Global Mine Detection System Market Size and Growth Trends and Forecast Report and Companies Analysis 2025-2033

Buy NowMine Detection System Market Size and Forecast 2025-2033

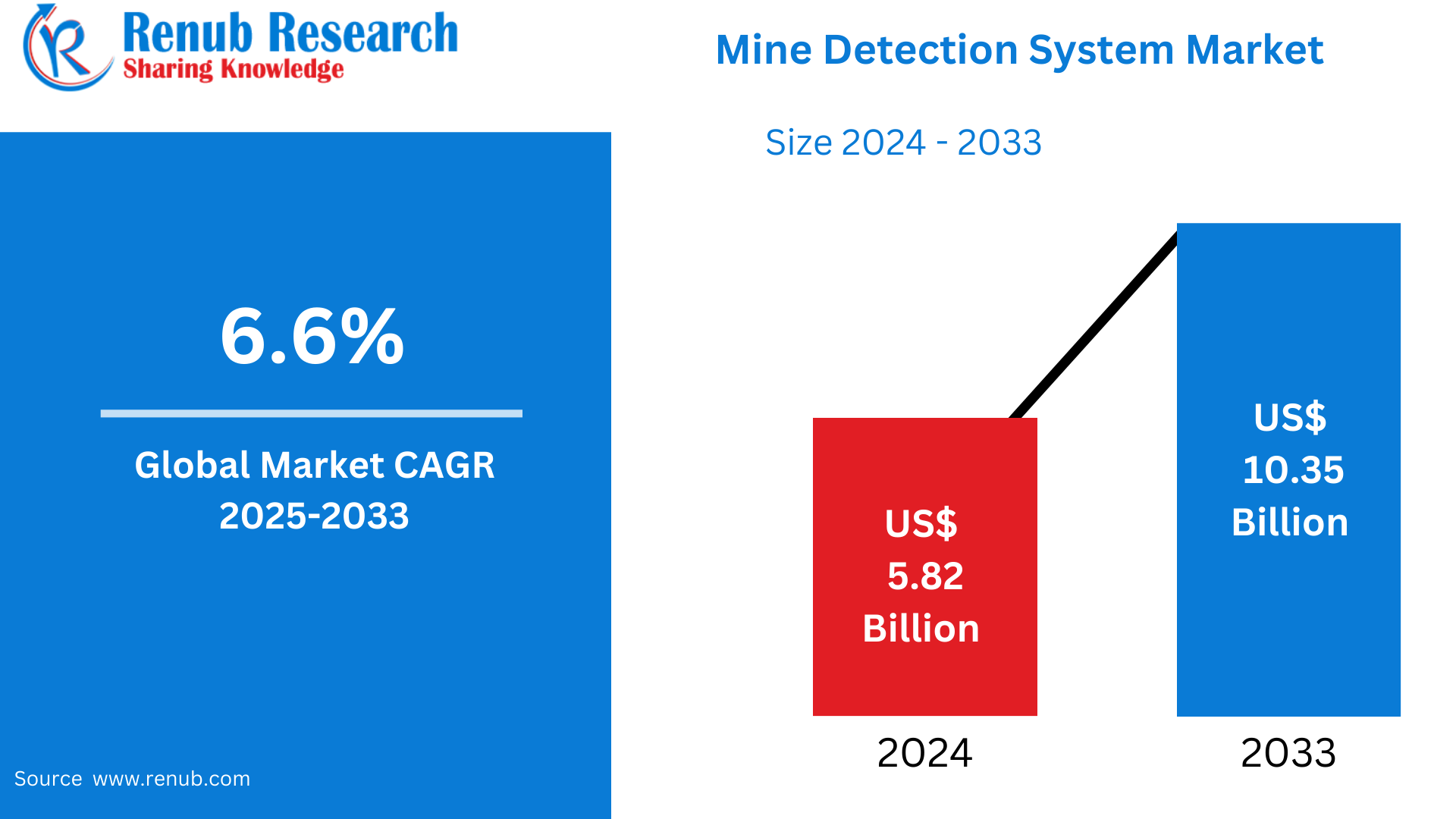

Mine Detection System Market is expected to reach US$ 10.35 billion by 2033 from US$ 5.82 billion in 2024, with a CAGR of 6.6% from 2025 to 2033. With breakthroughs like VENUS and MRead technology setting new industry standards, the worldwide market for mine detection systems is expanding rapidly due to a combination of factors such as growing military engagements, technical improvements, and a growing emphasis on demining operations.

Mine Detection System Global Market Report by Deployment Platform (Vehicle Mounted, Marine-Based, Airborne, Handheld), Technology (Ground Penetrating Radar, Electromagnetic Detection, Acoustic Detection, Infrared Detection), Application (Defense, Homeland Security), Countries and Company Analysis, 2025-2033.

