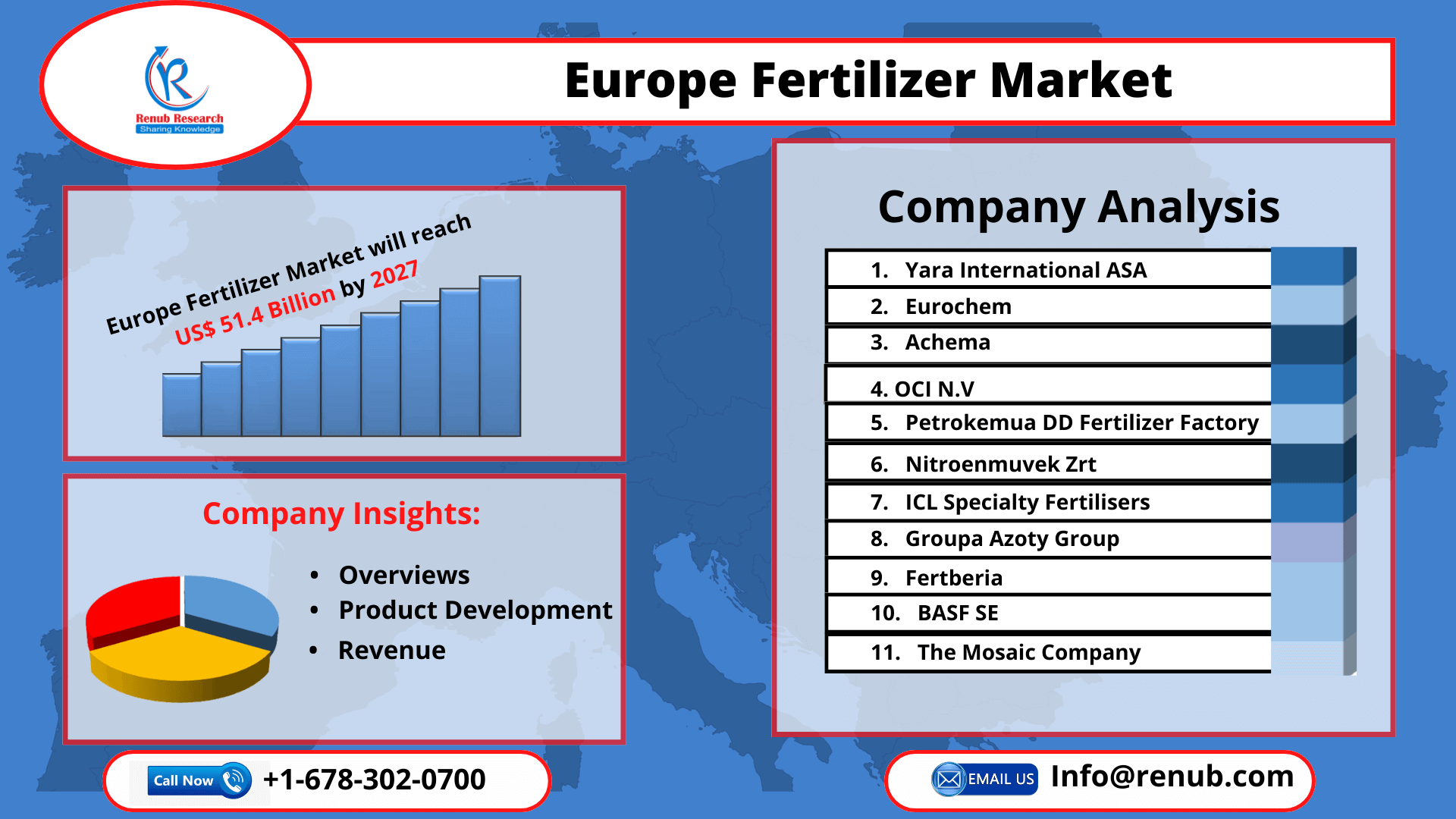

Europe Fertilizer Market to Reach US$ 8.4 Billion by 2027, Propelled by Awareness about Using Organic Fertilizers on Human Health and Soil Quality

21 Apr, 2022

As per the Renub Research report titled “Europe Fertilizer Market, Size, Forecast 2022-2027, Share, Growth, Industry Trends, Impact of COVID-19, Opportunity Company Analysis," the Europe Fertilizer Market Size was US$ 5.5 Billion in the year 2021. Fertilizers play a central role in Europe, meeting the agricultural requirements of a developing population by promoting the effective use of arable land and ensuring food preservation in Europe. These fertilizers are a rich source of primary nutrients, including phosphorus, nitrogen, and potassium, and help maintain the health of the crops. Similarly, they raise the organic & humus content in the soil, provides nutrients for microorganisms in the soil, and converts the physical?chemical properties of the soil.

