Electric Vehicle Aftermarket Market – Global Trends & Forecast 2025–2033

Buy NowElectric Vehicle Aftermarket Size and Forecast

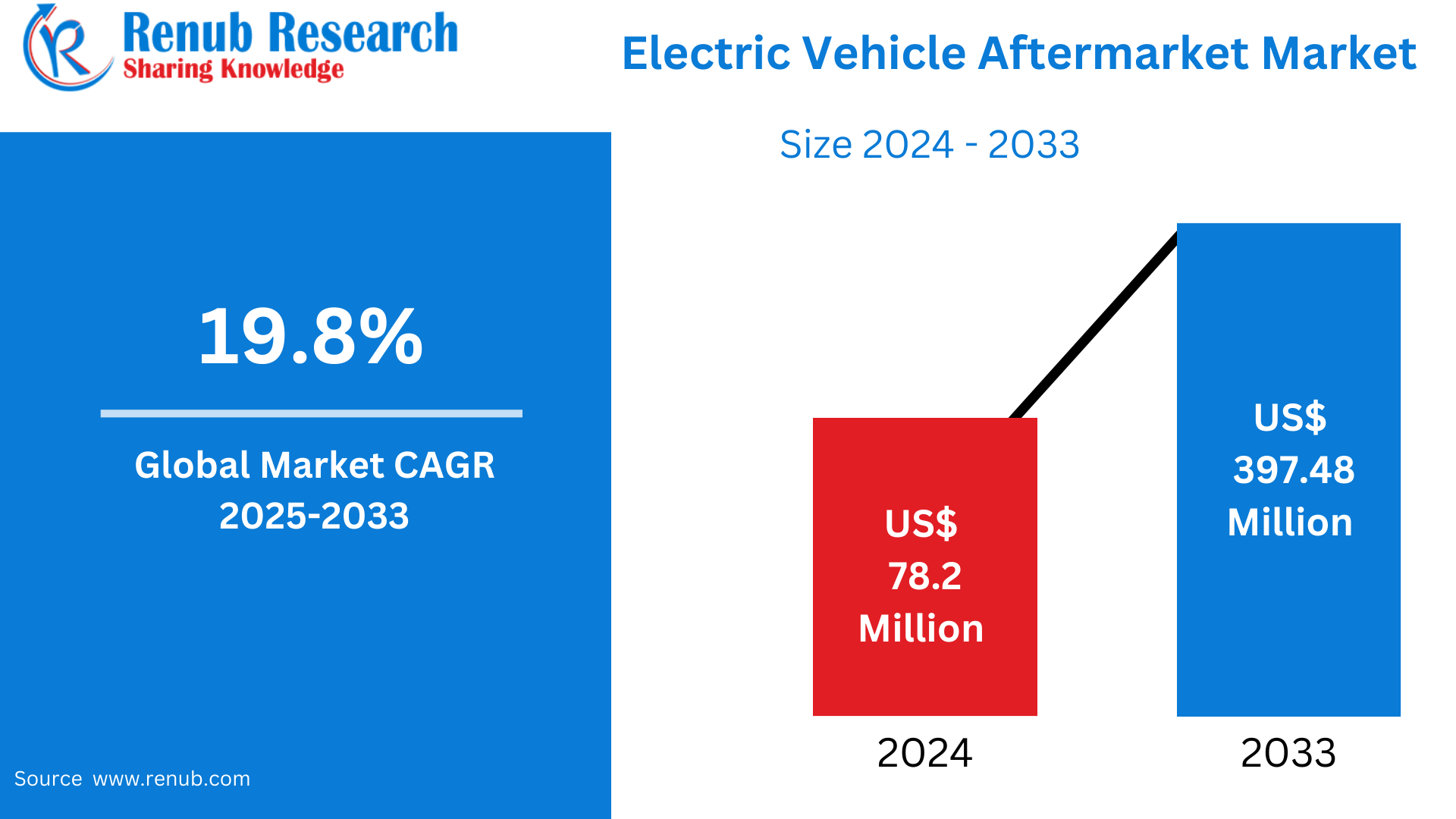

Electric Vehicle Aftermarket is expected to reach US$ 397.48 million by 2033 from US$ 78.2 million in 2024, with a CAGR of 19.8% from 2025 to 2033. Due to robust EV sales, kind government regulations, and a firmly established automotive service ecosystem, the North American electric car aftermarket share is increasing. Rapid development is facilitated by high user awareness, rising EV infrastructure expenditures, and the presence of significant auto and technology firms.

