Europe Geographic Information Systems (GIS) Market 2033 – Trends & Forecast

Buy NowEurope Geographic Information Systems (GIS) Market Size and Forecast 2025-2033

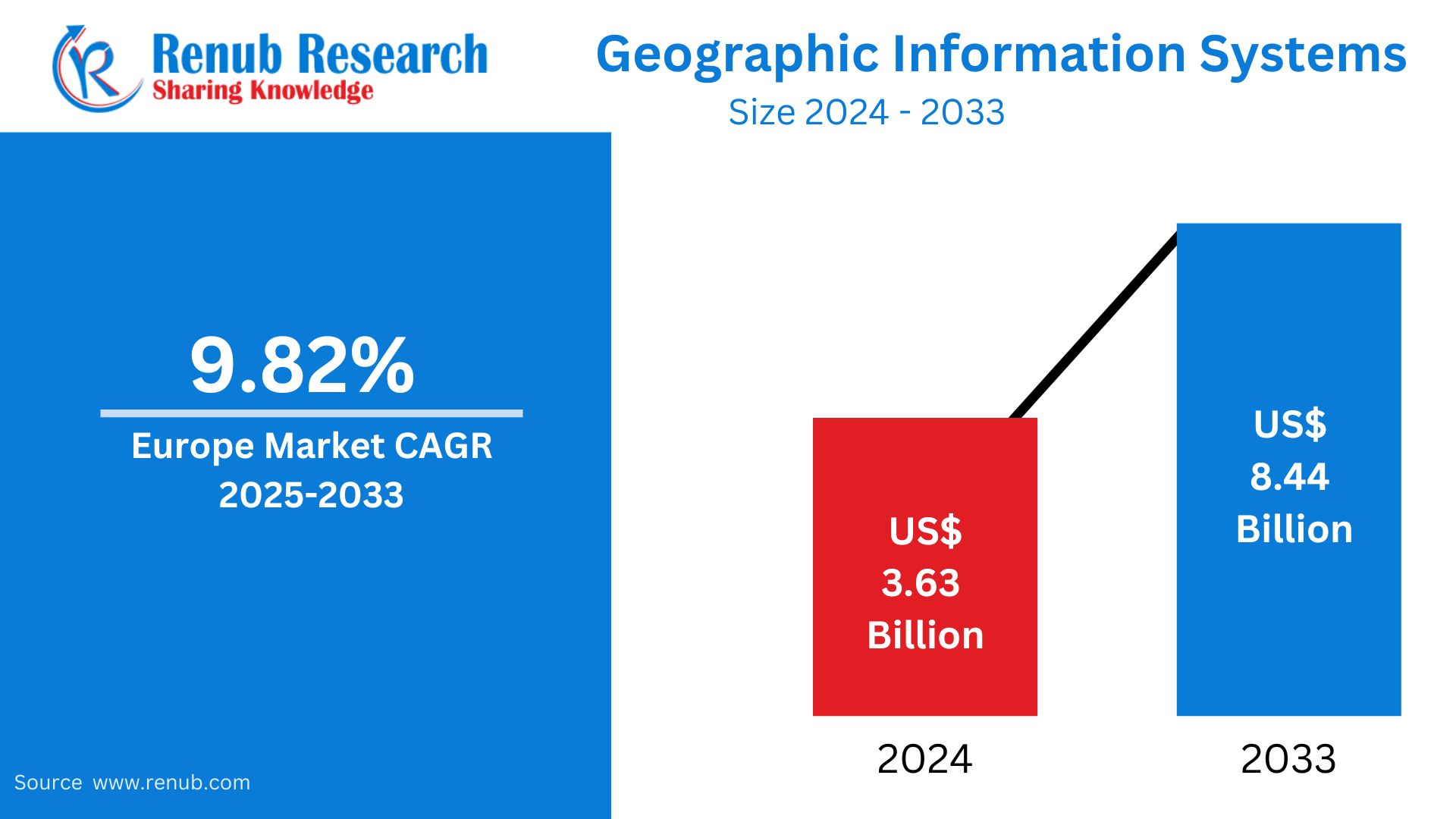

Europe Geographic Information Systems (GIS) Market is set to grow from USD 3.63 billion in 2024 to USD 8.44 billion by 2033, with a CAGR of 9.82% from 2025 to 2033, aided by growing uptake across industries such as urban planning, transportation, agriculture, and environmental monitoring. Advances in technology, smart cities, and surging demand for location-based services are anticipated to drive this expansion during the forecasting period in countries across Europe.

Europe Geographic Information Systems (GIS) Market Forecast Report by Component (Hardware, Software and Services), Function (Mapping, Surveying, Telematics and Navigation and Location-Based Services), Device Type (Desktop and Mobile), Vertical (Transportation & Logistics, Agriculture, Construction, Mining & Geology, Oil & Gas, Aerospace & Defense, Utilities, Government and Others), Countries and Company Analysis 2025-2033.

Europe Geographic Information Systems Market Overview

Geographic Information Systems (GIS) are advanced tools that record, store, analyze, and display spatial and geographic information. GIS combines different forms of data using maps and 3D scenes, enabling users to comprehend patterns, relationships, and trends concerning geography and location.

In the European continent, GIS is applied in various sectors in different European cities, such as environmental monitoring, urban planning, transportation, utilities, agriculture, and public safety. Governments and cities employ GIS for effective infrastructure development, traffic control, disaster relief, and land-use planning. Environmental organizations employ GIS for monitoring climate change, biodiversity conservation, and natural resource management. Farmers utilize precision agriculture with the help of GIS, which allows them to keep track of soil health, crop health, and yield optimization.

GIS is becoming increasingly popular in Europe with the important role it plays to facilitate smart city initiatives, sustainable development goals, and digitalization. In light of the big push towards data-driven decision-making, European nations are making large investments in GIS technologies to increase public services, reduce inefficiency, and maintain environmental and economic sustainability.

