Global Managed Service Market Size, Share & Trends Analysis 2025-2033

Buy NowManaged Services Market Size and Forecast 2025-2033

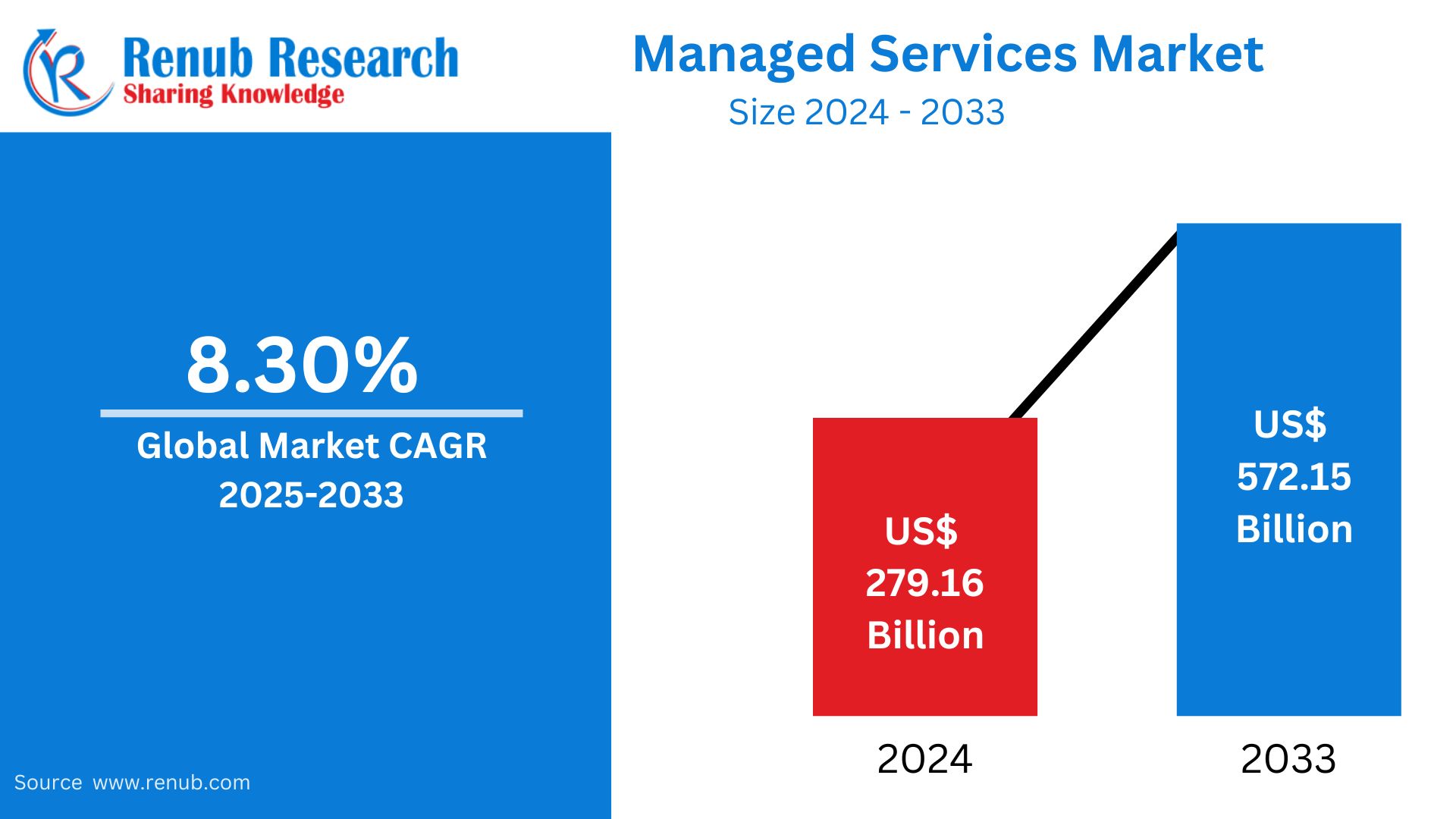

Managed Services Market is expected to reach US$ 572.15 billion by 2033 from US$ 279.16 billion in 2024, with a CAGR of 8.30% from 2025 to 2033. Some of the key drivers driving the market's expansion include the growing need for scalable and affordable business solutions, the growing complexity of managing IT infrastructure, and the growing demand for IT outsourcing solutions.

