Washing Machine Market Size, Share, Trends, Forecast 2025–2033

Buy NowWashing Machine Market Size and Forecast 2025-2033

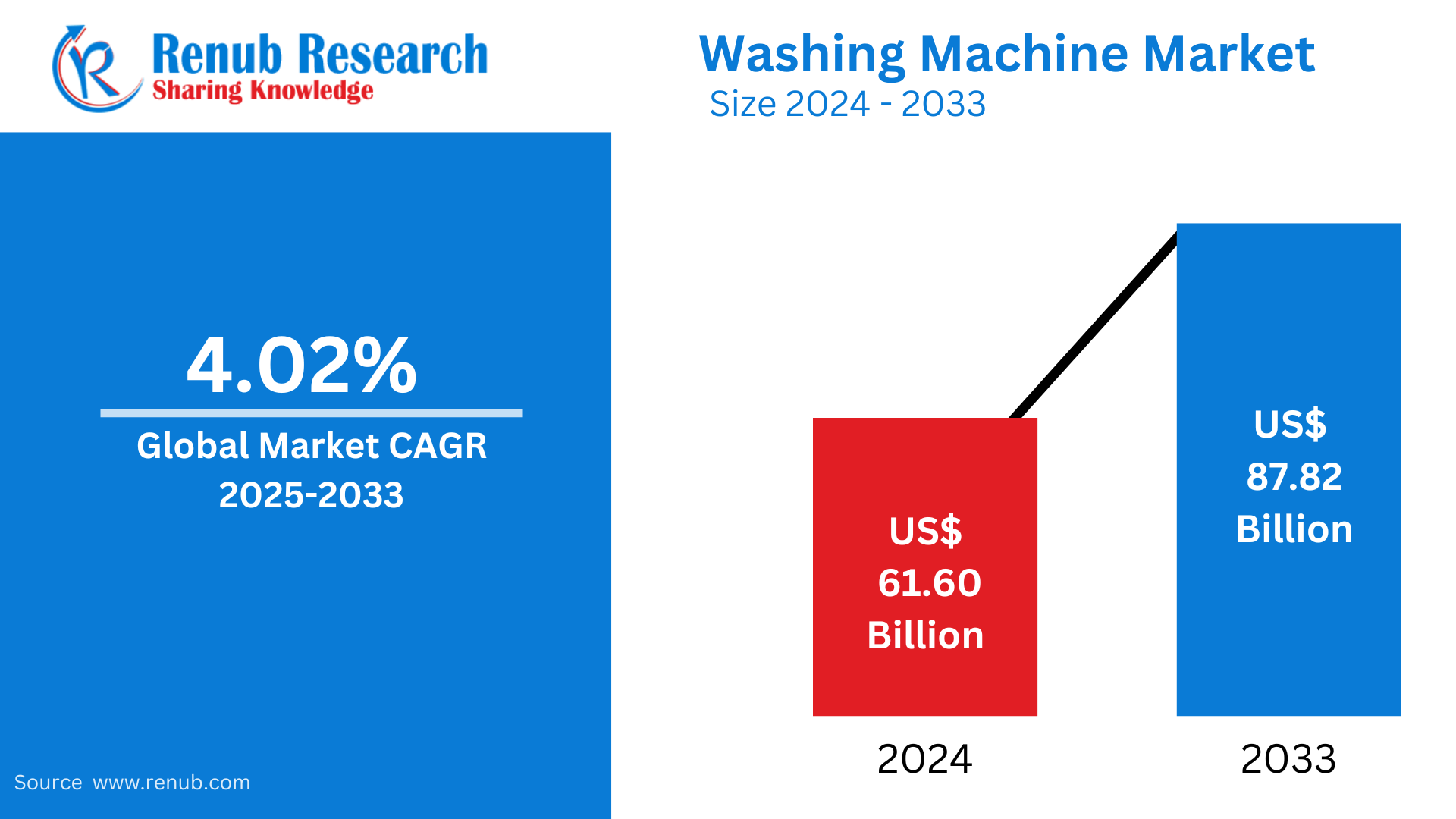

The global washing machine market was valued at USD 61.60 billion in 2024 and is projected to grow to USD 87.82 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 4.02% from 2025 to 2033. Factors such as rising disposable income, increasing urbanization, and advancements in washing machine technology are driving market growth worldwide.

