Global Coffee Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Coffee Market Size

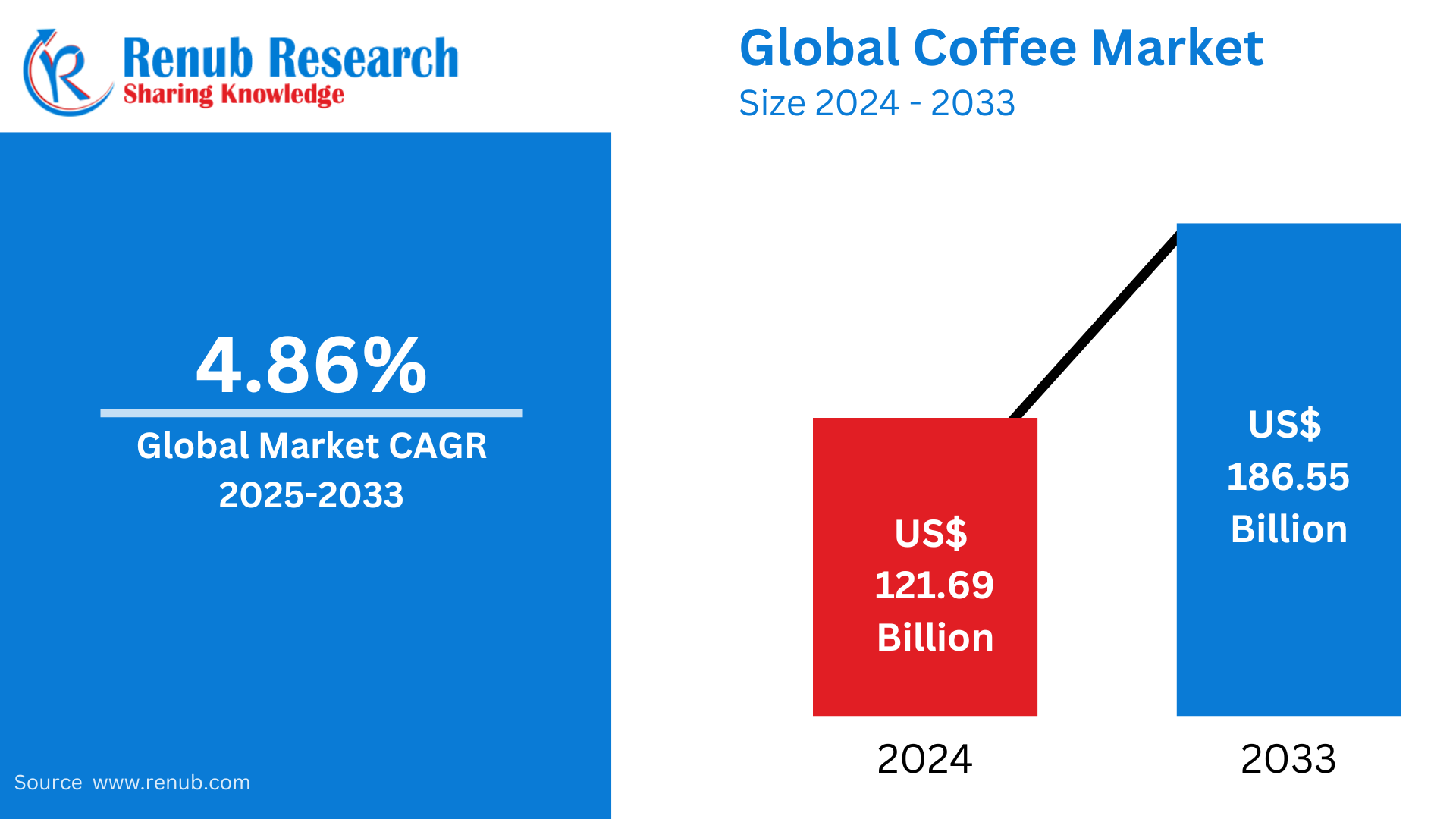

Coffee Market is expected to reach US$ 186.55 billion by 2033 from US$ 121.69 billion in 2024, with a CAGR of 4.86% from 2025 to 2033. One of the most popular drinks in the world, coffee is becoming more and more well-liked, especially in developing nations like Asia Pacific. The industry is expanding generally due to factors like shifting lifestyles, developing coffee culture among consumers worldwide, and rising disposable incomes.

