Asia Air Conditioners Market Size, Trends, and Growth Analysis 2025-2033

Buy NowAsia Air Conditioner (AC) Market Size and Forecast 2025-2033

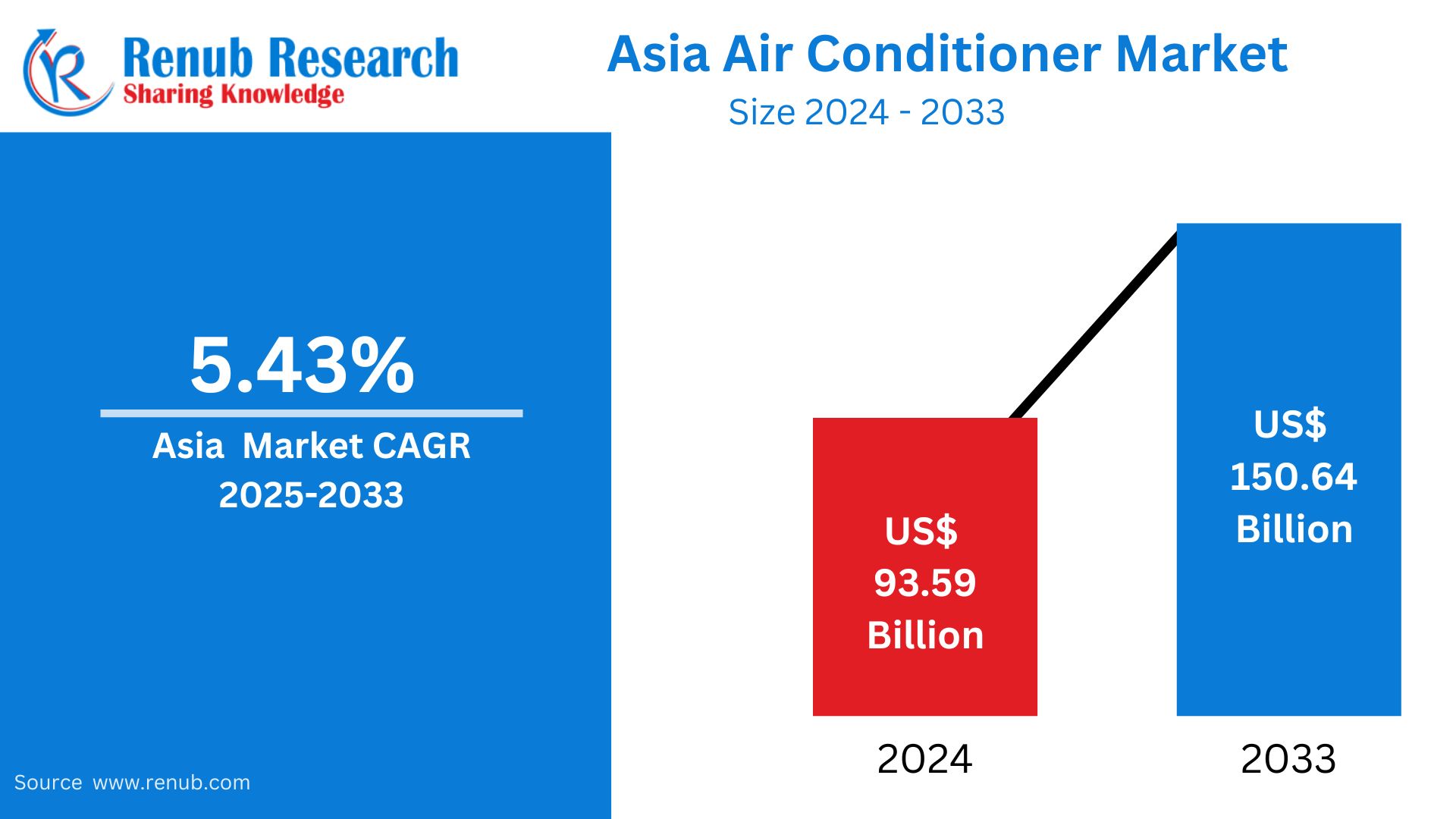

The Asia Air Conditioner (AC) Market was at USD 93.59 billion in 2024 and is expected to reach USD 150.64 billion by 2033, growing at a CAGR of 5.43% during 2025-2033. It is fuelled by increased temperatures, increasing urbanization, and more demand for energy-saving cooling systems in residential, commercial, and industrial applications in nations such as China, India, Japan, and Southeast Asia.

