India Air Conditioner Market Size, Share, Growth & Forecast 2024–2033

Buy NowIndia Air Conditioner Market Trends & Summary

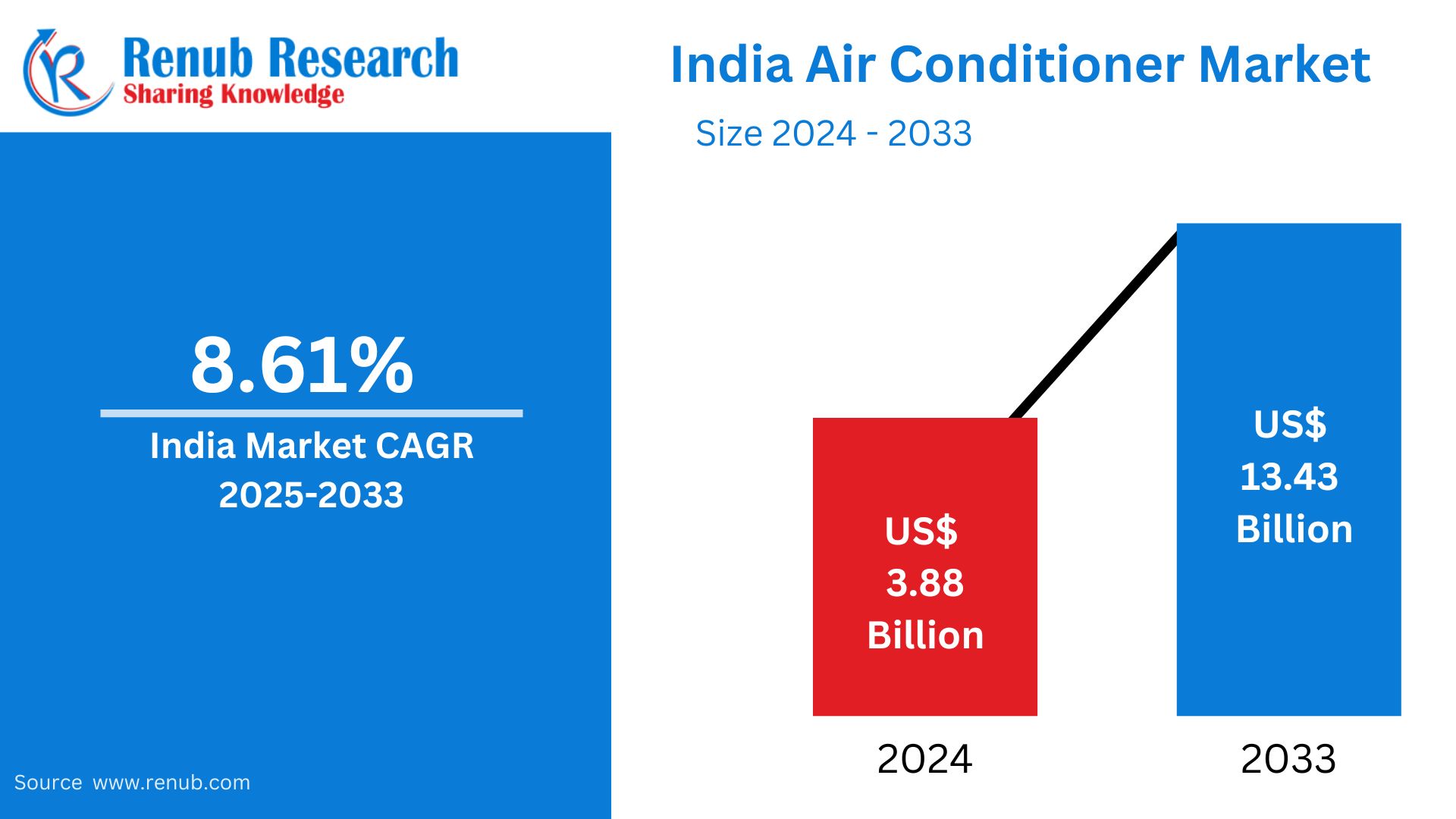

India Air Conditioner Market valued at USD 3.88 billion in 2024, is expected to grow substantially, reaching USD 13.43 billion by 2033, at a strong compound annual growth rate of 14.78% during the 2025–2033 period. With growing temperatures, urbanization, middle-class income growth, and rising energy-efficient cooling needs, the market is facing good demand in both residential and commercial segments across India.

