Global Dishwasher Market – Size, Share, Trends, Forecast 2025-2033

Buy NowGlobal Dishwasher Market Size and Forecast 2025-2033

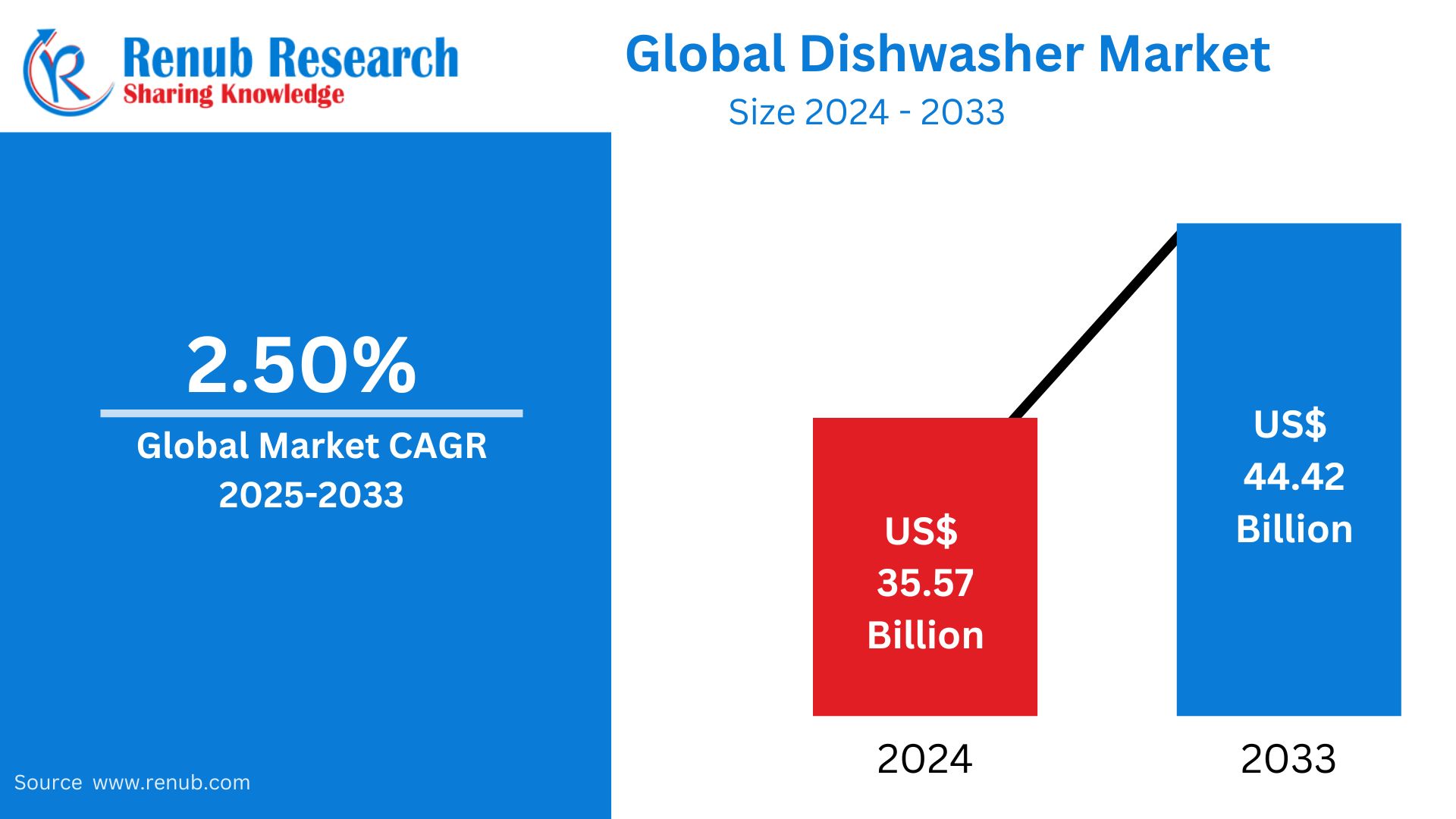

The Global Dishwasher Market size was USD 35.57 billion in 2024 and is expected to grow significantly to reach USD 44.42 billion by the year 2033. This growth is led by rising urbanization, rising disposable incomes, and a rise in the use of automated kitchen appliances. The market is forecasted to develop at a high compound annual growth rate (CAGR) of 2.50% for the 2025–2033 period.

