Indonesia Ready To Drink Tea and Coffee Market Report2025-2033

Buy NowIndonesia Ready Drink Tea and Coffee Market Size and Forecast 2025-2033

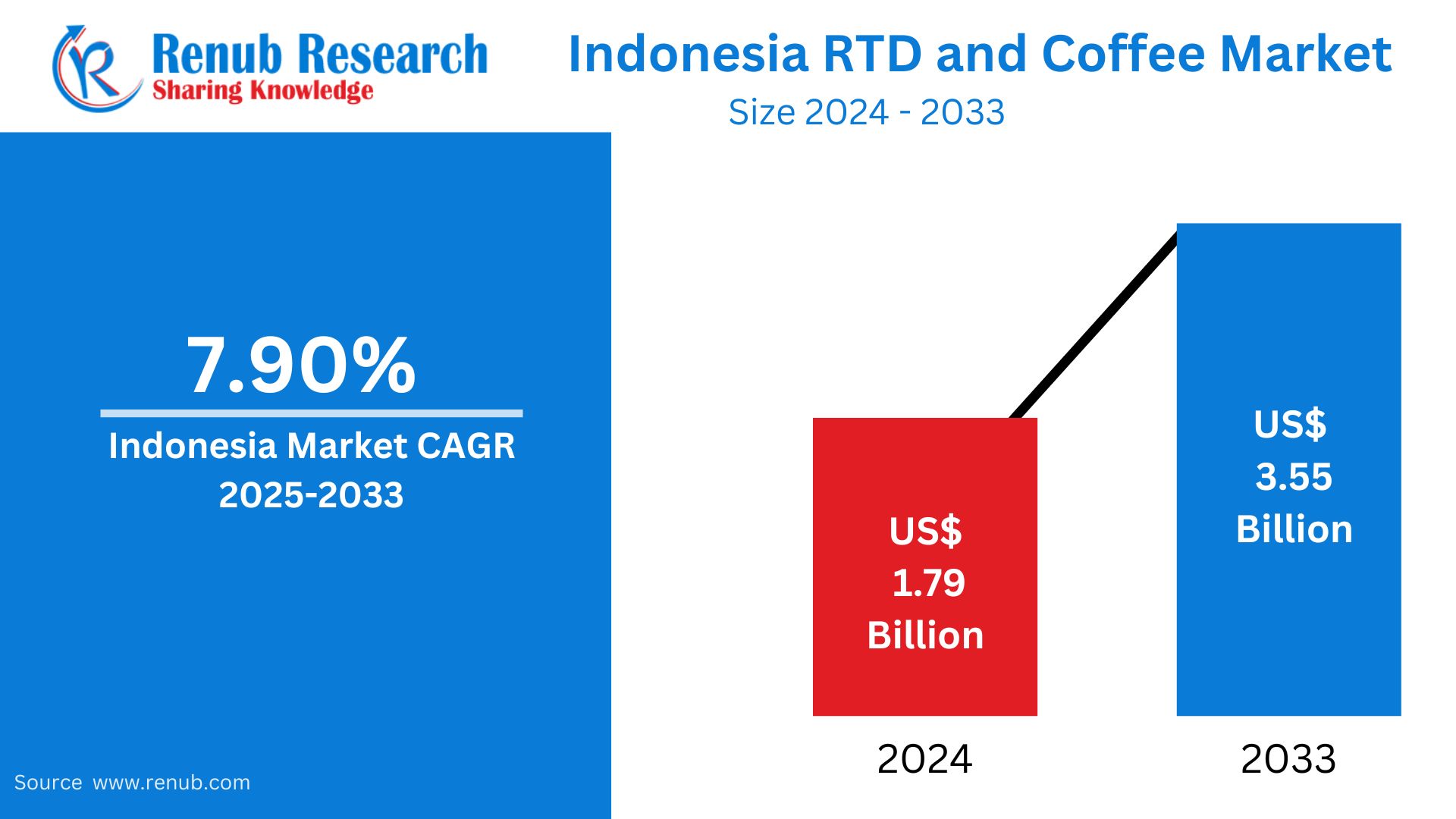

Indonesia Ready Drink Tea and Coffee Market is expected to reach US$ 3.55 billion by 2033 from US$ 1.79 billion in 2024, with a CAGR of 7.90% from 2025 to 2033. Some of the main drivers driving the market demand include the installation of RTD tea and coffee vending machines in various locations and stations, as well as the rising spending power of individuals. Furthermore, the creation of new flavors is opening up new avenues for market expansion.

The report Indonesia Ready Drink Tea and Coffee Market & Forecast covers by Product Category (Tea, Coffee), Packaging Type (Glass Bottle, PET Bottle, Canned, Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, Others), Region {Ready to Drink Tea Market (North, South, East, West), Ready to Drink Coffee Market (North, South, East, West)}, Countries and Company Analysis, 2025-2033.