The report India Air Conditioner Market Forecast covers by Types (Room, Ducted, Ductless, Centralized), Products Types (Split AC, Window AC, Other AC), Size (1 Ton, 1.5 Ton, 2 Ton, Others, Applications (Residential, Commercial & Retail Application, Hospitality, Transportation & Infrastructure, Healthcare, Others Applications), Sales Channels (Supermarkets, Specialty Stores, Online, Others), Regions and Company Analysis 2025-2033.

India Air Conditioner Market Overview

An air conditioner (AC) is an electronic device that has the function to control indoor air temperature, humidity, and quality by extracting heat and moisture from the air. It operates using a refrigeration cycle, applying parts such as compressors, condensers, and evaporators to dissipate heat for cooling air efficiently. Air conditioners are employed extensively in Indian homes, workplaces, shopping spaces, and establishments to create a comfortable environment to endure long hot summer months, particularly in areas with high heat and humidity, such as India's cities.

The popularity of air conditioners in India has surged in recent years due to rising disposable incomes, improved electrification in rural areas, and growing awareness of energy-efficient technologies. Urbanization and infrastructure development have also contributed to the adoption of AC units in residential apartments and corporate buildings. Moreover, increasing demand for inverter ACs, smart ACs, and eco-friendly refrigerants is reshaping consumer preferences. As global warming makes heatwaves more severe, air conditioners are becoming a necessity, not a luxury, in Indian homes and businesses.

Growth Drivers of the India Air Conditioner Market

Increasing Disposable Incomes and Lifestyle Changes

India's urbanization at a rapid pace, along with an increasing middle-class population, is greatly driving the demand for air conditioners. As individuals move to cities for better livelihoods and living standards, they are exposed to more modern infrastructure and appliances. With higher dual-income families and growing disposable income levels, consumers are more likely to spend on comfort-driving products such as air conditioners. Further, aspirational shopping behavior of the youth segment and the power of digital media are driving ACs from premium to mass purchase categories, particularly in Tier-I and Tier-II cities. This transition continues to transform demand across both residential and commercial segments in India. As per official projections of the United Nations, India's urban population is expected to rise from 410 million in 2014 to 814 million in 2050.

Climate Change and Higher Demand for Cooling Solutions

India has been witnessing record heatwaves in the last few years, especially in Rajasthan, Uttar Pradesh, and Maharashtra. Increasing global temperatures and volatile climate patterns have turned air conditioners into a necessity and not a luxury for many households. Prolonged summer seasons and increasing humidity levels are driving demand for room and split ACs in residential and institutional segments. Discomfort caused by climate change is also increasing usage rates in commercial buildings such as schools, offices, and shopping malls. With growing climate change, the demand for cooling solutions such as air conditioners is emerging as a sustained driver of demand across the nation. India is facing an early and very hot summer in 2025. India is witnessing an early and severe summer in 2025, with the first heatwave warning given in April by the India Meteorological Department (IMD). India witnessed one of its hottest summers in 14 years in 2024, with 536 heat wave days. Churu in Rajasthan saw a maximum temperature of 50.5°C. Sadly, more than 700 heatstroke deaths were reported between March and June 2024 in 17 states.

Government Energy Efficiency Programs and Adoption of Inverter Technology

Government efforts to promote energy-efficient appliances by way of labeling initiatives and the adoption of star rating schemes by the Bureau of Energy Efficiency (BEE) have prompted consumers to switch to energy-saving air conditioners. This move is inducing innovation among makers to create power-saving models, such as inverter ACs reducing electricity usage. Inverter technology, which facilitates variable compressor speed, is gaining popularity because it is inexpensive to buy as well as environment-friendly. The consciousness towards sustainable cooling technologies is also increasing among green-conscious consumers. All these trends are encouraging the adoption of technologically sophisticated and green air conditioning equipment in Indian markets.

Challenges Facing the Market

High Electricity Prices and Power Infrastructure Constraints

Even with increased demand, the high cost of electricity is still a major inhibitor to air conditioner penetration, especially among lower-end households in Tier-III cities and rural markets. Air conditioners are viewed as power-hungry appliances, and uneven power supply in various areas further restricts their usage. Inverter technology notwithstanding, attempts to minimize consumption, cost is still a primary concern. Prospective buyers postpone or forego AC purchases as a result of expected energy bills. In addition, insufficient infrastructure, for example, voltage instability and unreliable electricity grids in rural and semi-urban India, prevents regular usage, thus affecting total market penetration and sales within these segments.

