Power Quality Equipment Market – Global Industry Trends & Forecast 2025–2033

Buy NowPower Quality Equipment Market Size and Forecast 2025-2033

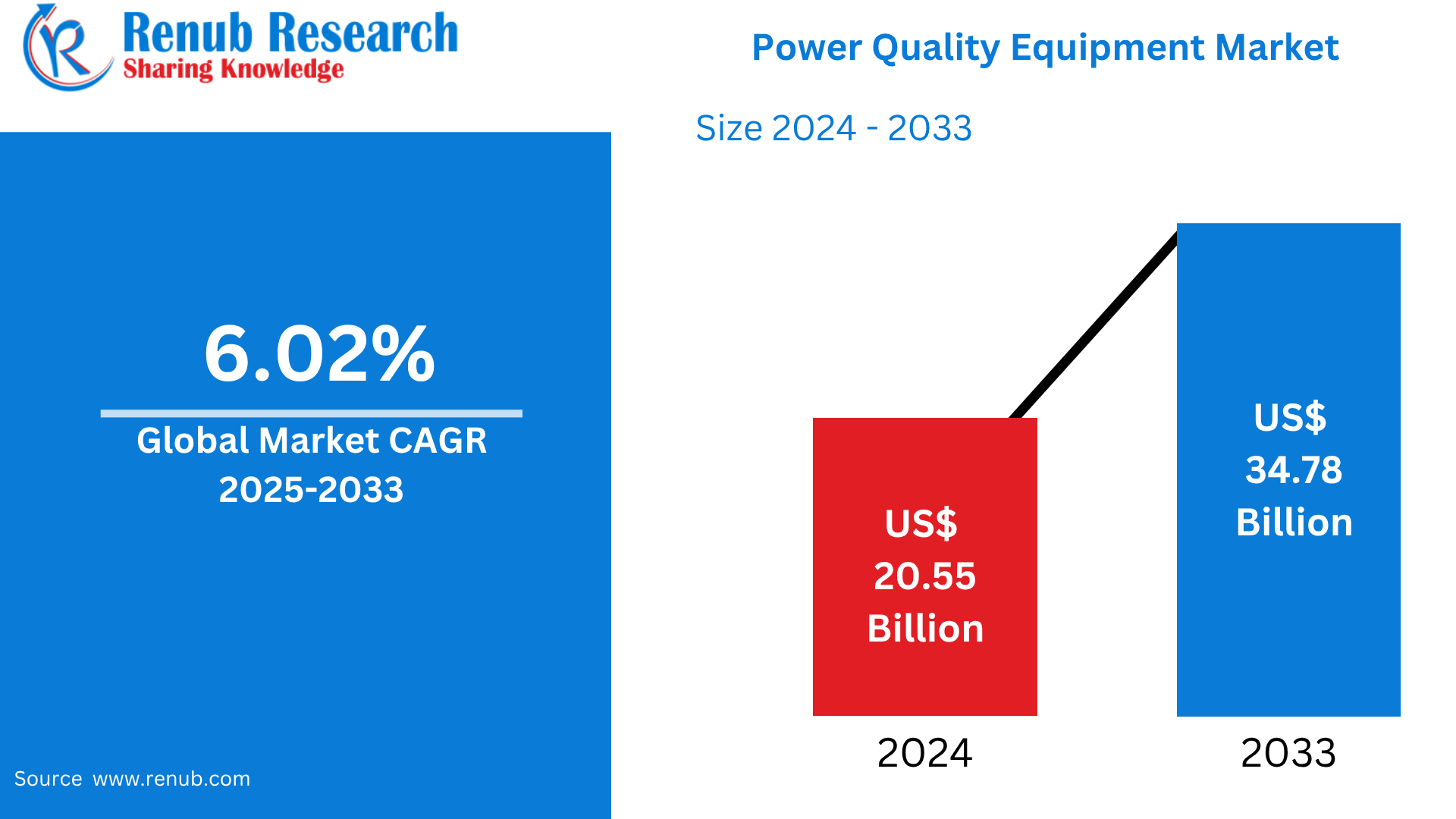

Global Power Quality Equipment Market was worth US$ 20.55 billion in 2024 and is expected to grow to US$ 34.78 billion by 2033 at a CAGR of 6.02% during the forecast period of 2025-2033. Greater dependence on sensitive electronic equipment, growing industrial automation, and increased awareness about power efficiency are fueling demand. End-users and utilities look for dependable solutions to ensure minimal downtime and improved energy performance.

