Global HVAC Equipment Market – Industry Trends & Forecast 2025–2033

Buy NowHVAC Equipment Market Size and Forecast 2025-2033

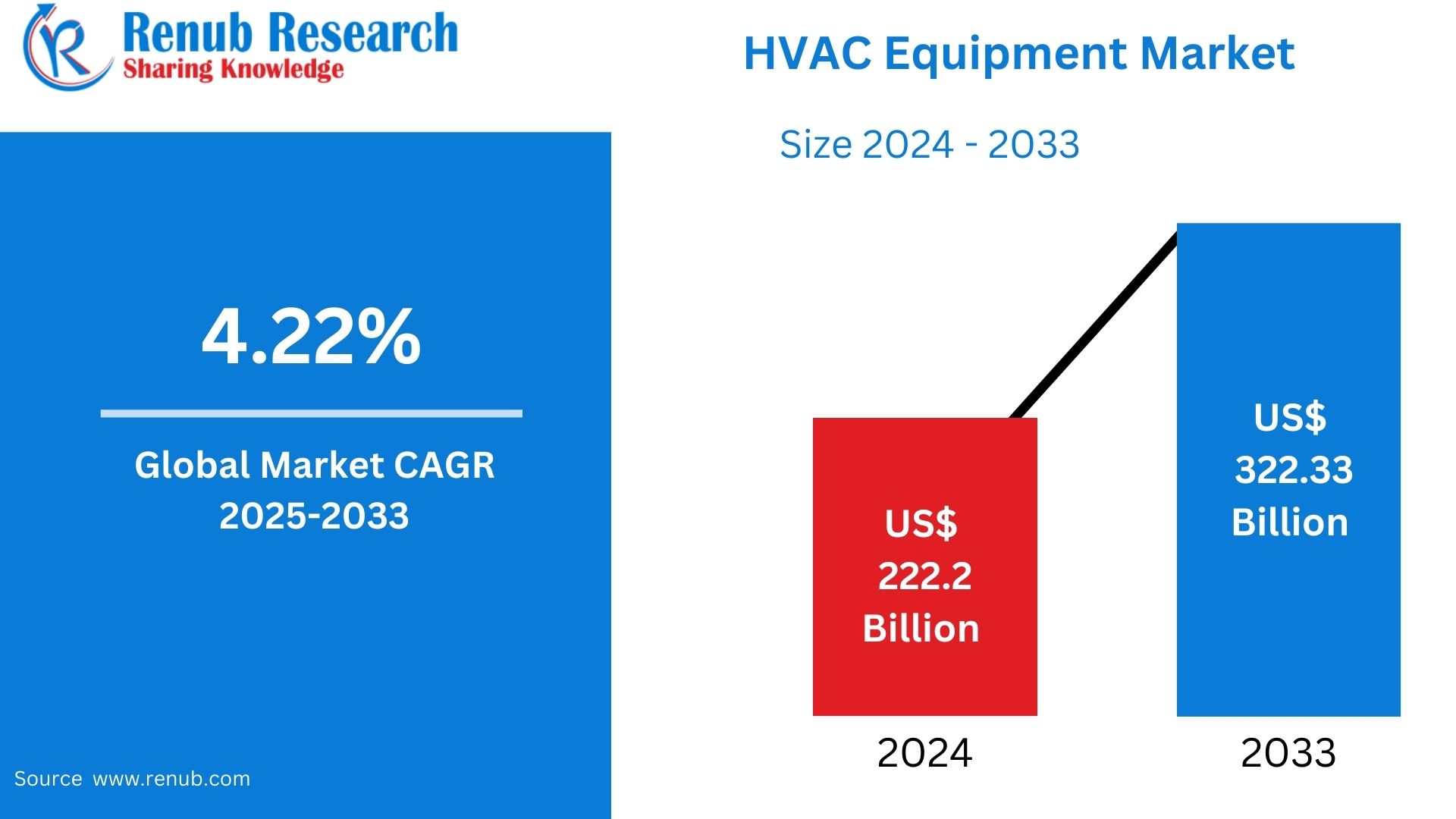

HVAC Equipment Market is expected to reach US$ 322.33 billion by 2033 from US$ 222.2 billion in 2024, with a CAGR of 4.22% from 2025 to 2033. Environmental sustainability awareness, energy efficiency laws, and major technology breakthroughs are driving the industry. The market expansion for HVAC equipment is also being fueled by the growing trend of smart and connected systems, urbanization in emerging nations, and the growing number of green building initiatives.

HVAC Equipment Global Market Report by Equipment (Heat Pump, Air Conditioning, Bollers, Air Purifier, Chillers, Air Handling Units, Unitary Heaters, Ventilation Fans, Dehumidifier, Others), End Use (Residential, Commercial, Industrial), Countries and Company Analysis, 2025-2033.

Global HVAC Equipment Industry Overview

The worldwide market for HVAC (heating, ventilation, and air conditioning) equipment is expanding steadily due to factors including climate change, urbanization, and rising awareness of energy efficiency and indoor air quality. HVAC systems are being widely used in the commercial, industrial, and residential sectors because to the growing need for suitable living and working conditions. Automation, IoT-enabled systems, and smart thermostats are examples of technological innovations that are improving system performance and consumer convenience. Eco-friendly HVAC systems are also becoming more popular due to strict environmental restrictions and a global push for sustainable and energy-efficient architecture. While industrialized nations concentrate on updating older systems to suit contemporary efficiency requirements and environmental goals, developing economies see quick adoption owing to infrastructural expansion.

By 2050, 68% of the world's population is expected to reside in urban regions, indicating that urbanization will likely continue on its increasing trajectory. Appropriate ventilation systems in buildings are helpful in lowering air pollution levels, controlling temperature, and preserving a healthy environment for urban dwellers as the population of cities grows. A buildup of germs, smells, and pollutants may be eliminated with the use of a ventilation system. Additionally, it can regulate a room's temperature to improve comfort and lessen the likelihood of mold growth. The United Nations estimates that the present population of 7.6 billion people will increase to 8.6 billion by 2030, 9.8 billion by 2050, and 11.2 billion by 2100. Even if fertility rates continue to fall, the world's population is predicted to continue growing, with an estimated 83 million new individuals joining the population each year.

