Europe Home Appliance Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowEurope Home Appliance Market Trends & Summary

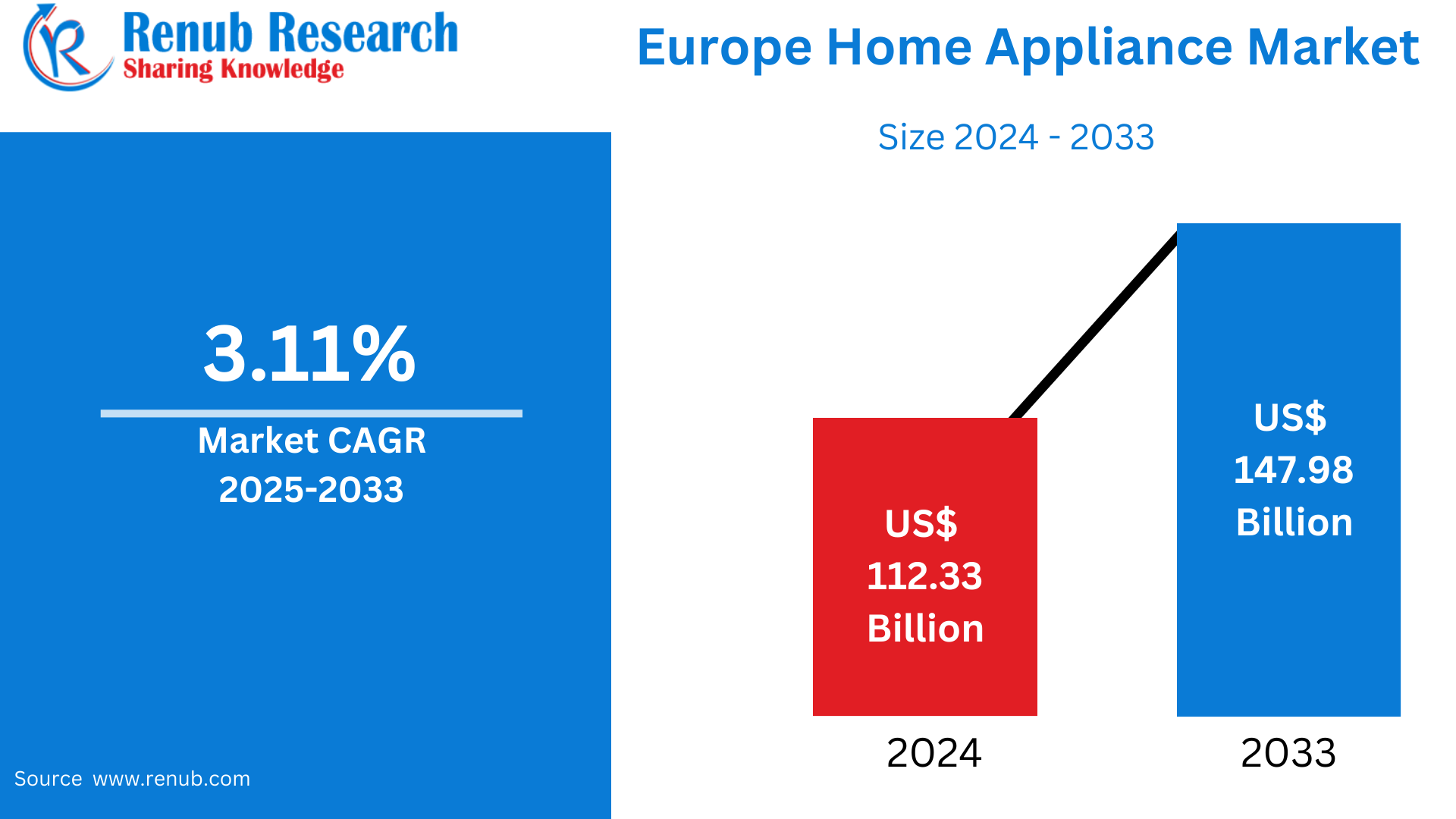

Europe Home Appliance Market is expected to reach US$ 147.98 billion by 2033 from US$ 112.33 billion in 2024, with a CAGR of 3.11% from 2025 to 2033. The market for home appliances in Europe is undergoing a dramatic shift due to shifting customer tastes and technical developments. Premium electronic household appliances are becoming more and more popular in Western European markets as buyers choose more expensive goods with cutting-edge features and better functionality.