The report Washing Machine Market Forecast Report by Product (Fully Automatic, Semi-Automatic), Technology (Smart Connected, Conventional), End-use (Commercial, Residential), Application (Healthcare, Hospitality, Others), Sales Channel (E-Commerce, Retail Chains, Direct Sales), Country and Company Analysis 2025-2033.

Washing Machine Market Overview

A washing machine is an essential household appliance designed to automate cleaning clothes, linens, and other textiles. It eliminates manual washing by removing dirt and stains using water, detergent, and mechanical agitation. Washing machines come in various types, including top-load, front-load, and semi-automatic models, catering to different user needs.

The primary use of a washing machine is to save time and effort while ensuring efficient and hygienic cleaning of garments. Advanced models feature multiple wash cycles, temperature control, and energy-saving modes to enhance convenience and performance. Additionally, modern washing machines include smart technology, allowing remote control and customization of washing settings. These appliances are widely used in residential homes, laundromats, and commercial establishments such as hotels and hospitals. As urbanization and busy lifestyles increase, washing machines are crucial, offering ease and efficiency in maintaining clean clothing and household fabrics.

Washing Machine is gaining popularity

Emerging Economies' Growing Demand

Growing middle classes in the emerging nations of India, Indonesia, Brazil, and Nigeria are fueling demand for home appliances, especially washing machines. Urbanization, enhanced access to power, and increased disposable incomes make washing machines an easy and affordable option for most families. Moreover, government support for rural electrification and home modernization is further encouraging the use of these appliances. Manufacturers offering affordable, robust, and water-saving models tailored to suit regional requirements can capitalize on this increasing demand in underdeveloped or recently urbanized regions.

Smart and Connected Appliance Growth

Smart washing machines equipped with IoT, Wi-Fi, and AI functionalities are gaining popularity. Customers are seeking appliances with remote control using phone apps, self-dosing detergent dispensing, customized wash programs, and power monitoring. Such features increase convenience and energy efficiency, particularly among urban and tech-literate consumers. With smart homes becoming increasingly popular, connected washing machines should see an uptick in demand. Companies that invest in research and development to offer user-friendly and smart washing solutions will be likely to be the leaders in this emerging market segment.

Focus on Sustainability and Energy Efficiency

Energy-efficient and eco-friendly washing machines are growing more significant as regulators and consumers become more concerned with sustainability. High Energy Star-rated appliances, low water usage, and higher spin speeds are highly sought after. Regulatory initiatives that encourage green appliances, increased consumer environmental awareness, and a strong demand for reducing greenhouse gas emissions offer tremendous opportunity for growth. Manufacturers who emphasize sustainable innovation and environmentally friendly manufacturing processes can secure eco-aware customers and keep pace with changing compliance requirements in international markets.

Expansion of Online Shopping and E-Commerce

The growth in e-commerce channels has transformed washing machine sales, particularly in remote and under-serviced markets. Consumers find it convenient to research, compare, and buy appliances online, complemented by flexible payment options, comprehensive product details, and home delivery services. This transition offers the prospect of brands establishing robust digital channels, carrying out targeted online promotions, and tapping into a wider customer base. Improving after-sales support and warranty services can further establish trust and drive online sales.

Premium Segment and Built-in Appliance Demand

Increased incomes and altered lifestyles are stimulating demand for high-end washing machines with premium features like steam cleaning, inverter motors, touch display, and personalized settings. Moreover, the demand for built-in or integrated appliances is increasing in urban housing with smaller sizes and contemporary interior designing. The trend provides a platform for companies to innovate and launch sleek, space-efficient, and high-feature machines. By providing design-oriented as well as high-performance models, companies can capture the premium and design-oriented consumer base.

Porter's Five Forces Analysis of the Washing Machine Market

Competitive Rivalry

The washing machine industry is extremely competitive and saturated, with many global and regional players such as Whirlpool, LG, Samsung, Bosch, and Haier. The players compete fiercely on price, innovation, energy efficiency, and brand image. Product differentiation is moderate, as most machines are similar in their core functions, so brand identity and after-sales service become important differentiators. Regular new product launches, technological innovation (e.g., AI-driven controls and eco-wash technology), and strong marketing campaigns fuel the competition. Additionally, e-commerce has reduced entry barriers for new brands, particularly in price-sensitive markets, making it more competitive. High fixed costs and low switching costs for consumers also compel companies to keep prices competitive, which eats into margins. In order to retain market share, incumbents are required to spend significantly on R&D, branding, and distribution, making the stakes of competition higher. Generally, the level of competitive rivalry in the washing machine industry is high and continues to escalate as the industry matures and commoditizes.