Growth Drivers in the Europe Geographic Information Systems Market

Smart City Initiatives Driving GIS Adoption

Europe's push towards the development of smart cities is a key driver for GIS adoption. More than 300 cities are integrating smart solutions using GIS for urban planning, traffic management, and resource optimization. For example, France's Ministry of Ecological Transition reported that cities using GIS technologies have saved 20% in energy consumption and improved public transportation efficiency by 25%. Public spending on smart city infrastructure was €50 billion in 2022, led by Germany and Spain. GIS is at the core of such initiatives through spatial analysis and real-time data visualization, which are critical for effective urban management. April 2022, The European Commission revealed 112 cities chosen for the EU Mission for 100 climate-neutral and smart cities by 2030. The 100 from EU Member States and the 12 from Horizon Europe partner countries will be provided with specific support from the Mission Platform, run by NetZeroCities, to become climate neutral by 2030 and motivate others by 2050.

Integration with Advanced Technologies Enhancing GIS Capabilities

GIS integration with other technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and drones is widening its scopes of application. These technologies facilitate real-time data collection and analysis, enhancing decision-making strategies in different fields. For instance, AI-based GIS systems can forecast environmental changes that help in disaster planning and urban development. The interoperability between GIS and new technologies is accelerating innovation and propelling the demand for advanced geospatial solutions across Europe. July 2024, EA Technology has released the new GIS Barrier Spacer UHF Sensor for its UltraTEV® Plus² Partial Discharge detection instrument. The UTP2-UHF-A2 Sensor is for PD detection in Extra High Voltage and High Voltage Gas Insulated Switchgear. It integrates with HFCTs, ultrasonic contact probes, and other UHF sensors to enhance the PD survey process in several GIS bays.

