Jewelry Market Size, Growth & Forecast 2025–2033 | Renub Research

Buy NowGlobal Jewelry Market – Forecast & Growth Trends 2025–2033

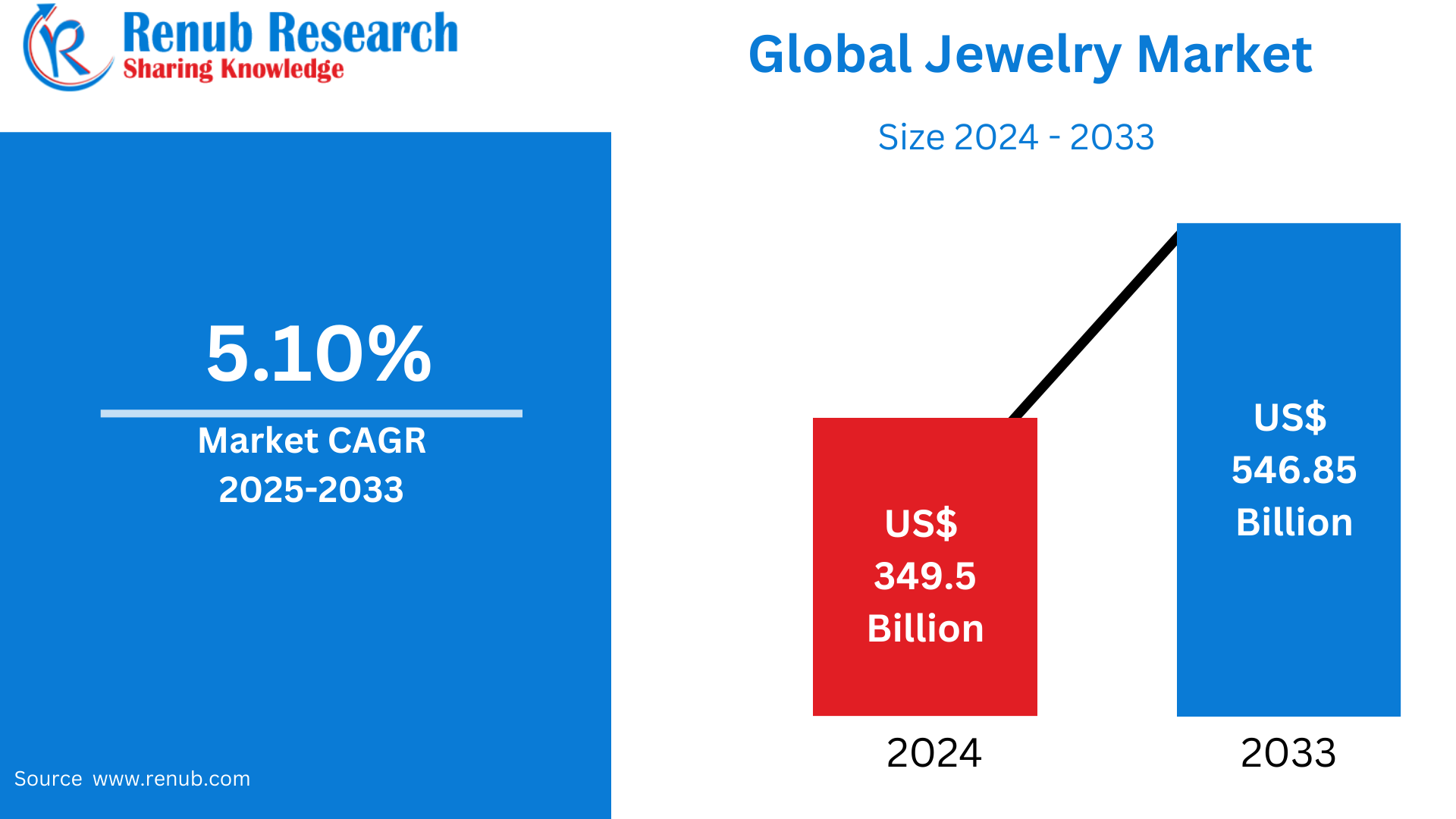

The Global Jewelry Market size was US$ 349.5 billion in 2024 and is expected to grow to US$ 546.85 billion by 2033, at a CAGR of 5.10% during the forecast period from 2025 to 2033. Rising disposable income, changing fashion trends, and a rise in demand for customized and luxury jewelry are major drivers of growth in both developed and emerging economies.

