Saudi Arabia Household Cleaners Market Overview 2025–2033

Buy NowSaudi Arabia Household Cleaners Market Size and Forecast

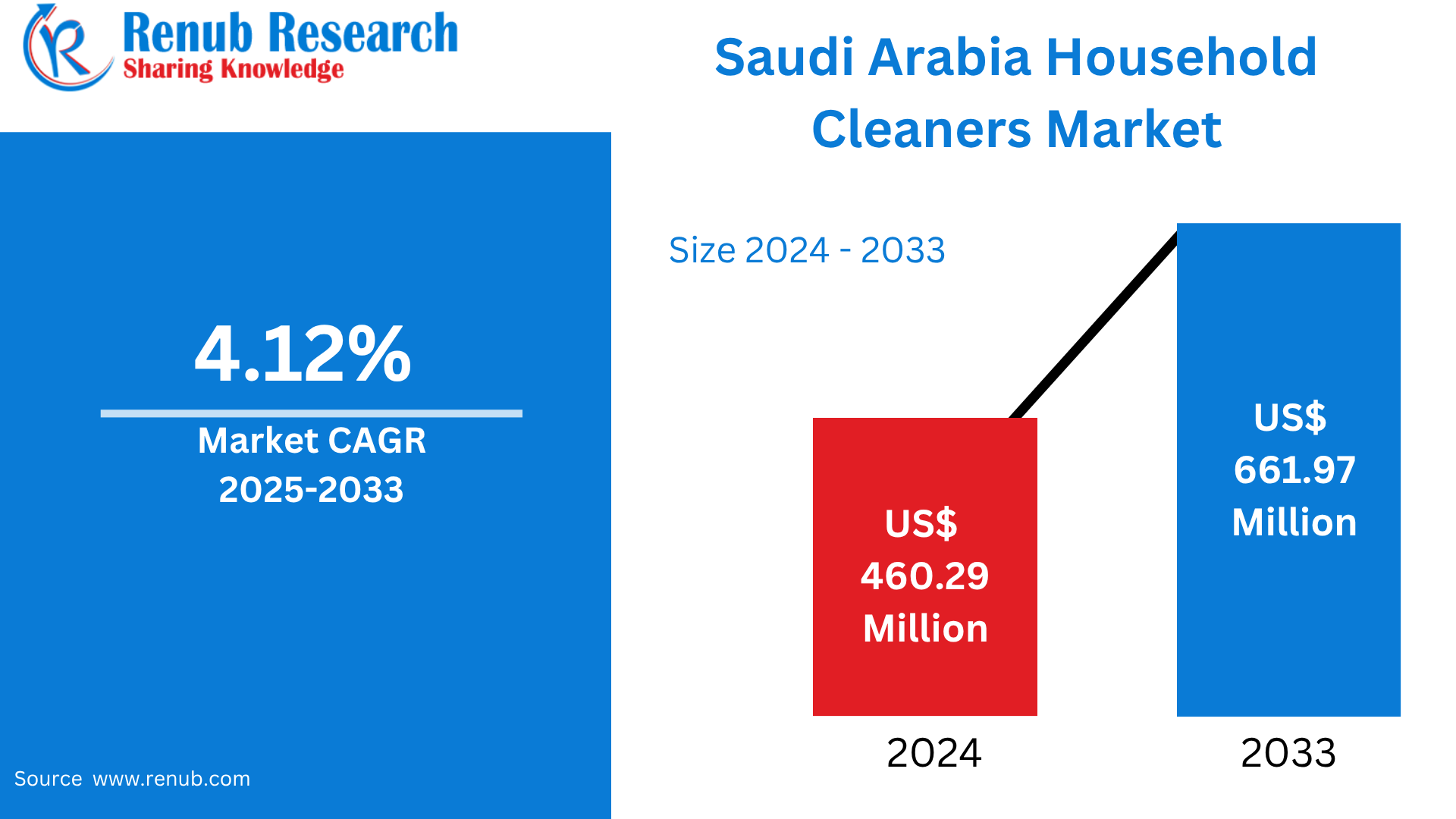

Saudi Arabia Household Cleaners Market is expected to reach US$ 661.97 Million by 2033 from US$ 460.29 Million in 2024, with a CAGR of 4.12% from 2025 to 2033. The market for home cleaners in Saudi Arabia is growing quickly due to rising consumer awareness of wellness, health, and cleanliness.

Saudi Arabia Household Cleaners Market Report by Type (Surface Cleaner, Glass Cleaner, Toilet Bowl Cleaner, Specialty Cleaners, Bleaches, Others), Application (Kitchen Cleaners, Bathroom Cleaners, Fabric Care, Floor Cleaner) and Company Analysis, 2025-2033.

Saudi Arabia Household Cleaners Industry Overview

Urbanization, a growing middle class, and increased awareness of sanitation and hygiene are driving the continuous rise of the Saudi Arabian home cleansers market. The need for a variety of cleaning supplies, including multipurpose sprays, toilet cleansers, kitchen degreasers, and surface disinfectants, has grown dramatically as people's awareness of their health has grown, particularly during the pandemic. Cleaning habits are also influenced by cultural and religious customs, which fuels consumer demand. The industry continues to draw both local and foreign firms that offer specialized and culturally relevant products as families place a higher priority on cleanliness.

The growing demand for environmentally friendly and non-toxic home cleansers is a significant trend impacting the industry. Consumers are looking for alternatives to conventional, chemical-based cleaning products due to health and environmental concerns. Natural, plant-based, and biodegradable formulations that are healthy for both the environment and families are becoming more and more popular as a result. To satisfy changing customer expectations, producers are responding by reformulating products and placing greater emphasis on certifications like halal conformity. Products with multiple uses are also becoming more popular since they enable customers to simplify their cleaning procedures while cutting down on waste and clutter.