The report Air Conditioner (AC) Market Forecast covers by Commercial (PAC, VRF), Room (Window-Type, Split-Type), Asia (China, Japan, India, Indonesia, Vietnam, Thailand, Taiwan, Malaysia, Philippines, Hong Kong, Bangladesh, Myanmar, Singapore, Cambodia, Sri Lanka, Rest of Asia), Company Analysis 2025-2033.

Asia Air Conditioner Market Overview

An air conditioner (AC) is a device that controls indoor temperature, humidity, and air quality by extracting heat and circulating cool air in enclosed areas. It works on a refrigeration cycle and may incorporate air filtration to provide comfort and health. Air conditioners are employed in different environments, such as residential buildings, commercial buildings like offices, malls, and restaurants, and industrial buildings where climate control is essential for equipment and processes.

In Asia, air conditioners have picked up widespread popularity because of the region's largely hot and humid climate. India, China, Japan, and Southeast Asian countries have long summers with peak temperatures, and hence air conditioning became a requirement rather than an extravagance. Growth in disposable incomes, urbanization, and improving lifestyles have also stimulated demand. Moreover, growth in the real estate and hospitality industries has helped to drive higher installations. Governments are also encouraging energy-efficient models, in line with sustainability targets, which continues to drive adoption throughout the region.

Growth Drivers in the Air Conditioners Market in Asia

Urbanization and Infrastructure Growth

Asia is witnessing enormous urban growth, especially in nations such as China, India, and Vietnam. The development of new housing complexes, shopping centers, offices, and hotels is heavily propelling demand for air conditioning equipment. City residents are more focused on comfort and indoor air quality, and AC systems become a must-have for them. Infrastructure projects funded by the government and initiatives related to smart cities are also boosting the pace of installations. Furthermore, rural-to-urban migration is boosting residential occupancy in cities and forming new consumer groups. These trends are not only boosting the number of AC units sold but also promoting the use of energy-efficient and technologically superior models. Jan 2023, cities in Asia are growing rapidly, with nearly 55 percent of the population projected to live in urban areas by 2030. This trend is challenging food security and nutrition, as a report by four United Nations agencies has pointed out.

Growing Middle-Class Sizes and Disposable Incomes

An exploding middle class throughout Asia is boosting consumer expenditure on products that bring convenience to lifestyles, such as air conditioners. With rising incomes within households in emerging markets like India, Indonesia, and the Philippines, customers are more inclined to spend on home comfort appliances. The increasing desire for urban lifestyles, along with the availability of convenient financing facilities like EMIs and buy-now-pay-later options, makes air conditioners more affordable. This income-driven demand is evident in rising sales of mid-range and premium AC models. It also encourages a shift toward smart and inverter ACs that offer convenience and energy efficiency, further propelling market growth. According to forecasts by Oxford Economics, Asian cities will represent nearly half of the global economic activity within the next two decades, with India projected to lead GDP growth during this period.

Climate Change and Exacerbating Heatwaves

Asia is especially susceptible to the effects of climate change, including more frequent and severe heatwaves. India, Pakistan, and Southeast Asia are countries that experience recurrent extreme summer temperatures, with growing dependence on air conditioning for survival and well-being. Increased global temperatures and shifting weather patterns are extending the duration of hot seasons, thus leading to increased year-round demand for cooling solutions. This climate-related need is making air conditioning shift from a luxury to a necessity for many areas. Governments and NGOs are also promoting the application of energy-efficient cooling to handle the public health burden of heat stress, fueling additional market growth. Extreme heat hit South and Southeast Asia in April 2024, reaching India, the Philippines, and Bangladesh. These heatwaves strike highly populated regions, with serious implications for health, the economy, and education.

Issues in the Asia AC Market

Excessive Energy Use and Power Infrastructure Burden

Air conditioners are some of the highest energy-using household appliances that greatly contribute to electricity consumption throughout Asia. Extensive usage of inefficient models in developing countries further aggravates the problem, putting added pressure on power grids, particularly during peak summer periods. Nations with lagging or poor energy infrastructure, like Bangladesh and Myanmar, are plagued by power outages and voltage drops, which constrain the adoption of AC. Second, increasing electricity expenses discourage cost-conscious consumers from extensive usage. Even though energy-saving inverter ACs are an alternative, the increased initial investment is a disincentive. Therefore, optimizing energy use without sacrificing cooling requirements is an urgent challenge facing the region.