Coffee Global Market Report by Product Type (Instant Coffee, Ground Coffee, Whole Grain, Others), Distribution Channel (Supermarket/Hypermarket, Convenience Store, Online Platform, Others), Countries and Company Analysis, 2025-2033

Global Coffee Market Overview

When coffee beans turn from green to bright red, they are harvested, processed, and dried. The ripeness of the berries is indicated by a change in color. Caffeine is the ingredient that gives coffee its stimulating properties. The majority of people drink coffee in the morning to increase their vitality. It is one of the most traded commodities in the world and is a fundamental part of food culture in many countries, particularly in the restaurant service industry. There are many coffee drinks available, and a study indicated that frequent coffee use has numerous health benefits, such as a lower risk of heart disease, melancholy, Alzheimer's disease, and Type 2 diabetes, as well as longer lifespans, less pain, and higher fiber intake.

Due to the proliferation of well-known coffee brands and growing global exposure to Western culture, the coffee market is expanding significantly. This expansion is further supported by the growing number of beneficial government programs. Global warming and unpredictable weather patterns, which have an impact on coffee production, provide difficulties for the market. Notwithstanding these obstacles, customer preferences for sustainability and quality are reflected in the rising demand for certified coffee products.

The coffee market is significantly shaped by shifting consumer trends and tastes. Market dynamics are influenced by elements including the growing demand for gourmet and specialty coffees, sustainable and organic sourcing, and the appeal of premium and single-origin coffee varietals. Gourmet and specialty coffee are frequently linked to superior quality and distinctive flavor qualities. The coffee market's overall worth is rising as a result of consumers' growing willingness to pay more for these coffees. For coffee growers, roasters, and retailers, the desire for specialty and gourmet coffee helps boost sales and profitability. Additionally, the market has changed due to the popularity of convenient coffee formats like coffee pods and capsules.

The market is greatly impacted by coffee bean output and availability. Coffee supply and prices can be impacted by a number of factors, including weather, natural disasters, illnesses that harm coffee plants (such coffee rust), and geopolitical difficulties. Among the top producers of coffee are Brazil, Vietnam, and Colombia; the volume of their output affects market dynamics. In June 2023, the U.S. Department of Agriculture released a report predicting that Brazil's coffee harvest would yield 66.4 million bags in 2023–2024. Furthermore, it is anticipated that in 2023–2024, the coffee harvests in Vietnam and Colombia will total 31.3 million and 11.6 million bags, respectively.

Coffee Consumption Statistics Worldwide

- The United States alone uses 1.62 billion pounds of coffee annually among a population of 340 million, or an average of 3.8 pounds of coffee per individual every year.

- The total amount of coffee consumed in the United States for the financial year 2022-2023 was 188.7 billion cups, or an average of 517 million cups per day.

- The Coffee Association of Canada released a 2023 report indicating that 71% of Canadians consume coffee daily.

- Although Luxembourg leads the world in per capita coffee consumption, the U.S. consumes the most coffee overall.

- In the United Kingdom, 80% of households stock instant coffee in the pantry.

- As of June 2024, 73% of the population in France regularly consumes coffee, with 53% of those being daily consumers of three cups, on average. This culture is a reflection of the varied tastes and the rich caffeinated history of France.

- In 2023, over 50% of German coffee drinkers expressed a willingness to pay extra for sustainably produced coffee.

- South America accounted for 4 million tonnes of coffee in 2023, the most of any region.

- China has the world's highest per-hectare yield of coffee. Its overall imports of coffee nearly doubled to 5.5 million bags and are expected to reach 5.6 million in the 2024-2025 period.

- In Japan, coffee houses boast creative brewing techniques and latte art at an expert level, though instant coffee is extremely popular.

- Statistics by the Government of India's Coffee Board show that overall domestic production was 352,000 metric tonnes during the 2022-2023 growing year, which ranked India as the world's sixth largest coffee producer in terms of volume.

- Saudi Arabia's branded coffee shop industry increased in 2022 by 18.5%, expanding to 3,550 locations. Saudi Arabia is in the top 10 most consumable coffee nations and, through demand, goes above and beyond 80,000 tonnes yearly.