Power Quality Equipment Market Forecast Report by Equipment (Uninterrupted Power Supply (UPS), Surge Protection Devices, Voltage Regulators, Power Quality Meters, Harmonic Filters, Others), Phase (Single Phase, Three Phase), End Use (Industrial & Manufacturing, Commercial, Utilities, Transportation, Residential), Country and Company Analysis 2025-2033.

Power Quality Equipment Market Outlooks

Power quality equipment is used to describe devices and systems that provide assurance of the efficient and dependable supply of electrical power without interruptions or distortions. Power quality equipment assists in the control of voltage fluctuations, harmonics, transients, and other types of disturbances that tend to have adverse effects on sensitive equipment and overall power system performance. Examples include uninterruptible power supplies (UPS), voltage regulators, power conditioners, harmonic filters, and surge protectors.

With the rise of global digitalization, automation, and application of electronic equipment in industries, commercial buildings, and houses, having steady power quality is crucial. Low power quality may cause equipment failure, downtime, data loss, and financial loss. Therefore, power quality equipment demand is increasing in industries such as manufacturing, IT & telecom, healthcare, and utilities.

The increasing use of renewable energy sources, which tend to bring power variations, further boosts the demand for efficient power quality solutions. Increasing awareness and reliance on continuous operations are driving the market's consistent growth globally.

Growth Drivers in the Power Quality Equipment Market

Industrial Automation and Digitization

The worldwide transition towards Industry 4.0 has increased automation in manufacturing, logistics, and service industries. These computer systems need a reliable power supply in order to avoid equipment failure, data loss, and downtime that costs money. Power quality equipment is responsible for regulating voltage, removing harmonics, and avoiding power disruptions. With automation spreading across the globe, demand for the equipment is likely to explode, particularly in precision-industry sectors like electronics, automobile, and pharmacy, where power disruption even for a short time can have serious operational impacts. May 2025, Schneider Electric will exhibit its software-defined automation innovations and cutting-edge technologies at Automate 2025, demonstrating how it helps build U.S. industry competitiveness and resilience through robotics, industrial artificial intelligence, and digitalization.

Proliferation of Renewable Energy Integration

As nations shift towards renewable energy sources such as wind and solar, they experience issues with power instability and fluctuations. These sources are intrinsically volatile and have the potential to inject harmonics, voltage sags, and frequency problems into the grid. Power quality equipment serves to arrest such challenges by stabilizing supply and making legacy and green power systems compatible with each other. As investment in clean energy picks up pace worldwide, the demand for resilient power quality systems will become ever more important to ensure grid efficiency and energy security. February 2025 - The Belize Government, in collaboration with the World Bank and the Canadian Government, revealed the launch of an additional energy project that targets enhancing the power supply of the country and making its electricity services more reliable. The $58.4 million project will further assist in the optimization of costs for clients, as well as ensuring renewable sources of energy are utilized better.

Data Centers and Cloud Infrastructure Expansion

Data centers are critical to cloud computing, AI, and big data analytics, needing constant, high-quality power. Any downtime may result in huge data loss, security breaches, and service outages. With increasing global data consumption, particularly post-pandemic, power quality solutions such as UPS systems, harmonic filters, and voltage regulators have become integral parts. These pieces of equipment protect servers, regulate load balancing, and streamline power consumption. With hyperscale data centers expanding globally and edge computing, this segment will make a considerable contribution to the need for power quality equipment. May 2025, Qualcomm Technologies, Inc. and HUMAIN agreed to a Memorandum of Understanding to partner on future-generation AI data centers, infrastructure, and cloud-to-edge services to address the increasing need for AI across Saudi Arabia and worldwide.

