Global Catheter Market Size, Share & Forecast 2025–2033

Buy NowCatheters Market Size and Forecast (2025-2033)

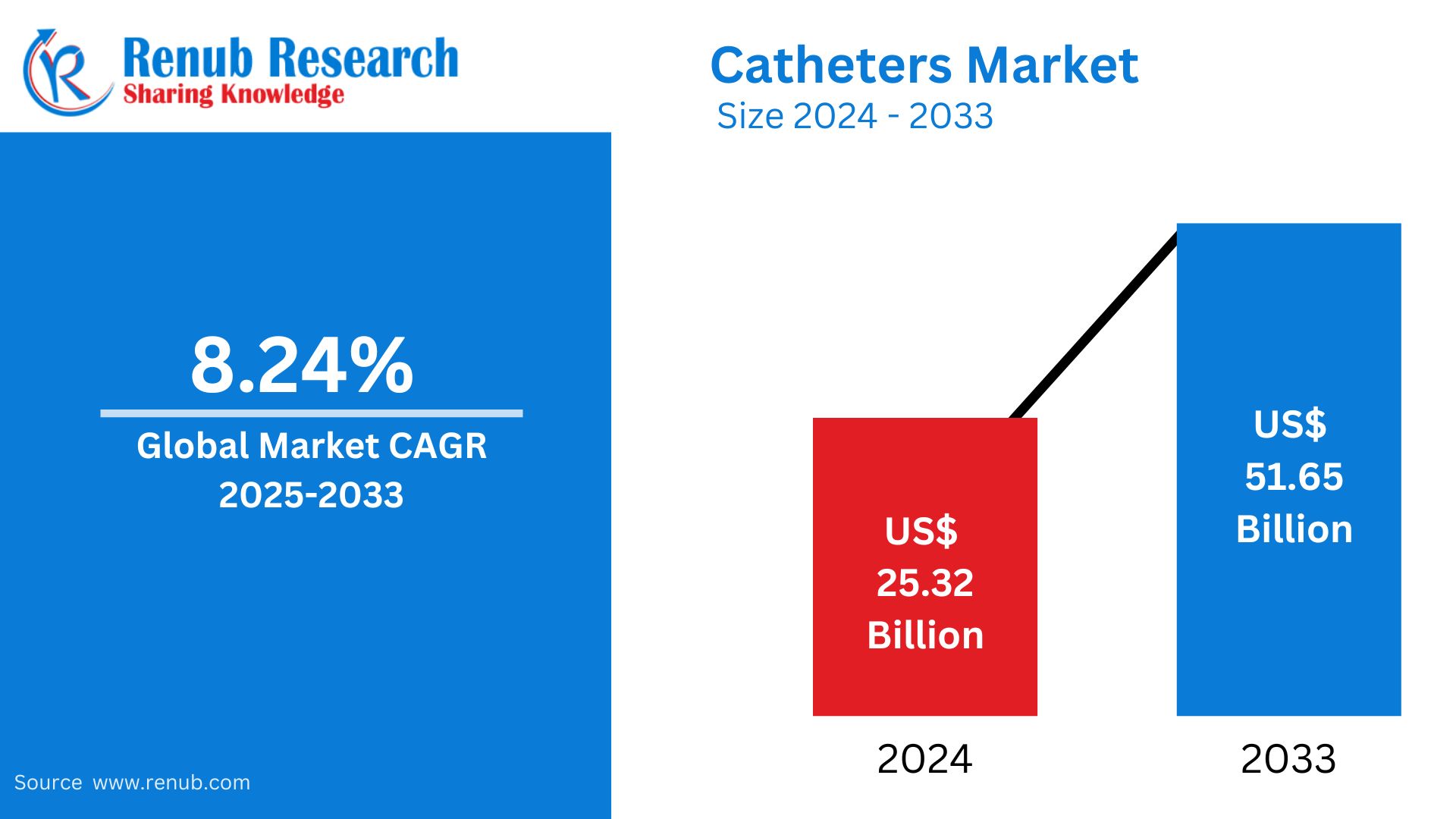

The global catheter market was valued at US$ 25.32 billion in 2024 and is expected to rise to US$51.65 billion by 2033, recording a compound annual growth rate of 8.24% from 2025 to 2033. Increased prevalence of chronic diseases, increased demand in healthcare services, better and advanced technologies in catheter products, and rising trends of old age individuals augment the growth.

Catheters Market Overview

A catheter is a medical device that can be introduced into the body for many functions: to drain fluids, introduce drugs, or monitor some kind of condition. The most commonly used flexible materials in this kind of catheter include silicone, rubber, or plastic, and these may be introduced into various orifices within the body through the urethra, the blood vessels, or the heart itself. There is an extremely broad spectrum of medical procedures and treatments utilizing catheters.