The report Global Dishwasher Market Forecast covers by Product (Freestanding, Built-in), Application (Commercial, Residential), Distribution Channels (Offline, Online), Country and Company Analysis 2025-2033.

Global Dishwasher Market Overview

A dishwasher is a home appliance that cleans and sanitizes dishes, pots and pans, and utensils automatically. It employs hot water, detergent, and strong jets to eliminate food debris and bacteria, which significantly lessens the drudgery of washing by hand. Contemporary dishwashers have numerous cycles for multiple levels of cleaning, energy-efficient features, and even smart connectivity to operate from a distance.

Worldwide, the use of dishwashers has increased with busy lifestyles, heightened hygiene awareness, and the trend towards smart homes. In developed economies such as North America and Europe, dishwashers are now standard kitchen equipment. However, their use is quickly increasing in emerging markets such as China and India as urbanization increases and middle-class consumers demand convenience. Moreover, the increasing number of dual-income households has also led to the demand for time-efficient kitchen solutions. With energy efficiency, water conservation, and space-saving designs as the focus of innovations, dishwashers are becoming a top choice in residential and commercial kitchens globally.

Growth Driver in the Global Dishwasher Market

Increasing Urbanization and Shifting Lifestyles

With urbanization gaining momentum worldwide, more consumers are shifting to fast-paced, convenience-driven lifestyles, which is fueling demand for time- and effort-saving appliances. Dishwashers, especially, have been popular among dual-income working professionals and families looking to reduce daily work. Increased numbers of nuclear families and city apartments with modular kitchen facilities favor the use of dishwashers. In addition, growth in disposable incomes for middle-class consumers in emerging markets is driving appliance adoption. Along with rising awareness of kitchen cleanliness and hygiene, these factors are driving dishwasher sales into a consistent growth in both developed and developing markets internationally. Around 55% of the global population currently resides in urban centers, and this is projected to grow to 68% (about 7 billion people) by the year 2050. The majority of this growth, as much as 90%, will be seen in Asia and Africa.

Smart Features and Technological Advancements

New dishwashers have energy-saving technology, AI-based washing cycles, and IoT-activated features that attract consumers with a high degree of technological affinity. Features like soil sensors, auto-dosing, steam cleaning, and app-operated functionalities provide customized and effective cleaning solutions. Smart home ecosystems' integration has also boosted consumer interest, enabling dishwashers to be synchronized with other devices for hassle-free control. Sustainability through minimized water and power consumption by manufacturers is also attracting environmental-friendly consumers. These innovations do not only increase functionality but also broaden the market scope by dealing with age-long issues of water consumption, decibel levels, and cleaning proficiency. In July 2022, Samsung Electronics Singapore has released a new generation of dishwashers, complementing their lineup of home appliances. The innovation seeks to upscale the lives of Singaporean consumers by ensuring cleanliness of kitchen items through effective washing. These dishwashers are loaded with various smart technologies to make the cleaning process faster and more personalized.

Emerging Hospitality and Foodservice Industry

Increased growth of the global hospitality industry comprising restaurants, hotels, cafes, and catering services—is playing a pivotal role in fueling the demand for commercial dishwashers. Such businesses need high-capacity, sanitary, and time-saving cleaning options to ensure food safety levels and customer satisfaction. As the foodservice sector recovers from the pandemic, demand for dependable dishwashing equipment has increased. Also, rising tourism, events, and quick-service restaurants globally are fueling investments in commercial kitchens and equipment. March 2024, Miele Professional introduces MasterLine, a new range of dishwashers for both home and commercial use. MasterLine provides outstanding hygiene, efficiency, and convenience with powerful cleaning performance on two levels and a range of accessories.

Obstacles to the Global Dishwasher Market

Initial Cost and Installation Hindrances

Although dishwasher advantages, these remain a comparably high-cost appliance, particularly in emerging economies. The machine's initial price, combined with plumbing and electric installation, repels price-conscious buyers. Households in most markets continue to consider dishwashers as indulgence goods rather than as necessity items in the kitchen. Complexity in installing in old kitchens, together with the availability of kitchen space, restricts further uptake. Buyers frequently must retrofit or replace cabinetry, which contributes to the overall expense. Also, compatibility issues with local dishware sizes and materials continue to be a concern. Overcoming these obstacles with compact designs, reasonable prices, and plug-and-play installations will be instrumental in achieving mass-market penetration worldwide.

