United States HVAC Equipment Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States HVAC Equipment Market Trends & Summary

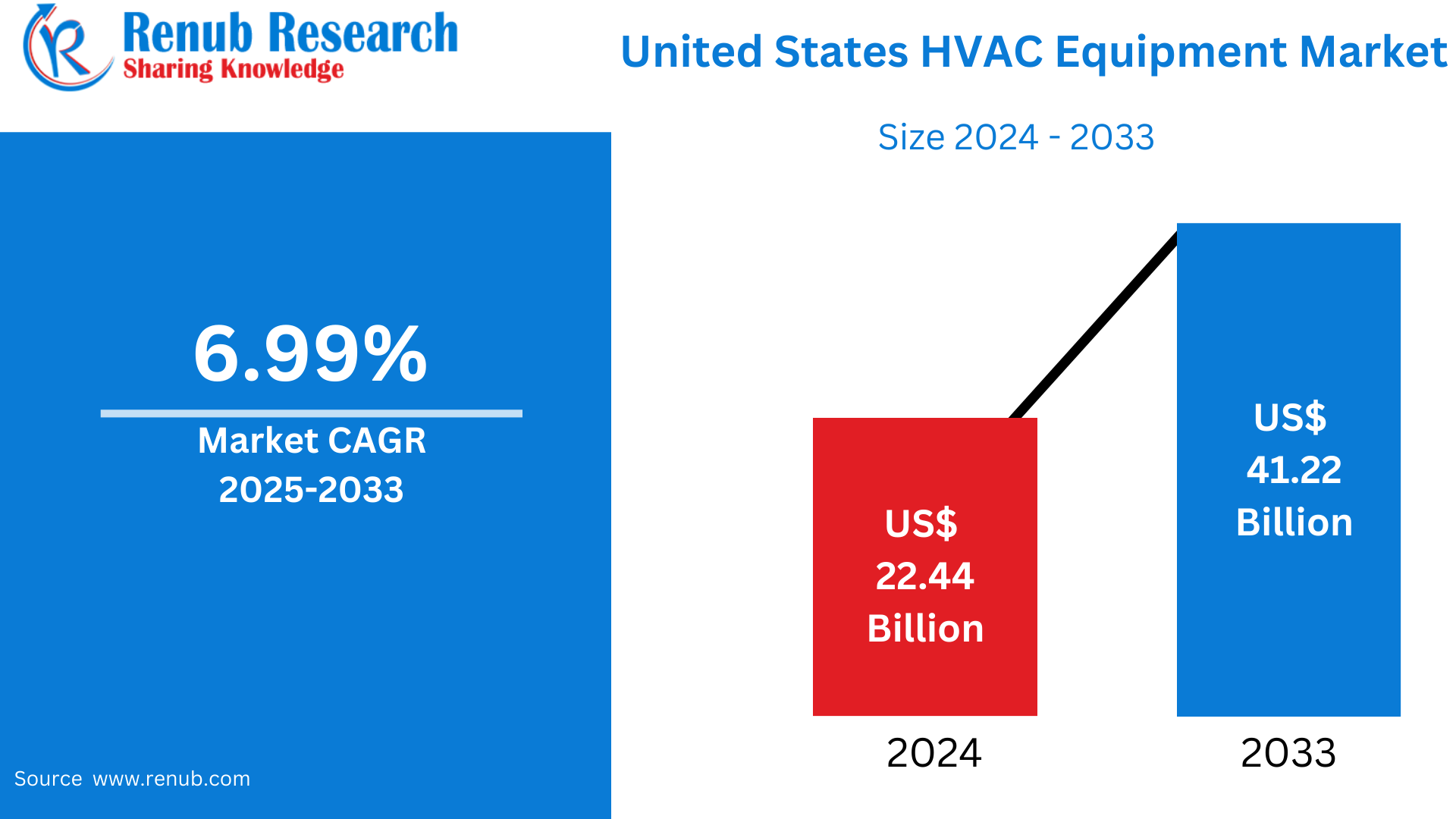

United States HVAC Equipment Market is expected to reach US$ 41.22 billion by 2033 from US$ 22.44 billion in 2024, with a CAGR of 6.99% from 2025 to 2033. Due to a number of variables, the HVAC equipment industry in the US is expanding rapidly. Because of the United States' large geographic area, temperatures can vary greatly by state, city, and coast, ranging from extremely cold to extremely hot. Because of this climate unpredictability, HVAC installations are crucial in both residential and business settings. Therefore, the urgent necessity to control indoor temperatures independent of the outside weather supports the expansion of the HVAC sector in the country.

The report United States HVAC Equipment Market & Forecast covers by Type of Equipment {Air Conditioning Equipment - (Unitary Air Conditioners, Room Air Conditioners, Packaged Terminal Air Conditioners, Chillers}), {Heating Equipment - (Warm Air Furnace (Gas and Oil), Boilers, Room and Zone Heating Equipment, Heat Pumps (Air-sourced and Geo-thermal)}, {Ventilation Equipment - (Air Handling Units, Fan Coil Units, Building Humidifiers and Dehumidifiers)}, End User (Residential, Commercial, Industrial), Region (West, South, Midwest, Northeast) and Company Analysis, 2025-2033.

