Japan Cancer Diagnostics Market – Screening Technologies & Forecast 2025–2033

Buy NowJapan Cancer Diagnostics Market Size and Forecast 2025-2033

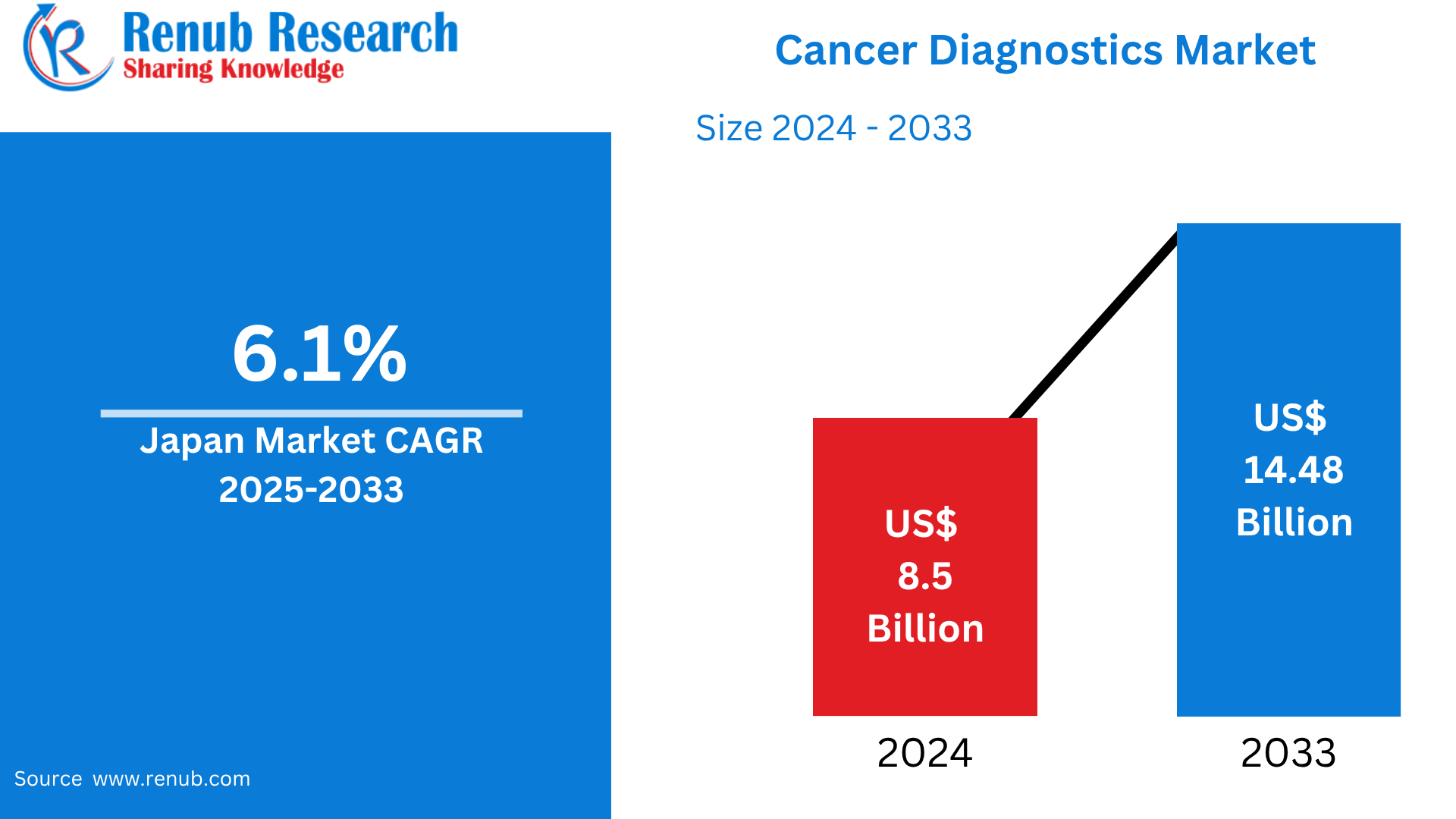

Japan Cancer Diagnostics Market is expected to reach US$ 14.48 billion by 2033 from US$ 8.5 billion in 2024, with a CAGR of 6.1% from 2025 to 2033. An aging population, rising cancer prevalence, government-sponsored screening programs, technological developments in molecular and imaging diagnostics, and growing demand for early detection and personalized medicine to enhance treatment outcomes and patient survival rates are the main factors propelling the Japanese cancer diagnostics market.

Japan Cancer Diagnostics Market Report by Application (Breast Cancer, Colorectal Cancer, Cervical Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Blood Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Ovarian Cancer, Others), Test Type (Tumor Biomarkers Tests, Imaging, Biopsy, Liquid Biopsy, Immunohistochemistry, In Situ Hybridization), End-User (Diagnostic Centers, Hospitals and Clinics, Research Institutes, Others) and Company Analysis, 2025-2033.

Japan Cancer Diagnostics Industry Overview

Rising cancer incidence, a fast-aging population, and improvements in diagnostic technology are all contributing to the continuous expansion of the Japanese cancer diagnostics market. The emphasis on early diagnosis and prevention in Japan's healthcare system has raised public awareness and encouraged broad participation in routine cancer screenings. As a result, there is a high need for diagnostic instruments that can identify cancer early on, when it is easier to treat. Biomarker testing, molecular diagnostics, biopsy techniques, and imaging technologies (such as MRI, CT, and PET scans) are important market sectors. Particularly for malignancies like breast, colorectal, and lung cancers, molecular and genetic tests are becoming more and more popular because of their capacity to offer individualized diagnostic insights.

The market environment is significantly shaped by government assistance. Under the national insurance system, Japan's health authorities fund a range of diagnostic treatments and aggressively encourage cancer screening programs. These programs increase the population's access to modern diagnostics. Furthermore, the way malignancies are detected and tracked is changing as a result of the rising use of liquid biopsies and the use of AI in diagnostic imaging. The industry does, however, confront certain obstacles, such as the high expense of certain cutting-edge diagnostic technologies and a lack of qualified experts in cancer diagnostics.