Growth Drivers for the Coffee Market

An increase in the number of beneficial government initiatives

The Coffee is a commodity with strong global demand, hence supply and demand affect its price and availability globally. The growth of the market is influenced by the condition of the harvests in the coffee-producing countries. Through partnerships with corporate institutions and regional technology programs, numerous governments in the European Union and industrialized nations, like the United States, support coffee growers with the overall goal of expanding coffee production.

A number of countries are creating long-term plans to increase coffee production in order to address the sector's environmental and economic weaknesses. For example, the Vietnamese government released the Vision to 2030 and the Vietnam Sustainable Coffee Plan up to 2020 in 2014. By using ecologically friendly fertilizers and herbicides and researching water-saving irrigation methods, the initiative seeks to set environmental standards. It aims to stabilize manufacturing conditions in the future. In order to meet the growing demand for coffee globally, nations such as India are promoting the expansion of coffee production in traditional coffee-growing regions by offering subsidies to coffee producers.

Western culture, increased global exposure, and the uptake of well-known coffee brands

Coffee shops were popular gathering places for friends, family, coworkers, and business associates, which led to their recent spectacular growth. The opening of upscale stores by companies like Coffee Day Enterprises Ltd., Starbucks Corporation, and Barista Coffee Co. Ltd. is credited with the expansion of the coffee market. Additionally, by creating aesthetically pleasing and calming spaces, these businesses have added an experiential element to coffee drinking. Additionally, the demand for these coffee shops and cafes is increasing as a result of corporate leaders' shifting work habits and the services these venues offer, such as free Wi-Fi and entertainment areas.

Rising Consumer Demand for Specialty Coffee

Growing interest in premium, gourmet, and artisanal coffee is driving up consumer demand for specialty coffee. Single-origin beans, unusual brewing techniques, and special mixes that provide distinctive flavors and sensations are attracting more and more attention. This change is greatly influenced by coffee culture, particularly in cities where cafes and coffee shops are become essential social gathering places. In addition to buying coffee, customers are embracing the pleasure of savoring delectably prepared drinks in a welcoming setting. This trend, which reflects a greater appreciation for quality and workmanship in coffee, is encouraging individuals to spend more money on premium coffee, from specialty drinks to home brewing supplies.

Challenges in the Coffee Market

Competition from Alternatives

The market for coffee is being impacted more and more by competition from substitutes including tea, energy drinks, and plant-based beverages. These options are becoming more popular among younger, health-conscious consumers because of their alleged health benefits, reduced caffeine content, or plant-based components. Energy drinks offer a rapid boost without the typical coffee taste, while tea, with its variety of flavors and antioxidants, is frequently seen as a healthier choice. A growing trend towards plant-based diets is also contributing to the popularity of plant-based beverages such smoothies and oat milk lattes. Coffee manufacturers find it difficult to adjust to these substitutes, particularly as consumer tastes shift toward drinks that support ethical or health-conscious decisions. In order to survive in this changing industry, coffee firms need to innovate.

Labor Shortages

Since coffee cultivation mainly depends on human labor for processes like harvesting and processing, labor shortages provide a serious issue to the sector. There is a labor shortage in important coffee-growing regions, which has an impact on harvest quality and quantity. An aging farmer population makes this problem even worse, since fewer young people are inclined to pursue farming because of the poor pay, difficult working conditions, and few prospects for promotion. Coffee plantations are therefore finding it difficult to sustain output levels and are increasingly relying on automation or technology, which can partially address labor shortages but may not completely replace the demand for specialized personnel in this labor-intensive sector.

Global Instant Coffee Market

The global instant coffee market is increasing steadily as people look for convenient and easy coffee solutions without sacrificing taste. Busy lives, particularly in urban regions, are fueling the demand for ready-to-mix and single-serve coffee solutions. Instant coffee is also favored due to its long shelf life, low cost, and convenience of preparation, which makes it a favorite among students, office workers, and travelers. Asia-Pacific and Latin America are experiencing growing adoption as their emerging markets see coffee culture on the rise. New flavors and high-end blends are encouraging companies to reach younger consumers and health-oriented drinkers who seek sugar-free or organic coffee.

Global Ground Coffee Market

The global ground coffee market is booming as consumers are increasingly adopting premium, fragrant, and barista-style coffee at home. Ground coffee targets individuals who enjoy freshness and the authenticity of the flavor. Europe and North America are the market leaders in consumption, although Asia-Pacific is catching up fast. An increase in specialty cafés, home-brewing equipment, and social networking coffee trends continues to boost demand. Low-acid and organic ground coffees are being demanded by health-oriented consumers. Further, increasing adoption of sustainable and fair-trade practices is influencing brand decisions, and most companies have been prioritizing ethical and environment-friendly coffee planting and packaging.