In the medical field, catheters are primarily used for urinary drainage, such as in patients with urinary retention or those undergoing surgeries. They are also essential in cardiovascular procedures, where they help deliver fluids or medications, measure pressure, or perform diagnostic tests. Additionally, catheters are commonly used in dialysis treatments for patients with kidney failure and in the delivery of fluids during surgery or chemotherapy. The versatility of catheters makes them an indispensable tool in modern medicine, enhancing patient care and treatment outcomes.

Growth Drivers of the Catheter Industry

Increasing Incidence of Chronic Diseases

The growing incidence of chronic diseases such as cardiovascular conditions, diabetes, and kidney failure is a key catalyst for the global catheters market. These diseases often necessitate catheter-based interventions, such as dialysis catheterization, blood pressure monitoring, or drug delivery. As the world is aging, and chronic disease is increasingly prevalent, there will be an increased demand for medical devices such as catheters. Additionally, as people live longer with chronic conditions, the demand for ongoing treatments that include catheter use, such as hemodialysis or cardiac procedures, will increase. Each year, 18 million people die from cardiovascular diseases that affect the heart and blood vessels and can lead to heart attacks, stroke, or heart failure. Approximately 9 million people die annually from cancers, 4 million from chronic respiratory diseases such as asthma or COPD, and 2 million from diabetes.

Catheter Technology Advancements

Technological advancements in catheter design and materials have been driving market growth. Modern catheters are now more flexible, durable, and minimally invasive, and complications and patient recovery time decrease. The development of the bioabsorbable catheter, infection risk-reducing catheter coatings, and advanced materials that allow more precise procedures have increased applications for catheters. It has made patients safer and more comfortable and enhanced overall effectiveness in catheter-based treatments, thus driving global demand. Sept 2024, The EMBOGUARD™ Balloon Guide Catheter optimizes clot removal by controlling local blood flow during MT procedures. It enhances first-pass recanalization, shortens procedure time, and minimizes the risk of clot fragments causing distal emboli.

Growing Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures is one of the major growth drivers for the global catheters market. Minimally invasive techniques that involve smaller incisions and faster recovery times rely on catheters for the delivery of drugs, drainage of fluids, or as a diagnostic tool. They are increasingly being used as they reduce the chances of complications and hospital stays, as well as the time taken by patients to recover. As healthcare providers and patients seek safer and more efficient treatment options, the demand for catheters in minimally invasive surgeries and treatments continues to grow. For instance, in September 2023, the American Society of Aesthetic Plastic Surgeons reported that 26.2 million surgical procedures are available in the U.S.

Germany Catheter Market

Germany constitutes a large percentage of the European catheter market due to its established healthcare system and high adoption of advanced medical technologies. The aging population of the country, along with the growing prevalence of chronic diseases like urinary and cardiovascular conditions, creates a large demand for catheters. Improvements in catheter design, such as the use of infection-resistant materials, have improved patient outcomes and increased their usage. Germany's intense research and development in the medical device sector ensures that products will always be improved, making the country a significant player in the European catheter market. Jun 2023 Biotronik announced limited availability of its Oscar, (One Solution: Cross, Adjust, Restore), multifunctional peripheral catheter and began promotional activities at LINC, the Leipzig Interventional Course, June 6-9, in Leipzig, Germany.

China Catheter Market

China's catheter market is expanding fast because of growing health care investment and increased awareness regarding the management of chronic diseases. A huge population with rising incidences of diabetes, cardiovascular diseases, and kidney disorders will increase catheter demand in the country. Improvement in healthcare infrastructure through government initiatives and better access to high-end treatments further accelerate market growth. China's emphasis on manufacturing low-cost catheters domestically with advanced technologies, including antimicrobial coatings, ensures a steady supply to both the local and international markets, making it a significant player in the Asia-Pacific catheter market. Aug 2023, the world's first Novasight dual-mode intravascular imaging catheter has gained an import drug license in China.

Brazil Catheter Market

Brazil is the largest market for catheters in Latin America, driven by an expanding health care system and a growing number of chronic conditions, including urinary disorders and cardiovascular diseases. The trend of minimally invasive procedures is on the rise in Brazil, fueling the use of catheters in diagnostics and treatments. Healthcare investments by the government and the growing awareness of modern medical equipment are also leading to market growth. Though problems such as unequal provision of medical facilities exist, the country concentrates more on developing medical care infrastructure and innovative catheter technology products that advance its stand in regional markets. September 2023- For the first time, Endovastec has successfully implanted the Reewarm™ PTX Drug-Coated Balloon (DCB) Catheter in Brazil. This therefore increases the international presence of catheter markets.