Indonesia Ready Drink Tea and Coffee Market Segmentation

Indonesia's ready-to-drink (RTD) tea and coffee market is flourishing due to shifting consumer tastes and lifestyles. Customers are looking for more convenient, on-the-go beverage options as a result of urbanization and busier schedules. Because of its refreshing flavor and cultural familiarity, RTD tea in particular is still a popular choice. In a competitive market, strong brand loyalty and creative packaging help sustain consumer attention, while local flavors and natural ingredients continue to appeal to health-conscious consumers.

However, RTD coffee is also becoming more popular, particularly with younger consumers who are influenced by international coffee trends. Numerous RTD coffee products have been developed as a result of the growth of regional coffee chains and the growing need for high-quality coffee experiences. These drinks provide a link between contemporary convenience and classic café culture. The RTD coffee market is anticipated to continue growing rapidly alongside tea as long as companies keep experimenting with tastes and broadening their consumer base through digital channels and retail networks.

Growth Drivers for the Indonesia Ready Drink Tea and Coffee Market

Increasing Health Consciousness

In Indonesia's ready-to-drink (RTD) tea and coffee sector, consumer choices are being significantly shaped by health consciousness. More customers are actively looking for beverages that fit with a better lifestyle as a result of growing understanding of the influence that nutrition has on general well-being. As a result, there is now a greater need for beverages that are natural, low in sugar, and have practical advantages. Antioxidant-rich green tea and herbal-infused teas that have invigorating or relaxing effects are becoming more and more popular. In a similar vein, RTD coffees that contain plant-based components or additional vitamins are becoming more popular. "Better-for-you" beverages are a major area of market growth as a result of brands reacting to this trend by reformulating goods and emphasizing health advantages in their marketing.

Attractive Branding and Packaging

For ready-to-drink (RTD) tea and coffee products to succeed in Indonesia's cutthroat market, branding and packaging are essential. Customers are frequently drawn to beverages that stand out on shelves due to the increasing variety of options offered. Packaging that is contemporary, visually appealing, and follows current design trends draws attention and affects consumer decisions. In addition to being aesthetically pleasing, packaging conveys important brand values that appeal to today's consumers, such sustainability, health, or superior quality. A strong brand identity, on the other hand, promotes loyalty and trust, which in turn promotes repeat business. Packaging is a potent instrument for uniqueness and sustained customer engagement since many brands utilize it to emphasize distinctive selling features like regional flavors, practical advantages, or environmentally friendly materials.

Urbanization and Busy Lifestyles

In Indonesia, the ready-to-drink (RTD) tea and coffee business is expanding due in large part to urbanization and people's increasingly hectic lifestyles. Convenient beverage options are in high demand as more individuals relocate to cities and establish fast-paced lifestyles. Customers frequently look for easy, quick fixes to keep themselves stimulated and refreshed throughout the day, particularly students and working professionals. This need is perfectly met by RTD beverages, which are portable and simple to consume without preparation. People value these drinks' grab-and-go accessibility whether they are working, studying, or commuting. This change in lifestyle has pushed companies to develop new packaging, portability, and availability strategies, making sure their goods can be found in urban convenience stores, vending machines, and online delivery services.

Challenges in the Indonesia Ready Drink Tea and Coffee Market

Intense Competition and Market Saturation

There is fierce competition and growing market saturation in Indonesia's ready-to-drink (RTD) tea and coffee sector. Brands are vying for consumers' attention as a result of the numerous established companies and the frequent product launches by new entrants. Aggressive pricing tactics are frequently the result of this congested environment, which can lead to price wars and eventually lower profit margins for businesses. It becomes difficult for brands to stand out in such a competitive market and keep devoted long-term customers. Businesses must make investments in innovative products, distinctive flavor profiles, focused advertising, and a powerful brand identity if they want to stand out. Continuous innovation, however, can be resource-intensive, and smaller firms might find it difficult to stay up. This makes it more difficult to maintain growth and establish a solid place in the market.

Supply Chain Disruptions and Raw Material Sourcing

For Indonesia's RTD tea and coffee market, supply chain interruptions and the sourcing of raw materials present major obstacles. Southeast Asian coffee bean crops have suffered as a result of climate change's unpredictable weather patterns, which include intense heat and protracted droughts. Indonesia is especially susceptible to these environmental changes because it is a significant producer and consumer of coffee. RTD coffee producers are finding it more and more challenging to find high-quality beans at reliable and reasonable costs as a result of the ensuing drop in coffee yields, which has resulted in limited supply and increased global pricing. These changes in the cost and availability of raw materials can have an impact on long-term planning, profit margins, and product pricing. As a result, businesses may need to look into alternate sourcing methods or modify product formulations in order to remain competitive.

