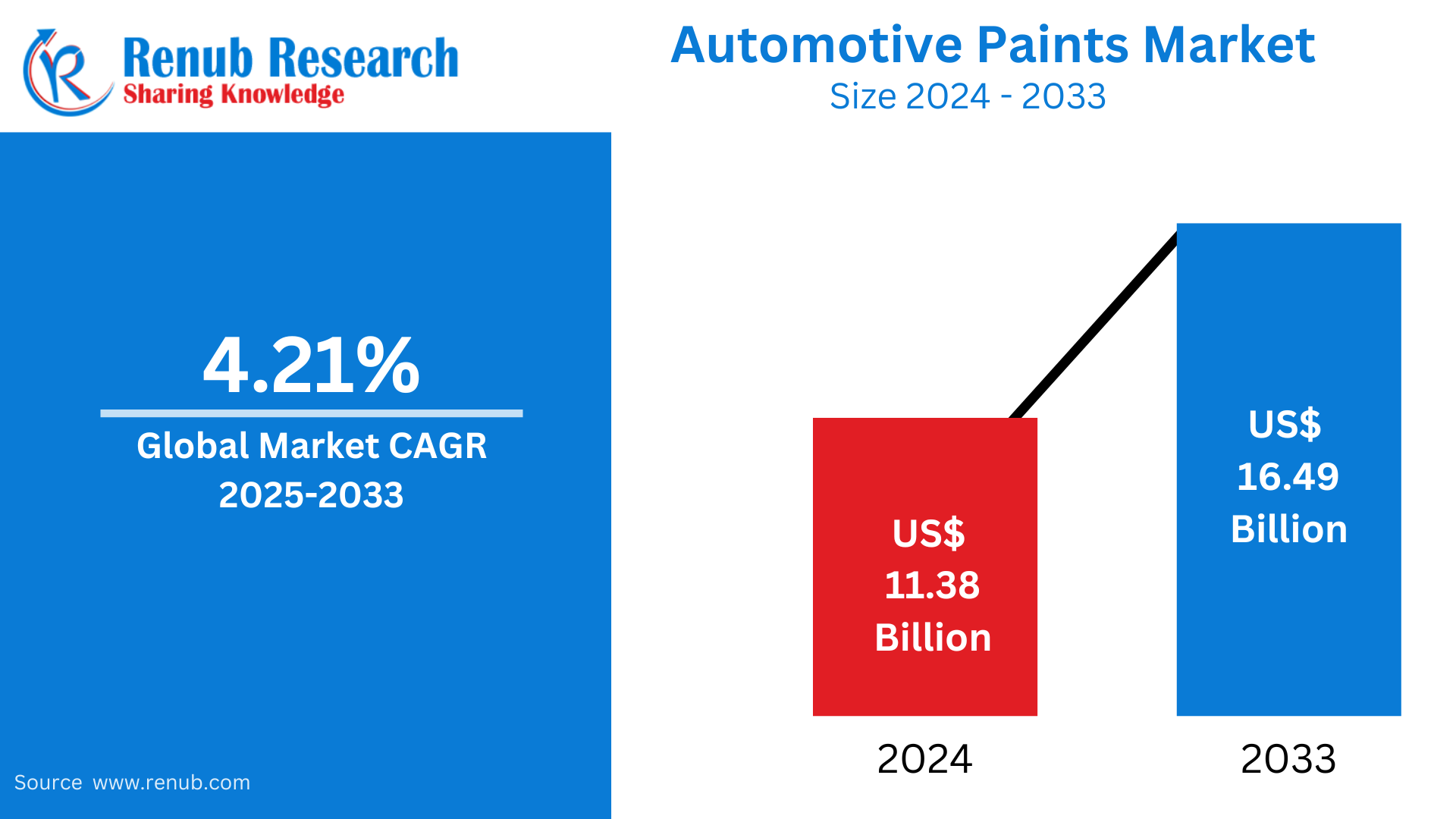

Automotive Paints market is expected to reach US$ 16.49 billion in 2033 from US$ 11.38 billion in 2024, with a CAGR of 4.21% from 2025 to 2033. The market is anticipated to develop due to factors including the growing demand for cars and the use of environmentally friendly paints.

Automotive Paint Market Overview

The automotive paints market is expected to be driven by rising passenger and commercial vehicle production volumes over the course of the forecast period. In the coming years, it is projected that the automotive paints market will continue to grow due to rising customer preferences for vehicles with a genuine aesthetic finish, rich texture, and glossy look, as well as increased individual income and enhanced consumer lifestyle.