Buildings in the European Union account for over 40% of energy consumption and 36% of greenhouse gas emissions, mostly from construction, use, refurbishment, and destruction, according to the European Commission. A significant portion of the energy used in these buildings is consumed by HVAC systems.

Key Factors Driving the HVAC Equipment Market Growth

Growing Call for Better Air Quality

The need for better air quality has grown dramatically, especially in the wake of the worldwide health emergency. HVAC systems that are excellent at improving indoor air quality as well as controlling temperature are now given top priority by both consumers and companies. As a result of this change, HVAC systems' filtration and ventilation technology have advanced. For example, LG's Plasmaster Ionizer++ technology efficiently eliminates up to 99.9% of adherent bacteria (Pseudomonas aeruginosa, Escherichia coli, and Staphylococcus aureus) in a 30-m³ test room. Additionally, it is increasingly common for HVAC equipment to include air filtration technology directly, guaranteeing healthier and cleaner indoor environments in both home and business settings.

Growing Environmental Sustainability Awareness

Government laws and a rising awareness of environmental problems are the primary drivers of the global push for HVAC systems to be more energy efficient. High-efficiency parts like smart thermostatic controls and variable speed compressors are being developed by manufacturers to adjust energy consumption in response to current demands. In order to better control humidity and adapt to heating and cooling needs while using less energy, Carrier unveiled their Infinity 20 air conditioner with Greenspeed intelligence, which operates at various speeds. Carrier is able to offer extremely effective cooling for households and small businesses thanks to systems with Greenspeed intelligence. By reducing the energy-intensive impact of heating and cooling buildings, this not only helps customers save money on operating expenses but also supports larger environmental sustainability initiatives.

