Mexico UPS Market Forecast and Outlook 2025–2033

Buy NowMexico UPS Market Size and Forecast

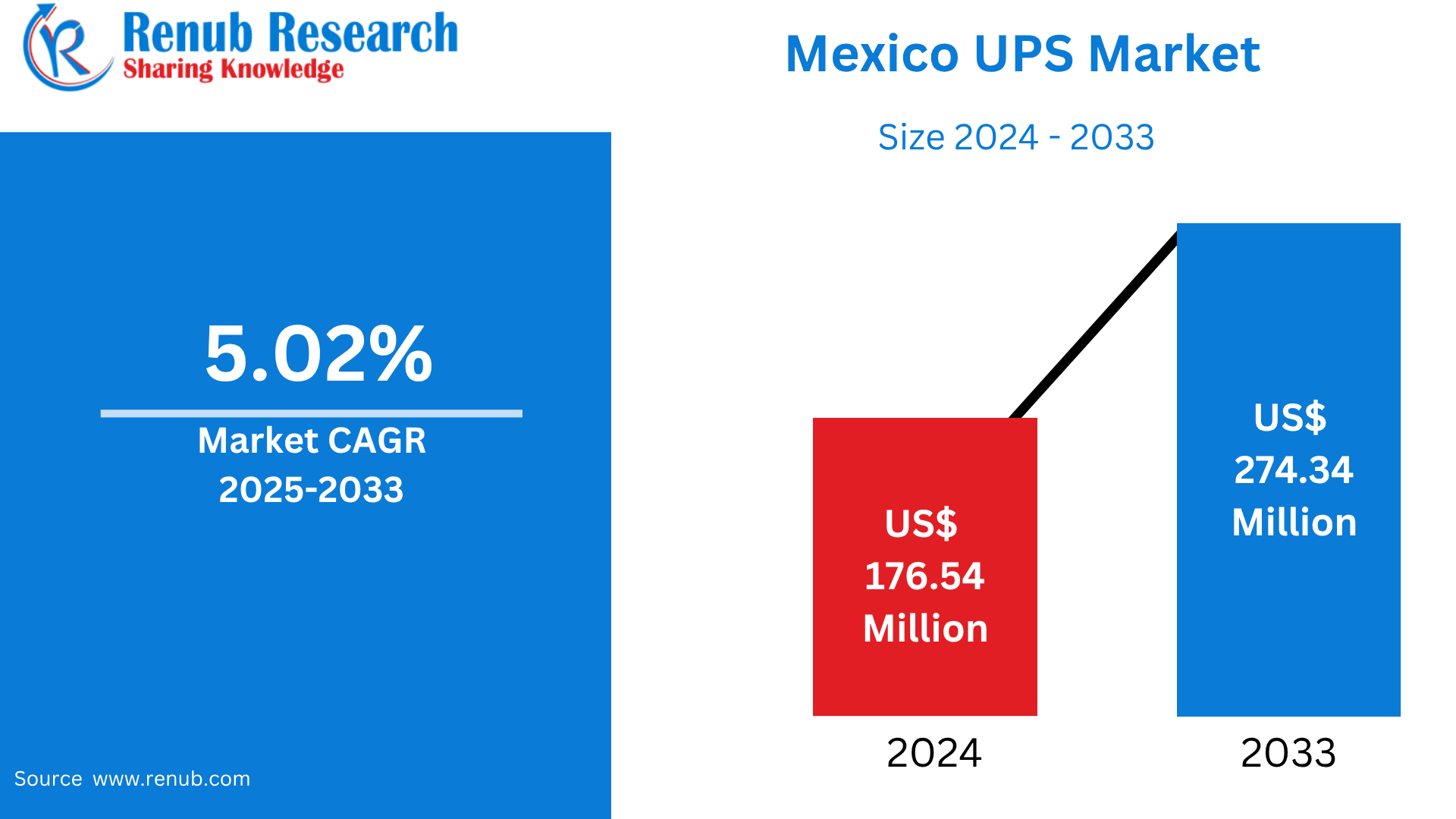

Mexico UPS Market is expected to reach US$ 274.34 million by 2033 from US$ 176.54 million in 2024, with a CAGR of 5.02% from 2025 to 2033. The increasing need for reliable power solutions across a range of sectors is driving the steady expansion of the uninterruptible power supply (UPS) market in Mexico. In order to preserve uninterrupted operations and safeguard priceless equipment, several significant industries, including healthcare, manufacturing, telecommunications, and data centers, are progressively utilizing UPS systems.

Mexico UPS Market Report by Capacity (Less than 10 kVA, 10-100 kVA, above 100 kVA), Type (Standby UPS System, Online UPS System, Line-interactive UPS System), Application (Data Centers, Telecommunications, Healthcare (Hospitals, Clinics, etc.), Industrial, Other Applications) and Company Analysis, 2025-2033.

Mexico UPS Industry Overview

Digital transformation, increased industrial activity, and an increasing dependence on vital infrastructure are driving significant development in Mexico's Uninterruptible Power Supply (UPS) sector. The need for dependable backup power solutions is growing as organizations and enterprises rely more on steady power to operate data centers, communication networks, healthcare systems, and financial services. In an increasingly digitalized economy, UPS systems—which provide uninterrupted power during outages or voltage fluctuations—are seen as crucial elements. The industry is also growing as a result of government measures to enhance connectivity and digital services, especially in urban and industrialized areas.

The quick expansion of data centers is one of the main factors propelling the UPS market in Mexico. With the growth of financial, e-commerce, and cloud computing technologies, there is now more money being spent on high-availability IT infrastructure. Strong power management systems are therefore necessary to avoid downtime and data loss. In addition, the automotive, electronics, and logistics industries' growing use of Industry 4.0 and smart manufacturing technologies has increased demand for high-capacity UPS systems. The market is expanding due to the necessity of maintaining operations in government buildings, schools, and hospitals, especially for medium- and large-scale UPS units.