United States HVAC Equipment Industry Overview

With a rising need for smart and energy-efficient technology, the HVAC (heating, ventilation, and air conditioning) equipment business in the US is essential to both the residential and commercial sectors. Climate control systems are becoming more and more necessary as a result of variables including urbanization, population expansion, and climate change. The market is changing because to technological developments including automation, environmentally friendly refrigerants, and the incorporation of Internet of Things (IoT) capabilities. Manufacturers are being driven to innovate by the trend toward sustainable and energy-efficient solutions, which is being spurred by tighter laws and customer demand for greener options. Large corporations including as Carrier, Trane, and Lennox are making investments in high-performance systems that have lower environmental impact and energy use.

The increased focus on health and air quality, particularly in the wake of the pandemic, is also helping the HVAC sector because air filtration systems are now a standard feature of building designs. Additionally, the need for linked HVAC systems that can be regulated remotely for comfort and efficiency is growing as smart home technologies become more prevalent. The HVAC equipment market is anticipated to increase consistently as a result of the growing number of residential and commercial building projects, as well as the retrofit and replacement sectors. Long-term sustainability and market diversification are also being fueled by developments in geothermal heating and cooling technology.

To increase energy efficiency, the US government is expanding building rehabilitation programs. Energy expenses for companies and homes are reduced by these energy-efficient improvements, which also reduce greenhouse gas emissions. They improve indoor air quality, highlighting their importance for public health and creating an atmosphere that is favorable for market expansion. In June 2024, for instance, the Administrator of the US General Services Administration (GSA) announced a proposal to invest USD 80 million from the Inflation Reduction Act (IRA) in intelligent building technology. Across over 560 federal buildings, these systems seek to reduce emissions, increase efficiency, reduce expenses, and improve comfort levels.

The nation's adoption of smart home technology is being propelled by rising consumer awareness of sustainability and energy efficiency, which is also fostering an environment that is conducive to the development of cutting-edge HVAC systems. For example, the US smart home hardware sales income was projected to reach USD 23.5 billion in 2023, up from USD 19.70 billion in 2018, according to the Consumer Technology Association (CTA). Therefore, it is anticipated that the convergence of these trends would sustain the expansion of the market under study during the forecast period.

Growth Drivers for the United States HVAC Equipment Market

Energy Efficiency and Sustainability

A major factor driving the U.S. market is the rising demand for energy-efficient HVAC systems, which is being driven by businesses' and consumers' increased emphasis on sustainability. Advanced HVAC solutions that optimize energy use are being adopted in response to stricter environmental restrictions and the need to minimize carbon footprints. Manufacturers are innovating more efficient systems as a result of the U.S. Department of Energy's (DOE) increased energy efficiency criteria. Customers are choosing more and more options that support environmental objectives while also reducing utility costs. Companies are also implementing these methods to cut expenses and achieve corporate sustainability goals. Government incentives, rebates, and tax credits further reinforce the emphasis on energy efficiency, increasing the appeal of energy-efficient HVAC systems to both residential and commercial customers.

Rising Awareness of Indoor Air Quality

The demand for HVAC systems with improved filtration and air purification capabilities has increased due to the COVID-19 pandemic's major increase in awareness of the significance of indoor air quality. HVAC systems that lower airborne pollutants are becoming more and more popular as a result of consumers' and companies' growing emphasis on indoor environment health and safety. To enhance air quality, stop the transmission of viruses, and lower allergies, HVAC units are incorporating advanced filters, UV-C lamps, and HEPA (High-Efficiency Particulate Air) filtering systems. This change is particularly apparent in places of business, education, and healthcare where it is essential to preserve clean air. The market for HVAC systems with improved air quality capabilities will continue to develop as a result of people spending more time indoors and the emphasis on air purification.

Urbanization and Construction Growth

One of the main factors driving the demand for HVAC systems in the United States is the fast urbanization and population expansion in metropolitan regions. The need for dependable, energy-efficient HVAC systems is growing as more people relocate to urban areas and new residential and commercial development projects are undertaken. While existing structures are being modified to meet current criteria for environmental sustainability and energy efficiency, new buildings need high-performance, contemporary technologies to provide maximum internal comfort. Because they lower energy consumption and operational costs, energy-efficient HVAC systems are becoming more and more in demand as urban expansion continues. Furthermore, HVAC systems are increasingly playing a crucial role in establishing pleasant, sustainable living and working environments in quickly expanding metropolitan areas, thanks to an emphasis on smart and connected technology.

Challenges in the United States HVAC Equipment Market

Rising Intense Competition

In the very competitive U.S. HVAC sector, both long-standing industry titans and recent arrivals are vying for market dominance. There is ongoing pressure on industry leaders like Carrier, Trane, and Lennox to develop and provide high-performance, energy-efficient solutions. Businesses need to invest in R&D to stay ahead of the curve as technical innovations like smart HVAC systems and sustainable goods gain importance. Maintaining profitability also depends on controlling expenses and increasing operational effectiveness, particularly as consumer price sensitivity increases. Customer service is particularly important since customers want long-term service contracts and dependable, prompt assistance. For HVAC businesses to be profitable and relevant in this cutthroat environment, they must constantly adjust to shifting consumer expectations and market needs.