Developments in Technology

An important development in the management of temperature control in residential and commercial buildings is the incorporation of internet of things (IoT) technology into HVAC systems. Users may remotely control their HVAC settings using smartphones, tablets, or other smart devices by integrating smart, linked systems. This connection improves user comfort and operational efficiency by enabling accurate temperature change, monitoring, and scheduling from any location. For example, Resideo introduced the Honeywell Home T10+ Smart Thermostat Kits, which use RedLINK 3.0 technology to provide HVAC systems with fully configurable solutions for comfort and indoor air quality control. By allowing management over numerous indoor air quality devices at once, these kits improve the T10 Pro Smart Thermostat and make setup and customization easier for users. The outcome is a more responsive and user-friendly temperature control environment in addition to better energy management and lower expenses.

Challenges in the HVAC Equipment Market

Energy Consumption and Efficiency

In the market for HVAC equipment, energy efficiency and consumption continue to be significant issues. HVAC systems have a major influence on operating costs and environmental impacts since they are among the most energy-intensive parts of residential, commercial, and industrial buildings. A persistent problem is maximizing efficiency while consuming the least amount of energy, particularly in areas where HVAC systems are strained by antiquated or inadequately insulated equipment. Retrofitting is difficult and expensive since many older buildings are not built to accommodate contemporary, energy-efficient systems. Furthermore, achieving a balance between comfort and lower energy use sometimes calls for cutting-edge technology, such variable-speed systems and smart thermostats, which may not be widely used. In an increasingly climate-conscious global market, addressing these efficiency issues is essential to achieving sustainability goals and lowering energy consumption.

Maintenance and Lifecycle Costs

In the market for HVAC equipment, maintenance and lifespan costs are major obstacles. Because HVAC systems require frequent inspections, part replacements, and expert personnel, maintenance may get costly over time, especially for big or sophisticated installations. Routine maintenance neglect frequently leads to unanticipated breakdowns, increased energy consumption, and system inefficiencies, all of which can cause operations to be disrupted and repair costs to rise. Furthermore, inadequate maintenance reduces the system's lifespan, necessitating early replacements and additional capital costs. Downtime brought on by HVAC malfunctions can affect comfort and productivity in commercial and industrial environments. Predictive technology and proactive maintenance programs are becoming more and more crucial in addressing these problems, but they also come with a cost and a sustained commitment from building owners and operators.

HVAC Equipment Market Overview by Regions

Due to fast infrastructure development and urbanization, the HVAC equipment market is growing strongly across all regions, with Asia-Pacific leading the way. While the Middle East and Africa experience growing demand due to harsh climate conditions, North America and Europe concentrate on energy-efficient renovations. The following provides a market overview by region:

United States HVAC Equipment Market

The market for HVAC equipment in the US is expanding significantly due to a number of factors, including attractive government incentives, technical improvements, and rising demand for energy-efficient systems. The market is distinguished by a wide variety of goods that serve the residential, commercial, and industrial sectors, such as air conditioners, heat pumps, and air purifiers. To improve their product offerings and increase their market position, major industry players are concentrating on innovation and strategic alliances. The market's future is being shaped by the use of smart HVAC systems, integration with building automation, and sustainability. The market for HVAC equipment in the US is expected to increase steadily due to the growing demand for cozy and energy-efficient interior spaces.

Germany HVAC Equipment Market

Technology breakthroughs, ecological objectives, and strict energy efficiency laws are propelling the market for HVAC equipment in Germany. As a result of the government's pledge to achieve carbon neutrality by 2050, HVAC systems are increasingly using renewable energy sources, such heat pumps and solar-assisted solutions. Homeowners and companies may now more easily adopt energy-efficient solutions thanks to the introduction of significant subsidies and incentives. Building automation and a move toward smart technologies, which improve system performance and user control, are characteristics of the market. The German HVAC equipment industry is expected to develop further, in line with the country's energy and environmental goals, despite obstacles including high upfront costs and the demand for specialized personnel.