Global Jewelry Market Outlooks

Jewelry is ornamental material used for personal decoration, like necklaces, rings, earrings, bracelets, and brooches. Crafted from diverse materials—ranging from valuable metals such as gold and silver to gemstones, beads, and even artificial materials—jewelry fulfills various functions, ranging from cultural, religious, aesthetic, and symbolic purposes. Throughout history, jewelry has symbolized status, wealth, love, and identity across civilizations.

In today’s global market, jewelry remains immensely popular due to its emotional and cultural significance. It is commonly gifted during celebrations, weddings, anniversaries, and festivals. The growing influence of fashion trends, social media, and celebrity endorsements has further increased its appeal, especially among younger consumers.

Technological innovation has also made possible the development of customized and low-cost designs, expanding accessibility. Moreover, changing lifestyles, increasing disposable incomes, and growing e-commerce platforms fuel the growth of the world jewelry market. Both traditional skill and modern innovation are important drivers of its sustained popularity.

Drivers of Growth in the Global Jewelry Market

Increasing Disposable Income and Urbanization

With the growth of global economies, especially in emerging economies such as China and India, higher disposable incomes and urban lifestyles have highly contributed to demand for jewelry. People are in a spending mood for luxury and fashion and perceive jewelry as a fashion statement as well as an investment. Higher consumption in gold, diamonds, and fashion jewelry categories is being driven by the growing middle class, particularly in the Asia-Pacific region. Additionally, urbanization has resulted in increased exposure to international fashion trends, fueling demand for modern and branded items. Over two-thirds of the world will reside in cities by 2050. Urban shares in all nations are expected to grow over the next few decades, though at differing rates. By 2050, it's estimated that 1 in 7 individuals worldwide will reside in cities. Actually, in 2050 there are only a few nations where rural proportions are likely to be greater than urban. These are a number in Sub-Saharan Africa, Asia, Pacific Island Nations, and Guyana in South America.

E-commerce and Digital Transformation

The growth of websites has transformed jewellery retail, empowering consumers to seek out, configure, and acquire items from their homes. Try-ons using augmented reality (AR), virtual advisory sessions, and online certification services have established assurance in online jewelry buying. Influencer marketing and social media channels also fuel buyer interaction and advocacy. This e-convenience especially has drawn in Gen Z and millennial purchasers, fueling strong market growth.

Cultural and Ceremonial Significance

Jewelry is highly cultural, religious, and emotionally charged in most parts of Asia and the Middle East. In India and other similar countries, jewelry is a part of weddings, festivals, and religious ceremonies. Gold, especially, is considered a symbol of prosperity, tradition, and good fortune. Such strong-rooted traditions guarantee stable demand even in times of economic recession. As world diasporas expand, cultural practices—and related jewelry demand—spread beyond their homelands to international markets.

Challenges in the International Jewelry Market

Volatility of Prices of Precious Stones and Metals

The market for jewelry is extremely responsive to price movements of gold, silver, platinum, and diamonds. The prices of these commodities have a material impact on production expenses, retail prices, and purchasing behavior of consumers. For instance, a spurt in gold prices usually causes demand to slow down or switch to light and substitute products. This volatility makes inventory management, pricing, and profitability of manufacturers and retailers difficult.

Issues Regarding Ethical Sourcing and Sustainability

Today's consumers are more aware of the ethical and environmental consequences of their purchases. Conflict diamonds, hazardous mining practices, and unsustainable production processes have come under the spotlight. Brands that do not offer transparency and sustainable practices risk reputational damage. This issue has created a growing need for lab-grown diamonds, recycled materials, and certified sourcing, prompting companies to overhaul supply chains and implement strict ESG (Environmental, Social, and Governance) standards.

Expansion of Personalized Jewelry

Personalized jewelry—name necklaces, engraved rings, and birthstone accessories—is experiencing high demand as a result of its emotional significance and personalized appeal. Customers look for specially designed items that mirror individuality or celebrate occasions of significance. Advances in 3D printing and digital customization platforms enable brands to deliver customized products rapidly and cost-effectively. This trend is particularly favored among millennials and Gen Z, who are more inclined toward meaningful, unique pieces over bulk luxury products.