Promising opportunities for the automotive paints market are anticipated during the forecast period as a result of OEMs' increased investments in developing automotive paints, which are anticipated to reduce the negative environmental impact caused by volatile emissions from certain types of automotive paints. For instance, two significant companies that focus on coatings and adhesives, Sirrus Inc. and BASF Group, have decided to create a new class of high-performance automobile coatings that are backed by methylene malonate technology.

However, solvents like toluene found in some types of automotive paints release volatile organic compounds (VOCs) that are bad for the environment. A few nations' governments have put restrictions on the amount of volatile organic compounds (VOCs) that these paints can emit. This is frequently anticipated to impede the growth of the automotive paints market over the course of the forecast period. Additionally, solvent-based paints run the risk of being internally replaced by environmentally friendly water-based paints. This is frequently expected to limit the growth of the automotive paints market to some degree over the course of the forecast time.

Growth Drivers of the Global Automotive Paint Market

Growth of Electric and Autonomous Vehicles

The market for automotive paint is being greatly impacted by the rise of electric and driverless vehicles (EVs). Advanced, high-performance automobile paints are becoming more and more necessary as EV demand increases and automakers prioritize quality, personalization, and aesthetics. These cars need coatings that provide durability, scratch resistance, and environmental protection in addition to improving their beauty. Furthermore, specialty finishes including matte, metallic, and pearlescent coatings are frequently required due to the distinctive body shapes of electric and driverless vehicles. The emphasis on high-end amenities in EVs increases demand for premium paints. Furthermore, the demand for distinctive, eye-catching coatings will only increase due to the anticipated inventive, futuristic designs of autonomous vehicles, making the automotive paint industry an essential component of the EV revolution.

Growing Disposable Income and Luxury Vehicle Sales

The market for luxury cars is rising due to rising disposable income, especially in emerging economies. This is raising the need for premium automotive paints. Customers are more likely to spend in luxury vehicles, which frequently ask for specialized and aesthetically pleasing coatings, as their purchasing power increases. To increase their visual attractiveness and uniqueness, luxury cars are frequently customized with distinctive paint finishes like metallic, matte, or multi-layered coatings. In nations like China, India, and Brazil, where a growing middle class is driving up sales of luxury cars, this tendency is especially noticeable. The market for cutting-edge, long-lasting, and high-performance automobile paints is predicted to keep growing as consumers' preferences for luxury and customized vehicles rise.

Improved Durability and Performance

The market for automobile paint is expanding due in large part to improved performance and durability. Contemporary car coatings provide improved defense against environmental elements like UV radiation, chemicals, and severe weather, as well as scratches, chipping, and fading. These developments in paint technology guarantee that car surfaces stay immaculate for extended periods of time, saving customers money on upkeep and repairs. Furthermore, there has been a noticeable increase in interest in high-performance paints that offer improved lifespan and coverage without sacrificing appearance. In premium, luxury, and electric vehicles, where paint longevity and beauty are crucial, there is an especially high demand for long-lasting, robust coatings. The market for long-lasting vehicle coatings is still growing as consumers look for high-quality, low-maintenance finishes.

Challenges in the Automotive Paints Industry

Technological Challenges in Paint Application

One major obstacle facing the automobile paint sector is the technological difficulties associated with paint application. It takes precise application procedures to achieve consistent, high-quality finishes, especially for sophisticated coatings like metallic, matte, and pearlescent. Environmental factors like temperature and humidity variations can have an impact on the paint's final look, leading to flaws like uneven shine or poor adherence. Furthermore, for correct application, the intricacy of contemporary vehicle finishes necessitates sophisticated, frequently costly equipment and experienced labor. Implementing new technologies, including self-healing and scratch-resistant coatings, can be expensive because they call for specific methods and equipment. Furthermore, making sure that paint coats cure evenly and correctly adds even another level of difficulty to the procedure. In order to match the increasing demands of consumers, producers must continue to invest in research, equipment, and training due to these technological obstacles.

Competition from Alternative Coatings

The market for automotive paint is severely challenged by competition from alternative coatings including powder coatings and electrocoating. These substitutes provide a number of benefits, such as increased durability, decreased environmental impact, and increased efficiency. While powder coatings are solvent-free, lowering volatile organic compounds (VOCs) and providing improved durability and scratch resistance, electrocoating (e-coating) offers superior corrosion resistance and uniform coverage, especially for vehicle chassis. These alternative technologies are becoming more popular as manufacturers and customers place a higher priority on sustainability, which may lower the market for conventional automotive paints. The rivalry is getting fiercer as advancements in these substitute coatings make them more affordable and adaptable. In order to preserve their market share, auto paint makers must adjust by making investments in environmentally friendly products, enhancing performance, and providing distinctive finishes.