The report Europe Home Appliance Market & Forecast covers by Product (Major Appliances-Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Cookers and Ovens, Other Major Appliances), (Small Appliances-Vacuum Cleaners, Food Processors, Coffee machines, Irons, Toasters, Grills and Roasters, Other Small Appliances), Distribution Channel (Exclusive Stores, Multi-brand Stores, Online, Other Distribution Channels), Countries and Company Analysis, 2025-2033.

Europe Home Appliance Industry Overview

Due to customer demand for energy-efficient products, technical developments, and a growing emphasis on sustainability, the European home appliance market is expanding steadily. European consumers are looking for appliances that encourage environmental responsibility and energy saving in addition to convenience. As a result, manufacturers are concentrating on developing energy-efficient models that lower consumption and carbon footprints in response to the spike in demand for environmentally friendly appliances. As more customers look for connected devices that offer improved functionality, remote control, and connection with home automation systems, the industry is also being shaped by the rising interest in smart home technology.

The design and operation of household appliances are also being impacted by the trend toward urbanization and smaller living areas. Compact, multipurpose, and space-saving gadgets are growing in popularity as they meet the demands of people who live in small houses or flats. Consumers may now readily acquire a large variety of household appliances from different companies thanks to the expansion of e-commerce. Digital platforms are being used by manufacturers to reach a wider audience and offer individualized consumer experiences. All things considered, the European home appliance industry is developing quickly, with a focus on sustainability, innovation, and satisfying the shifting demands of contemporary customers.

For manufacturers conducting business in the European market, product innovation and portfolio expansion have become critical strategic imperatives. Businesses are constantly adding appliances with cutting-edge features like artificial intelligence, intelligent diagnostics, and remote operating capabilities to their product lines. The development of appliances that can be included into larger home automation systems has increased due to the trend toward linked homes, providing customers with more convenience and control over how their homes are run. With an increasing focus on appliances that blend in with contemporary home decor while keeping excellent functioning, manufacturers are increasingly paying attention to design aesthetics.

The European home appliance market's distribution environment is changing dramatically, with a noticeable move toward omnichannel retail tactics. While online platforms are growing their market share, traditional brick and mortar shops are modifying their business plans to include digital channels. Experience stores and showrooms, especially for luxury labels, have seen a rise in industry investment as a means of allowing customers to engage with things prior to making purchases. With manufacturers and retailers concentrating on developing seamless shopping experiences across all channels, this hybrid approach to retail is changing how customers investigate, evaluate, and buy home appliances.

Growth Drivers for the Europe Home Appliance Market

Consumer demands are shifting in favor of technology and eco-friendly goods

The market for home appliances in Europe is expanding significantly due to the rise in tech-savvy customers and the quick uptake of the internet. The retail industry has changed as a result of these changes in customer behavior, and there is now a greater need for smart, energy-efficient appliances. Manufacturers are concentrating on cutting-edge approaches that optimize sustainability and energy savings. For instance, Samsung introduced the Bespoke Infinite Line refrigerator in January 2023, which offers choices for a wine cellar, freezer, and refrigerator that can be customized.

Additionally, the industry is expanding due to the development of innovative designs and features for improved functioning. The need for appliances is also being driven by an increase in hotels, restaurants, and more stringent hygiene standards. The ease of online buying is propelling the market as more and more customers choose e-commerce. The home appliances business is seeing a rise in income due to the popularity of modular, energy-efficient appliances that meet both practical and aesthetic demands, such as warming drawers, speed cooking ovens, and induction cooktops.

Changes in Lifestyle and Urbanization

Europe's continuous urbanization trend has had a big impact on the home appliance industry by generating new needs and consumption trends. The need for compact, efficient, and multipurpose appliances has increased due to urban lifestyles, which are typified by fewer living areas and busy schedules. Particularly in urban homes where space optimization is essential, this change has spurred manufacturers to create creative solutions that optimize utility while decreasing spatial needs. As contemporary lifestyles have changed, so too have expectations for the convenience and usefulness of appliances. More and more modern consumers are looking for appliances that can meet their varied demands and flexible schedules.