Expansion of Branded Jewelry

Branded jewelry is on the move as consumers increasingly trust and move toward established brands for quality guarantee, design creativity, and after-sales service. Global brands such as Tiffany & Co., Cartier, and Pandora are spreading their presence in Asia-Pacific, the Middle East, and Latin America. Branded products are also using influencer marketing, celebrity endorsements, and robust after-sales services to win consumer loyalty. The brand premium tends to facilitate higher margins even in price-conscious markets.

Men's Jewelry Segment Increasing

The men's jewelry segment, which was previously niche, is growing at a fast rate with evolving fashion standards and increased acceptance of jewelry by men. Men's watches, bracelets, rings, and chains are becoming increasingly popular among young consumers. Such a trend is also underpinned by marketing efforts introducing gender-neutral or masculine jewelry collections. Luxury and streetwear brands alike are taking advantage of the trend, turning men's jewelry into a high-growth space.

United States Jewelry Market

The U.S. is among the world's largest and most matured jewelry markets. Spurred by high disposable income, robust retail infrastructure, and cultural focus on gifting, the U.S. market exhibits robust demand for fine as well as fashion jewelry. Penetration of e-commerce is high, with prominent brands and digital natives providing new age shopping experiences. Lab-grown diamonds and sustainable sourcing are popular trends. Also, holiday shopping occasions such as Valentine's Day and Christmas drive high volumes. Nov 2024, India's omnichannel jewelry market leader CaratLane is excited to announce the opening of its first international store in New Jersey, launched officially on 27th October. This move marks an important step in CaratLane's goal to make pretty, everyday jewelry accessible to people across the world while staying rooted in its Indian culture and ethos.

France Jewelry Market

France, with its luxury heritage, is at the heart of global jewelry trading. With famous brands such as Cartier and Van Cleef & Arpels, the French market emphasizes craftsmanship, design, and exclusivity. Luxury boutiques and department stores serve high-end customers, and burgeoning tourism drives retail jewelry sales. Growing demand for sustainable luxury and online channels is slowly shifting consumer behavior in this generally conservative market.

India Jewelry Market

India is one of the biggest consumers of gold jewelry in the world, influenced heavily by cultural and religious traditions. Wedding and festival purchases dominate, with gold being considered an ornament and a long-term investment. The market is moving away from unorganized, local retailers to organized, branded players with certified products and contemporary designs. Government reforms, hallmarking standards, and digital take-up are increasingly professionalizing the industry and increasing consumer confidence. April 2025, American fine jewellery brand Angara officially launched in India with a digital-first strategy and intends to make a physical store presence in the country over the next few months to reach out to Indian consumers.

Saudi Arabia Jewelry Market

Saudi Arabia's jewelry market is rapidly modernizing, fueled by growing female labor participation, fashion awareness, and liberalized social attitudes. Classic gold and diamond jewelry are still mainstream staples, particularly for weddings and Islamic festivals. But younger shoppers are taking to lighter, day-to-day wear and global brands. Vision 2030's efforts to diversify the economy and develop retail, tourism, and e-commerce industries are also helping expand the market and create more consumer options.

Jewelry Market Segmentation

Product

- Ring

- Earring

- Bracelet

- Necklace

- Others

Material

- Gold

- Diamond

- Platinum

- Others

Distribution Channel

- Offline

- Online

End User

- Men

- Women

- Children

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Tiffany & Co

- Pandora

- Chow Tai Fook

- Louis Vuitton SE

- Richemont

- GRAFF

- Signet Jewelers Limited

- H. Stern

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Material, Distribution Channel, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Jewelry Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Jewelry Market Share Analysis

6.1 By Product

6.2 By Material

6.3 By Distribution Channel

6.4 By End User

6.5 By Countries

7. Product

7.1 Ring

7.2 Earring

7.3 Bracelet

7.4 Necklace

7.5 Others

8. Material

8.1 Gold

8.2 Diamond

8.3 Platinum

8.4 Others

9. Distribution Channel

9.1 Offline

9.2 Online

10. End User

10.1 Men

10.2 Women

10.3 Children

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Tiffany & Co

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 Pandora

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 Chow Tai Fook

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 Louis Vuitton SE

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Richemont

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 GRAFF

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 Signet Jewelers Limited

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 H. Stern

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com