The need for automotive paint is expected to rise as passenger car sales increase

The passenger vehicles section anticipates a boom in the automotive paint market. Increasing urbanization, growing disposable income, and enhancing living requirements pressure the need for private transportation. Technological advancements in automotive layout and production also enhance vehicle aesthetics, prompting better paint usage. Moreover, purchaser possibilities for custom-designed colorings and precise finishes contribute to the section's expansion.

Waterborne coating dominates the global auto paint market

Global automotive paint is segmented into waterborne, solvent-borne, and powder coatings by technology. Waterborne coating leads the market with a significant sales share due to its capability to guard automobiles against numerous weather conditions and tremendous cost reduction. In addition, waterborne technology offers lower temperature processing, excessive chemical resistance, and solvent-free practice of coatings. On the other hand, powder coating provides a precise film thickness that enables them to rectify inappropriately lined regions. This makes powder coating a preferred desire for huge stop-use packages. Also, the enterprise individuals comply with the appealing features of paints.

Clear coat is famous in the automotive paint market

Rising demand for an exceptional gloss finish and attractive exterior appearance on advanced and luxurious vehicles positively induces the demand for automotive clearcoats. Further, temperature fluctuation and long-term protection from micro scratches are projected to drive the demand for clearcoats in the automotive section. However, the market for electrocoats captures a significant revenue share and is expected to propel prominently during the forecast period. Electrocoats like cathodic epoxy, anodic acrylic, and cathodic acrylic are popular among market players due to their benefits. They make vehicle surfaces more durable and weather-resistant.

Market Overview by Regions

By countries, the global automotive paints market is divided into North America (United States and Canada), Europe (Germany, United Kingdom, France, Italy, Spain, Switzerland), Asia Pacific (Japan, China, India, Australia, South Korea, Indonesia), Latin America (Mexico, Brazil, Argentina), Middle East & Africa (South Africa, Saudi Arabia, United Arab Emirates) and Rest of world.

United States Automotive Paints Market

The growing production of automobiles, consumer desire for personalized finishes, and developments in paint technology are all contributing factors to the growth of the US automotive paint market. The market gains from consumers' desire for distinctive, high-end paint options like metallic, matte, and multi-layered coatings as well as emerging trends in vehicle aesthetics. Furthermore, in response to strict environmental restrictions, the move toward ecologically friendly paints—such as low-VOC and water-based formulations—is encouraging the use of sustainable goods. The industry is also growing as a result of the rise in driverless vehicles and electric vehicles (EVs), which frequently have cutting-edge designs and specialized coatings. Demand is also met by the aftermarket sector, which is fueled by auto repairs, customizations, and refurbishment. The market is expected to continue growing in spite of obstacles including shifting raw material prices.

United Kingdom Automotive Paint Market

The market for automotive paint in the UK is expanding steadily due to improvements in paint technology and rising consumer desire for premium, personalized car finishes. Premium coatings like metallic, pearlescent, and matte are growing in popularity as car owners hunt for unique looks. Furthermore, in response to strict environmental restrictions, eco-friendly paint solutions, such as water-based and low-VOC paints, are becoming more and more popular as environmental sustainability gains more attention. The rise of luxury and electric cars, which frequently call for specific, long-lasting coatings, is another factor driving the industry. Additionally, the aftermarket industry, which is fueled by auto repairs and modifications, is quite important. It is anticipated that the UK automotive paint market would keep growing in spite of obstacles including shifting raw material prices and supply chain interruptions.

China Automotive Paints Market

The automotive paint market in the United Arab Emirates (UAE) is growing, fueled by a rising demand for high-quality, durable, and aesthetically appealing vehicle finishes. As consumers in the UAE increasingly prioritize vehicle customization, premium coatings such as metallic, pearlescent, and matte finishes are becoming more popular. Additionally, the expansion of the luxury and electric vehicle segments is driving the need for specialized, high-performance paints. The market is also benefiting from growing environmental concerns, with a shift towards eco-friendly solutions like water-based and low-VOC paints, in line with stricter regulations. The UAE's robust automotive aftermarket sector, including car repairs, refinishing, and customizations, further supports market growth. Despite challenges like raw material price volatility and supply chain disruptions, the UAE automotive paint market is poised for continued expansion.