Global Mine Detection System Industry Overview

Technology used to detect and locate landmines or unexploded ordnance (UXOs) buried in the ground or submerged in water is known as a mine detection system. By reducing mishaps brought on by landmines left behind after hostilities or wars, these devices are essential to protecting military personnel, civilians, and humanitarian organizations. Ground-penetrating radar (GPR), metal detectors, infrared sensors, and even specially trained detecting animals are some of the techniques used to detect mines. Both military and civilian uses depend on these technologies, which aid in clearing land for infrastructure and agricultural projects or for rehabilitation.

Mine detection technologies are getting increasingly sophisticated, effective, and precise as post-conflict recovery and demining gain greater attention on a worldwide scale. Additionally, the systems serve a variety of locations where unexploded devices could still be present, including as land, marine, and undersea.

Because more people are aware of the risks presented by landmines and explosive ordnance, especially in areas that have recently experienced warfare, the market for mine detection systems is expanding quickly. To protect troops and civilians, governments, military forces, and international organizations are spending money on cutting-edge mine removal equipment.

The market for mine detecting systems is expanding due to a number of causes. The need for efficient demining technology has increased because to the growing number of post-conflict zones worldwide, particularly in areas like the Middle East, Africa, and Southeast Asia. Landmines pose serious threats to humans, especially in residential or agricultural regions, and these areas frequently suffer from the aftermath of wars. Funding for mine-clearance projects is also coming from international organizations like the International Committee of the Red Cross (ICRC) and the United Nations (UN), which is driving market expansion. Furthermore, improvements in robotics, AI, and sensor technologies have greatly increased the precision, efficiency, and affordability of mine detecting systems.

Key Factors Driving the Mine Detection Systems Market Growth

Surge in Military Land Clearance Operations

Globally, military land clearance operations are becoming more intense as a result of growing geopolitical disputes, border tensions, and security threats. To secure vital locations and safeguard their armed troops, nations that are confronted with active or dormant combat zones are making significant investments in mine detecting systems. Accurate and dependable detection methods are in high demand due to the threat of landmines and improvised explosive devices (IEDs) in military combat zones. In order to reduce deaths and facilitate secure troop mobility, these methods are crucial. Demand is further increased by the fact that mine removal is frequently a top priority duty on international peacekeeping deployments. A major force behind the worldwide market, this increase in operational requirement promotes ongoing innovation and the acquisition of sophisticated, durable, and quick-response detection systems.

Integration of Unmanned and Autonomous Technologies

By greatly increasing efficiency and safety, the combination of unmanned and autonomous technologies is transforming mine detection. Nowadays, autonomous vehicles, drones, and ground robots with sophisticated sensors, artificial intelligence, and real-time data transmission capabilities are employed for mine detection and reconnaissance in dangerous areas. By facilitating remote minefield mapping and identification, these devices lower the risk to human workers. They can also cover more ground faster than manual techniques, which improves operational accuracy and speed. To maximize mine clearing efforts, both the military and humanitarian organizations are investing in these devices. The market for mine detecting systems is expanding and innovating as a result of this trend, which is a reflection of a larger movement towards automation and smart security solutions.

Rising Casualties from Landmines

Effective mine detecting systems are receiving more attention worldwide as a result of the startling increase in landmine and explosive ordnance-related deaths, especially in post-conflict and developing areas. Demining operations are a humanitarian need as civilians, especially children, frequently become victims of buried mines long after hostilities have finished. Governments, non-governmental groups, and international organizations have increased financing and resources for landmine removal efforts in response to this rising issue. Manufacturers are responding by creating detecting systems that are more accurate, affordable, and easy to use. These include of robotic devices, portable detectors, and AI-powered solutions aimed at enhancing precision and security. The need to implement trustworthy detection methods to lessen civilian casualties and restore safe living conditions is becoming more pressing as awareness of the long-term risks posed by landmines increases.

Challenges in the Mine Detection System Market

High Cost of Advanced Technologies

One of the biggest obstacles facing the industry for mine detecting systems is the expensive cost of cutting-edge technologies. While modern systems with robots, artificial intelligence, and ground-penetrating radar provide increased precision and efficiency, they also come with high development, acquisition, and maintenance costs. For many areas, especially low-income or post-conflict nations where mine detection is most urgently needed, these exorbitant prices represent a barrier to entrance. Governments and humanitarian groups are unable to purchase and use these technologies on a large scale due to financial constraints. The financial strain is further increased by continuing operations and training expenses. Because of this, many impacted locations still use on antiquated or manual detection techniques in spite of technology developments, which slows down demining efforts and increases hazards to civilian populations.