Notwithstanding these obstacles, it is anticipated that continued research expenditures, the development of healthcare facilities, and cooperative initiatives between public and private organizations would spur innovation and market growth. The need for precise, quick, and least invasive diagnostic methods will only increase since cancer is still one of the major causes of death in Japan. As a result, this area of the healthcare industry is dynamic and always changing.

Key Factors Driving the Japan Cancer Diagnostics Market Growth

Rising Cancer Prevalence

As one of the top causes of death in Japan, cancer continues to be one of the most important public health concerns. The need for early and precise diagnostic solutions has increased dramatically due to the continual rise in cancer cases, particularly those of the lung, breast, colorectal, and prostate malignancies. Both genetic and lifestyle-related malignancies are becoming more common as people age and their lives change. In order to identify cancer in its earliest and most curable stages, this trend calls for frequent screenings and more advanced diagnostic techniques. Therefore, healthcare providers are spending money on cutting-edge technology that deliver speed and accuracy. The significance of diagnostics in enhancing prognosis and survival outcomes increases with the size of the patient group.

Government-Supported Screening Initiatives

Through national screening programs, the Japanese government significantly contributes to increasing access to cancer diagnosis. The Ministry of Health, Labour, and Welfare supports public health initiatives that aggressively promote routine screenings for common malignancies, including lung, colorectal, breast, and cervical cancers. For many people, these programs eliminate financial obstacles because they are usually completely paid or subsidized by Japan's national health insurance system. Early detection rates have increased as a result, increasing the demand for sophisticated diagnostic instruments in both public and commercial healthcare environments. In addition to raising public awareness, these government-sponsored programs encourage the broad use of innovative technology, which drives market expansion and attempts to lessen the long-term financial burden of cancer on the healthcare system.