Affordability and Accessibility in Rural and Low-Income Areas

Despite increasing demand, affordability continues to be a major hindrance across most of Asia. Low-income and rural consumers simply cannot afford the initial investment of air conditioners, particularly in countries with low per capita income. Limited knowledge about energy-saving technology and no finance options also limit market penetration. Even where interest is present, infrastructure for installation and maintenance in rural or off-grid areas may be inadequate. Producers are hindered by logistical and distribution barriers from accessing these segments. Without subsidies, low-cost product innovations, or rural electrification enhancements, much of the market is inaccessible.

Asia Commercial PAC Air Conditioner Market

Packaged Air Conditioners or PACs are extensively adopted in Asia's commercial buildings like retail outlets, clinics, small offices, and schools. They are space-saving, low-cost, and simpler to install than big central AC systems. They are influenced by the booming Asian retail and small-business sectors. Governments' interest in infrastructure development and smart city projects also adds boost to the market growth. Energy-efficient retrofitting and innovative design technology are enabling PACs to compete favorably with new technologies such as VRF systems, especially for mid-size commercial applications.

Asia Commercial VRF Air Conditioner Market

Variable Refrigerant Flow (VRF) systems are increasingly finding significant adoption in the commercial air conditioning market in Asia because of their energy efficiency, zoning flexibility, and expandability. VRF systems are particularly favored for use in large commercial buildings, hotels, and IT parks. These nations, including Japan and South Korea, are pioneering users of VRF technology due to superior infrastructure and green building norms. Increasing demand for energy-efficient HVAC solutions and lower long-term operating expenses is propelling adoption in Southeast Asia and India, in spite of higher initial investment costs.

Asia Room Split Air Conditioner Market

Split air conditioners rule the room AC market in Asia owing to their low cost, efficiency, and minimal noise levels. These products are extensively used in urban homes, particularly in China, India, and Vietnam. The trend of nuclear families, increasing temperatures, and residential building construction are major drivers. Furthermore, companies are launching inverter technology and smart connectivity features to appeal to technology-conscious buyers. Government policies promoting energy-efficient appliances and growing consumer awareness about sustainability are further driving the split AC market in Asia.

Asia Room Window Air Conditioner Market

Window air conditioners, though competing with split ACs, still maintain a significant market share in price-conscious and small-apartment residential sectors in Asia. They are particularly favored in ageing buildings, rent houses, and compact rooms by virtue of straightforward installation and inexpensive pricing. Even India and the Philippines continue to demonstrate consistent demand. Yet increasingly growing concerns relating to energy utilization and noise level are pushing people towards more effective alternatives. Producers are reacting with energy-tagged models and more silent designs to maximize the product life in competitive city environments.

Japan Air Conditioner Market

Japan's air conditioner industry is technologically mature and highly developed, fueled by the need for space-saving, energy-efficient, and environmentally sustainable solutions. Supported by robust local players such as Daikin and Mitsubishi Electric, the nation takes the lead in innovation and inverter and VRF systems adoption. The demographic aging and requirement of climate control in healthcare and residential markets drive steady demand. Furthermore, Japan's emphasis on low-carbon technologies and integration of smart homes keeps driving consumer choice. Energy labeling, automation, and environmentally friendly refrigerants are some of the trends dominating Japan's AC market dynamics. March 2025 - Mitsubishi Heavy Industries Thermal Systems, one of the divisions of MHI Group, is to introduce 31 new model residential air-conditioners for sale in Japan during 2025.

China Air Conditioner Market

China, driven by record urbanization, high manufacturing competence, and higher incomes, holds the position as Asia's leading air conditioner market. The domestic demand for Chinese residential and commercial ACs remains strong. Split systems are the most prevalent, but VRF and central air solutions are increasingly popular in commercial property. Government initiatives encouraging energy-efficient appliances and green building codes are influencing product design. Moreover, China's robust export base makes it a world center for AC manufacturing. Smart ACs with IoT capabilities are gaining traction among tech-savvy consumers. September 2023, Toshiba HVAC, a business unit of Carrier Global Corporation, has introduced its Digital Inverter (DI) series in mainland China. This simple-to-install, light commercial ductless air-conditioning system includes energy-saving, intelligent solutions.