Government Programs and Directives Encouraging GIS Adoption

European governments are actively encouraging GIS adoption via policies and regulations to enhance urban planning, environmental monitoring, and public safety. Programs such as the European Commission's Smart Cities Marketplace enable the use of GIS in public sector projects. Further, investments in the development of infrastructure and environmental protection are promoting the application of GIS for effective management of resources and policy enforcement. In October 2023, The European Parliament and Council adopted Regulation EU 2023/2411, which broadened the geographical indication (GI) protection to cover craft and industrial products as well as agricultural products. This regulation, effective from 1 December 2025, will safeguard products vital to local identities and economies, like Carrara marble, Limoges porcelain, and Murano glass. In April 2024, the European Parliament and Council adopted Regulation (EU) 2024/1143 to strengthen the protection of geographical indications (GIs) for wine, spirit drinks, and agricultural products. This regulation creates a unified framework, addressing past limitations, and takes effect from 13 May 2024.

Challenges in the Europe Geographic Information Systems Market

High Implementation Costs and Budget Constraints

The high upfront investment needed for GIS deployment, such as hardware, software, and trained personnel costs, is a major hindrance, particularly for small and medium-sized businesses (SMEs) and local authorities. Eurostat reports that almost 45% of European SMEs identify budget constraints as a significant barrier to the implementation of advanced GIS technologies. The high costs may discourage organizations from adopting GIS solutions, which hampers market growth.

Data Interoperability and Complexity in Data Integration Issues

GIS data from various sources integrates with difficulty, and interoperability across platforms has been a concern. The Digital Transformation Scoreboard by the European Commission indicates more than 60% of companies experience challenges with aligning GIS systems with currently available infrastructure, causing delays and higher costs. Lack of congruent data standards among EU countries complicates transnational GIS projects, lowering operation efficiency and collaborative efforts.

Europe Geographic Information Systems Hardware Market

Hardware in the Europe GIS market includes devices such as GNSS antennas, total stations, LiDAR systems, and GIS collectors. These devices are vital for precise data collection and spatial analysis. The need for sophisticated hardware is rising with the growth of applications that need high-precision data, such as autonomous cars and infrastructure monitoring. Investments in hardware capability improvements are imperative to support the increasing GIS application complexity within different industries.

Europe Geographic Information Systems Surveying Market

Surveying is a core use of GIS with precise spatial information used to map, construct, and manage land. The European market for surveying is enhanced by the use of advanced technologies such as drones and LiDAR, which improve data accuracy and reduce costs. The technologies are key in large-scale projects, such as urban planning and environmental observation. The incorporation of real-time data collection practices is revolutionizing conventional surveying approaches, allowing them to be more adaptive to changing project demands.

Europe Transportation & Logistics Geographic Information Systems Desktop Market

The European logistics and transportation industry is highly dependent on desktop GIS solutions to optimize routes, manage fleets, and plan infrastructure. Desktop GIS offers powerful analytical capabilities and data visualization, which are critical in coordinating complicated transport networks. The combination of GIS technology with real-time traffic information and IoT devices improves decision-making and improves operations. With the increasing demand for effective logistics solutions, the use of desktop GIS in this industry is likely to grow.

Europe Mining & Geology Geographic Information Systems Market

In the geology and mining industry, GIS is used in exploration, resource management, and environmental impact studies. GIS facilitates the analysis of geological information, which helps in the identification of mineral deposits and planning the extraction process. The technology also helps in adhering to environmental regulations by tracking land use and evaluating ecological effects. The use of GIS in this industry increases operational efficiency and sustainability.

France Geographic Information Systems Market

France's GIS market is fueled by government policies in urban planning, environmental monitoring, and infrastructure construction. The French National Institute of Geographical and Forest Information (IGN) applies GIS for land-cover mapping and resource management. The combination of AI with GIS is improving the precision of spatial data analysis, enabling projects in agriculture, transportation, and public safety. France's Smart City development further drives the need for cutting-edge GIS solutions. March 2025, Atos has inked a strategic partnership with Esri France, a Geographic Information Systems (GIS) market leader, to support their AI-enabled digital twin offerings for territories and infrastructure. Their software solutions will enhance the acquisition, management, and visualization of intricate location-related information through digital twin simulations.