Electric Vehicle Aftermarket Global Report by Replacement Parts (Tire, Battery, Brake Parts, Filters, Body Parts, Lighting & Electronic Components, Wheels, Others), Vehicle Type (Passenger Car, Commercial Vehicle), Distribution Channel (Authorized Service Centers (OEMs), Premium multi-brand service center, Digital Aggregators, Others), Countries and Company Analysis, 2025-2033.

Global Electric Vehicle Aftermarket Industry Overview

EV sales are steadily increasing as a result of the global push for more environmentally friendly modes of transportation. Countries are promoting bans on internal combustion engine (ICE) cars, offering incentives, and setting pollution reduction targets in an effort to hasten the adoption of EVs. The need for aftermarket services, which include components, maintenance, diagnostics, and improvements unique to electric powertrains and systems, is increasing along with the number of EVs on the road. In addition, EVs rely heavily on software for user interface, safety, energy efficiency, and performance monitoring, unlike traditional cars. Owners regularly look for updates to fix problems, add new features, or enhance battery performance. Additionally, telematics systems provide data-informed diagnostics and predictive maintenance, creating a new aftermarket industry centered on software services and digital improvement.

The growth of modular repair solutions, which need aftermarket by facilitating affordable, in-vehicle service of complicated electric components, has made the US a key player in the sector. This improves workshop productivity and decreases downtime, particularly when combined with focused technician training initiatives. In the US and Canada, ZF Aftermarket released 25 Electric Axle Drive Repair Kits in 2024, enabling workshops to service EVs without removing the electric drive. These kits, which were part of ZF's expanding portfolio for electric and hybrid cars, addressed 25 different maintenance scenarios. To properly use the kits, technicians have to finish high voltage training.

Additionally, a growing number of municipal transportation systems, logistics companies, and delivery organizations are switching to electric fleets. These business owners want dependable maintenance contracts that put uptime first, as well as replacement components and servicing. Aftermarket businesses are concentrating on this sector with part supply agreements and predictive maintenance solutions.

Key Factors Driving the Electric Vehicle Aftermarket Growth

Solutions for Charging and Infrastructure Extension

The need for easy and widely accessible charging stations is growing as EV adoption picks up speed. Aftermarket companies take advantage of this opportunity by offering cutting-edge charging solutions that satisfy a range of charging requirements. These choices range from wireless charging pads to portable chargers and advanced home charging systems. Additionally, the aftermarket offers improvements to EV charging capabilities, such as faster charging durations and compatibility with several charging protocols. Aftermarket suppliers customize their offerings to complement government and corporate investments in the construction of charging infrastructure, creating a win-win partnership that encourages EV adoption and the expansion of the aftermarket industry.

According to the U.S. Department of Energy, the number of EV charging ports listed in the Station Locator increased by 6.3% in the second quarter of 2024, with private ports expanding by 4.4% and public ports by 6.5%. As more people choose EVs, the demand for flexible and effective charging options pushes the EV aftermarket to develop new products that solve charging-related problems.

Improvements to Comfort and Aesthetics

EV owners want to customize their cars with features and designs that suit their personal preferences and lifestyles. In order to satisfy these demands, aftermarket companies provide a range of goods, such as unique body modifications, paint jobs, personalized lighting, and interior enhancements. These choices encourage a sense of uniqueness among EV owners while allowing for personal expression. The whole experience inside the car is further improved by comfort upgrades including premium seats, sound systems, and state-of-the-art infotainment systems. Notably, the global EV market is expanding, as seen by the 25% growth in EV sales to 17 million in 2024. Aftermarket vendors fill the void when EVs deviate from traditional design standards by offering a range of options to enhance EVs' comfort and appearance.