Global Coffee Convenience Store Market

Convenience stores are pivotal in international coffee sales, particularly for single-serve and ready-to-drink products. These convenience stores act as key grab-and-go locations for the quick caffeine need of consumers, especially in urban areas and transportation hubs. Coffee cups, canned goods, and capsule packs are displayed strategically near checkouts to make impulse buys more convenient. The phenomenon is particularly prevalent in Japan, the U.S., and South Korea. With convenience store chains spreading across emerging economies, the demand for branded and private-label coffee products keeps growing. Bundle deals and loyalty programs also increase repeat sales.

Online Coffee Market

Online channels are transforming the global coffee market by providing consumers with a variety of products, ranging from artisanal beans to global brands. The movement towards e-commerce is driven by convenience, variety in products, and compelling subscription models. Direct-to-consumer approaches are increasingly popular, enabling roasters to provide fresh, personalized blends. Consumers are now more attracted to curated coffee boxes, eco-friendly brands, and specialty imports that cannot be found in physical retail outlets. Digital channels also make it possible for extensive product education, which creates more customer interaction. With growing mobile commerce and digital payments in the world, online coffee retailing is set to experience high growth in every region.

United States Coffee Market

Due to a robust coffee culture and rising demand for premium coffee, the US coffee market is among the biggest and most vibrant in the world. Specialty coffee has been increasingly popular, especially among younger, health-conscious consumers. This includes single-origin beans, artisanal blends, and creative brewing techniques. While local cafes and coffee chains like Dunkin' and Starbucks control the majority of the market, there is a growing demand for at-home brewing equipment and ready-to-drink (RTD) coffee products. Additionally, plant-based alternatives and coffee that comes from ethical, sustainable sources are becoming more and more popular. But issues like price swings, supply chain interruptions, and competition from non-coffee substitutes like tea and energy drinks still influence the industry.

In the United States, 400 million cups of coffee are consumed by people. According to the U.S. Food and Drug Association (FDA), the average American coffee drinker consumes roughly three cups of coffee each day. With more than 150 million coffee drinkers, the United States is one of the world's biggest coffee users, according to the FDA, and this number is only expected to rise, which is driving up demand for roasted coffee.

United Kingdom Coffee Market

Due to a strong café culture and a move toward specialty coffee, the UK coffee market has grown steadily. Single-origin beans, premium mixes, and artisanal brewing techniques are becoming more and more popular among consumers who are choosing premium, artisanal coffee. While independent coffee shops and coffee giants like Costa Coffee and Starbucks dominate the market, home brewing using coffee makers and pods is becoming more and more popular. Additionally, ready-to-drink (RTD) coffee is becoming more and more popular. Consumer trends toward environmental and health consciousness are reflected in the growing demand for sustainable, ethically sourced coffee and plant-based milk substitutes. But obstacles including price swings, supply chain interruptions, and competition from tea and non-coffee drinks hinder the market's expansion.

With a notable move toward specialty and premium coffees, the UK coffee sector has experienced tremendous development. About 95 million cups of coffee are drunk every day in the UK, which adds up to an incredible 2.8 billion cups a year, according to a survey from the British Coffee Association. The vast majority of adults—more than 80%—consume coffee on a daily basis; the average person drinks three cups daily.

China Coffee Market

A burgeoning middle class and rising coffee consumption, especially in cities, are driving China's coffee market's rapid expansion. Specialty coffee, such single-origin beans and artisanal blends, is becoming more and more popular, especially among younger generations. Local coffee shops and cafes are doing quite well, while major multinational chains like Starbucks have grown considerably. Growth is also being fueled by the emergence of easy coffee options, such as at-home brewing and ready-to-drink (RTD) beverages. Furthermore, there is a discernible trend toward sustainability as Chinese consumers grow more aware of coffee that comes from ethical sources. Coffee consumption per capita is still lower than in Western nations, despite this growth, which offers prospects for further market expansion in the years to come.

