China Used Car Market & Volume by Types (Sedan, SUV, Micro Van, Trailer, Motorcycle, Others) Vehicle age, Distribution Channels, Region, Pricing, Company

Buy NowGet Free Customization in this Report

China is one of the world's largest auto markets and alone produces more than half of the cars across the globe. China is also the biggest used car market and the largest manufacturer of automobile sector globally. In China, used-cars are sold by Organized Dealers, Unorganized / Independent Dealers, and through online sites like Guazi.com, Uxin Group (xin.com), Renreche (renrenche.com), Souche.com, etc. China Used Car Market is anticipated to reach 385 Billion by the end of the year 2025.

China used car market is growing due to the rapid growth of online channels in the industry. Chinese online used-car dealing platforms are increasingly investing in physical retail stores as they seek to improve customer experience on their platforms and improve brand recognition.

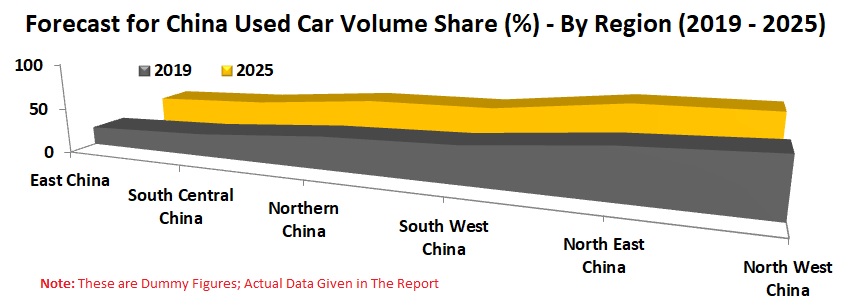

East China dominates the used car market in China among South Central China, Northern China, southwest China, North-East China, and northwest China. China has accelerated the development of the automobile industry with the rapid pace and achieved remarkable output with several laws and regulation that supported China used car market.

China's Ministry of E-Commerce policy such as Administering Automobile Sales, Registering used car sold across provinces and city borders, amending measures that govern the recycling of scrapped vehicles and promoting the so-called "parallel imports" pilot scheme. These policies allowed selected unauthorized dealers to sell imported cars in a bid to rein in high-end car prices.

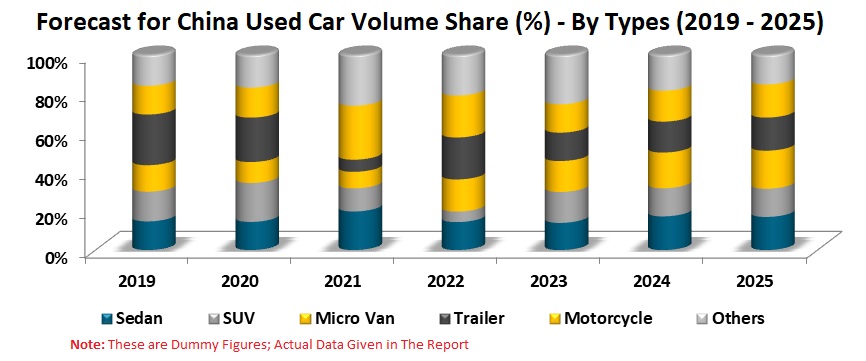

Sedan and SUV is the most popular used car which was sold in China as more and more Chinese younger generation below 30 years old prefer to buy these two vehicles. As per our study, the China annual SUV used car sales to be triple in the next ten years, as the number of wealthy consumers is increasing year on year.

Chinese people consider buying a used car due to excellent condition and lower cost and the chance to buy a better model and brand. Because of this, segments like <3 Years old vehicle and Less than USD 4500 price vehicles driving the used car market in China.

Renub Research report titled “China Used Car Market & Volume, and Volume by Types (Sedan, SUV, Micro Van, Trailer, Motorcycle, and Others), Market & Volume by Vehicle age (<3 Years, 3 - 10 Years, and >10 Years), Market & Volume by Distribution Channels (Organized Dealers / Large Vehicle Market, Online, and Unorganized / Independent Dealers), Market & Volume by Region (East China, South Central China, Northern China, South West China, North East China, North West China), Volume by Pricing (Less than USD 4500, Between USD 4500 - 7500, Between USD 7501 - 12000, and More than USD 12000), by Company (Guazi , Uxin Group (2C and 2B business Segments), Renreche, Souche, and CAR Inc)” provides a complete analysis of China Used Care Market.