Low Market Penetration in Developing Countries

Penetration of dishwashers is still low in most developing nations because of cultural, economic, and infrastructural reasons. In Asia-Pacific, Africa, and parts of Latin America, manual dishwashing remains an integral part of day-to-day routines, often with the aid of domestic labor. This cultural influence, combined with low awareness and affordability, hampers dishwasher adoption. In rural and semi-urban areas, sporadic water supply and electricity further hamper market development. Consumers even in urban households might be lacking in awareness about water- and time-saving benefits. Increasing educational campaigns and launching small, energy-saving, and region-relevant models are essential to resolving this challenge.

Global Built-in Dishwasher Market

The built-in dishwasher market is experiencing robust demand, especially in developed nations and urban areas with contemporary kitchens. The devices are incorporated smoothly into cabinetry and provide a smooth, space-efficient design that suits modular kitchen designs. Built-in models are preferred by consumers due to their design, quietness, and technology features such as sensor-based washing and energy conservation. Constructers and interior designers also increasingly integrate built-in dishwashers into high-end residential construction projects, contributing further to market expansion. As the demand for smart home appliances and kitchen automation rises, built-in dishwashers are gaining popularity as an optimal option for homeowners who value both functionality and design incorporation within their kitchens.

Global Residential Dishwasher Market

Residential dishwashers represent the majority of the world's dishwasher market, led by increased consumer awareness, two-income households, and convenience in household routines. With increasing numbers of individuals residing in urban apartments with constrained kitchen space, countertop and compact dishwashers are becoming increasingly popular in addition to full-size models. Urban living standards and disposable income in emerging economies are prompting first-time customers to purchase appliances. In addition, marketing efforts and promotions by appliance manufacturers are enhancing the consumer perception of dishwashers as convenient and hygienic solutions. The home segment will continue to reap the rewards of trends such as smart kitchens, sustainability, and lifestyle-based purchases of appliances.

Global Commercial Dishwasher Market

Commercial dishwashers are catering to restaurants, hotels, hospitals, and institutional kitchens that require high-volume, hygienic, and time-saving dish washing solutions. Such machines are designed for longevity, speed, and food safety compliance. With the worldwide foodservice and hospitality sector growing, especially in Asia-Pacific and the Middle East, demand for commercial dishwashers is mounting. Some key features are more than one wash cycle, energy efficiency, and compact industrial back-of-house design. COVID-19 created heightened awareness regarding sanitization, encouraging foodservice suppliers to invest in upgrading dishwashing systems. Increasing emphasis on efficiency of operations and customer expectations related to hygiene has led to a steady growth prediction for the commercial segment globally.

Global Online Dishwasher Market

The online channel is gaining momentum in the dishwasher market because of convenience, greater assortment, and competitive prices. These include e-commerce platforms like Amazon, Flipkart, and Alibaba, which provide doorstep delivery, reviews from consumers, and product comparisons with complete detail, promoting consumers to buy appliances online. The pandemic push towards the digital space further fast-tracked this trend, with many brands putting money into direct-to-consumer platforms and omnichannel marketing. Online-only models and offer discounts also appeal to price-sensitive customers. In developed nations, established logistics infrastructure and buy-now-pay-later (BNPL) services also encourage online adoption. With increasing internet penetration and digital literacy worldwide, online distribution will continue to grow dishwasher sales.

United States Dishwasher Market

The United States is among the biggest and most mature dishwasher markets in the world, fueled by high penetration of household appliances, advanced kitchen infrastructure, and consumer affinity for convenience. Integrated dishwashers are a typical appliance in the majority of homes, with portable and smart dishwashers picking up steam. Innovation through features like Wi-Fi connectivity and energy-saving technology defines the market. Sustained competition among brand leaders Whirlpool, GE Appliances, and Bosch drives product differentiation and price feasibility. Moreover, the movement towards sustainable lifestyle pushes consumers to opt for Energy Star-rated dishwashers. Replacement demand for older houses and remodeling also accounts for the market's steady growth. Feb 2024 – GE Appliances introduces a new family of stainless tub dishwashers that cater to consumers seeking a cleaner appearance and enhanced features for effective cleaning. With these introductions, GE Appliances is the #1 manufacturer of dishwashers in the U.S. and has invested heavily in its manufacturing operations.