Germany Geographic Information Systems Market

Germany dominates the European GIS market, with extensive applications in transportation, utilities, and environmental management. Germany's focus on smart infrastructure and renewable energy projects requires advanced GIS tools for planning and monitoring. Government initiatives and investments in digitalization are driving the use of GIS in multiple industries. Germany's attention to data precision and interoperability serves as a standard for GIS deployment in Europe. February 2022. The German environmental satellite EnMAP (Environmental Mapping and Analysis Programme) is prepared for launch, in April 2022 from Cape Canaveral, USA. This mission by the German Aerospace Center, the Federal Ministry for Economic Affairs and Energy, and OHB will introduce a new era of Earth observation, with an emphasis on climate change and its impact on ecosystems.

United Kingdom Geographic Information Systems Market

The UK GIS market is growing because of its usage in government services, urban development, and conservation of the environment. Investments in smart city programs and infrastructure are fueling demand for GIS technology. The coupling of GIS with cloud computing and AI increases its potential in real-time mapping and data analysis. Partnerships between GIS providers and public agencies are promoting innovation and increasing the market. April 2024, Esri UK assisted London Gatwick in developing a geospatial platform through GIS technology to support a number of airport functions, such as engineering and environmental services. The system enhances safety in construction by reducing unintentional hits on hidden utilities and enhances biodiversity management.

Russia Geographic Information Systems Market

The GIS market of Russia is driven by its emphasis on national security, resource management, and infrastructure development. The government applies GIS to urban planning, environment monitoring, and surveillance systems. Data privacy issues and the application of GIS in surveillance have become concerns, which have raised ethical issues. Despite these issues, the demand for GIS in transportation and energy is increasing due to efficient resource planning and management needs.

Geographic Information Systems (GIS) Market Segments

Component

- Hardware

- Software

- Services

Function

- Mapping

- Surveying

- Telematics and Navigation

- Location-Based Services

Device Type

- Desktop

- Mobile

Vertical

- Transportation & Logistics

- Agriculture

- Construction

- Mining & Geology

- Oil & Gas

- Aerospace & Defense

- Utilities

- Government

- Others

Countries

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

Companies have been covered from 4 viewpoints

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Trimble Inc.

- Bentley Systems, Inc.

- Autodesk Inc.

- Hexagon AB

- Pitney Bowes Inc.

- GE Vernova Inc.

- Schneider Electric SE

- L3Harris Technologies Inc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Component Function, Device Type, Vertical and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Geographic Information Systems Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Component

6.2 By Function

6.3 By Device Type

6.4 By Vertical

6.5 By Countries

7. Component

7.1 Hardware

7.2 Software

7.3 Services

8. Function

8.1 Mapping

8.2 Surveying

8.3 Telematics and Navigation

8.4 Location-Based Services

9. Device Type

9.1 Desktop

9.2 Mobile

10. Vertical

10.1 Transportation & Logistics

10.2 Agriculture

10.3 Construction

10.4 Mining & Geology

10.5 Oil & Gas

10.6 Aerospace & Defense

10.7 Utilities

10.8 Government

10.9 Others

11. Countries

11.1 France

11.2 Germany

11.3 Italy

11.4 Spain

11.5 United Kingdom

11.6 Belgium

11.7 Netherlands

11.8 Russia

11.9 Poland

11.10 Greece

11.11 Norway

11.12 Romania

11.13 Portugal

11.14 Rest of Europe

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Trimble Inc.

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Bentley Systems, Inc.

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Autodesk Inc.

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 Hexagon AB

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 Pitney Bowes Inc.

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 GE Vernova Inc.

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 Schneider Electric SE

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

14.8 L3Harris Technologies Inc

14.8.1 Overviews

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com