Challenges in the Power Quality Equipment Market

High Initial Investment and Operational Costs

In spite of long-term cost savings, power quality systems entail high capital outlay, especially for large-scale or industrial-grade installations. Equipment, installation, maintenance, and expert labor-related costs can be too high for small and medium-sized businesses. Moreover, the ROI might not be readily apparent, discouraging cost-conscious companies. With economic conditions still uncertain in many regions, price sensitivity continues to present a considerable barrier to broader market penetration, particularly in emerging nations where funding infrastructure is still in short supply.

Lack of Awareness and Qualified Personnel

In most developing economies, there is low awareness of the significance of power quality and its long-term value. Power disturbances are usually addressed reactively, not proactively. Additionally, the installation and maintenance of power quality systems demand technical expertise, which is scarce in many areas. This lack of technical know-how not only discourages adoption but also impacts the reliability and performance of installed systems. Training schemes and education campaigns are required to overcome this issue and realize market potential.

UPS Power Quality Equipment Market

Uninterruptible Power Supply (UPS) solutions are the backbone of power backup strategies for data centers, hospitals, banks, and telecommunications facilities. They safeguard equipment from unexpected power loss and voltage irregularities, maintaining continuous operations and data security. As more people depend on digital infrastructure, the worldwide UPS market continues to expand steadily. Innovations such as the modular UPS and energy-efficient models only increase their applicability in mission-critical environments. The segment is also experiencing vigorous demand in home and small commercial usages with an increase in cases of power disturbance.

Power Quality Meters Market

Power quality meters aid the monitoring and testing of electric parameters to catch anomalies and cure defects in real-time. Utilities, manufacturers, and commercial units willing to reduce the damage of devices and become energy efficient would have a reliance on these equipment pieces. With advancements in smart grid and rising deployment of IoT technologies, such meters are becoming more intelligent and precise. The rising focus on predictive maintenance and regulatory compliance also boost adoption, particularly in industrial and energy-consuming segments in North America, Europe, and Asia-Pacific.

Single Phase Power Quality Equipment Market

Single-phase units are extensively applied in residential and small commercial installations. Power disruptions such as voltage sags and surges can ruin sensitive home appliances and small office equipment. The growth of smart homes and growing use of gadgets such as HVAC systems, computers, and appliances have driven demand for quality power solutions. Single-phase power quality equipment such as voltage stabilizers, filters, and surge protectors provide system longevity and efficiency and hence represent a fast-growing segment in the overall power quality market.

Commercial Power Quality Equipment Market

Commercial spaces like shopping malls, corporate offices, and educational establishments use a constant power supply for lighting, HVAC systems, elevators, and computing infrastructure. Repeat power outages not only interfere with business but also drive up the cost of energy. Power quality equipment guarantees flawless operation, energy efficiency, and lower maintenance costs. With the increasing trend of intelligent commercial buildings and green infrastructure, investment in power quality systems within the commercial building sector is increasing at a very fast rate, particularly in metropolitan cities.

Transportation Power Quality Equipment Market

Transportation infrastructure, particularly electric railways, metro systems, and electric vehicle (EV) charging stations, rely on high-quality power to be operated safely and efficiently. Disturbances or distortions in power can result in system malfunction, safety issues, and delay in service. Power quality devices like harmonic filters and voltage regulators are critical for maintaining system reliability. With growing urban transport infrastructure and EV networks worldwide, demand for strong power management systems in transportation is also growing considerably.

