China Automobile Market, Size, Forecast 2021-2030, Industry Trends, Growth, Impact of COVID-19, Opportunity Company Analysis

Buy NowChina Automobile Market Outlook

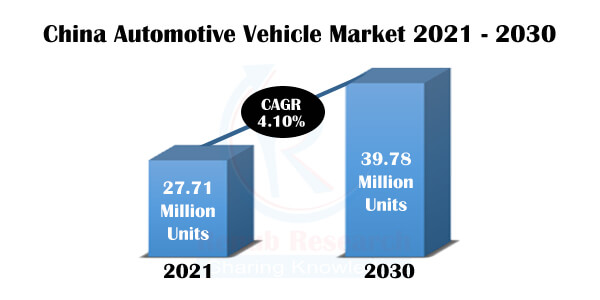

China has been the world's most extensive automotive market for years. The automotive sector is one of the top pillar industries for China's economy and a significant employer. Moreover, enjoying over a decade of surging growth, the Chinese automotive market is reaching a critical point in its development. In addition, the automotive vehicles market is mainly dominated by Chinese brands, which makes carmakers worldwide fight to sell their cars to Chinese consumers. According to the Renub Research analysis, China Automobile Market was 27.71 Million Units in 2021.

China Automotive Vehicle Industry is expected to grow with a CAGR of 4.10% from 2021-2030.

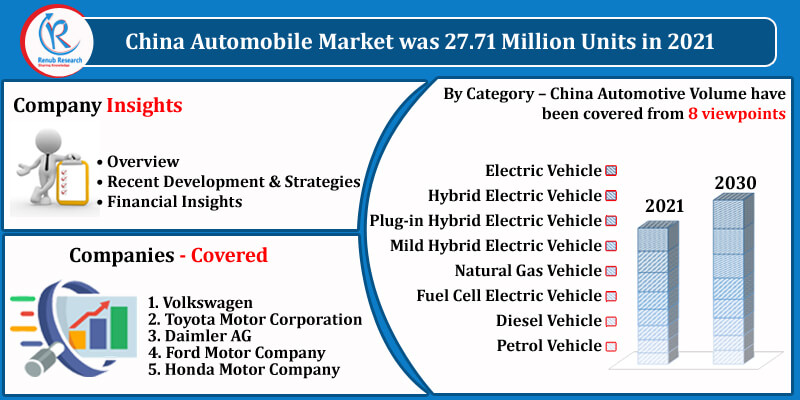

The Chinese automotive industry is uniquely situated to become a centre for the best technologies. By Category, the Chinese automotive vehicles industry's principal categories include Electric Vehicle (EV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Mild Hybrid Electric Vehicle (MHEV), Natural Gas Vehicle (NGV), Fuel Cell Electric Vehicle (FCEV), Diesel Vehicle, Petrol Vehicle. In recent years, Electric vehicles (EV) and Mild Hybrid Electric vehicles (MHEV) have been very successful in China. In particular, due to the Chinese government's support and the cost-saving trend offered through buying an electric vehicle, which avoids the cost of purchasing a license plate, which is indeed a considerable saving.

China Automobile Market Size is expected to reach 39.78 Million Units by 2030

Notwithstanding, to stimulate the automotive market, the government policies are also helping the automotive industry in China. Therein, the government have launched some guidelines, and provinces have also released incentive schemes to promote the automotive sector. For instance, in 2020, Guangzhou announced a subsidy of 10,000 RMB for New Energy Vehicles sold between March and December. Additionally, a State-level contribution to New Energy Vehicles was extended until 2022.

In addition, the role of Chinese dealers is also evolving drastically. Independent dealerships are the backbone of the Chinese automotive retail commerce. Nearly all of the dealers use digital tools to support sales and marketing. Almost half of all the dealers' view digitization and developing an online presence as their top priority for investments in the coming years.

Joint Ventures account for Two-Thirds of the Passenger Car Market in China

The policies and regulations have recently formed unique automotive manufacturing with a mix of domestic automotive companies and joint ventures between domestic and foreign companies. Joint ventures with international automotive companies account for two-thirds of the passenger car market. Domestic brands mainly take up the rest. The major players are Volkswagen, Toyota Motor Corporation, Daimler AG, Ford Motor Company and Honda Motor Company.

COVID-19 devastating effect on Chinese Automotive Vehicle Inustry

COVID-19 overwhelmed significant burdens on the automotive industry in China. Wuhan, Hubei, is one of the critical development cities of the country's six major automobile industrial clusters where the outbreak started. Wuhan gathers many vehicle manufacturers and has more than 500 automobile parts enterprises that suffered adversely.

Hence, in the wake of the COVID-19 pandemic, the Chinese government has taken steps to buttress automobile consumption. These steps include postponing the China Six Emission Standard implementation, providing fiscal and taxation support, speeding up the elimination of obsolete diesel trucks, and optimizing automotive vehicle trading channels.