Threat of New Entrants

Although the washing machine industry offers attractive opportunities, the threat of new entrants is moderate. The capital outlay needed to start manufacturing, distribution, and brand-building is high. Large-scale production facilities, supply chain management, and conformance to stringent energy and safety regulations are additional barriers. But entry costs have been reduced by the expansion of contract manufacturing and OEM alliances. Startups and unrecognized brands first try to penetrate through niche segments, e.g., small or green models, or through e-commerce to avoid retail expenses. However, without a dominant brand presence, after-sales support system, or the means to compete on innovation and reliability, it's challenging for entrants to scale significantly. Additionally, entrenched companies have economies of scale and consumer trust deep-rooted, further defending their market share. Although not out of the question, access to this market requires strategic differentiation and the investment of considerable resources, tempering the overall danger at moderate levels instead of high.

Bargaining Power of Suppliers

Supplier power within the washing machine industry is generally moderate. Companies draw upon a worldwide supply chain for such components as motors, drums, sensors, and semiconductors. Several of these, especially microcontrollers and semiconductors, are supplied by a few specialized vendors, which can enhance their negotiating power—especially at times of shortage, as in the global chip shortage. But large-scale manufacturers tend to have long-term agreements, multiple sources, and large-scale negotiating power because of their volume of orders. Vertical integration—having companies manufacture important components internally—is another method of minimizing reliance on third-party providers. While suppliers of commodity components such as steel or plastic parts have little power, those offering highly specialized or patented technologies can exert more influence. Still, the overall supplier landscape is fragmented enough that most major manufacturers can maintain a reasonable balance of power, unless global supply disruptions tip the scales temporarily.

Bargaining Power of Buyers

Buyers in the washing machine market, especially end consumers, wield substantial power. With simple access to web reviews, comparison tools, and discount offers from retailers, consumers are able to switch brands with little resistance. The sheer number of alternatives—from low-end to high-end models, for different loads and features—enables customers to ask for more value with less. This behavior forces vendors to provide competitive prices, regular promotions, and value-enhancing features like intelligent connectivity, longer warranties, and power savings. For large volume purchasers such as retailers or business buyers (e.g., property managers or laundromats), the leverage is even stronger. They can command huge discounts and favorable conditions because of volume purchases. Brand-loyal or technologically savvy purchasers, however, might still have an affinity for certain manufacturers, lessening their bargaining power somewhat. In general, low switching cost and transparency of information guarantee that retail channels and consumers have high bargaining power, compelling manufacturers to innovate and compete on value consistently.

Threat of Substitutes

The threat of direct substitutes in the market for washing machines is fairly low. Washing machines perform a particular utility with few genuine alternatives in developed markets. Hand washing, the main alternate, is time-consuming, not very efficient, and not convenient for most urban or developed region households. But in poorer or rural communities—particularly in developing nations—hand washing or laundry facilities can still represent a substitute danger. On top of that, professional cleaning facilities and community laundry facilities provide indirect substitution, especially in high-density cities or among floating populations such as students and renters. New business models like appliance rental or subscription services are also on the rise, which may not substitute the role of a washing machine but alter consumers' access to it. These shifts might alter purchasing behaviors, particularly among younger or price-sensitive customers. However, the fundamental utility and time-saving advantage of washing machines maintain the threat of substitutes moderate for most mainstream segments.

Growth Drivers in the Washing Machine Market

Rising Disposable Income and Urbanization

With increasing disposable income and rapid urbanization, more consumers can afford modern home appliances, including washing machines. Urban dwellers seek convenience, driving demand for fully automatic and smart washing machines. As housing spaces become more compact, demand for space-saving and energy-efficient washing machines is growing. Additionally, increased participation of women in the workforce has led to higher reliance on appliances that reduce household chores, further propelling market growth. Urbanization is a key trend in the Asia-Pacific region, with 54% of the global urban population (over 2.2 billion people) residing in Asia. By 2050, this population is expected to increase by 50%, adding 1.2 billion more people.

Technological Advancements and Smart Features

Innovations in washing machines, such as AI-driven washing cycles, IoT-enabled connectivity, and energy-efficient models, attract tech-savvy consumers. Smart washing machines allow remote smartphone operation, offering enhanced convenience and control. Features like automatic detergent dispensing, self-cleaning technology, and fabric care settings improve washing efficiency and garment longevity. Manufacturers continuously develop smart and connected washing machines to cater to the growing consumer preference for automation and digitalization. In March 2024, Samsung, India’s largest consumer electronics brand, introduced a new range of AI EcobubbleTM fully automatic front-load washing machines. These machines, the first in the 11 kg segment, feature AI Wash, Q-DriveTM, and Auto Dispense, allowing laundry to be done 50% faster, providing 45.5% better fabric care, and being up to 70% more energy-efficient.