Technological Developments and Personalization Possibilities

As EV manufacturers introduce new models and enhancements, aftermarket companies take advantage of these developments to provide cutting-edge goods and services that enhance the entire EV ownership experience. The customization choices offered by this technical breakthrough cater to a wide range of customer preferences. In order to improve their vehicle's performance, battery characteristics, and charging options, EV owners search for aftermarket components. Additionally, as companies produce improved battery packs that increase range and overall battery longevity, the aftermarket is driven by the increasing accessibility of new battery technology. Importantly, following years of investment, the International Energy Agency reported that global battery production capacity reached 3 TWh in 2024. The competitive environment created by technological advancements encourages aftermarket providers to constantly provide creative solutions, which advances the growth of the EV aftermarket.

Challenges in the Electric Vehicle Aftermarket

Battery Disposal and Recycling

The recycling and disposal of EV batteries, which have a short lifespan, present major issues as the use of EVs increases. These batteries can cause serious environmental problems, including as soil pollution and hazardous chemical leaks, if they are not disposed of properly. Furthermore, more and more spent batteries will eventually need to be recycled or disposed of due to the growing number of EVs on the road. In order to protect the environment and guarantee the reuse of important elements like nickel, cobalt, and lithium, it is imperative to establish an effective recycling infrastructure. However, recycling EV batteries is a crucial issue for the EV aftermarket since it is a complicated operation and the infrastructure needed to manage the volume and diversity of batteries effectively is still being developed.

Competition from Traditional Auto Parts

The established traditional internal combustion engine (ICE) car aftermarket poses a serious threat to the EV aftermarket. Since ICE cars have been on the market for many years, the automobile ecosystem has become closely entwined with their parts and service networks. It is difficult for the new EV aftermarket to establish itself since ICE component makers and service providers have a significant market share and control the aftermarket. Furthermore, EV-specific component manufacturers have challenges in creating an extensive supply chain, and ICE vehicle service providers can lack the infrastructure or experience necessary to make the switch to EV maintenance smoothly. Since the industry is still developing and setting new standards for parts and services, this rivalry impedes the expansion of the EV aftermarket.

Electric Vehicle Aftermarket Overview by Regions

The aftermarket for electric vehicles (EVs) is expanding worldwide, with North America and Europe concentrating on software updates and charging infrastructure. While EV producers predominate in Asia, particularly China, the UAE is making progress thanks to government subsidies and ecological programs. The following provides a market overview by region:

United States Electric Vehicle Aftermarket

As more people choose electric vehicles, the aftermarket for EVs in the US is changing quickly. Products and services including EV chargers, batteries, components, accessories, and maintenance services specifically designed for electric cars are all part of this sector. Specialized maintenance, software upgrades, and replacement parts are becoming more and more necessary as the number of EVs on the road rises. Innovations in the aftermarket industry include performance-enhancing accessories, personalized interiors, and improved charging systems. As the market for EVs grows, the aftermarket sector is crucial in helping EV owners by offering necessary maintenance that keep cars operating smoothly and current with new technology.

The rise in recycled and remanufactured EV parts is supporting a circular economy, cutting waste, and strengthening sustainability efforts. Since the Inflation Reduction Act (IRA) was passed, over USD 45 billion has been set aside for the domestic production of EV batteries, modules, and chargers, enhancing the aftermarket supply chain and encouraging domestic manufacturing, according to the Center for American Progress. Aftermarket services are now more accessible to consumers because to the integration of digital systems for remote diagnostics, predictive maintenance, and online marketplaces for EV components.

United Kingdom Electric Vehicle Aftermarket

Because of the growing popularity of electric cars and the changing demands of EV owners, the aftermarket for EVs in the UK is changing dramatically. Specialized goods and services for EVs are becoming more and more in demand as more people switch to electric mobility. This covers the creation of cutting-edge charging systems, battery replacements, performance improvements, and interior personalizations. Software advancements are also being seen in the aftermarket industry, where businesses are providing digital solutions like road trip assistance and intelligent parking services, which improve the whole EV ownership experience. Furthermore, the aftermarket business has implemented eco-friendly procedures and recycling programs as a result of the emphasis on environmental sustainability. Even with these developments, problems like compatibility and standardization still exist, necessitating constant work to guarantee the availability and suitability of spare parts and accessories.