India Air Conditioner Market

India's air conditioner market is developing at a rapid pace because of rising temperatures, growing middle-class incomes, and growing urban infrastructure. Demand is highest in metro and Tier-1 cities but is also rising in rural areas. The residential segment, and especially split ACs, rule the marketplace. Initiatives from the government such as the Perform Achieve Trade (PAT) program and energy labeling promote energy-saving models. Seasonal offers, EMIs, and online websites are additionally generating demand. Though high import dependence for parts continues, indigenous production under "Make in India" is picking up pace, ensuring long-term market growth. Mar 2025, Sharp Corporation, through its subsidiary Sharp Business Systems (India), has re-entered India's air-conditioner market.

Singapore Air Conditioner Market

Singapore's air conditioner market is marked by heavy penetration, stimulated by year-round hot and humid weather and high-density urban lifestyles. The nation's emphasis on smart cities and sustainability has resulted in extensive use of inverter ACs and energy-saving VRF systems in residential and commercial properties. Stringent energy regulations and green building requirements also have a critical role to play. The commercial segment, particularly offices, retail, and hospitality, is a key growth driver. With space limitations and sophisticated infrastructure, the market prefers compact, low-noise, and smart-integrated air conditioning solutions. July 2024, Samsung Electronics Singapore debuted its latest WindFree Air Conditioner series in addition to broadening its smart living line-up of home appliances with offerings such as Comfort Cooling, Energy-Saving, and Connected Living.

Vietnam Air Conditioner Market

The air conditioner market in Vietnam is growing aggressively due to economic growth, the surge in urbanization, and rising residential demand. The middle class is increasing fast, and consumer knowledge of branded and energy-saving ACs is enhancing. Split ACs lead the home segment, whereas the commercial market is witnessing greater use of PAC and VRF systems. Key urban areas such as Ho Chi Minh City and Hanoi are growth hotspots. Affordability and electricity infrastructure constraints in rural areas, however, remain issues. Government policies for energy efficiency underpin long-term demand. Feb 2025, AUX Air Conditioning officially launched in Vietnam, involving AUX Group leaders, Japan R&D engineers, and important members of AUX Vietnam Sales Company.

Asia Air Conditioner Market Segmentation

Commercial

- PAC

- VRF

Room

- Window-Type

- Split-Type

Asia Air Conditioner (AC) Market & Volume

- China

- Japan

- India

- Indonesia

- Vietnam

- Thailand

- Taiwan

- Malaysia

- Philippines

- Hong Kong

- Bangladesh

- Myanmar

- Singapore

- Cambodia

- Sri Lanka

- Rest of Asia

Companies have been covered from 5 viewpoints

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Company Analysis

- Daikin Industries

- Carrier

- Electrolux

- Emerson Electric Company

- Hitachi-Johnson Controls Air Conditioning Inc.

- Trane Technologies plc

- Mitsubishi Heavy Industries Ltd

- Ingersoll-Rand plc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Segments and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Asia Air Conditioner (AC) Market & Volume