The report Managed Services Global Market & Forecast covers by Type (Managed Data Center, Managed Security, Managed Communications, Managed Network, Managed Infrastructure, Managed Mobility), Size of Enterprise (Small & Medium Size, Large Enterprise), End-User (BFSI, IT and Telecommunication, Healthcare, Entertainment and Media, Retail, Manufacturing, Government, Others), Deployment (On-premise, Cloud), Countries and Company Analysis, 2025-2033.

Global Managed Services Market Overview

The increased complexity of IT systems and the growing demand for businesses to optimize operations have led to significant expansion in the worldwide managed services sector in recent years. Managed services are a broad category of IT solutions that companies contract out to outside service providers, including network management, data storage, cloud computing, and cybersecurity. By utilizing these services, businesses can concentrate on their main operations while making sure that their IT infrastructure is secure, optimized, and complies with legal requirements. Managed services are now a strategic way for organizations to stay competitive in an increasingly digital world as they look to save expenses and improve operational efficiency.

The industry has been widely adopted by a number of industries, including telecommunications, healthcare, and finance. As businesses place a higher priority on protecting data and digital assets, cloud computing and cybersecurity are two major motivators. Furthermore, the scope of managed services has been further broadened by the development of automation, artificial intelligence, and the Internet of Things (IoT), opening up new potential for service providers. In emerging markets, where IT infrastructure development and digital transformation are accelerating, the industry is also seeing rising demand. The managed services sector is expected to grow even more in the years to come due to ongoing technology developments and changing corporate requirements.

In the managed services sector, enterprise cloud transition still offers both possibilities and difficulties. The complexity of modern infrastructure transitions is highlighted by recent research that show 48% of IT decision-makers in the US and the UK need 1-2 months to successfully perform a single multi-cloud application transfer. Specialized managed service products centered on cloud optimization, migration support, and hybrid infrastructure management have emerged as a result of this complexity.

With providers progressively integrating cutting-edge technologies like blockchain, the Internet of Things (IoT), artificial intelligence, and virtual/augmented reality into their service portfolios, the sector is witnessing a rapid increase in technical integration skills. Managed services firms are being compelled to improve their analytics and reporting capabilities as a result of organizations' current desire for result-based outcomes with precisely defined, real-time criteria. With 25% of firms reporting average downtime costs between USD 301,000 and USD 400,000 per hour, this change is especially noticeable in the enterprise market, where downtime costs have become a key concern, underscoring the necessity of strong managed operations solutions.

Growth Drivers for the Managed Services Market

Growing Difficulties in Cybersecurity

For companies of all sizes, maintaining strong cybersecurity has become crucial in an era of constantly changing cyberthreats. Specialized security solutions, such as round-the-clock monitoring, threat detection, incident response, and compliance management, are provided by managed services providers. While guaranteeing adherence to pertinent laws and standards, they assist companies in safeguarding their vital information and IT resources against a variety of online dangers. This is especially important for sectors like retail, healthcare, and finance that are governed by strict data privacy regulations. Businesses may uphold strict security requirements, reduce risks, and steer clear of possible legal and financial repercussions linked to data breaches or non-compliance by utilizing MSPs' experience. Industry statistics indicate that there were 2365 cyberattacks in 2023, resulting in 343,338,964 victims.

Data breaches increased by 72% in 2023 compared to the previous record of 2021. The average cost of a data breach is $4.45 million. In 2023, around 35% of malware was distributed by email, making it the most prevalent malware vector. Email security problems have been reported by 94% of firms. In 2022, business email hacks caused losses totaling $2.7 billion. It is anticipated that employment in information security would increase by 32% between 2022 and 2032. Statistics on the managed services market are being greatly impacted by this.

Widespread Use of Cloud Computing

One of the main factors driving market expansion is the growing trend toward cloud computing. Businesses frequently need professional help to manage these settings when they move to cloud-based solutions in order to gain access, collaboration, and cost savings. Providers of managed services provide all-inclusive cloud management solutions that guarantee cost-effectiveness, performance, and security. For example, the top end-to-end, hybrid multi-cloud, and AI solutions provider, Rackspace Technology, stated in May 2024 that it was collaborating with young Hollywood on a multi-phase Google Cloud solution to revolutionize video content management.

The partnership effectively developed the required third-party metadata, video assets, and infrastructure, and used the Google Cloud Video Intelligence Application Programming Interface (API) to process videos. The innovative entertainment network can now process videos ten times faster and have better access to data thanks to the new cloud architecture, which also opens up new avenues for distribution and revenue.