Technological Advancements in Brewing

In Japan, rapid advances in cancer diagnostics are changing the way the illness is identified and tracked. Advances in liquid biopsies, next-generation sequencing (NGS), molecular diagnostics, and AI-powered imaging systems have made it possible to diagnose a variety of tumors more quickly, accurately, and with less invasiveness. Early diagnosis greatly improves treatment success rates and survival outcomes, making these technologies particularly crucial. These advancements are also essential to personalized medicine, which customizes treatment regimens based on molecular and genetic profiling. These technologies are becoming more accessible and more reasonably priced as long as private companies and research organizations keep funding R&D. As a result of its incorporation into clinical practice, cancer care is being reshaped, with diagnostics now playing a major role in Japanese treatment plans.

Challenges in the Japan Cancer Diagnostics Market

High Cost of Advanced Diagnostic Technologies

One of the biggest obstacles to the Japanese cancer diagnostics business is the high expense of sophisticated diagnostic technology. Significant financial resources are needed for the acquisition, training, upkeep, and infrastructure adaption of tools like next-generation sequencing (NGS), molecular diagnostics, and AI-driven imaging systems. Rural clinics and smaller hospitals sometimes lack the funding necessary to install these systems, which leads to uneven access to state-of-the-art diagnostics. The initial expense of implementing such technology is still a barrier, despite the fact that the Japanese government offers some assistance in the form of national insurance and subsidies. This price burden limits the potential influence of these improvements on early diagnosis and treatment by slowing the general adoption of contemporary cancer diagnostics and preventing consistent quality of care across all areas.

Regional Disparities in Healthcare Access

Even with Japan's robust healthcare system, access to cutting-edge cancer diagnostics varies significantly by area. High-tech hospitals and specialist cancer facilities with the newest diagnostic equipment are advantageous in urban areas. On the other hand, the infrastructure, tools, and skilled workers needed for thorough cancer screening and diagnosis are frequently lacking in rural and isolated locations. Delays in early identification, uneven patient outcomes, and a greater strain on urban healthcare facilities are all consequences of this urban-rural difference. For diagnostic services, patients in less accessible areas would need to travel great distances, which can be expensive and time-consuming. To guarantee equitable access to high-quality diagnostic care across the country, closing this gap will continue to be a significant issue that calls for focused initiatives and smart investments in regional healthcare development.

Market Segmentations

Application

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Blood Cancer

- Kidney Cancer

- Liver Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Others

Test Type

- Tumor Biomarkers Tests

- Imaging

- Biopsy

- Liquid Biopsy

- Immunohistochemistry

- In Situ Hybridization

End User

- Diagnostic Centers

- Hospitals and Clinics

- Research Institutes

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Llumina

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Roche Holding AG.

- Pfizer, Inc.

- Koninklijke Philips N.V.

- bioMérieux

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Application, By Test Type and By End Users |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Japan Cancer Diagnostics Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Application

6.2 By Test Type

6.3 By End Users

7. Application

7.1 Breast Cancer

7.2 Colorectal Cancer

7.3 Cervical Cancer

7.4 Lung Cancer

7.5 Prostate Cancer

7.6 Skin Cancer

7.7 Blood Cancer

7.8 Kidney Cancer

7.9 Liver Cancer

7.10 Pancreatic Cancer

7.11 Ovarian Cancer

7.12 Others

8. Test Type

8.1 Tumor Biomarkers Tests

8.2 Imaging

8.3 Biopsy

8.4 Liquid Biopsy

8.5 Immunohistochemistry

8.6 In Situ Hybridization

9. End-User

9.1 Diagnostic Centers

9.2 Hospitals and Clinics

9.3 Research Institutes

9.4 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Llumina

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Abbott Laboratories

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Thermo Fisher Scientific, Inc.

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 QIAGEN N.V.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Roche Holding AG.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Pfizer, Inc.

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Koninklijke Philips N.V.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 bioMérieux

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com