Price Sensitivity and Strong Market Competition

The market is extremely price-sensitive, and price is the determining factor for the majority of customers. While premium products provide superior features and energy-efficient alternatives, their cost deters much of the price-sensitive buyer base. Local and foreign producers compete aggressively through pricing, and this leads to a bloody fight. Frequent discounting also decimates margins and presses pressure on small players. The unorganized sector also continues to have a small but useful role, providing low-priced alternatives that may have no warranties or energy conformity. Blending affordability and innovation is a recurring issue for competitors seeking to grow in India's heterogenous consumer market.

India Room Air Conditioner Market

India's room air conditioner market is seeing significant growth led by growing urbanization and an expanding middle-class population. Consumers are more and more searching for affordable, space-saving cooling solutions for living rooms and bedrooms, particularly in Tier-I and Tier-II cities. With improving disposable incomes, even first-time consumers are shifting towards room ACs because they are easy to install and come with energy-saving variants. Brands are adding smarter and inverter variants to their portfolio to appeal to this segment. February 2025: Haier Appliances India is setting a new benchmark in home cooling with the launch of its exclusive colourful range of Kinouchi Air Conditioners. Aimed at transforming modern homes, this premium series seamlessly blends avant-garde aesthetics with superior performance.

India Ducted Air Conditioner Market

India's ducted air conditioner market is increasing steadily, particularly in the hospitality and commercial segments. These types of systems are favored in big places such as hotels, shopping malls, and office buildings because they provide central cooling in addition to aesthetically clean interior spaces. While the cost of initial installation is steep, their energy efficiency in bigger installations renders them economically viable in the long term. The growth in infrastructure development and smart buildings will further drive this segment in upcoming years.

India Split Air Conditioner Market

Split air conditioners are ruling the Indian AC market with their high cooling efficiency, low noise rates, and pleasing looks. These air conditioners are best suited for residential as well as small office configurations. With inverter technology becoming common, split ACs provide enhanced energy savings, and thus they are gaining popularity even in Tier-II and Tier-III cities. Firms are also incorporating features like app control, voice control, and energy monitoring to woo smart tech-savvy urban clients across the nation.

India Window Air Conditioner Market

Window air conditioners still maintain a large market share in India's cost-sensitive home segment. They find particular use in older flats where space considerations or infrastructure cannot allow for the fitting of splits. Popular as they are known to be and inexpensive to service, window ACs are an efficient choice for frugal households. Companies are also enhancing the energy efficiency and equipping the ACs with features such as remote controls and sleep modes in order to stay ahead in an evolving market.

India 1.5 Ton Air Conditioner Market

The 1.5-ton air conditioner segment is the most sought after in India, addressing average-sized rooms in urban homes. Providing enough cooling capacity for spaces of up to 150 square feet, these models are the perfect blend of performance and power consumption. Suitable for both living rooms and bedrooms, the 1.5-ton segment is widely adopted in Tier-I and Tier-II cities. The segment continues to evolve with inverter technology, smart connectivity, and high star ratings by brands.

India 1 Ton Air Conditioner Market

The 1-ton air conditioner market in India is gaining popularity, particularly with nuclear families and single room consumers. It suits small rooms and is predominantly popular in price-sensitive markets, such as Tier-III cities. Compact size, reduced energy, and affordability are proving to be its drivers. Newer inverter models, with high efficiency at affordable price points, also contribute to this segment's growth. First-time consumers are a target audience for most brands in this segment, and hence it is a competitive and fast-growing segment.

India Residential Air Conditioner Market

India's domestic air conditioner market is growing fast as a result of urban lifestyle patterns, increasing temperatures, and enhanced living standards. Customers are replacing conventional cooling techniques such as coolers and ceiling fans with ACs for enhanced comfort. There is a growing demand for energy-efficient, inverter-based models, particularly in the middle- and upper-class segments. Companies are focusing more on providing cost-effective financing and EMI solutions, thus increasing the affordability of ACs to a wider base of residential consumers.

India Hospitality Air Conditioner Market

The hospitality industry in India is an avid consumer of air conditioning solutions, with the increasing number of hotels, resorts, and guest houses in the metros and travel destinations. Travellers increasingly require climate-controlled premises as a mandatory feature. Centralized cooling equipment with energy-efficiency is fast becoming the mid- to upscale-hotel option. Green approaches and customer well-being are promoting the use of VRF and ducted AC systems in hotels.