The mechanics of retail are also shifting, with customers buying cleaning goods increasingly through internet channels. Due to its convenience, increased availability, and affordable prices, online shopping has grown significantly. Supermarkets and other traditional retail establishments continue to maintain a sizable portion of the market, but the rise of e-commerce is changing how many firms distribute their goods. These changes are also being influenced by government programs that encourage digital transformation and the construction of contemporary retail infrastructure. All things considered, the Saudi household cleaning market is poised for further development due to shifting consumer preferences, environmental awareness, and breakthroughs in product development. There are chances for both long-standing businesses and recent arrivals to serve a customer base that is becoming more discerning and knowledgeable.

Key Factors Driving the Saudi Arabia Household Cleaners Market Growth

Urbanization and Growing Middle Class

The market for home cleaners in Saudi Arabia is growing significantly due to the country's fast urbanization and growing middle class. Convenient and efficient cleaning products that work with hectic schedules are in high demand as more people relocate to cities and lead busier lives. Consumers with higher disposable money might invest more in high-end, specialty cleaning products that offer enhanced performance and other features like antibacterial qualities or pleasing scents. Additionally, urban inhabitants are more exposed to international brands and trends, which affects their shopping decisions. This change is pushing producers to create goods that fit contemporary lifestyles, such as small, user-friendly designs that appeal to urban families and young professionals, which will accelerate market expansion.

Shift Toward Eco-Friendly and Natural Products

Growing health consciousness and environmental concerns are driving a noticeable consumer trend in Saudi Arabia toward natural and eco-friendly household cleaning products. Many customers are looking for non-toxic, biodegradable, and halal-certified cleansers that meet their safety standards and values instead of conventional chemical-based ones. This change mirrors a larger worldwide trend toward wellness and sustainability, as consumers are paying more attention to the environmental effect and components of products. In response, producers are changing product formulas, utilizing plant-based components, and stressing label openness. For companies dedicated to natural and ethical product lines, the need for green cleaning solutions offers a substantial development potential as it not only promotes environmental sustainability but also appeals to health-conscious consumers.

Expansion of Retail and E-Commerce Channels

Saudi Arabian consumers now have much easier access to household cleaning goods thanks to the expansion of contemporary retail formats like supermarkets and hypermarkets as well as the quick ascent of e-commerce platforms. Supermarkets and hypermarkets provide convenience and competitive pricing by bringing a large range of brands and items under one roof. Meanwhile, because of their broad product range, simplicity of use, and home delivery choices, online shopping platforms have become increasingly popular. This tendency is further supported by the rising smartphone adoption and the expanding digital infrastructure. By reaching a wider audience—including busy families and tech-savvy younger consumers—multi-channel retail development enables firms to boost sales and promote innovation in product packaging and marketing tactics specifically designed for online buyers.

Challenges in the Saudi Arabia Household Cleaners Market

Consumer Skepticism Toward New Products

Consumer trust is a major factor in Saudi Arabian purchase decisions, particularly with regard to cleaning supplies for the home. Many customers are reluctant to test new or unknown items because they prefer well-known brands that have been shown to be dependable and effective. Manufacturers trying to promote novel formulations, such as natural or eco-friendly alternatives, that are not yet well recognized may find it difficult to overcome this cautious attitude. Significant marketing efforts, open communication about the advantages of the product, and occasionally certificates or endorsements from reliable people are all necessary to gain the trust of consumers. Without these, new goods or entrants could find it difficult to take off, which would reduce market diversity and impede the nation's adoption of cleaners that are healthier or more environmentally friendly.

Environmental Concerns and Sustainability Pressure

Demand for sustainable household cleaning products and packaging is being driven by Saudi consumers' and regulators' growing environmental consciousness. Manufacturers are compelled by this tendency to use biodegradable components, recyclable or less plastic packaging, and greener formulas. Adopting these environmentally friendly substitutes, however, frequently necessitates adjustments to supply chain, manufacturing, and sourcing practices as well as increased production costs. These changes might be especially difficult for smaller enterprises because of financial limitations and technological difficulties. Furthermore, in order to promote adoption, customers must continue to be educated about the advantages and functionality of sustainable goods. Notwithstanding these obstacles, sustainability is emerging as a crucial differentiator, and businesses who make investments in ecologically friendly operations stand to benefit from sustained competitive advantages in the changing Saudi market.

Market Segmentations

Type

- Surface Cleaner

- Glass Cleaner

- Toilet Bowl Cleaner

- Specialty Cleaners

- Bleaches

- Others

Application

- Kitchen Cleaners

- Bathroom Cleaners

- Fabric Care

- Floor Cleaner

All the Key players have been covered

- Overview

- Key Persons

- Recent Development

- Revenue Analysis

Company Analysis:

- Church & Dwight Co. Inc.

- Colgate-Palmolive Company

- Henkel AG & Company KGaA

- Reckitt Benckiser Group plc.

- The Procter & Gamble Company

- Unilever Plc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Type and Application |

| Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Household Cleaners Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Application

6.3 By Distribution Channel

7. Type

7.1 Surface Cleaner

7.2 Glass Cleaner

7.3 Toilet Bowl Cleaner

7.4 Specialty Cleaners

7.5 Bleaches

7.6 Others

8. Application

8.1 Kitchen Cleaners

8.2 Bathroom Cleaners

8.3 Fabric Care

8.4 Floor Cleaner

9. Distribution Channel

9.1 Online

9.2 Offline

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Church & Dwight Co. Inc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Colgate-Palmolive Company

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Henkel AG & Company KGaA

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Reckitt Benckiser Group plc.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 The Procter & Gamble Company

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Unilever Plc.

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com