Growing IT Infrastructure Complexity

The market for managed services is significantly influenced by the growing complexity of IT systems, including hybrid cloud environments, vast data networks, and sophisticated cybersecurity requirements. Rapid technological breakthroughs, a wide range of software applications, and the integration of several platforms are making it more and more difficult for businesses to manage and maintain their IT infrastructure. In order to effectively handle this complexity and guarantee the best possible system performance, dependability, and security, managed service providers (MSPs) provide specialized knowledge, resources, and cutting-edge solutions.

For example, Cognizant introduced a multi-hybrid cloud and edge management platform in April 2023 with the goal of streamlining their cloud management operations and facilitating the shift to contemporary cloud-native architectures. Through a carefully selected library of solution accelerators, Cognizant Skygreed employs an industry-focused methodology that promotes cost-effectiveness, sustainability, and simplification while empowering businesses to swiftly and effectively realize higher business value. Over the upcoming years, this is anticipated to improve the managed services market projection.

Challenges in the Managed Services Market

Cybersecurity Threats

Given the mounting pressure on Managed Service Providers (MSPs) to protect customer data, cybersecurity threats present a serious problem. As ransomware and data breaches become more common, MSPs need to constantly improve their security protocols to safeguard confidential data. These dangers have the potential to seriously harm a company's reputation in addition to being a financial risk. To identify and stop such breaches, MSPs must put advanced security procedures, frequent vulnerability assessments, and quick response plans into place. MSPs must make investments in state-of-the-art technologies and make sure their staff is prepared to react swiftly and efficiently in order to preserve customer confidence and adhere to industry rules as the frequency and complexity of cyberattacks increase.

Compliance and Regulatory Challenges

Navigating a complicated regulatory framework presents major obstacles for managed service providers, or MSPs. Because data privacy and protection are governed by laws like the CCPA, GDPR, and HIPAA, MSPs have to make sure that their operations adhere to various regulatory requirements in various jurisdictions. Heavy fines, legal repercussions, and irreversible harm to a provider's reputation might result from noncompliance. MSPs must put strict data security measures in place, handle personal data transparently, and make sure that client data is processed and stored in compliance with relevant legal requirements. This calls for constant observation, frequent audits, and current understanding of changing legislation. Although it complicates service delivery, compliance is necessary to preserve confidence and stay out of trouble with the law.

United States Managed Services Market

The rise in remote work, the widespread use of artificial intelligence (AI) for increased productivity and cybersecurity, and the growing demand for industry-specific solutions in sectors like retail, healthcare, and logistics are the main drivers of this growth in the US market. The use of AI technologies for automated monitoring and predictive analytics, the move to cloud-based services that provide scalability and cost effectiveness, and the growth of Internet of Things (IoT) deployments that call for strong management and security are some of the major trends influencing the market. In response to the growing frequency of cyberattacks and the requirement for thorough threat detection and response plans, managed security services are also expanding significantly. Major businesses like IBM, Cisco, and AT&T are present in the competitive landscape and are concentrating on innovation and strategic alliances to satisfy the changing needs of the market.

United Kingdom Managed Services Market

The growing complexity of IT infrastructure, digital transformation, and the growing need for affordable IT solutions are the main factors propelling the UK managed services market. In order to concentrate on their core competencies while maintaining scalability, security, and efficiency, businesses are increasingly outsourcing their IT administration. As businesses look for professional help to safeguard sensitive data and systems, the increase in cybersecurity risks is also driving up demand for managed security services.

With significant centers in places like London, Manchester, Birmingham, and Scotland, the market is distinguished by a varied geographic landscape. These cities are home to a range of sectors that fuel the need for IT solutions. London continues to be the primary economic hub, drawing multinational corporations in need of all-encompassing IT and security services. The demand for managed network and cloud services is rising in Manchester and Birmingham due to their expanding tech sectors. The increased demand for specialist managed services is also a result of Scotland's emphasis on the energy and financial sectors. In addition to regional suppliers like BCN Group, OryxAlign, and Babble, major players in the UK managed services market include industry titans like BT, Deloitte, Microsoft, and Google. These organizations serve enterprises of all sizes nationwide and provide a broad range of services, such as cloud services, cybersecurity, business continuity solutions, and IT infrastructure management.

India Managed Services Market

The market for managed services in India is expanding rapidly due to the growing complexity of IT infrastructure and the need for effective, affordable solutions. The quick uptake of cloud computing, digital transformation projects, and the growing demand for cybersecurity measures across a variety of industries, including manufacturing, IT, BFSI, and healthcare, are important factors. Furthermore, the growth of the managed services market is being aided by the establishment of Global Capability Centers (GCCs) in India, which do high-value jobs outside of the realm of typical IT support.