Skilled Labor Shortage

There is a severe lack of trained workers in the HVAC sector in the United States, especially in the installation, maintenance, and repair sectors. The need for competent technicians is increasing due to the growing demand for HVAC systems, yet there aren't enough professional people to fill these positions. As businesses vie for a small number of skilled workers, this scarcity may cause project schedule delays and higher labor expenses. The quality of installation and maintenance services can also be impacted by a shortage of qualified personnel, which may result in system breakdowns or inefficiencies. Long-term issues for the industry's workforce sustainability are brought on by the aging workforce, which makes it harder for young individuals to enter the field.

Northeast United States HVAC Equipment Market

Because of the region's diverse climate and frigid winters, there is a steady need for heating, ventilation, and air conditioning systems, which propels the Northeastern United States HVAC equipment market. Both residential and commercial HVAC systems are in high demand in big cities like New York, Boston, and Philadelphia. In order to save energy costs and comply with strict environmental requirements, consumers and companies are choosing high-performance, eco-friendly systems, which is driving the market. Furthermore, the need for sophisticated filtration and air purification systems is being driven by the growing emphasis on indoor air quality, particularly in the wake of the epidemic. The market's expansion in this area is also aided by current development projects, government incentives, and retrofitting initiatives.

Midwest United States HVAC Equipment Market

The severe winters and scorching summers in the Midwest of the United States create a year-round need for dependable heating and cooling systems, which propels the market for HVAC equipment in this area. There is a high need for residential and commercial HVAC solutions in states like Illinois, Michigan, Ohio, and Wisconsin, especially in the industrial and agricultural sectors. Advanced, energy-efficient HVAC systems are becoming more and more popular among consumers and organizations who prioritize sustainability and energy efficiency. Smart controls and better filtration systems are examples of technological innovations that are becoming more and more common. Growth is also being fueled by the region's thriving building and remodeling industry as well as government incentives for energy-efficient improvements. The growing need for green building certifications and indoor air quality solutions is also helping HVAC firms.

- In May 2024, Lennox and Samsung, a well-known company with 40 years of experience in developing HVAC technology, signed an agreement to establish a joint venture. Selling ductless air conditioning and heat pump products—including mini-, multi-, and VRF models—across the US and Canada is anticipated to be the main goal of this endeavor. It is anticipated that the recently established company would conduct business as Samsung Lennox HVAC North America.

United States HVAC Equipment Market Segments

Type of Equipment – Market breakup in 3 viewpoints:

- Air Conditioning Equipment

- Unitary Air Conditioners

- Room Air Conditioners

- Packaged Terminal Air Conditioners

- Chillers

2. Heating Equipment

- Warm Air Furnace (Gas and Oil)

- Boilers

- Room and Zone Heating Equipment

- Heat Pumps (Air-sourced and Geo-thermal)

3. Ventilation Equipment

- Air Handling Units

- Fan Coil Units

- Building Humidifiers and Dehumidifiers

End User – Market breakup in 8 viewpoints:

- Residential

- Commercial

- Industrial

Regions – Market breakup in 4 viewpoints:

- West

- South

- Midwest

- Northeast

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Revenue

Company Analysis:

- Lennox International Inc.

- Rheem Manufacturing Inc.

- Trane Inc. (Trane Technologies PLC)

- Mitsubishi Electric Hydronics & IT Cooling Systems (Mitsubishi Electric Corporation)

- Nortek Air Solutions LLC (Madison Air)

- Carrier Corporation

- Whirlpool Corporation

- SPX TECHNOLOGIES.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type of Equipment, End User and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States HVAC Equipment Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type of Equipment

6.2 By End User

6.3 By Region

7. Type of Equipment

7.1 Air Conditioning Equipment

7.1.1 Unitary Air Conditioners

7.1.2 Room Air Conditioners

7.1.3 Packaged Terminal Air Conditioners

7.1.4 Chillers

7.2 Heating Equipment

7.2.1 Warm Air Furnace (Gas and Oil)

7.2.2 Boilers

7.2.3 Room and Zone Heating Equipment

7.2.4 Heat Pumps (Air-sourced and Geo-thermal)

7.3 Ventilation Equipment

7.3.1 Air Handling Units

7.3.2 Fan Coil Units

7.3.3 Building Humidifiers and Dehumidifiers

8. By End User

8.1 Residential

8.2 Commercial

8.3 Industrial

9. By Region

9.1 West

9.2 South

9.3 Midwest

9.4 Northeast

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Lennox International Inc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Rheem Manufacturing Inc.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Trane Inc. (Trane Technologies PLC)

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Mitsubishi Electric Hydronics & IT Cooling Systems (Mitsubishi Electric Corporation)

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Nortek Air Solutions LLC (Madison Air)

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Carrier Corporation

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Whirlpool Corporation

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 SPX TECHNOLOGIES.

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com