Australia Lung Cancer Diagnostics Market – Technologies & Forecast 2025–2033

Buy NowAustralia Lung Cancer Diagnostics Market Size and Forecast 2025-2033

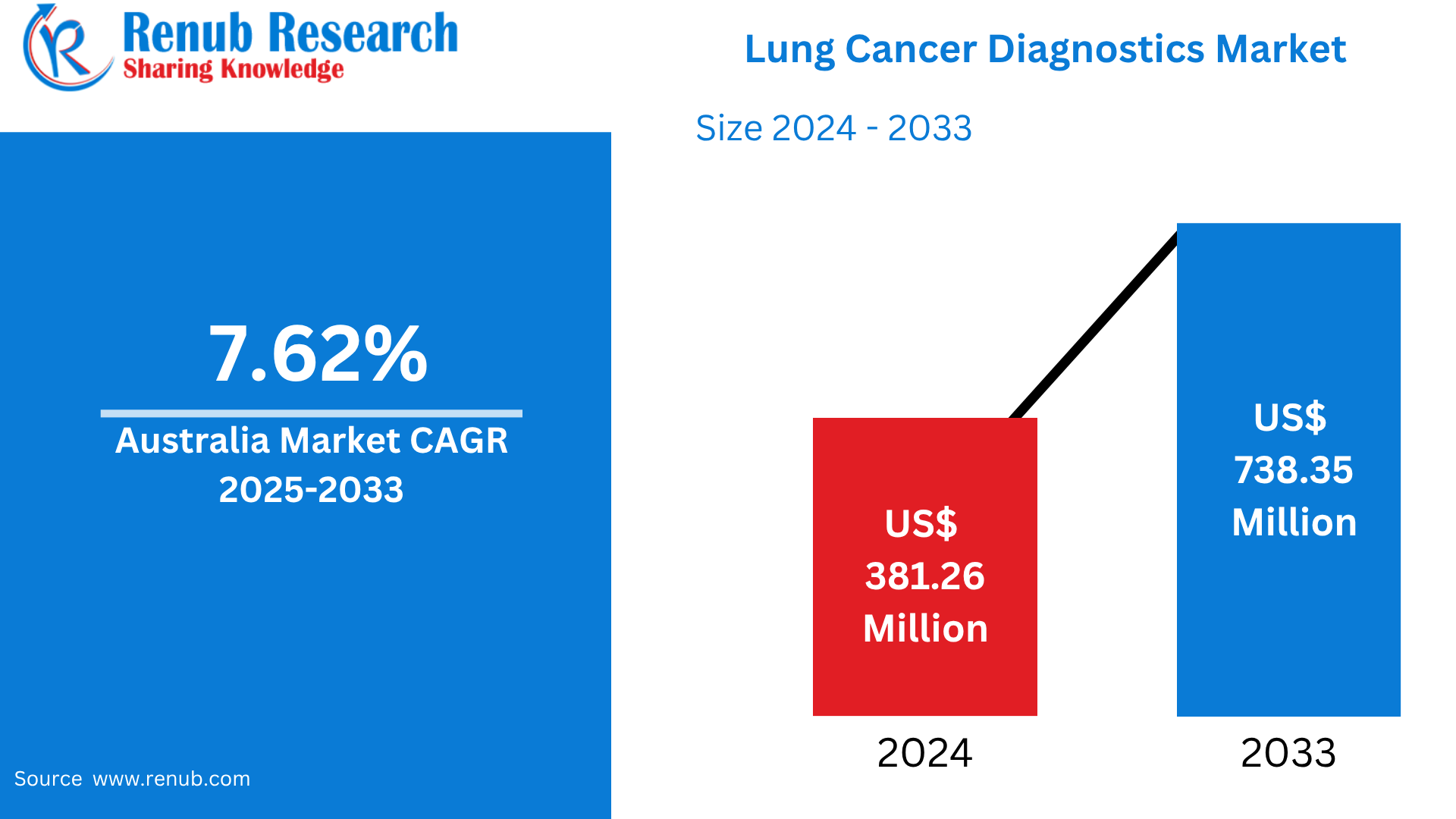

Australia Lung Cancer Diagnostics Market is expected to reach US$ 738.35 million by 2033 from US$ 381.26 million in 2024, with a CAGR of 7.62% from 2025 to 2033. Rising cancer incidence, government screening programs, technological developments like artificial intelligence (AI) and liquid biopsies, greater awareness, and rising investment in precision oncology and molecular diagnostics for early, accurate diagnosis are the main factors driving Australia's lung cancer diagnostics market.

Australia Lung Cancer Diagnostics Market Report by Diagnosis Test Type (Imaging Test, Biopsy, Sputum Cytology, Molecular Test, Others), Cancer Type (Non- Small Cell Lung Cancer, Small Cell Lung Cancer), End-User (Hospital Associated Labs, Independent Diagnostic Laboratories, Diagnostic Imaging Centers, Cancer Research Institutes, Others) and Company Analysis, 2025-2033.

Australia Lung Cancer Diagnostics Industry Overview

The market for lung cancer diagnostics in Australia is expanding significantly due to improvements in diagnostic technology and increased emphasis on early diagnosis. Artificial intelligence (AI)-enhanced imaging and liquid biopsies, which identify circulating tumor DNA, are two examples of technologies that are changing the landscape by providing quick, accurate, and non-invasive diagnostic alternatives. Better patient outcomes result from these advancements because they allow physicians to detect lung cancer earlier. Additionally, thorough genetic profiling is made possible by the incorporation of next-generation sequencing (NGS) into diagnostic procedures, which enables individualized treatment plans. The nation's commitment to improving oncology patient care and diagnostic skills is demonstrated by the Australian government's efforts to address the disease, such as the creation of the Australian Comprehensive Cancer Network.