United Arab Emirates Catheter Market

The United Arab Emirates is a major gainer in the Middle East catheter market, where investments in advanced healthcare technology and infrastructure are driving progress. Lifestyle-related diseases like diabetes and cardiovascular disorders further increase the demand for treatments that involve catheters. Finally, the UAE's orientation towards medical tourism also assists in the growth of this market, as the country attracts patients who are on the lookout for high quality, minimally invasive treatments. Innovations in catheter design and a strong focus on patient safety and infection control make the UAE a vital market contributor in the region. February 2024, Zylox-Tonbridge receives market approval for five medical devices in the UAE.

South Africa Catheter Market

South Africa tops the catheter market in Africa, with the increase due to the rising chronic conditions of kidney diseases and cardiovascular-related illnesses. Improving healthcare infrastructure in the country coupled with increasing awareness for more advanced medical devices have resulted in increased adoption of catheters. Investments by government and private sectors in care support market growth, but market gaps remain-such as unequal care access. Technology advances that make the cost-effect catheter more accessible and distribution network improvements help to bridge these gaps and put South Africa at the center of the region's critical market. Available as of November 2022 by Coloplast, this is an intermittent catheter meant to reduce urinary tract infection risk.

Catheter Market Company News

Abbott Laboratories

- Major regulatory approvals were granted in February 2023 for the use of Abbott's Sensor EnabledTM TactiFlex Ablation Catheter and FlexAbility Ablation Catheter in the treatment of aberrant and difficult cardiac diseases, respectively.

- The AmuletTM LAA Occluder IDE study concluded in August 2021 that Abbott's device, the AmuletTM LAA Occluder, was more effective than Boston Scientific's Watchman device in treating patients with high-risk atrial fibrillation (AFib). The trial also shown that the Watchman and Amulet devices are equally safe and efficient.

Becton Dickinson and Company

- BD introduced the BD PosiFlushSafeScrub, a new prefilled flush syringe, in May 2023. In order to minimize CRBSIs and enhance patient care, it is intended to speed up the flushing and cleaning of IV catheters during clinical operations.

- BD released an innovative ultrasound system in November 2023 to help physicians insert vascular access devices more quickly and efficiently.

- Becton, Dickinson, and Company recently assessed the efficacy of midline catheters in blood collection. It was the first research on the subject to undergo peer review.

Boston Scientific Corporation

- The Chinese medical technology business Acotec Scientific Holdings Limited, well-known for its drug-coated balloons, radiofrequency ablation technologies, and thrombus aspiration catheters, is set to be acquired by Boston Scientific in December 2022 for a majority interest.

- The FDA authorized the FARAPULSETM Pulsed Field Ablation (PFA) System from Boston Scientific Corporation in January 2024 as a drug-resistant, recurrent symptomatic alternative to thermal ablation for the treatment of intermittent atrial fibrillation (AF).

- The FDA authorized Boston Scientific's AGENTTM Drug-Coated Balloon in March 2024 to treat coronary in-stent restenosis in individuals suffering from coronary artery disease.

Teleflex Incorporated

- Teleflex's Triumph Catheter, which has accurate wire advancement and good vision, was approved by the FDA in February 2023. In the meanwhile, Seattle's UW Medicine Heart Institute employed the GuideLiner Coast Catheter for the first time.

- With an emphasis on patient selection and vascular access, Teleflex launched a clinical registry in November 2023 to assess the results of employing the MANTATM Vascular Closure Device in TAVR surgeries on-label.

- Teleflex Inc. introduced two new devices in May 2023 that help to improve PICC insertion processes and lower complications: the NaviCurveTM Stylet and the Arrow® VPS Rhythm® DLX.

- Teleflex Inc. introduced two new devices in May 2023 to improve and streamline PICC implantation. For Vascular Access Specialists, the Arrow® VPS Rhythm® DLX Device and NaviCurveTM Stylet combine to increase productivity and predictability.

- Teleflex Inc. achieved significant milestones with two novel catheters in February 2023: the first clinical application for the GuideLiner® CoastTM Catheter was started, and the TriumphTM Catheter received FDA 510(k) approval.

Medtronic Plc.

- In order to treat juvenile Atrioventricular Nodal Reentrant Tachycardia (AVNRT), the FDA authorized Medtronic's FreezorXtra Cardiac Cryoablation and Freezor and Focal Catheters in February 2022.

- The FDA approved Medtronic plc's PulseSelect Pulsed Field Ablation System in December 2023, making it the first PFA technology to treat both paroxysmal and chronic atrial fibrillation.

- The CE Mark was granted to Medtronic in March 2023 for their AfferaTM Mapping and Ablation System with Sphere-9TM Catheter and AfferaTM Prism-1 Mapping Software. With PFA, RF, and HD mapping, the technology enhances electrophysiology and provides real-time feedback. It aids in the treatment of AFib, which affects 60 million individuals globally and raises the risk of heart failure, stroke, and death.