China HVAC Equipment Market

The market for HVAC equipment in China is expanding rapidly due to factors such growing urbanization, more construction projects, and growing consumer demand for energy-efficient products. The necessity for sophisticated HVAC systems has increased as a result of the government's support of green construction initiatives and its dedication to sustainability and carbon neutrality. Energy efficiency and user control are being improved by technological developments, such as the use of IoT and AI in HVAC systems. The market is distinguished by a wide variety of goods serving the commercial, industrial, and residential markets. Leading companies in the sector are concentrating on strategic alliances and innovation to increase their market share. The market for HVAC equipment in China is expected to increase further, in line with the country's energy and environmental goals, despite obstacles such high upfront costs and the demand for specialized personnel.

Coal-based district heating is now the most popular method of space heating in northern Chinese cities. The Chinese people's cultural history and way of life have been significantly influenced by traditional heating techniques. However, a sizable portion of Chinese households continue to heat their homes with little coal burners, which contributes to air pollution that is harmful to human health. The Chinese government launched the "Clean Heating Plan" in 2017 to address these problems, with the goal of converting 70% of northern homes from coal to cleaner heating options. As a result, China has successfully worked to lower air pollution and has set a goal of becoming carbon neutral by 2060.

United Arab Emirates HVAC Equipment Market

Rapid urbanization, harsh weather, and a strong focus on sustainability and energy efficiency are some of the reasons propelling the UAE's HVAC equipment market's strong development. The need for sophisticated HVAC systems has grown dramatically as a result of the nation's ambitious infrastructure initiatives, which include megadevelopments and smart cities. Further driving market expansion are technological developments like the adoption of energy-efficient solutions like variable refrigerant flow (VRF) systems and the integration of IoT-enabled smart HVAC systems. The market's expansion has also been aided by government programs that support renewable energy integration and green construction requirements. The market for HVAC equipment is expected to grow further as the UAE makes more investments in sustainability and infrastructure to meet the demands of the commercial, industrial, and residential sectors.

Recent Developments in HVAC Equipment Industry

- With investments of USD 105 million, Midea Group announced in November 2023 the opening of its third industrial complex in Egypt, in the Sadat City industrial zone. This brings the total amount of Midea Group's investments in the Egyptian market to USD 247 million and opens the door to about 3,900 new job opportunities as well as exports to all countries worldwide.

Market Segmentations

Equipment

- Heat Pump

- Air Conditioning

- Bollers

- Air Purifier

- Chillers

- Air Handling Units

- Unitary Heaters

- Ventilation Fans

- Dehumidifier

- Others

End Use

- Residential

- Commercial

- Industrial

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Carrier Corporation

- Daikin Industries, Ltd.

- Fujitsu

- Haier Group

- Havells India Ltd.

- Hitachi Ltd.

- Johnson Controls

- LG Electronics

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Equipment, By End Use and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global HVAC Equipment Market

5.1 Historical Market Trends

5.2 Market Forecast

6. HVAC Equipment Market Share Analysis

6.1 By Equipment

6.2 By End Use

6.3 By Countries

7. Equipment

7.1 Heat Pump

7.2 Air Conditioning

7.3 Bollers

7.4 Air Purifier

7.5 Chillers

7.6 Air Handling Units

7.7 Unitary Heaters

7.8 Ventilation Fans

7.9 Dehumidifier

7.10 Others

8. End Use

8.1 Residential

8.2 Commercial

8.3 Industrial

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Carrier Corporation

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Daikin Industries, Ltd.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Fujitsu

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Haier Group

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Havells India Ltd.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Hitachi Ltd.

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Johnson Controls

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 LG Electronics

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com