Difficult Terrain and Harsh Environments

Environmental factors and challenging terrain may make mine detecting activities more difficult. Many minefields are located in difficult-to-reach places, such hilly regions, deserts, deep woods, or places with limited infrastructure. Transporting and deploying detecting people and equipment is made more difficult by these difficult terrains. Furthermore, unfavorable weather conditions, including intense heat, cold, rain, or flooding, can have a big effect on how well detecting systems work. Under such circumstances, equipment may perform worse or possibly sustain damage, which might cause delays and raise operational risk. The pace and scope of mine clearance operations in impacted areas are constrained by these environmental conditions, which also make demining operations more expensive and difficult and put workers at greater risk.

Mine Detection System Market Overview by Regions

Due to significant defense spending, North America and Europe lead the world market for mine detecting systems. While the Middle East, Africa, and Latin America experience an increase in need for humanitarian demining activities, Asia-Pacific is experiencing tremendous expansion due to regional conflicts. The following provides a market overview by region:

United States Mine Detection System Market

The market for mine detecting systems in the United States is primarily driven by technology innovation and military modernization. The nation places a high priority on cutting-edge defense capabilities, such as complex mine detecting systems that improve personnel safety and operational efficiency. A major development that allows for more precise and effective detection in complicated situations is the integration of AI, robotics, and unmanned systems. The United States also contributes significantly to international demining operations, sponsoring and deploying technologies to help humanitarian efforts across the world. Research institutes and domestic military contractors support ongoing innovation in this field. The market is further shaped by procurement laws, regulatory frameworks, and partnerships with allies, guaranteeing that the United States will continue to dominate the world in mine detecting capabilities for both military and humanitarian applications.

Germany Mine Detection System Market

Germany's mine detection system market stands out for its strong emphasis on technological innovation and humanitarian endeavors. The country is leading the way in developing advanced mine detection technologies, including ground-penetrating radar and robotic systems, for both military and commercial applications. German companies and universities collaborate on projects aimed at increasing the efficiency and security of mine removal operations. By providing financial and technical support to regions impacted by landmines, Germany also makes a substantial contribution to global demining operations. Tight export regulations may restrict international partners' access to advanced technology, which affects the market as well. Despite these challenges, Germany's commitment to global cooperation and innovation continues to fuel the growth of the market for mine detecting systems.

India Mine Detection System Market

The necessity for humanitarian demining operations, border conflicts, and national security concerns are driving the demand for mine detecting systems in India. Ground-penetrating radar, electromagnetic induction, and unmanned systems are among the cutting-edge technology that the Indian Armed Forces are progressively using to improve its detection capabilities. The Defense Research and Development Organization (DRDO) and other domestic defense research agencies are actively creating and implementing indigenous solutions that are suited to India's various topographies and operational needs. The market is also impacted by the government's emphasis on independence in military manufacture, which has resulted in partnerships between the public and private sectors to create mine detecting systems that are both economical and effective. Notwithstanding obstacles such as financial and technological restrictions, India's dedication to enhancing mine detecting skills is spurring investment and innovation in this field.

Saudi Arabia Mine Detection System Market

National security goals and regional humanitarian initiatives are driving the growth of the mine detecting systems market in Saudi Arabia. The Kingdom is making significant investments in cutting-edge technology including sonar-, radar-, and laser-based detection systems to improve its defensive capabilities and support international demining initiatives. Saudi Arabia's dedication to providing worldwide humanitarian aid is demonstrated by programs such as the Masam Project, which aims to remove landmines in Yemen. The market is distinguished by a wide variety of deployment choices that meet different operating needs, such as handheld, ship-mounted, vehicle-mounted, and airborne-mounted systems. Through significant partnerships with international defense and technology businesses and ongoing technical breakthroughs, issues like terrain adaptation and detection sensitivity are being addressed.

Market Segmentations

Deployment Platform

- Vehicle Mounted

- Marine-Based

- Airborne

- Handheld

Technology

- Ground Penetrating Radar

- Electromagnetic Detection

- Acoustic Detection

- Infrared Detection

Application

- Defense

- Homeland Security

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- BAE Systems

- Chemring Group PLC

- Israel Aerospace Industries

- MBDA

- MINE KAFON LAB

- Northrop Grumman Corporation

- Schiebel Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Deployment Platform, By Application, By End Use and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Mine Detection System Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Mine Detection System Market Share Analysis

6.1 By Deployment Platform

6.2 By Application

6.3 By End Use

6.4 By Countries

7. Deployment Platform

7.1 Vehicle Mounted

7.2 Marine-Based

7.3 Airborne

7.4 Handheld

8. Technology

8.1 Ground Penetrating Radar

8.2 Electromagnetic Detection

8.3 Acoustic Detection

8.4 Infrared Detection

9. Application

9.1 Defense

9.2 Homeland Security

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 BAE Systems

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Chemring Group PLC

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Israel Aerospace Industries

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 MBDA

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 MINE KAFON LAB

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Northrop Grumman Corporation

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Raytheon Technologies Corporation

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Schiebel Corporation

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com