5.1 Market

5.1.1 Commercial Air Conditioners Market

5.1.2 Room Air Conditioners Market

5.2 Volume

5.2.1 Commercial Air Conditioners Volume

5.2.2 Room Air Conditioners Volume

6. Market & Volume Share – Asia Air Conditioner (AC)

6.1 Market Share – Segments

6.2 Market Share – By Country

6.3 Volume Share – By Country

7. Country – Asia Air Conditioner (AC) Market & Volume

7.1 Japan

7.1.1 Commercial Air Conditioners Market

7.1.1.1 PAC

7.1.1.2 VRF

7.1.2 Commercial Air Conditioners Volume

7.1.2.1 PAC

7.1.2.2 VRF

7.1.3 Room Air Conditioners Market

7.1.3.1 Window-Type

7.1.3.2 Split-Type

7.1.4 Room Air Conditioners Volume

7.1.4.1 Window-Type

7.1.4.2 Split-Type

7.2 China

7.2.1 Commercial Air Conditioners Market

7.2.1.1 PAC

7.2.1.2 VRF

7.2.2 Commercial Air Conditioners Volume

7.2.2.1 PAC

7.2.2.2 VRF

7.2.3 Room Air Conditioners Market

7.2.3.1 Window-Type

7.2.3.2 Split-Type

7.2.4 Room Air Conditioners Volume

7.2.4.1 Window-Type

7.2.4.2 Split-Type

7.3 India

7.3.1 Commercial Air Conditioners Market

7.3.1.1 PAC

7.3.1.2 VRF

7.3.2 Commercial Air Conditioners Volume

7.3.2.1 PAC

7.3.2.2 VRF

7.3.3 Room Air Conditioners Market

7.3.3.1 Window-Type

7.3.3.2 Split-Type

7.3.4 Room Air Conditioners Volume

7.3.4.1 Window-Type

7.3.4.2 Split-Type

7.4 Indonesia

7.4.1 Commercial Air Conditioners Market

7.4.1.1 PAC

7.4.1.2 VRF

7.4.2 Commercial Air Conditioners Volume

7.4.2.1 PAC

7.4.2.2 VRF

7.4.3 Room Air Conditioners Market

7.4.3.1 Window-Type

7.4.3.2 Split-Type

7.4.4 Room Air Conditioners Volume

7.4.4.1 Window-Type

7.4.4.2 Split-Type

7.5 Vietnam

7.5.1 Commercial Air Conditioners Market

7.5.1.1 PAC

7.5.1.2 VRF

7.5.2 Commercial Air Conditioners Volume

7.5.2.1 PAC

7.5.2.2 VRF

7.5.3 Room Air Conditioners Market

7.5.3.1 Window-Type

7.5.3.2 Split-Type

7.5.4 Room Air Conditioners Volume

7.5.4.1 Window-Type

7.5.4.2 Split-Type

7.6 Thailand

7.6.1 Commercial Air Conditioners Market

7.6.1.1 PAC

7.6.1.2 VRF

7.6.2 Commercial Air Conditioners Volume

7.6.2.1 PAC

7.6.2.2 VRF

7.6.3 Room Air Conditioners Market

7.6.3.1 Window-Type

7.6.3.2 Split-Type

7.6.4 Room Air Conditioners Volume

7.6.4.1 Window-Type

7.6.4.2 Split-Type

7.7 Taiwan

7.7.1 Commercial Air Conditioners Market

7.7.1.1 PAC

7.7.1.2 VRF

7.7.2 Commercial Air Conditioners Volume

7.7.2.1 PAC

7.7.2.2 VRF

7.7.3 Room Air Conditioners Market

7.7.3.1 Window-Type

7.7.3.2 Split-Type

7.7.4 Room Air Conditioners Volume

7.7.4.1 Window-Type

7.7.4.2 Split-Type

7.8 Malaysia

7.8.1 Commercial Air Conditioners Market

7.8.1.1 PAC

7.8.1.2 VRF

7.8.2 Commercial Air Conditioners Volume

7.8.2.1 PAC

7.8.2.2 VRF

7.8.3 Room Air Conditioners Market

7.8.3.1 Window-Type

7.8.3.2 Split-Type

7.8.4 Room Air Conditioners Volume

7.8.4.1 Window-Type

7.8.4.2 Split-Type

7.9 Philippines

7.9.1 Commercial Air Conditioners Market

7.9.1.1 PAC

7.9.1.2 VRF

7.9.2 Commercial Air Conditioners Volume

7.9.2.1 PAC

7.9.2.2 VRF

7.9.3 Room Air Conditioners Market

7.9.3.1 Window-Type

7.9.3.2 Split-Type

7.9.4 Room Air Conditioners Volume

7.9.4.1 Window-Type

7.9.4.2 Split-Type

7.10 Hong Kong

7.10.1 Commercial Air Conditioners Market

7.10.1.1 PAC

7.10.1.2 VRF

7.10.2 Commercial Air Conditioners Volume

7.10.2.1 PAC

7.10.2.2 VRF

7.10.3 Room Air Conditioners Market