Increasing Awareness of Water and Energy Conservation

Consumers are becoming more environmentally conscious, increasing demand for energy-efficient and water-saving washing machines. Governments worldwide are implementing stringent regulations promoting sustainable appliances. Manufacturers are responding with eco-friendly washing machines equipped with inverter technology, low water consumption mechanisms, and energy star ratings. These innovations help users reduce electricity and water bills while minimizing their environmental footprint, thus boosting market adoption. Jan 2025, Samsung's new 9KG front load washing machines feature AI Energy mode, cutting energy use by up to 70% with Ecobubble technology for efficient washing.

Challenges in the Washing Machine Market

High Initial Costs and Maintenance Expenses

Advanced washing machines with smart features, energy efficiency, and automation come at a premium price, making them less affordable for budget-conscious consumers. Additionally, spare parts, repairs, and maintenance costs can be high, especially for smart and fully automatic models. This factor limits adoption in developing markets where consumers prioritize affordability over high-end features.

Supply Chain Disruptions and Raw Material Costs

The washing machine market is vulnerable to supply chain disruptions, affecting the availability of components like semiconductors and motors. Additionally, fluctuations in raw material costs, such as steel and plastic, impact manufacturing expenses, increasing product prices. Geopolitical tensions, trade restrictions, and global economic downturns further contribute to supply chain challenges, affecting market growth.

Fully Automatic Washing Machine Market

Fully automatic washing machines dominate the market due to their convenience and efficiency. These machines handle the entire washing process, from soaking to drying, without requiring manual intervention. Available in top-load and front-load variants, they cater to different consumer preferences. Their advanced features, such as customized wash cycles, energy-efficient operations, and digital controls, make them highly desirable. As living standards rise, demand for fully automatic washing machines grows.

Smart Connected Washing Machine Market

Smart-connected washing machines are gaining traction due to their integration with IoT technology. These machines can be controlled via mobile apps, allowing users to monitor wash cycles remotely. Features like voice control compatibility, AI-powered washing programs, and real-time maintenance alerts enhance user experience. The growing adoption of smart home ecosystems and increasing internet penetration are key drivers of this segment's expansion.

Commercial Washing Machine Market

Commercial washing machines are used by businesses such as laundromats, hotels, and hospitals. They are designed for heavy-duty use and offer higher load capacities and durability. They feature industrial-grade motors, robust construction, and customizable wash cycles for various fabric types. The expansion of hospitality, healthcare, and textile industries fuels global demand for commercial washing machines.

The Healthcare Washing Machine Market

Hospitals and healthcare facilities require specialized washing machines to ensure hygiene and sanitation. These machines use high-temperature water and disinfectant cycles to eliminate bacteria and viruses from linens and uniforms. Compliance with health and safety regulations is a significant factor driving demand in this segment. The need for advanced washing solutions in medical facilities increases as healthcare infrastructure expands.

Retail Chains Washing Machine Market

Retail chains are crucial in washing machine distribution, offering consumers various brands and models. Large retailers and supermarkets stock washing machines from leading manufacturers, providing competitive pricing, financing options, and warranty services. The growing presence of organized retail channels, both offline and online, is driving sales and increasing market penetration, particularly in emerging economies.

United States Washing Machine Market

The U.S. washing machine market is driven by high disposable income, advanced technology adoption, and strong consumer demand for smart appliances. Energy-efficient models are gaining popularity due to government incentives and regulations promoting sustainability. Key manufacturers focus on innovation, offering AI-powered and eco-friendly washing machines. The rise of e-commerce further contributes to market expansion. July 2024, Electrolux is launching a new range of smart laundry appliances designed to extend the life of clothing and minimize resource use. This initiative addresses the opportunity to significantly reduce the carbon, water, and waste footprints of clothing. The new range features the 600-900 series washers, 700-800 series washer dryers, and 600-900 series tumble dryers.

France Washing Machine Market

The washing machine market in France is characterized by increasing demand for compact, energy-efficient, and smart appliances. Consumers prioritize sustainability, leading to the popularity of eco-friendly models with low water and power consumption. The presence of leading European manufacturers and government policies supporting green technology contribute to market growth. Online retail channels are also expanding, boosting sales.