The market is supported not just by technology developments but also by growing accessibility and awareness. Programs aimed at high-risk groups, such as individuals with a family history of lung cancer or a history of smoking, are growing. In order to ensure more access to diagnostic services, mobile screening units and community outreach programs are being introduced in disadvantaged regions. Public health campaigns that inform the public about the value of early detection and the availability of screening methods support these initiatives. When taken as a whole, these elements support Australia's lung cancer diagnostics market's explosive expansion and place the nation at the forefront of cutting-edge cancer treatment.

Key Factors Driving the Australia Lung Cancer Diagnostics Market Growth

Rising Incidence of Lung Cancer

Lung cancer cases have significantly increased in Australia, not just among smokers and other typical high-risk categories, but also among older people and non-smokers. This tendency is caused by a number of factors, including genetic predispositions, occupational dangers, and environmental exposures. There is a pressing need for earlier and more precise detection techniques since the chance of being diagnosed with lung cancer increases with population age. The need for cutting-edge diagnostic tools that can detect the illness at an early stage and cure it is being driven by this rising occurrence. The development and application of cutting-edge lung cancer detection technologies is a major goal in the Australian healthcare system since early diagnosis is essential for increasing survival rates.

Advancements in Diagnostic Technologies

Rapid advances in medical technology are having a substantial impact on the lung cancer diagnostics business in Australia. Advancements like liquid biopsies, which use blood samples to identify circulating tumor DNA, offer a non-invasive and incredibly sensitive early detection method. Imaging aided by artificial intelligence (AI) improves radiological data interpretation by decreasing human error and increasing accuracy. Furthermore, thorough genetic profiling of cancers is becoming possible because to next-generation sequencing (NGS), which advances precision medicine by enabling doctors to customize therapies according to the unique characteristics of each patient. By making procedures quicker, less invasive, and more precise, these technological advancements are revolutionizing the way lung cancer is detected, improving patient outcomes and propelling market expansion.

Growing Awareness and Screening Campaigns

Growing public knowledge of lung cancer and the value of early diagnosis is crucial for the market's growth. Nationwide initiatives to inform the public about risk factors, symptoms, and available diagnostic methods are being aggressively carried out by government and nonprofit groups. More people are actively seeking screening services as a result of these initiatives, particularly those who fall into high-risk groups. Additionally, focused outreach programs in underprivileged and rural areas are assisting in closing the diagnostics access gap. More individuals will probably take part in screening programs as awareness grows, which directly contributes to earlier diagnosis and higher survival rates.

Challenges in the Australia Lung Cancer Diagnostics Market

High Cost of Advanced Diagnostics

The high cost of sophisticated diagnostic technology is one of the main issues facing the lung cancer diagnostics business in Australia. Although they provide less intrusive and more reliable diagnostic choices, innovative techniques like liquid biopsies and next-generation sequencing (NGS) are sometimes more expensive. For patients who are not sufficiently covered by private insurance or public healthcare systems, these expenses may be unaffordable. Because of this, access to these state-of-the-art diagnostics is still unequal, especially for those who lack insurance or have low incomes. Hospitals and healthcare providers are also impacted by the high cost, and they could be reluctant to implement newer technology because of financial limitations. This financial obstacle prevents broad adoption and impedes initiatives for early cancer detection and individualized cancer treatment.

Limited Access in Rural and Remote Areas

The large size of Australia poses a major obstacle to the equitable detection of lung cancer, especially in rural and isolated areas. Specialized medical facilities including pathology labs, diagnostic imaging centers, and cancer treatments are lacking in many of these places. The problem is also made worse by the lack of qualified medical personnel in these areas. Long travel times for patients to receive diagnostic services can cause delays in diagnosis and treatment. In non-urban communities, this regional mismatch leads to greater death rates and worse health outcomes. Ensuring uniform and prompt access to high-quality lung cancer diagnostics in every location is still a major challenge for the Australian healthcare system, notwithstanding telemedicine and mobile health initiatives.

Recent Developments in Australia Lung Cancer Diagnostics Industry

- The first new national cancer screening program in almost two decades, the National Lung Cancer Screening Program, was announced by the Australian government in April 2025 and is scheduled to launch in July of that year.

Market Segmentations

Diagnosis Test Type

- Imaging Test

- Biopsy

- Sputum Cytology

- Molecular Test

- Others

Cancer Type

- Non- Small Cell Lung Cancer

- Small Cell Lung Cancer

End-User

- Hospital Associated Labs

- Independent Diagnostic Laboratories

- Diagnostic Imaging Centers

- Cancer Research Institutes

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Llumina

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Roche Holding AG.

- Sanofi S.A.

- Agilent Technologies

- bioMérieux

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Diagnosis Test Type, By Cancer Type and By End Users |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Australia lung Cancer Diagnostics Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Diagnosis Test Type

6.2 By Cancer Type

6.3 By End Users

7. Diagnosis Test Type

7.1 Imaging Test

7.2 Biopsy

7.3 Sputum Cytology

7.4 Molecular Test

7.5 Others

8. Cancer Type

8.1 Non- Small Cell Lung Cancer

8.2 Small Cell Lung Cancer

9. End-User

9.1 Hospital Associated Labs

9.2 Independent Diagnostic Laboratories

9.3 Diagnostic Imaging Centers

9.4 Cancer Research Institutes

9.5 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Llumina

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Abbott Laboratories

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Thermo Fisher Scientific, Inc.

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 QIAGEN N.V.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Roche Holding AG.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Sanofi S.A.

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Agilent Technologies

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 bioMérieux

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com