China Electric Vehicle Aftermarket

Due to China's dominance in EV manufacturing and adoption, the country's EV aftermarket is developing quickly. The need for specialized services, such software improvements, charging infrastructure, and battery replacements, has increased as a result of the millions of EVs on the road. By providing exclusive services like battery switching and roadside support, Original Equipment Manufacturers (OEMs) like NIO and BYD are gaining more influence over the aftermarket and fostering a more cohesive ownership experience. Independent aftermarket companies like Tuhu are building their networks at the same time to serve the rising EV industry. The scene is being further altered by the emergence of digital solutions, such as road trip assistance and smart parking. Despite obstacles including infrastructure development and standardization, China's EV aftermarket is expected to grow significantly and establish patterns that will affect international markets.

United Arab Emirates Electric Vehicle Aftermarket

The UAE's dedication to sustainability and green transportation is fueling the substantial expansion of the electric vehicle (EV) aftermarket in the country. The National Electric Vehicles Policy and the Dubai Green Mobility Strategy 2030 are two government programs that seek to boost EV adoption and provide charging infrastructure. Incentives such as free parking, toll exemptions, and lower registration costs for EV owners are used in conjunction with these laws. The establishment of a strong EV ecosystem is also supported by the UAE's advantageous geographic position and economic diversification. To support the expanding EV industry, there are still obstacles to overcome, such as the requirement for broad consumer awareness, the creation of extensive service networks, and the training of a competent labor force. For the UAE to meet its aggressive EV adoption goals and promote a sustainable automotive future, these issues must be resolved.

Recent Developments in Electric Vehicle Aftermarket Industry

- In an effort to increase consumer confidence in used EVs, Polestar, an EV manufacturer, announced in April 2025 the introduction of battery health certifications and incentives. By enhancing buyer transparency and establishing incentives for the used EV market, this program seeks to allay worries over battery deterioration in used EVs.

- In order to improve their positions in the rapidly developing field of electric car battery technology, Hyundai Motor Co. and Kia Corp. formed a strategic partnership in October 2024. The businesses intended to collaborate on the development of South Korean manufacturing technologies for lithium iron phosphate battery cathode materials.

- In order to take advantage of the substantial prospects in the rapidly evolving electric car infrastructure market, Siemens announced plans in September 2024 to strengthen its eMobility company.

Market Segmentations

Replacement Parts

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting & Electronic Components

- Wheels

- Others

Vehicle Type

- Passenger Car

- Commercial Vehicle

Distribution Channel

- Authorized Service Centers (OEMs)

- Premium multi-brand service center

- Digital Aggregators

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- 3M

- ABB Ltd

- EVBox Group

- ChargePoint Inc.

- Webasto SE

- Siemens AG

- Bosch Automotive Sevrice Solution Inc.

- Schneider Electric SE

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Replacement Parts, By Vehicle Type, By Distribution Channel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Electric Vehicle Aftermarket Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Electric Vehicle Aftermarket Market Share Analysis

6.1 By Replacement Parts

6.2 By Vehicle Type

6.3 By Distribution Channel

6.4 By Countries

7. Replacement Parts

7.1 Tire

7.2 Battery

7.3 Brake Parts

7.4 Filters

7.5 Body Parts

7.6 Lighting & Electronic Components

7.7 Wheels

7.8 Others

8. Vehicle Type

8.1 Passenger Car

8.2 Commercial Vehicle

9. Distribution Channel

9.1 Authorized Service Centers (OEMs)

9.2 Premium multi-brand service center

9.3 Digital Aggregators

9.4 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 3M

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 ABB Ltd.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 EVBox Group

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 ChargePoint Inc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Webasto SE

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Siemens AG

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Bosch Automotive Sevrice Solution Inc.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Schneider Electric SE

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com