United Arab Emirates Automotive Paints Market

The growing demand for premium, long-lasting, and visually pleasing vehicle coatings is driving the growth of the automotive paint industry in the United Arab Emirates (UAE). Premium coatings including metallic, pearlescent, and matte finishes are growing in popularity as UAE consumers place a higher value on personalizing their cars. Furthermore, the need for specialty, high-performance paints is being driven by the growth of the luxury and electric vehicle markets. Growing environmental concerns and a move toward eco-friendly alternatives, such as water-based and low-VOC paints, in response to tightening laws are also helping the industry. Market expansion is further supported by the UAE's thriving automotive aftermarket industry, which includes auto repairs, refinishing, and customizations. The UAE automotive paint industry is expected to grow further in spite of obstacles such supply chain interruptions and fluctuations in raw material prices.

Market Segmentation

Vehicle Types – Market breakup in 3 viewpoints:

1. Passenger cars

2. Light commercial vehicles

3. Heavy commercial vehicles

Technology – Market breakup in 3 viewpoints:

1. Waterborne

2. Solvent-borne

3. Powder coatings

Paint Types – Market breakup in 4 viewpoints:

1. Primer

2. Base Coat

3. Clear Coat

4. Electrocoat

Regional Analysis

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Switzerland

Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Australia

Latin America

4.1 Mexico

4.2 Brazil

4.3 Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

Rest of World

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

- PPG Industries

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- The Sherwin Williams Company

- Kansai Paints Co. Ltd.

- DuPont de Nemours Inc

- Solvay S.A

- Cabot Corporation

- Covestro AG

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Vehicle Types, Technology, Paint Types, and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size and growth rate of the global automotive paints market from 2025 to 2033?

-

What are the main drivers fueling the demand for automotive paints globally?

-

How are electric and autonomous vehicles impacting the automotive paints market?

-

Which paint technologies (waterborne, solvent-borne, powder coatings) are gaining the most traction and why?

-

What challenges are associated with the application of automotive paints?

-

How are environmental regulations influencing the adoption of eco-friendly paint solutions?

-

Which vehicle segment (passenger cars, LCVs, HCVs) contributes most to the market demand?

-

What types of paints (primer, base coat, clear coat, electrocoat) are leading the market and why?

-

Which regions or countries are dominating the automotive paints market?

-

How are aftermarket automotive paint demands shaping market opportunities?

-

What role do luxury and customized vehicles play in the premium paint segment?

-

How are alternative coatings like electrocoats and powder coatings affecting traditional paint markets?

-

What key innovations or R&D activities are being pursued by major automotive paint companies?

-

What are the major challenges related to raw material price volatility and supply chain in this market?

-

Who are the leading players in the global automotive paints market, and what are their strategies?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Automotive Paint Market

6. Market Share

6.1 By Vehicle Types

6.2 By Technology

6.3 By Paint Types

6.4 By Countries

7. Vehicle Types

7.1 Passenger Cars

7.2 Light Commercial Vehicle

7.3 Heavy Commercial Vehicle

8. Technology

8.1 Waterborne Coatings

8.2 Solvent Borne Coatings

8.3 Powder Coatings

9. Paint Types

9.1 Primer

9.2 Base Coat

9.3 Clear Coat

9.4 Electrocoat

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 United Kingdom

10.2.3 France

10.2.4 Italy

10.2.5 Spain

10.2.6 Switzerland

10.3 Asia Pacific

10.3.1 Japan

10.3.2 China

10.3.3 India

10.3.4 South Korea

10.3.5 Indonesia

10.3.6 Australia

10.4. Latin America

10.4.1 Mexico

10.4.2 Brazil

10.4.3 Argentina

10.5. Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

10.6 Rest of World

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 PPG Industries

13.1.1 Overviews

13.1.2 Recent Development

13.1.3 Revenues

13.2 Akzo Nobel N.V.

13.2.1 Overviews

13.2.2 Recent Development

13.2.3 Revenues

13.3 Axalta Coating Systems Ltd.

13.3.1 Overviews

13.3.2 Recent Development

13.3.3 Revenues

13.4 The Sherwin Williams Company

13.4.1 Overviews

13.4.2 Recent Development

13.4.3 Revenues

13.5 Kansai Paints Co. Ltd.

13.5.1 Overviews

13.5.2 Recent Development

13.5.3 Revenues

13.6 DuPont de Nemours Inc

13.6.1 Overviews

13.6.2 Recent Development

13.6.3 Revenues

13.7 Solvay S.A

13.7.1 Overviews

13.7.2 Recent Development

13.7.3 Revenues

13.8 Cabot Corporation

13.8.1 Overviews

13.8.2 Recent Development

13.8.3 Revenues

13.9 Covestro AG

13.9.1 Overviews

13.9.2 Recent Development

13.9.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com