Renub Research latest report titled “China Automobile Market, By Category (Electric Vehicle (EV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Mild Hybrid Electric Vehicle (MHEV), Natural Gas Vehicle (NGV), Fuel Cell Electric Vehicle (FCEV), Diesel Vehicle, Petrol Vehicle), Company (Volkswagen, Toyota Motor Corporation, Daimler AG, Ford Motor Company and Honda Motor Company)" provides a detailed analysis of China Automotive Vehicle Market.

Category – China Automobile Volume have been covered from 8 viewpoints:

1. Electric Vehicle (EV)

2. Hybrid Electric Vehicle (HEV)

3. Plug-in Hybrid Electric Vehicle (PHEV)

4. Mild Hybrid Electric Vehicle (MHEV)

5. Natural Gas Vehicle (NGV)

6. Fuel Cell Electric Vehicle (FCEV)

7. Diesel Vehicle

8. Petrol Vehicle

Company Insights:

• Overview

• Recent Development & Strategies

• Financial Insights

Company Analysis:

1. Volkswagen

2. Toyota Motor Corporation

3. Daimler AG

4. Ford Motor Company

5. Honda Motor Company

Report Details:

| Report Features | Details |

| Base Year | 2020 |

| Historical Period | 2017 - 2020 |

| Forecast Period | 2021 – 2030 |

| Market | Million Units |

| Segment Covered | By Category |

| Companies Covered | Volkswagen, Toyota Motor Corporation, Daimler AG, Ford Motor Company and Honda Motor Company |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. ChinaAutomotive Market

6. Volume Share – By Categories

7. By Category – China Automotive Volume

7.1 Electric Vehicle (EV) Volume

7.2 Hybrid Electric Vehicle (HEV) Volume

7.3 Plug-in Hybrid Electric Vehicle (PHEV) Volume

7.4 Mild Hybrid Electric Vehicle (MHEV) Volume

7.5 Natural Gas Vehicle (NGV) Volume

7.6 Fuel Cell Electric Vehicle (FCEV) Volume

7.7 Diesel Volume

7.8 Petrol Volume

8. Company Analysis

8.1 Volkswagen

8.1.1 Overview

8.1.2 Recent Development

8.1.3 Financial Insights

8.2 Toyota Motor Corporation

8.2.1 Overview

8.2.2 Recent Development

8.2.3 Financial Insights

8.3 Daimler AG

8.3.1 Overview

8.3.2 Recent Development

8.3.3 Financial Insights

8.4 Ford Motor Company

8.4.1 Overview

8.4.2 Recent Development

8.4.3 Financial Insights

8.5 Honda Motor Company

8.5.1 Overview

8.5.2 Recent Development

8.5.3 Financial Insights

List Of Figures:

Figure-01: China Automotive Volume (Million Units), 2017 – 2020

Figure-02: Forecast for – China Automotive Volume (Million Units), 2021 – 2030

Figure-03: Category – EV Volume (Thousand Units), 2017 – 2020

Figure-04: Category – Forecast for EV Volume (Thousand Units), 2021 – 2030

Figure-05: Category – HEV Volume (Thousand Units), 2017 – 2020

Figure-06: Category – Forecast for HEV Volume (Thousand Units), 2021 – 2030

Figure-07: Category – PHEV Volume (Thousand Units), 2017 – 2020

Figure-08: Category – Forecast for PHEV Volume (Thousand Units), 2021 – 2030

Figure-09: Category – MHEV Volume (Thousand Units), 2017 – 2020

Figure-10: Category – Forecast for MHEV Volume (Thousand Units), 2021 – 2030

Figure-11: Category – NGV Volume (Thousand Units), 2017 – 2020

Figure-12: Category – Forecast for NGV Volume (Thousand Units), 2021 – 2030

Figure-13: Category – FCEV Volume (Thousand Units), 2017 – 2020

Figure-14: Category – Forecast for FCEV Volume (Thousand Units), 2021 – 2030

Figure-15: Category – Diesel Vehicle Volume (Thousand Units), 2017 – 2020

Figure-16: Category – Forecast for Diesel Vehicle Volume (Thousand Units), 2021 – 2030

Figure-17: Category – Petrol Vehicle Volume (Thousand Units), 2017 – 2020

Figure-18: Category – Forecast for Petrol Vehicle Volume (Thousand Units), 2021 – 2030

Figure-19: Volkswagen – Global Revenue (Billion US$), 2017 – 2020

Figure-20: Volkswagen – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure-21: Toyota Motor Corporation – Global Revenue (Billion US$), 2017 – 2020

Figure-22: Toyota Motor Corporation – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure-23: Daimler AG – Global Revenue (Billion US$), 2017 – 2020

Figure-24: Daimler AG – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure-25: Ford Motor Company – Global Revenue (Billion US$), 2017 – 2020

Figure-26: Ford Motor Company – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure-27: Honda Motor Company – Global Revenue (Billion US$), 2017 – 2020

Figure-28: Honda Motor Company – Forecast for Global Revenue (Billion US$), 2021 – 2030

List Of Tables:

Table-01: China Automotive Volume Share by Category (Percent), 2017 – 2020

Table-02: Forecast for – China Automotive Volume Share by Category (Percent), 2021 – 2030

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com