As a result, devices with characteristics including rapid wash cycles, adjustable operating modes, and delayed start times have been developed. In response to these shifts in lifestyle, manufacturers are launching appliances with better time management functions, more convenience features, and more compatibility with contemporary living styles.

Put Sustainability and Energy Efficiency First

Energy efficiency and environmental awareness have emerged as key factors influencing the European home appliance industry. Manufacturers are being forced to create more environmentally friendly goods as a result of the strict EU regulations pertaining to energy and water efficiency, which have completely changed the business landscape. Significantly more resource-efficient than manual techniques, this regulatory framework has had a particular impact on the design and development of large appliances like washing machines and dishwashers.

Significant expenditures in research and development, especially in nations like Germany, Italy, and Poland that are at the forefront of sustainable appliance technology innovation, further demonstrate the industry's dedication to sustainability. Manufacturers are concentrating on creating goods that not only satisfy present efficiency requirements but also take future environmental laws into account. Customers can now monitor and optimize their appliance consumption thanks to the integration of smart appliances and energy management systems, which has led to a strong desire for items that provide both environmental advantages and greater energy performance.

Challenges in the Europe Home Appliance Market

Competition from Low-Cost Imports

One major obstacle facing the European home appliance business is competition from low-cost imports. Cost-conscious buyers are drawn to non-European products because they are frequently more competitively priced, especially those with reduced labor and production expenses. Local and regional producers are under pressure to cut prices due to the flood of less expensive options, which may jeopardize profit margins and restrict investment in quality enhancement or innovation. When competing only on price, European brands—which are renowned for their robustness and energy efficiency—may find it challenging to hold onto market share. They are therefore compelled to set themselves apart by luxury branding, sustainability, or cutting-edge features—strategies that might not be appealing to all customer segments. This dynamic makes long-term growth more difficult and increases competition.

Rising Raw Material and Energy Costs

The European home appliance sector is facing serious obstacles due to rising energy and raw material costs. Production costs are directly impacted by rising costs for vital inputs like metals, polymers, and energy, which reduces manufacturers' profit margins. Higher retail prices are frequently the result of these increased operating expenses, which may deter price-conscious buyers and maybe lower demand overall. Furthermore, supply chain planning and budgeting are made unclear by shifting commodity prices, which compel businesses to either absorb expenses or pass them on to customers. Manufacturing operations that use a lot of energy are particularly at risk, especially in areas where utility prices are rising. In this cost-sensitive environment, the danger of diminished competitiveness and reduced market growth increases as manufacturers battle to strike a balance between affordability and profitability.

France Home Appliance Market

Strong customer interest in sustainability, energy efficiency, and smart technology integration is driving the French home appliance industry. Appliances with automation, convenience, and environmental advantages are becoming more and more popular in France, which is driving manufacturers to create clever, environmentally responsible designs. There is a discernible trend toward small, multipurpose appliances that fit into contemporary urban living. A major factor is environmental awareness, as seen by the rising need for robust, recyclable, and repairable goods. Nevertheless, demand may be impacted by economic factors like inflation and changes in consumer preferences, particularly for expensive goods. As a result, companies are concentrating on improving the value of their products and the consumer experience by combining design, technology, and digital retail tactics to meet changing demands in the home.

United Kingdom Home Appliance Market

The home appliance market in the UK is changing, with a focus on sustainability, energy efficiency, and smart technologies. Appliances that provide ease, connection, and a lower environmental impact are becoming more and more popular. Appliances are increasingly using artificial intelligence (AI) and the Internet of Things (IoT) to improve functionality and user experience. The rising demand for smart home appliances with automation and remote-control capabilities is indicative of this trend.

In addition, there is a discernible trend toward tiny, multipurpose appliances that meet the demands of smaller homes and urban life. In order to meet these needs, manufacturers are coming up with new ideas and products that fit in with contemporary lives. Government programs that support sustainability and energy efficiency also have an impact on the market, motivating producers and customers to give eco-friendly products top priority. Notwithstanding these developments, obstacles like financial strains and legal requirements still influence market dynamics.