Johnson & Johnson

- Johnson & Johnson MedTech purchased Laminar, Inc. in November 2023 for an upfront payment of $400 million with possible milestone payments. By doing this, Biosense Webster, Inc. will better position itself to treat cardiac arrhythmias and incorporate Laminar into its operations.

- In February 2024, the European CE mark clearance for the VARIPULSETM Platform was granted to Biosense Webster, a Johnson & Johnson MedTech company. For the treatment of recurrent paroxysmal atrial fibrillation (AF), this platform provides pulsed field ablation (PFA). The only PFA system with CARTOTM integration offers a simple workflow along with instantaneous feedback and visualization.

- At the 29th Annual International AF Symposium in February 2024, Biosense Webster, Inc. presented research results that demonstrated how long-term patient outcomes, safety, and efficacy can all be maintained during catheter ablation for paroxysmal AFib by minimizing radiation exposure.

Edwards Lifesciences Corporation

- The FDA authorized the EVOQUE transcatheter therapy from Edwards Lifesciences Corporation in February 2024 as the initial treatment for tricuspid regurgitation.

- The COMMENCE study statistics were presented by Edwards Lifesciences at the American Association for Thoracic Surgery convention in May 2023. utilizing an average follow-up of 7.7 years, the study demonstrated minimal rates of valve degradation in bioprosthetic aortic valves utilizing RESILIA tissue.

Stryker Corporation

- By August 2023, Medtronic's StealthStation surgical guidance system will be outperformed by Stryker's completely autonomous ExcelsiusGPS surgical guidance system, which employs the proprietary FP8000 camera and navigates four times quicker. Using real-time alignment adjustments, it enables surgeons to plan complex 2D and 3D operations, such as screw and catheter implantation, by utilizing imaging data from Stryker's AiroTruCT. The gadget is currently in use in five university hospitals after passing testing in a single operating room.

- Stryker opened the Keystone Suite, a Neurovascular (NV) lab, in Gurgaon, India, in December 2022. With state-of-the-art equipment and designated areas for physician interaction, the facility addresses crucial healthcare requirements in the area while promoting cooperation and innovation in stroke care.

Market Segmentation

Type – Market breakup from 3 viewpoints:

- TAVR

- TMVR

- TPVR

Material – Market breakup from 2 viewpoints:

- Mechanical tissue

- Biological tissue

End-User – Market breakup from 3 viewpoints:

- Hospitals

- Ambulatory surgical centers

- Others

Product – Market breakup from 4 viewpoints:

- Transfemoral approach

- Transapical approach

- Transaortic approach

- Others

Application – Market breakup from 3 viewpoints:

- Aortic Stenosis

- Aortic Regurgitation

- Others

Regionl

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherland

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered from 3 viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

- Abbott Laboratories

- Becton Dickinson and Company

- Boston Scientific Corporation

- Teleflex Incorporated

- Medtronic Plc.

- Johnson & Johnson

- Edwards Lifesciences Corporation

- Stryker Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

1. Abbott Laboratories |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Catheters Market

6. Market Share

6.1 By Product Type

6.1.1 Cardiovascular Catheters

6.1.2 Neurovascular Catheters

6.1.3 Urinary Catheters

6.1.4 Intravascular Catheters

6.2 By End Users

6.3 By Countries

7. Product Type

7.1 Cardiovascular Catheters

7.1.1 Cardiovascular Therapeutic Catheters

7.1.2 Cardiovascular Diagnostic Catheters

7.2 Neurovascular Catheters

7.2.1 Microcatheters

7.2.2 Balloon Catheters

7.2.3 Access Catheters

7.2.4 Embolization Catheters

7.2.5 Others

7.3 Urinary Catheters

7.3.1 Intermittent Catheters

7.3.2 Foley/Indwelling Catheters

7.3.3 External Catheters

7.4 Intravascular Catheters

7.4.1 Short PIVC

7.4.2 Integrated/Closed PIVC

7.5 Specialty Catheters

8. End Users

8.1 Hospitals

8.2 Ambulatory Surgical Centers

8.3 Diagnostic Imaging Centers

8.4 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherland

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1.1 Strength

11.1.2 Weakness

11.1.3 Opportunity

11.1.4 Threat

12. Key Players Analysis

12.1 Abbott Laboratories

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue Analysis

12.2 Becton Dickinson And Company

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue Analysis

12.3 Boston Scientific Corporation

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue Analysis

12.4 Teleflex Incorporated

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue Analysis

12.5 Medtronic Plc.

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue Analysis

12.6 Johnson & Johnson

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue Analysis

12.7 Edwards Lifesciences Corporation

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue Analysis

12.8 Stryker Corporation

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com