Due to the existence of important commercial hubs and a strong tech environment, managed services are in high demand in Western and Southern India, which includes states like Maharashtra, Karnataka, and Telangana.

United Arab Emirates Managed Services Market

The growing need for affordable IT solutions, the quick industry-wide acceptance of digital transformation, and the increased emphasis on cybersecurity and compliance rules are the main factors propelling the managed services market in the United Arab Emirates (UAE). Because companies use these advances for efficiency and scalability, the industry is also growing as a result of the emergence of cloud computing, automation, and the Internet of Things.

Due to its position as a financial and economic center, Dubai holds a 40% market share in the United Arab Emirates' managed services industry. Supported by government initiatives and an increasing number of small and medium-sized businesses (SMEs) implementing managed services, Abu Dhabi comes in second with a 30% share. The remaining 30% comes from Sharjah and other northern emirates, where there is a growing need for managed IT services in industries including manufacturing, logistics, and education. Microsoft, Huawei, and DXC Technology are important companies in the UAE managed services market. They are concentrating on innovation and strategic alliances to satisfy the changing needs of the market.

Managed Services Market Segmentation

Type – Market breakup in 6 viewpoints:

- Managed Data Center

- Managed Security

- Managed Communications

- Managed Network

- Managed Infrastructure

- Managed Mobility

Size of Enterprise – Market breakup in 2 viewpoints:

- Small & Medium Size

- Large Enterprise

End-User – Market breakup in 8 viewpoints:

- BFSI

- IT and Telecommunication

- Healthcare

- Entertainment and Media

- Retail

- Manufacturing

- Government

- Others

Deployment – Market breakup in 2 viewpoints:

- On-premise

- Cloud

Regional Market Insights: North America, Europe, and Asia-Pacific

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- the Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Revenue Analysis

Key Players in the Managed Service Provider (MSP) Landscape

- Fujitsu Ltd

- Cisco Systems Inc.

- IBM Corporation

- AT&T Inc.

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Nokia Solutions and Networks

- Rackspace Inc.

- Tata Consultancy Services Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Size of Enterprise, End User, Deployment and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Managed Services Market

6. Market Share Analysis

6.1 By Type

6.2 By Size of Enterprise

6.3 By End User

6.4 By Deployment

6.5 By Countries

7. Type

7.1 Managed Data Center

7.2 Managed Security

7.3 Managed Communications

7.4 Managed Network

7.5 Managed Infrastructure

7.6 Managed Mobility

8. Size of Enterprise

8.1 Small & Medium Size

8.2 Large Enterprise

9. End-User

9.1 BFSI

9.2 IT and Telecommunication

9.3 Healthcare

9.4 Entertainment and Media

9.5 Retail

9.6 Manufacturing

9.7 Government

9.8 Others

10. Deployment

10.1 On-premise

10.2 Cloud

11 Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherland

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 Australia

11.3.5 South Korea

11.3.6 Thailand

11.3.7 Malaysia

11.3.8 Indonesia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 South Africa

11.5.2 Saudi Arabia

11.5.3 UAE

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Fujitsu Ltd

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Product Portfolio

14.1.4 Recent Development

14.1.5 Revenue Analysis

14.2 Cisco Systems Inc.

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Product Portfolio

14.2.4 Recent Development

14.2.5 Revenue Analysis

14.3 IBM Corporation

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Product Portfolio

14.3.4 Recent Development

14.3.5 Revenue Analysis

14.4 AT&T Inc.

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Product Portfolio

14.4.4 Recent Development

14.4.5 Revenue Analysis

14.5 Microsoft Corporation

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Product Portfolio

14.5.4 Recent Development

14.5.5 Revenue Analysis

14.6 Verizon Communications Inc.

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Product Portfolio

14.6.4 Recent Development

14.6.5 Revenue Analysis

14.7 Dell Technologies Inc.

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Product Portfolio

14.7.4 Recent Development

14.7.5 Revenue Analysis

14.8 Nokia Solutions and Networks

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Product Portfolio

14.8.4 Recent Development

14.8.5 Revenue Analysis

14.9 Rackspace Inc.

14.9.1 Overview

14.9.2 Key Persons

14.9.3 Product Portfolio

14.9.4 Recent Development

14.9.5 Revenue Analysis

14.10 Tata Consultancy Services Limited

14.10.1 Overview

14.10.2 Key Persons

14.10.3 Product Portfolio

14.10.4 Recent Development

14.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com