United Arab Emirates Coffee Market

Due to a strong coffee culture and rising demand for specialty coffee, the United Arab Emirates (UAE) coffee market is expanding rapidly. Both residents and foreigners are drinking more coffee in the United Arab Emirates, with both contemporary coffee drinks and traditional Arabic coffee (Gahwa) becoming more and more popular. Along with individual cafés serving upscale, artisanal coffee, the growth of coffee chains like Starbucks and Costa Coffee as well as regional brands like Arabica are all contributing to the growing coffee landscape. Demand for at-home brewing supplies and ready-to-drink (RTD) coffee is also rising. Furthermore, ethical sourcing and sustainability are growing in importance to UAE customers. The coffee market in the United Arab Emirates is expected to continue expanding, particularly among younger, health-conscious consumers, despite competition from tea and other beverages.

Coffee Market Segmentation

Product Type

- Instant Coffee

- Ground Coffee

- Whole Grain

- Others

Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- Online Platform

- Others

Country

- European Union

- United States

- Brazil

- Japan

- Philippines

- Canada

- China

- Indonesia

- United Kingdom

- Russia

- Ethiopia

- Vietnam

- Korea, South

- Mexico

- Australia

- Colombia

- Algeria

- Switzerland

- Turkey

- India

- Argentina

- Saudi Arabia

- Morocco

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis:

- Starbucks

- Nescafe

- The Kraft Heinz Company

- Lunchin Coffee

- J M Smucker

- Coca cola

- Dutch Bros

- Keurig Dr Pepper

- JDE PEET'S N.V

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Distribution Channel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in the Report

-

What is the projected market size and growth rate of the global coffee market from 2025 to 2033?

-

What are the main factors driving growth in the global coffee industry?

-

How are changing consumer preferences influencing the demand for specialty and gourmet coffee?

-

What challenges does the coffee market face, such as climate change and labor shortages?

-

How do coffee consumption trends vary across major regions like the United States, China, UK, and UAE?

-

What is the impact of rising demand for ethical and sustainably sourced coffee on market dynamics?

-

How are ready-to-drink (RTD) coffee and at-home brewing trends shaping the market landscape?

-

Which product types (instant, ground, whole grain) and distribution channels (supermarkets, online, etc.) dominate the market?

-

What role do global coffee producers like Brazil, Vietnam, and Colombia play in supply and pricing?

-

Who are the key players in the global coffee market and what are their strategies for maintaining competitiveness?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Coffee Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Distribution Channel

6.3 By Country

7. Product Type

7.1 Instant Coffee

7.2 Ground Coffee

7.3 Whole Grain

7.4 Others

8. Distribution Channel

8.1 Supermarket/Hypermarket

8.2 Convenience Store

8.3 Online Platform

8.4 Others

9. Country

9.1 European Union

9.2 United States

9.3 Brazil

9.4 Japan

9.5 Philippines

9.6 Canada

9.7 China

9.8 Indonesia

9.9 United Kingdom

9.10 Russia

9.11 Ethiopia

9.12 Vietnam

9.13 Korea, South

9.14 Mexico

9.15 Australia

9.16 Colombia

9.17 Algeria

9.18 Switzerland

9.19 Turkey

9.20 India

9.21 Argentina

9.22 Saudi Arabia

9.23 Morocco

10. Company Analysis

10.1 Starbucks

10.1.1 Overview

10.1.2 Key Persons

10.1.3 Recent Development

10.1.4 Revenue

10.2 Nescafe

10.2.1 Overview

10.2.2 Key Persons

10.2.3 Recent Development

10.2.4 Revenue

10.3 The Kraft Heinz Company

10.3.1 Overview

10.3.2 Key Persons

10.3.3 Recent Development

10.3.4 Revenue

10.4 Lunchin Coffee

10.4.1 Overview

10.4.2 Key Persons

10.4.3 Recent Development

10.4.4 Revenue

10.5 J M Smucker

10.5.1 Overview

10.5.2 Key Persons

10.5.3 Recent Development

10.5.4 Revenue

10.6 Coca cola

10.6.1 Overview

10.6.2 Key Persons

10.6.3 Recent Development

10.6.4 Revenue

10.7 Dutch Bros

10.7.1 Overview

10.7.2 Key Persons

10.7.3 Recent Development

10.7.4 Revenue

10.8 Keurig Dr Pepper

10.8.1 Overview

10.8.2 Key Persons

10.8.3 Recent Development

10.8.4 Revenue

10.9 JDE PEET'S N.V.

10.9.1 Overview

10.9.2 Key Persons

10.9.3 Recent Development

10.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com