Germany Home Appliance Market

The market for home appliances in Germany is expanding steadily due to customer desire for energy efficiency, technical developments, and sustainability. Appliances that provide ease, connection, and a lower environmental impact are becoming more and more popular. Appliances are increasingly using artificial intelligence (AI) and the Internet of Things (IoT) to improve functionality and user experience. The rising demand for smart home appliances with automation and remote-control capabilities is indicative of this trend.

The market for home appliances in Germany is expanding steadily due to customer desire for energy efficiency, technical developments, and sustainability. Appliances that provide ease, connection, and a lower environmental impact are becoming more and more popular. Appliances are increasingly using artificial intelligence (AI) and the Internet of Things (IoT) to improve functionality and user experience. The rising demand for smart home appliances with automation and remote-control capabilities is indicative of this trend.

Spain Home Appliance Market

Advances in technology and changing customer tastes are driving a substantial transition in the Spanish home appliance sector. As people look for items that offer convenience, connection, and a lower environmental effect, there is an increasing demand for smart and energy-efficient appliances. Manufacturers are being forced to innovate as a result of this change, including elements like artificial intelligence (AI) and the Internet of Things (IoT) into their products.

Consumers are increasingly choosing tiny, multipurpose appliances that meet the demands of smaller living areas as a result of urbanization and home modernization, which is further changing market dynamics. Furthermore, government programs that support energy efficiency and sustainability are pushing manufacturers and consumers to give priority to environmentally friendly products. Notwithstanding these developments, obstacles like financial strains and legal requirements still influence the market environment, necessitating innovation and adaptation on the part of businesses to satisfy the shifting needs of Spanish customers.

Europe Home Appliances Industry Developments

26 May 2024: Haier, the market leader in home appliances*, will team up with the best tennis players from May 20 to June 9. Haier is a Roland-Garros tournament official partner. All of the more than one billion tennis fans in the globe are looking for grace, accuracy, and spectacular performances. Haier's role as an Official Partner is a natural fit because of these attributes. The business has consistently produced incredible environments and experiences that meet all needs.

April 25, 2024: After more than eight years as CEO and sixteen years in the Group management team, Electrolux Group President & CEO Jonas Samuelson has notified the Board of Directors that he will be departing his position and the Board on January 1, 2025. The Board will now begin its search for a successor.

Europe Home Appliance Market Segments

Product – Market breakup in 2 viewpoints:

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Cookers and Ovens

- Other Major Appliances

- Small Appliances

- Vacuum Cleaners

- Food Processors

- Coffee machines

- Irons

- Toasters

- Grills and Roasters

- Other Small Appliances

Distribution Channel – Market breakup in 4 viewpoints:

- Exclusive Stores

- Multi-brand Stores

- Online

- Other Distribution Channels

Country – Market breakup in 14 viewpoints:

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Company Analysis:

- Arcelik AS

- Robert Bosch GmbH

- Electrolux AB

- De'Longhi S.p.A

- Liebherr Group

- Miele

- Koninklijke Philips

- Gorenje Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Home Appliance Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product

6.1.1 By Major Appliances

6.1.2 By Small Appliances

6.2 By Distribution Channel

6.3 By Countries

7. Product

7.1 Major Appliances

7.1.1 Refrigerators

7.1.2 Freezers

7.1.3 Dishwashing Machines

7.1.4 Washing Machines

7.1.5 Cookers and Ovens

7.1.6 Other Major Appliances

7.2 Small Appliances

7.2.1 Vacuum Cleaners

7.2.2 Food Processors

7.2.3 Coffee machines

7.2.4 Irons

7.2.5 Toasters

7.2.6 Grills and Roasters

7.2.7 Other Small Appliances

8. Distribution Channel

8.1 Exclusive Stores

8.2 Multi-brand Stores

8.3 Online

8.4 Other Distribution Channels

9. Countries

9.1 France

9.2 Germany

9.3 Italy

9.4 Spain

9.5 United Kingdom

9.6 Belgium

9.7 Netherlands

9.8 Russia

9.9 Poland

9.10 Greece

9.11 Norway

9.12 Romania

9.13 Portugal

9.14 Rest of Europe

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Arcelik AS

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Robert Bosch GmbH

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Electrolux AB

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 De'Longhi S.p.A

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Liebherr Group

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Miele

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Koninklijke Philips

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Gorenje Group

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com