North Indonesia Ready Drink Tea and Coffee Market

The market for ready-to-drink (RTD) tea and coffee in North Indonesia, especially in North Sumatra, is expanding significantly due to both changing customer preferences and local manufacturing capabilities. A major producer of coffee, North Sumatra is home to the well-known Mandheling and Lintong types, which are highly valued in global markets. In addition to boosting the local economy, this local production gives RTD beverage producers a consistent supply of premium coffee beans. Convenient, portable beverage options are becoming more popular in North Indonesia, in line with national trends. In particular, younger consumers are looking for goods that combine quality and ease. According to contemporary retail channels and internet platforms, RTD tea and coffee goods are now more readily available in cities like Medan. To meet the varied interests of the local populace, brands are consequently launching novel flavors and formulations, which is helping the industry grow in the area.

South Indonesia Ready Drink Tea and Coffee Market

In South Indonesia, the market for ready-to-drink (RTD) tea and coffee is steadily expanding, especially in areas like South Sumatra and South Sulawesi. Growing urbanization, a youthful, tech-savvy populace, and a growing need for convenient beverage options are the main drivers of this expansion. In order to satisfy local tastes and preferences, local brands are making the most of regional coffee types like Gayo and Toraja. Additionally, customers find cold beverages like RTD tea and coffee especially enticing due to the region's tropical climate.

In South Indonesia, distribution channels are changing, with the emergence of contemporary retail formats and e-commerce platforms complementing conventional retail locations. This multi-channel strategy improves the visibility and accessibility of the goods. Brands are concentrating on product innovation, such as the launch of novel flavors and functional ingredients, and stressing formulations that are health-conscious in order to stand out in a crowded market. By addressing the wide range of consumer tastes in South Indonesia, these tactics hope to set up the RTD beverage market for future expansion in the area.

East Indonesia Ready Drink Tea and Coffee Market

In East Indonesia, which includes areas like Papua and Maluku, the market for ready-to-drink (RTD) tea and coffee is expanding gradually. These regions profit from the nation's overall production and distribution networks even though they are not the main producers of tea or coffee. The need for accessible, on-the-go beverage options is being driven by the growing urbanization and the youthful, tech-savvy population in areas like Jayapura and Ambon. In line with the national trend toward healthier, lower-sugar beverages, local tastes are moving toward goods that provide both refreshment and health advantages.

East Indonesia's distribution is changing, with the emergence of contemporary retail formats and e-commerce platforms complementing conventional retail locations. This multi-channel strategy improves the visibility and accessibility of the goods. In order to satisfy the varied tastes of the local populace, brands are launching novel flavors and formulas, setting up the RTD beverage industry for future expansion in the area.

West Indonesia Ready Drink Tea and Coffee Market

In West Indonesia, the market for ready-to-drink (RTD) tea and coffee is steadily expanding, especially in areas like Banten and West Java. One important source of tea that helps provide RTD tea products is West Java. Due to busy lives and a youthful, health-conscious populace, there is a greater need for quick beverage options in the region's major hubs, like Bandung and Bogor. RTD beverages that provide both refreshment and practical advantages are becoming more and more popular among consumers. In response, companies are launching novel flavors and compositions to suit regional tastes, such as low-sugar and herbal-infused choices. These products are now more widely available to a wider audience in West Indonesia thanks to the growth of contemporary retail channels and e-commerce platforms.

Indonesia Ready Drink Tea and Coffee Market Segments

Product Category – Market breakup in 2 viewpoints:

- Tea

- Coffee

Packaging Type – Market breakup in 4 viewpoints:

- Glass Bottle

- PET Bottle

- Canned

- Others

Distribution Channel – Market breakup in 4 viewpoints:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Region – Market breakup in 2 viewpoints:

1. Ready to Drink Tea Market

- North

- South

- East

- West

2. Ready to Drink Coffee Market

- North

- South

- East

- West

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis:

- Nestle SA

- The Coca Cola Company

- Pepsico

- Starbucks Corporation

- Monster Beverage

- Danone S.A.

- Ashahi Group Holding

- Unilever Plc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Category, Packaging Type, Distribution Channel, Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Indonesia Ready Drink Tea and Coffee Market

6. Market Share Analysis– Ready to Drink Tea and Coffee

6.1 By Product Category

6.2 By Packaging Type

6.3 By Distribution Channel

6.4 By Region

6.4.1 Ready to Drink Tea

6.4.2 Ready to Drink Coffee

7. Product Category

7.1 Tea

7.2 Coffee

8. Packaging Type

8.1 Glass Bottle

8.2 PET Bottle

8.3 Canned

8.4 Others

9. Distribution Channel

9.1 Supermarkets/Hypermarkets

9.2 Convenience Stores

9.3 Online

9.4 Others

10. Region

10.1 Ready to Drink Tea Market

10.1.1 North

10.1.2 South

10.1.3 East

10.1.4 West

10.2 Ready to Drink Coffee Market

10.2.1 North

10.2.2 South

10.2.3 East

10.2.4 West

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Nestle SA

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 The Coca Cola Company

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Pepsico

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Starbucks Corporation

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Monster Beverage

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Danone S.A.

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Ashahi Group Holding

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Unilever Plc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com