United States Power Quality Equipment Market

United States is a prominent market because of the highly digitalized economy, old grid infrastructure, and strong industrial automation focus of the country. Investments in renewable energy, data center growth, and government policies focusing on energy efficiency and smart grid activities all spur demand for power quality solutions. Both commercial and utility industries are especially boosted by government regulations, data center growth, and investments in renewable energy. March 2025, JST Power Equipment will begin production at a new padmount transformer factory in Wytheville, Virginia, after a solid fiscal year in 2024. This growth benefits US customers and boosts engineering and manufacturing in North America, complementing JST's recent investments, such as the Nogales, Mexico factory expansion.

France Power Quality Equipment Market

France is aggressively pursuing clean energy integration and smart grid deployment. As renewable penetration increases, power quality management has become a national concern. The trend towards industrial automation and high energy standards is driving high demand for power quality meters, UPS devices, and voltage correction devices, particularly in industries such as manufacturing, telecommunications, and utility public. June 2023, Hitachi Energy secured an order from France-Spain joint venture Electricity Interconnection France-Spain (Inelfe), owned by Spain's Red Eléctrica and France's RTE, to deliver four HVDC converter stations for a subsea cable connecting France and Spain between the Biscay Gulf.

India Power Quality Equipment Market

India experiences frequent power disturbances caused by grid instability, fast urbanization, and congested infrastructure. This has heightened awareness and demand for power quality products in all industries, IT parks, and even domestic markets. Government policies such as "Make in India" and infrastructure development are driving the market, with more private and public investments in power reliability solutions. Oct 2024, Hitachi Energy introduced the Relion REF650, an all-in-one protection and control relay for medium voltage power distribution grid in India. It provides improved flexibility, modularity, and security over earlier releases with an intuitive interface optimized to address the dynamic power quality requirements of utility and industrial sites across the country.

Saudi Arabia Power Quality Equipment Market

Saudi Arabia's Vision 2030 initiative features ambitious energy diversification and infrastructure modernization programs. As the nation invests massively in smart cities, industrial parks, and renewable energy, maintaining a reliable power supply becomes imperative. The power quality equipment demand is increasing in industries such as oil & gas, manufacturing, and data centers due to economic growth as well as sustainability objectives. April 2025, The SEC, overseen by the Ministry of Energy, has initiated Phase 2 of its battery energy storage system (BESS) development with an investment of more than SAR6.73 billion. This stage will deliver 2.5 GW of storage capacity at five locations in Riyadh, Al-Qaisumah, Al-Jawf, Al-Dawadmi, and Rabigh. Under the NREP, the program targets 50% renewable energy contribution to the electricity mix by 2030. BYD Auto Company and Alfanar Projects have been awarded contracts for 500 MW/2,000 MWh systems at each location.

Market Segments

Equipment

- Uninterrupted Power Supply (UPS)

- Surge Protection Devices

- Voltage Regulators

- Power Quality Meters

- Harmonic Filters

- Others

Phase

- Single Phase

- Three Phase

End Use

- Industrial & Manufacturing

- Commercial

- Utilities

- Transportation

- Residential

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Hitachi Energy Ltd

- Siemens AG

- EATON Corporation Plc

- Emerson Electric Company

- Schneider Electric SE

- General Electric Company

- Toshiba Corporation

- Schaffner

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Equipment, By Phase, By End Use and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Power Quality Equipment Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Power Quality Equipment Market Share Analysis

6.1 By Equipment

6.2 By Phase

6.3 By End Use

6.4 By Countries

7. Equipment

7.1 Uninterrupted Power Supply (UPS)

7.2 Surge Protection Devices

7.3 Voltage Regulators

7.4 Power Quality Meters

7.5 Harmonic Filters

7.6 Others

8. Phase

8.1 Single Phase

8.2 Three Phase

9. End Use

9.1 Industrial & Manufacturing

9.2 Commercial

9.3 Utilities

9.4 Transportation

9.5 Residential

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Hitachi Energy Ltd

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Siemens AG

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 EATON Corporation Plc

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Emerson Electric Company

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Schneider Electric SE

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 General Electric Company

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Toshiba Corporation

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Schaffner

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com