China Washing Machine Market

China is a major player in the global washing machine market, with rapid urbanization, rising incomes, and technological advancements fueling demand. Domestic brands compete with international manufacturers, offering a variety of models at different price points. The market is shifting toward smart washing machines with AI and IoT features. Additionally, increasing environmental awareness drives demand for energy-efficient appliances. Aug 2024, Xiaomi has introduced the Mijia Super Clean Washing Machine, featuring a capacity of 10 kg. It is now available for purchase on JD.com.

Saudi Arabia Washing Machine Market

Saudi Arabia's washing machine market is growing due to increasing urbanization, rising expatriate populations, and improved living standards. The demand for fully automatic and smart washing machines is rising, supported by the expansion of residential and commercial sectors. High temperatures and water scarcity influence consumer preferences, leading to greater adoption of water-efficient and energy-saving models. January 2025 – LG Electronics is transforming laundry with its innovative WashTower™—an AI-powered washer and dryer combination that combines efficiency with stylish design.

Washing Machine Market Segments

Product

- Fully Automatic

- Semi-Automatic

Technology

- Smart Connected

- Conventional

End-use

- Commercial

- Residential

Application

- Healthcare

- Hospitality

- Others

Sales Channel

- E-Commerce

- Retail Chains

- Direct Sales

Countries– Market breakup in 25 Countries:

- United States

- Canada

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

- Brazil

- Mexico

- Argentina

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Person

- Recent Development

- Revenue

Key Company Covered

- Whirlpool

- SAMSUNG

- LG Electronics

- IFB Appliances

- Panasonic Holdings Corporation

- Haier Inc.

- Godrej

- GENERAL ELECTRIC COMPANY

- AB Electrolux

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Technology, Type, End User, Application, Sales Channeland Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Washing Machine Market

6. Market Share Analysis

6.1 By Product

6.2 By Technology

6.3 By End-use

6.4 By Application

6.5 By Sales Channel

6.6 By Countries

7. Product

7.1 Fully Automatic

7.2 Semi-Automatic

8. Technology

8.1 Smart Connected

8.2 Conventional

9. End-use

9.1 Commercial

9.2 Residential

10. Application

10.1 Healthcare

10.2 Hospitality

10.3 Others

11. Sales Channel

11.1 E-Commerce

11.2 Retail Chains

11.3 Direct Sales

12. Countries

12.1 North America

12.1.1 United States

12.1.2 Canada

12.2 Europe

12.2.1 France

12.2.2 Germany

12.2.3 Italy

12.2.4 Spain

12.2.5 United Kingdom

12.2.6 Belgium

12.2.7 Netherlands

12.2.8 Turkey

12.3 Asia Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.3.4 Australia

12.3.5 South Korea

12.3.6 Thailand

12.3.7 Malaysia

12.3.8 Indonesia

12.3.9 New Zealand

12.4 Latin America

12.4.1 Brazil

12.4.2 Mexico

12.4.3 Argentina

12.5 Middle East & Africa

12.5.1 South Africa

12.5.2 Saudi Arabia

12.5.3 UAE

13. Porter's Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Competition

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threats

15. Key Players Analysis

15.1 Whirlpool

15.1.1 Overview

15.1.2 Key Person

15.1.3 Recent Development

15.1.4 Revenue

15.2 SAMSUNG

15.2.1 Overview

15.2.2 Key Person

15.2.3 Recent Development

15.2.4 Revenue

15.3 LG Electronics

15.3.1 Overview

15.3.2 Key Person

15.3.3 Recent Development

15.3.4 Revenue

15.4 IFB Appliances

15.4.1 Overview

15.4.2 Key Person

15.4.3 Recent Development

15.4.4 Revenue

15.5 Panasonic Holdings Corporation

15.5.1 Overview

15.5.2 Key Person

15.5.3 Recent Development

15.5.4 Revenue

15.6 Haier Inc.

15.6.1 Overview

15.6.2 Key Person

15.6.3 Recent Development

15.6.4 Revenue

15.7 Godrej

15.7.1 Overview

15.7.2 Key Person

15.7.3 Recent Development

15.7.4 Revenue

15.8 GENERAL ELECTRIC COMPANY

15.8.1 Overview

15.8.2 Key Person

15.8.3 Recent Development

15.8.4 Revenue

15.9 AB Electrolux

15.9.1 Overview

15.9.2 Key Person

15.9.3 Recent Development

15.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com