Type - China Used Car Volume

In this report, we have done a complete assessment of China used car Market & Volume on the basis of by type of Cars

• Sedan

• SUV

• Micro Van

• Trailer

• Motorcycle

• Others

Vehicle Age - Market & Volume

In this report, we have a complete insight of China used car volume share by vehicle age

• <3 Years

• 3 - 10 Years

• >10 Years

Distribution Channel - Market & Volume

This report explains the extensive framework of used car distribution channels, where reader would get the complete insight of China demand and supply of used car along with top Organized Dealers/Large Vehicle Market and Unorganized/Independent Dealers. This report also explains the major factors that make Organized Dealers/Large Vehicle Market and Unorganized/Independent Dealers top distribution channels of used car.

• Organized Dealers/ Large Vehicle Market

• Online

• Unorganized/ Independent Dealers

• Companies Covered

Region - Market & Volume

This report explains the extensive framework of sales, in Chinese regions.

• East China

• South Central China

• Northern China

• South West China

• North East China

• North West China

Pricing Analysis - Volume

The report provides the data of Used Vehicle in China in the below-mentioned prices.

• Less than USD 4500

• Between USD 4500 – 7500

• Between USD 7501 – 12000

• More than USD 12000

Key Players - China Used Car Market

Some of the key players in China used car market are as follows

• Guazi

• Uxin Group (2C and 2B business Segments)

• Renreche, Souche

• CAR Inc

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.1.1 Rise of the Used-Car Dealer

4.1.2 Purchasing Pattern is Changing

4.2 Challenges

4.2.1 Lack of Integrity

4.2.2 Lack of Used Car Evaluation Criteria

4.2.3 Lack of After-Sell Service Systems

4.2.4 Incomplete Policies and Regulations

5. China Used Vehicle Market

6. China Used Vehicle Units

7. Volume Share – China Used Car

7.1 By Types

7.2 By Vehicle Age

7.3 By Distribution Channels

7.4 By Region

7.5 By Pricing Analysis

8. Type – China Used Vehicle Volume

8.1 Sedan

8.2 SUV

8.3 Micro Van

8.4 Trailer

8.5 Motorcycle

8.6 Others

9. Vehicle Age – China Used Vehicle Market & Volume

9.1 <3 Years

9.1.1 Volume

9.1.2 Market

9.2 3 - 10 Years

9.2.1 Volume

9.2.2 Market

9.3 >10 Years)

9.3.1 Volume

9.3.2 Market

10. Distribution Channels – China Used Vehicle Market & Volume

10.1 Organized Dealers / Large Vehicle Market

10.1.1 Volume

10.1.2 Market

10.2 Online

10.2.1 Volume

10.2.2 Market

10.3 Unorganized / Independent Dealers

10.3.1 Volume

10.3.2 Market

11. By Region - China Used Vehicle Market & Volume

11.1 East China

11.1.1 Volume

11.1.2 Market

11.2 South Central China

11.2.1 Volume

11.2.2 Market

11.3 Northern China

11.3.1 Volume

11.3.2 Market

11.4 South West China

11.4.1 Volume

11.4.2 Market

11.5 North East China

11.5.1 Volume

11.5.2 Market

11.6 North West China

11.6.1 Volume

11.6.2 Market

12. Pricing Analysis – China Used Vehicle Volume

12.1 Less than USD 4500

12.2 Between USD 4500 - 7500

12.3 Between USD 7501 - 12000

12.4 More than USD 12000

13. Merger & Acquisitions

14. Companies Covered

14.1 Guazi in Units

14.1.1 Recent Development or Strategy

14.1.2 Sales

14.2 Uxin Group in Units (2C and 2B business Segment)

14.2.1 Recent Development or Strategy

14.2.2 Sales

14.3 Renrenche in Units

14.3.1 Recent Development or Strategy

14.3.2 Sales

14.4 Souche in Units

14.4.1 Recent Development or Strategy

14.4.2 Sales

14.5 CAR Inc

14.5.1 Recent Development or Strategy

14.5.2 Sales

List of Figures:

Figure-01: China - Used Care Market (In USD Million), 2015 – 2018

Figure-02: China - Forecast for Used Care Market (In USD Million), 2019 – 2025

Figure-03: China - Used Vehicle Volume (Million Units), 2015 – 2018

Figure-04: China - Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-05: China - Used Vehicle Volume Share by Age (Percent), 2015 – 2018

Figure-06: China - Forecast for Used Vehicle Volume Share by Age (Percent), 2019 – 2025

Figure-07: China - Used Vehicle Volume Share by Distribution Channels (Percent), 2015 – 2018

Figure-08: China - Forecast for Used Vehicle Volume Share by Distribution Channels (Percent), 2019 – 2025

Figure-09: China - Used Vehicle Volume Share by Pricing (Percent), 2015 – 2018

Figure-10: China - Forecast for Used Vehicle Volume Share by Pricing (Percent), 2019 – 2025

Figure-11: China - Sedan Used Car Volume (Million Units), 2015 – 2018

Figure-12: China - Forecast for Sedan Used Car Volume (Million Units ), 2019 – 2025

Figure-13: China - SUV Used Car Volume (Million Units), 2015 – 2018

Figure-14: China – Forecast for SUV Used Car Volume ( Million Units), 2019 – 2025

Figure-15: China - Used Micro Van Volume (Million Units), 2015 – 2018

Figure-16: China – Forecast for Used Micro Van Volume (Million US$), 2019 – 2025

Figure-17: China - Used Trailer Volume (Million Units), 2015 – 2018

Figure-18: China - Forecast for Used Trailer Volume (Million Units), 2019 – 2025

Figure-19: China - Used Motorcycle Volume (Million Units), 2015 – 2018

Figure-20: China - Forecast for Used Motorcycle Volume (Million Units), 2019 – 2025

Figure-21: China - Others Used Vehicle Volume (Million Units), 2015 – 2018

Figure-22: China - Forecast for Others Used Vehicle Volume (Million Units), 2019 – 2025

Figure-23: China - Used Vehicle <3 Years Volume (Million units), 2015 – 2018

Figure-24: China – Forecast for Used Vehicle <3 Years Volume (Million units), 2019 – 2025

Figure-25: China – Forecast for Used Vehicle <3 Years Volume (Million units), 2019 – 2025

Figure-26: China - Used Vehicle <3 Years Market (In USD Million), 2015 – 2018

Figure-27: China – Forecast for Used Vehicle <3 Years Market (In USD Million), 2019 – 2025

Figure-28: China - Used Vehicle 3-10 Years Volume (Million Units), 2015 - 2018

Figure-29: China – Forecast for Used Vehicle 3-10 Years Volume (Million Units), 2019 – 2025

Figure-30: China - Used Vehicle 3-10 Years Market (In USD Million), 2015 - 2018

Figure-31: China – Forecast for Used Vehicle 3-10 Years Market (In USD Million), 2019 – 2025

Figure-32: China - Used Vehicle > 10 years Volume (Million Units), 2015 – 2018

Figure-33: China – Forecast for Used Vehicle > 10 years Volume (Million Units), 2019 – 2025

Figure-34: China - Used Vehicle > 10 years Market (In USD Million), 2015 – 2018

Figure-35: China – Forecast for Used Vehicle > 10 years Market (In USD Million), 2019 – 2025

Figure-36: China - Organized Dealers/Large Vehicle Volume (Million Units), 2015 – 2018

Figure-37: China – Forecast for Organized Dealers/Large Vehicle Volume (Million Units), 2019 – 2025

Figure-38: China - Organized Dealers/Large Vehicle Market (In USD Million), 2015 – 2018

Figure-39: China – Forecast for Organized Dealers/Large Vehicle Market (In USD Million), 2019 – 2025

Figure-40: China - Online Used Vehicle Volume (Million Units), 2015 – 2018

Figure-41: China - Forecast for Online Used Vehicle Market (Million Units), 2019 – 2025

Figure-42: China - Online Used Vehicle Market (In USD Million), 2015 – 2018

Figure-43: China - Forecast for Online Used Vehicle Market (In USD Million), 2019 – 2025

Figure-44: China - Unorganized/Independent Dealers Vehicle Volume (Million Units), 2015 – 2018

Figure-45: China - Forecast for Unorganized/Independent Dealers Vehicle Volume (Million Units), 2019 – 2025

Figure-46: China - Unorganized/Independent Dealers Vehicle Market (In USD Million), 2015 – 2018