7.10.3.1 Window-Type

7.10.3.2 Split-Type

7.10.4 Room Air Conditioners Volume

7.10.4.1 Window-Type

7.10.4.2 Split-Type

7.11 Bangladesh

7.11.1 Commercial Air Conditioners Market

7.11.1.1 PAC

7.11.1.2 VRF

7.11.2 Commercial Air Conditioners Volume

7.11.2.1 PAC

7.11.2.2 VRF

7.11.3 Room Air Conditioners Market

7.11.3.1 Window-Type

7.11.3.2 Split-Type

7.11.4 Room Air Conditioners Volume

7.11.4.1 Window-Type

7.11.4.2 Split-Type

7.12 Myanmar

7.12.1 Commercial Air Conditioners Market

7.12.1.1 PAC

7.12.1.2 VRF

7.12.2 Commercial Air Conditioners Volume

7.12.2.1 PAC

7.12.2.2 VRF

7.12.3 Room Air Conditioners Market

7.12.3.1 Window-Type

7.12.3.2 Split-Type

7.12.4 Room Air Conditioners Volume

7.12.4.1 Window-Type

7.12.4.2 Split-Type

7.13 Singapore

7.13.1 Commercial Air Conditioners Market

7.13.1.1 PAC

7.13.1.2 VRF

7.13.2 Commercial Air Conditioners Volume

7.13.2.1 PAC

7.13.2.2 VRF

7.13.3 Room Air Conditioners Market

7.13.3.1 Window-Type

7.13.3.2 Split-Type

7.13.4 Room Air Conditioners Volume

7.13.4.1 Window-Type

7.13.4.2 Split-Type

7.14 Cambodia

7.14.1 Commercial Air Conditioners Market

7.14.1.1 PAC

7.14.1.2 VRF

7.14.2 Commercial Air Conditioners Volume

7.14.2.1 PAC

7.14.2.2 VRF

7.14.3 Room Air Conditioners Market

7.14.3.1 Window-Type

7.14.3.2 Split-Type

7.14.4 Room Air Conditioners Volume

7.14.4.1 Window-Type

7.14.4.2 Split-Type

7.15 Sri Lanka

7.15.1 Commercial Air Conditioners Market

7.15.1.1 PAC

7.15.1.2 VRF

7.15.2 Commercial Air Conditioners Volume

7.15.2.1 PAC

7.15.2.2 VRF

7.15.3 Room Air Conditioners Market

7.15.3.1 Window-Type

7.15.3.2 Split-Type

7.15.4 Room Air Conditioners Volume

7.15.4.1 Window-Type

7.15.4.2 Split-Type

7.16 Rest of Asia

7.16.1 Market

7.16.2 Volume

8. Types – Asia Air Conditioner (AC) Market

8.1 Split Type (Single)

8.2 Split Type (Multi)

8.3 PAC

8.4 VRF

8.5 Others

9. Porter’s Five Forces

9.1 Bargaining Power of Buyer

9.2 Bargaining Power of Supplier

9.3 Threat of New Entrants

9.4 Rivalry among Existing Competitors

9.5 Threat of Substitute Products

10. SWOT Analysis

10.1 Strengths

10.2 Weaknesses

10.3 Opportunities

10.4 Threats

11. Key Plays Analysis

11.1 Daikin Industries

11.1.1 Overviews

11.1.2 Key Person

11.1.3 Recent Developments

11.1.4 Product Portfolio

11.1.5 Revenue

11.2 Carrier

11.2.1 Overviews

11.2.2 Key Person

11.2.3 Recent Developments

11.2.4 Product Portfolio

11.2.5 Revenue

11.3 Electrolux

11.3.1 Overviews

11.3.2 Key Person

11.3.3 Recent Developments

11.3.4 Product Portfolio

11.3.5 Revenue

11.4 Emerson Electric Company

11.4.1 Overviews

11.4.2 Key Person

11.4.3 Recent Developments

11.4.4 Product Portfolio

11.4.5 Revenue

11.5 Hitachi-Johnson Controls Air Conditioning Inc.

11.5.1 Overviews

11.5.2 Key Person

11.5.3 Recent Developments

11.5.4 Product Portfolio

11.5.5 Revenue

11.6 Trane Technologies plc

11.6.1 Overviews

11.6.2 Key Person

11.6.3 Recent Developments

11.6.4 Product Portfolio

11.6.5 Revenue

11.7 Mitsubishi Heavy Industries Ltd

11.7.1 Overviews

11.7.2 Key Person

11.7.3 Recent Developments

11.7.4 Product Portfolio

11.7.5 Revenue

11.8 Ingersoll-Rand plc.

11.8.1 Overviews

11.8.2 Key Person

11.8.3 Recent Developments

11.8.4 Product Portfolio

11.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com