Germany Dishwasher Market

Germany boasts one of the highest penetration rates for dishwashers in Europe, a testament to its sophisticated home appliance market and eco-friendly consumers. Built-in dishwashers are the norm because of high adoption of modular kitchens. Consumers in Germany value energy and water efficiency, cleanliness, and quiet operation, consistent with the nation's sustainability objectives. Bosch, Miele, and Siemens are the market leaders with their smart, long-lasting, and green models. Germany also favors energy-labeling policies and green programs for encouraging appliance replacement. With increasing adoption of smart homes and people looking for automation, dishwashers with AI-powered and connected options are becoming increasingly popular, placing Germany in the lead of the European dishwasher market. March 2023: Mabe launched a new mini dishwasher that washes dishes in less than 40 seconds and doesn't need installation.

China Dishwasher Market

China’s dishwasher market is growing rapidly, fueled by urbanization, rising incomes, and shifting household preferences. Once considered a luxury item, dishwashers are increasingly seen as essential in middle-class homes, especially in tier 1 and 2 cities. Brands are launching compact and countertop models to suit local kitchen layouts and smaller family sizes. Local players such as Haier and Midea are also investing in smart dishwashers specifically designed to suit local requirements, while foreign players are also gaining traction. E-commerce is a significant sales channel, particularly during festival seasons of promotion. The market, while having cultural resistance and affordability issues in lower-tier cities, has good long-term growth prospects. April 2024, ROBAM, a high-end kitchen appliances leader, revolutionizes the sector with its disruptive sterilizing dishwasher—the first according to new industry standards. The innovation marks the turning point in the world market, where Chinese brands are increasingly surpassing Western rivals in terms of technology and market share.

Mexico Dishwasher Market

Mexico's dishwasher market is slowly increasing as new appliances become increasingly affordable for middle-class households. Urban development and modular kitchen installation growth are driving adoption, especially within city regions. Built-in forms are still constrained, though portable and built-in compact models are increasingly popular. Although price sensitivity and cultural factors continue to restrain expansion, increasing consumer perception of water-saving and hygiene advantages is enhancing attitudes. Retail stores and digital channels are greatly impacting product visibility.

Saudi Arabia Dishwasher Market

The Saudi Arabian dishwasher market is expanding due to changing lifestyles of consumers, an increasing expatriate population, and increasing demand for modern kitchen appliances. Urbanization and high disposable incomes have resulted in increased use of built-in dishwashers in new constructions. The hot climate of the country and emphasis on hygiene also contribute to demand. Global brands rule the market, but local retail and online platforms are picking up pace. Government-backed housing schemes and increasing smart home integration also drive demand. While awareness is still on the rise in some segments, the market has potential because of lifestyle changes and higher appliance acceptance. In February 2024, Samsung has introduced a next-generation dishwasher with smart features, enabling remote monitoring and control through a mobile app. This attribute fulfills the growing requirement for smart home connectivity in Saudi Arabia's high-end appliance industry.

Global Dishwasher Market Segmentation

Product

- Freestanding

- Built-in

Application

- Commercial

- Residential

Distribution Channels

- Offline

- Online

Regional Insights – North America, Europe, APAC & More

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

All the key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Product Portfolio

- Revenue

Competitive Landscape and Key Players

- Electrolux AB

- Panasonic

- Whirlpool

- Robert Bosch Gmbh

- Samsung

- Siemens

- LG Electronics

- Haiers

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Application, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Dishwasher Market

6. Market Share Analysis

6.1 By Products

6.2 By Application

6.3 By Distribution Channel

6.4 By Countries

7. Product

7.1 Freestanding

7.2 Built-in

8. Application

8.1 Commercial

8.2 Residential

9. Distribution Channels

9.1 Offline

9.2 Online

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 United Arab Emirates

11. Porter's Five Forces Analysis

11.1 Threat of New Entry

11.2 The Bargaining Power of Buyer

11.3 Threat of Substitution

11.4 The Bargaining Power of Supplier

11.5 Competitive Rivalry

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Merger & Acquisitions

14. Key Players Analysis

14.1 Electrolux AB

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Product Portfolio

14.1.5 Revenue

14.2 Panasonic

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Product Portfolio

14.2.5 Revenue

14.3 Whirlpool

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Product Portfolio

14.3.5 Revenue

14.4 Robert Bosch Gmbh

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Product Portfolio

14.4.5 Revenue

14.5 Samsung

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Product Portfolio

14.5.5 Revenue

14.6 Siemens

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Product Portfolio

14.6.5 Revenue

14.7 LG Electronics

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Product Portfolio

14.7.5 Revenue

14.8 Haiers

14.8.1 Overviews

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Product Portfolio

14.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com