Across Europe, the market for nitrogenous fertilizers grows with abundant raw materials due to shale gas exploration. Urea is the consideration for the consumption in the agricultural sector in the European industry, followed by UAN (Liquid Urea Ammonium Nitrate. The availability of this gas at a less price has decreased imports of urea, ammonia, and urea ammonium nitrate in Europe. Increased commercial farming and the low-cost production of fertilizers are anticipated to propel the demand for nitrogenous fertilizers.

Geographically, France Dominates the European Fertilizers Market:

France holds the most significant share in the European fertilizer market, followed by Germany and United Kingdom. The demand for phosphate fertilizer increases slower than nitrogenous fertilizer, owing to France's insufficient supplies of phosphate rocks. Also, the rate of application of phosphate fertilizers is low in Europe, owing to the low rate of phosphorous diffusion and their residual effect in crops and soil. The primary factor driving cropland conversion in Western European countries like Germany, the United Kingdom, and Spain transforms arable land for settlement and infrastructure. The shrinkage of farmland has emerged in accepting a greater concentration of fertilizers by farmers to cater to the increasing need for food crops across the region.

Besides, shrinking farmland and rising demand for food crops such as wheat boost the requirement for agricultural chemicals. Wheat is the highest consumer of nitrogen-based soil nourishment among the cereals consumed across Europe, followed by Coarse, Oil Seeds, and Potatoes. Nitrogen is used to grains and cereals in the form of soil additives or sprinklers. A rise in the consumption of bio-fuel and bio-energy in Europe increased the demand for fodder crops. Fodder crops are the more fertilizer-consuming crops, growing the need for fertilizers in Europe.

COVID-19 Impact on European Fertilizers Market:

The impact of COVID-19 on the fertilizer market in Europe has been minimal, owing to the priority status of the commodities. Thus, supply chain disruptions have not severely affected the supply of fertilizers to the European market due to trade limitations.

Key Players:

Prominent players operating in the European Fertilizers Market are Yara International ASA, Eurochem, Achema, OCI N.V, Petrokemua DD Fertilizer Factory, Nitroenmuvek Zrt., ICL Specialty Fertilisers, Grupa Azoty Group, Fertberia, BASF SE, and The Mosaic Company. For instance, Yara International, in 2021, has signed a letter of intent with Skycraft and Aker Horizon to establish Europe's first large-scale green ammonia project in Norway. This will make Yara one of the major players in producing green ammonia in the European region.

Market Summary:

- Segment – We have covered by segment in the Europe Fertilizer Market breakup from 3 viewpoints. (Nitrogen, Potassium & Phosphate)

- Type – Our report covered by type in the Europe Fertilizer Market breakup from 5 viewpoints. (Nitrate, Urea, UAN, Compound fertilizer & Others)

- Crop – This Report covered by crop in the Europe Fertilizer Market breakup from 9 viewpoints. (Wheat, Coarse, Oil Seeds, Potatoes, Sugar Beet, Perm Crop, Fodder Crop, Fertilizer grassland, Others arable)

- Geography – Renub research report covered by country in the Europe Fertilizer Market breakup from 6 viewpoints (France, Germany, United Kingdom, Spain, Italy, Others)

- Key Players – All the key players have been covered from 3 Viewpoints (Overview, Recent Development, and Revenues) of companies like Yara International ASA, Eurochem, Achema, OCI N.V, Petrokemua DD Fertilizer Factory, Nitroenmuvek Zrt., ICL Specialty Fertilisers, Grupa Azoty Group, Fertberia, BASF SE, and The Mosaic Company.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com