But there are also significant obstacles facing the sector. Small and medium-sized businesses (SMEs) may be discouraged from using sophisticated UPS systems because to the high upfront investment and continuing maintenance costs. Further obstacles to wider adoption include a lack of technical expertise in some regions and a lack of knowledge about the advantages of contemporary UPS systems. The forecast for the UPS market in Mexico is still positive in spite of these challenges. UPS systems are becoming more widely available and appealing because to advancements in energy efficiency, battery technology, and remote monitoring. Reliable power backup systems will continue to be in high demand as Mexico's infrastructure and economy become more digitalized, providing growth prospects for UPS manufacturers, distributors, and service providers.

Key Factors Driving the Mexico UPS Market Growth

Expansion of Data Centers

With large investments from multinational digital companies like Amazon, Google, and Microsoft, Mexico is becoming a major location for the construction of data centers. To prevent service outages and data loss, these facilities need steady, dependable electricity. High-capacity uninterruptible power supply (UPS) systems are therefore essential for guaranteeing infrastructure resilience and business continuity. Local demand for cutting-edge electricity solutions is being driven by places like Querétaro becoming into tech centers. Additionally, this development is pushing UPS manufacturers, both domestic and foreign, to increase their footprint in the area. The importance of data centers, and therefore the UPS sector, as a pillar of Mexico's digital economy is being cemented by the country's growing reliance on digital storage, cloud computing, and high-speed internet access.

Digital Transformation and Cloud Adoption

As cloud computing, e-commerce platforms, and remote working technologies become more widely used, Mexico's digital transformation is quickening in both the public and commercial sectors. For servers, communication systems, and online transactions to function, these technological innovations need a steady and uninterrupted power source. In order to protect operations against voltage swings and unplanned power outages that might cause monetary losses or operational downtime, UPS systems are crucial. The necessity for dependable energy backup infrastructure is further highlighted by the emergence of smart cities, IoT applications, and financial solutions. The need for UPS systems with sophisticated monitoring and energy-efficient technologies is growing as more companies and governmental organizations invest in IT infrastructure, which encourages market development and innovation in the industry.

Government Initiatives and Infrastructure Development

As part of its larger growth goal, the Mexican government is aggressively pushing for the renovation of its infrastructure. This includes measures for internet access, 5G rollout, and smart grid projects aimed at enhancing the country's electrical system and increasing digital connection. The expansion of mission-critical facilities that rely on continuous electricity, such hospitals, data centers, and financial institutions, is supported by these advancements. UPS systems are being increasingly used as a precaution to reduce the hazards associated with an unpredictable electrical supply. The need for dependable power backup solutions is increasing due to government-led initiatives to build a more robust and digitally linked economy, which is advantageous for both local and foreign UPS suppliers.

Challenges in the Mexico UPS Market

Supply Chain Disruptions and Import Dependence

Due to its heavy reliance on imported parts including batteries, semiconductors, and control systems, the UPS industry in Mexico is susceptible to supply chain disruptions worldwide. The availability and prompt delivery of these components can be greatly impacted by variables such as geopolitical unrest, delays in international shipping, and shortages of essential raw materials. Furthermore, changes in exchange rates may have an effect on the cost of imports, which may cause price volatility in the home market. Regulatory obstacles and customs processes may cause further delays in product availability. Suppliers find it challenging to maintain steady pricing and inventory levels as a result of these concerns. In order to ensure long-term market stability and growth, it will be crucial to eliminate import reliance and improve local supply capabilities as demand for UPS systems rises.

Energy Efficiency and Environmental Compliance

UPS manufacturers in Mexico are being compelled to use greener technology and sustainable design methods due to the growing regulatory emphasis on energy efficiency and environmental effect. Investments in R&D and new materials are frequently necessary to meet these changing requirements, which can increase production costs. Adapting to these changes can be particularly difficult for businesses who manufacture inexpensive UPS systems since they may reduce profit margins or require product redesigns. Furthermore, it might take a lot of time and resources to get certifications or exceed regulatory energy performance standards. Notwithstanding these challenges, following environmental regulations is increasingly becoming essential for competitiveness. Businesses may have a difficult time getting access to government-sponsored infrastructure projects or certain market sectors if they don't fit with efficiency and environmental aims.

Market Segmentations

Capacity

- Less than 10 kVA

- 10-100 kVA

- Above 100 kVA

Type

- Standby UPS System

- Online UPS System

- Line-interactive UPS System

- Others

Application

- Data Centers

- Telecommunications

- Healthcare (Hospitals, Clinics, etc.)

- Industrial

- Other Applications

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Hitachi Ltd

- ABB Ltd

- General Electric Company

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Delta Electronics Inc.

- Schneider Electric SE

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Capacity, Type and Application |

| Application Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Mexico Uninterruptible Power Supply (UPS) Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Capacity

6.2 By Type

6.3 By Application

7. Capacity

7.1 Less than 10 kVA

7.2 10-100 kVA

7.3 Above 100 kVA

8. Type

8.1 Standby UPS System

8.2 Online UPS System

8.3 Line-interactive UPS System

9. Application

9.1 Data Centers

9.2 Telecommunications

9.3 Healthcare (Hospitals, Clinics, etc.)

9.4 Industrial

9.5 Other Applications

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Hitachi Ltd

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 ABB Ltd

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 General Electric Company

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Emerson Electric Co.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Mitsubishi Electric Corporation

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Toshiba Corporation

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Delta Electronics Inc.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Schneider Electric SE

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com