Figure-47: China - Forecast for Unorganized/Independent Dealers Vehicle Market (In USD Million), 2019 – 2025

Figure-48: East China - Used Vehicle Volume (Million Units), 2015 – 2018

Figure-49: East China – Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-50: East China - Used Vehicle Market (In USD Million), 2015 – 2018

Figure-51: East China – Forecast for Used Vehicle Market (In USD Million), 2019 – 2025

Figure-52: South Central China - Used Vehicle Volume (Million Units), 2015 – 2018

Figure-53: South Central China – Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-54: South Central China - Used Vehicle Market (In USD Million), 2015 – 2018

Figure-55: South Central China – Forecast for Used Vehicle Market (In USD Million), 2019 – 2025

Figure-56: Northern China - Used Vehicle Volume (Million Units), 2015 – 2018

Figure-57: Northern China - Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-58: Northern China - Used Vehicle Market (In USD Million), 2015 – 2018

Figure-59: Northern China – Forecast For Used Vehicle Market (In USD Million), 2015 – 2018

Figure-60: South West China - Used Vehicle Volume (Million Units), 2015 – 2018

Figure-61: South West China - Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-62: South West China - Used Vehicle Market (In USD Million), 2015 – 2018

Figure-63: South West China - Forecast for Used Vehicle Market (In USD Million), 2019 – 2025

Figure-64: North East China - Used Vehicle Volume (In USD Million), 2015 – 2018

Figure-65: North East China - Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-66: North East China - Used Vehicle Market (In USD Million), 2015 – 2018

Figure-67: North East China - Forecast for Used Vehicle Market (In USD Million), 2019 – 2025

Figure-68: North East China - Used Vehicle Volume (Million Units), 2015 – 2018

Figure-69: North East China - Forecast for Used Vehicle Volume (Million Units), 2019 – 2025

Figure-70: North East China - Used Vehicle Market (In USD Million), 2015 – 2018

Figure-71: North East China - Forecast for Used Vehicle Market (In USD Million), 2019 – 2025

Figure-72: China - Used Vehicle Less than USD 4500 Volume (Million Units), 2015 – 2018

Figure-73: China - Forecast for Used Vehicle Less than USD 4500 Volume (Million Units), 2019 – 2025

Figure-74: China - Used Vehicle Between USD 4500 – 7500 Volume (Million Units), 2015 – 2018

Figure-75: China – Forecast for Used Vehicle Between USD 4500 – 7500 Volume (Million Units), 2019 – 2025

Figure-76: China - Used Vehicle Between USD 7501 – 12000 Volume (Million Units), 2015 – 2018

Figure-77: China – Forecast for Used Vehicle Between USD 7501 – 12000 Volume (Million Units), 2019 – 2025

Figure-78: China - Used Vehicle More than USD 12000 Volume (Million Units), 2015 – 2018

Figure-79: China – Forecast for Used Vehicle More than USD 12000 Volume (Million Units), 2019 – 2025

Figure-80: China - Guazi Online Used Car Sales (In Units), 2015 - 2018

Figure-81: China – Forecast for Guazi Online Used Car Sales (In Units), 2019 - 2025

Figure-82: China - Uxin Group Online Used Car (2C and 2B business Segment) Sales (In Units), 2015 - 2018

Figure-83: China – Forecast for Uxin Group Online Used Car (2C and 2B business Segment) Sales (In Units), 2019 - 2025

Figure-84: China - Renrenche Online Used Car Sales (In Units), 2015 - 2018

Figure-85: China – Forecast for Renrenche Online Used Car Sales (In Units), 2019 - 2025

Figure-86: China - Souche Online Used Car Sales (In Units), 2015 - 2018

Figure-87: China – Forecast for Souche Online Used Car Sales (In Units), 2019 - 2025

Figure-88: China - CAR Inc Online Used Car Sales (In Units), 2015 - 2018

Figure-89: China – Forecast for CAR Inc Online Used Car Sales (In Units), 2019 - 2025

List of Tables:

Table-1: China - Used Vehicle Volume Share by Types (Percent), 2015 – 2018

Table-2: China - Forecast for Used Vehicle Volume Share by Types (Percent), 2019 – 2025

Table-3: China - Used Car Volume Share by Region (Percent), 2015 – 2018

Table-4: China - Forecast for Used Vehicle Volume Share by Region (Percent), 2019 – 2025

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com