India Air Conditioner Supermarkets Market

Indian supermarkets and big retail stores are incorporating effective air conditioning systems to create comfortable shopping spaces. With more customers and extended hours of operation, retailers find ACs to be a must for customer retention. Such areas usually incorporate split or ducted AC systems based on layout and area. Growing competition among retail chains is also driving investments in HVAC solutions that enhance in-store experience and ensure optimal storage temperatures for perishables.

India Online Air Conditioner Market

India's online air conditioner market is flourishing, powered by e-commerce leaders Amazon and Flipkart with seasonal discounts, extensive product variety, and door-step delivery. Online channels are targeting tech-adopting urban consumers who prefer to compare specifications and reviews prior to buying. The trend was boosted post-pandemic due to higher digital adoption. Companies are also introducing online-only models with slim designs and intelligent features. EMI facility, free delivery, and hassle-free return further add to the popularity of this channel.

North India Air Conditioner Market

North India, particularly Delhi, Punjab, and Uttar Pradesh, have hot summers and thus require air conditioners. High growth of urbanization, higher per capita income, and growth in infrastructure development are driving the market. Both residential and institutional demand here is high with prominent presence of top national as well as international brands. Summer season generates steep peak seasonal demand, thus making it go on high-value promotion and volume-based sales here.

South India Air Conditioner Market

South India enjoys consistent demand for air conditioners due to its hot and humid climate throughout the year. Cities like Chennai, Bengaluru, and Hyderabad are major hubs where residential and commercial AC usage is widespread. Growth is driven by the IT sector, hospitality industry, and increasing middle-class consumer base. Preference for inverter and energy-efficient models is high due to longer daily usage. Brands also offer regional marketing and service customization here.

India Air Conditioner Market Segmentation

Types

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

Products Types

- Split AC

- Window AC

- Other AC

Size

- 1 Ton

- 1.5 Ton

- 2 Ton

- Others

Applications

- Residential

- Commercial & Retail Application

- Hospitality

- Transportation & Infrastructure

- Healthcare

- Others Applications

Sales Channels

- Supermarkets

- Specialty Stores

- Online

- Others

Regional Analysis

- North

- South

- West

- East

All the key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Competitive Landscape and Major Players

- Voltas Limited

- Blue Star Limited

- Havells India Limited

- Whirlpool of India Limited

- Godrej and Boyce Manufacturing Company Limited

- MIRC Electronics Limited

- Johnson Controls-Hitachi Air Conditioning India Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Types, Products Types, Size, Applications, Sales Channels, and Regions |

| Regions Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Air Conditioner Market

6. India Air Conditioner Market Share Analysis

6.1 By Types

6.2 By Products Types

6.3 By Size

6.4 By Applications

6.5 By Sales Channels

6.6 By Regions

7. Types

7.1 Room Air Conditioner

7.2 Ducted Air Conditioner

7.3 Ductless Air Conditioner

7.4 Centralized Air Conditioner

8. Products Types

8.1 Split AC

8.2 Window AC

8.3 Other AC

9. Size

9.1 1 Ton

9.2 1.5 Ton

9.3 2 Ton

9.4 Others

10. Applications

10.1 Residential

10.2 Commercial & Retail Application

10.3 Hospitality

10.4 Transportation & Infrastructure

10.5 Healthcare

10.6 Others Applications

11. Sales Channels

11.1 Supermarkets

11.2 Specialty Stores

11.3 Online

11.4 Others

12. Regions

12.1 North

12.2 South

12.3 West

12.4 East

13. Company Analysis

13.1 Voltas Limited

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Product Portfolio

13.1.5 Revenue

13.2 Blue Star Limited

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Product Portfolio

13.2.5 Revenue

13.3 Havells India Limited

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Product Portfolio

13.3.5 Revenue

13.4 Whirlpool of India Limited

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Product Portfolio

13.4.5 Revenue

13.5 Godrej and Boyce Manufacturing Company Limited

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Product Portfolio

13.5.5 Revenue

13.6 MIRC Electronics Limited

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Product Portfolio

13.6.5 Revenue

13.7 Johnson Controls-Hitachi Air Conditioning India Limited

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Product Portfolio

13.7.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com