United States Oats Market Size & Forecast 2025–2033

Buy NowUnited States Oats Market Size

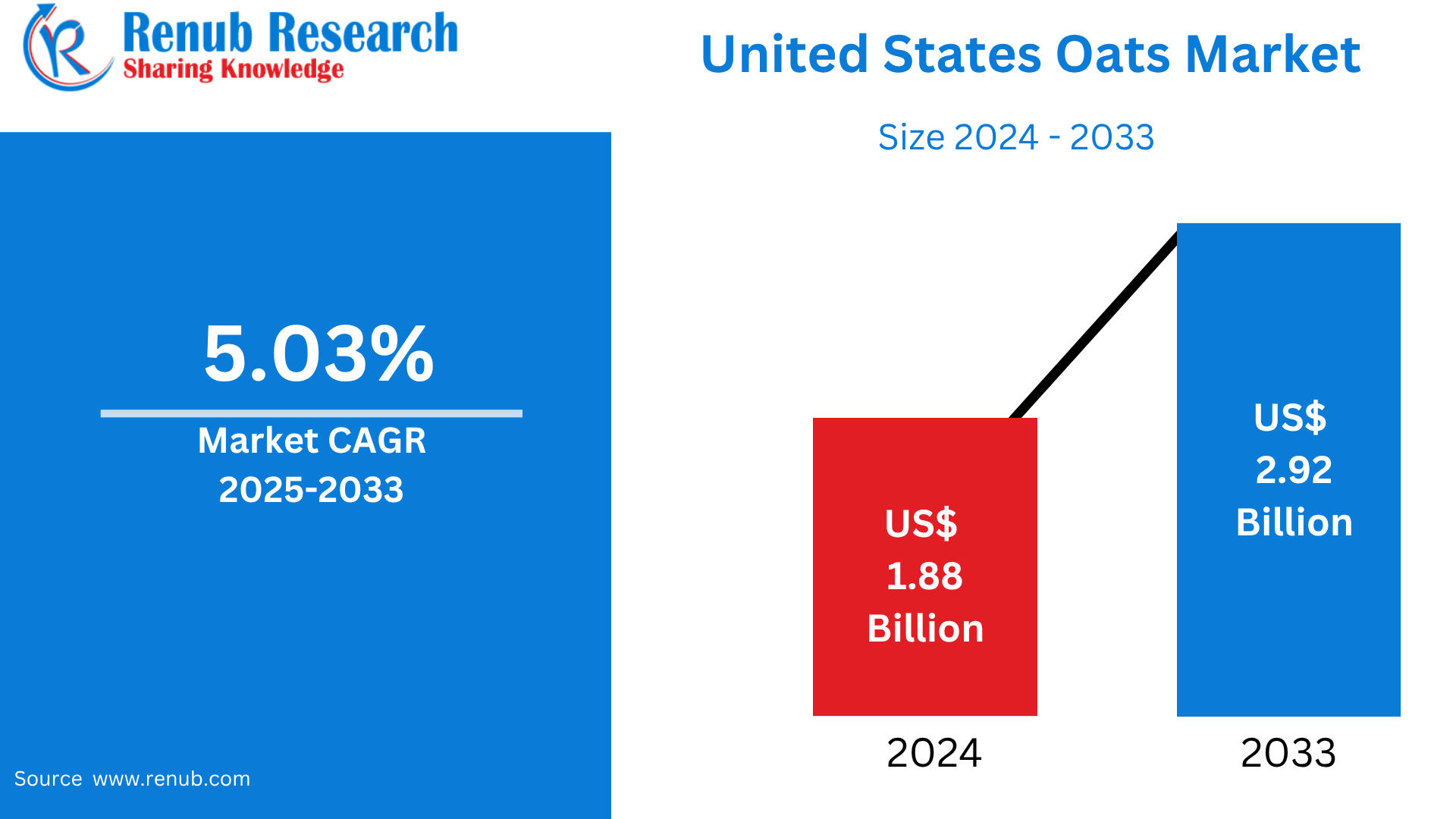

United States Oats Market is expected to reach US$ 2.92 billion by 2033 from US$ 1.88 billion in 2024, with a CAGR of 5.03% from 2025 to 2033. The US market for oats is increasing due to the increased plant-based diets, increased health awareness, and demand from customers for easy, healthy meals. Due to their numerous applications and environmentally friendly production, oats are increasingly being utilized in cereals, snacks, and beverages.

United States Oats Market Report by Type (Rolled Oats, Whole Oats, Steel Cut, Instant Oats, Others), Application (Animal Feed, Food & Beverage, Personal Care & Cosmetics, Others) and Company Analysis 2025-20333.

United States Oats Industry Overview

Globally, oats are a frequent cereal grain that is cultivated and consumed. They are primarily cultivated for their edible seeds and belong to the Avena sativa species. They are extremely nutrient-rich, rich in protein, dietary fiber, vitamins, and minerals, and when cooked, possess a distinctive chewy texture and nutty taste. They are commonly consumed as oatmeal, a popular breakfast dish prepared by soaking or boiling oats in milk or water. They are also incorporated into a range of baked foods, such as bread, cookies, and granola bars. Rolled oats, oat bran, and oat flour found in supermarkets are some of the easily available oat products. They are also renowned for containing high levels of antioxidants and aiding weight control and digestion.

The US market for oats is growing at a fast rate as a result of an increased awareness by consumers of health and wellness. High in fiber and minerals, oats are valued for their heart-healthy and digestive benefits. Plant-based and vegan lifestyles, especially among those who are lactose intolerant, have boosted demand for oat-based products, including oat milk. In addition, the range of dietary uses for oats—from breakfast cereals to snacks and beverages—conforms to the increasing requirement for convenience and healthy options. Another key consideration is sustainability, as oats grow with fewer resources, which makes consumers who are concerned about the environment attracted to their market share.

Growth Drivers for the United States Oats Market

Rising Health and wellness trends

The United States oat sector is growing rapidly because of health and wellbeing trends. The high nutritional quality of oats is widely recognized, particularly due to their rich content of beta-glucan, a soluble fiber that reduces cholesterol and supports cardiovascular health. Due to this, oats are increasingly used by health-aware consumers who are interested in regulating their weight, improving digestion, and maintaining overall well-being. Through stimulating the formation of beneficial gut bacteria, oats also function as a natural prebiotic, enhancing gut health. Oat-based products, including oatmeal, granola, energy bars, and oat milk, are increasingly popular as people develop greater interest in plant-based and functional food. Oats continue to be a staple of the modern American diet due to these advancements and increasing awareness of preventative health.

Convenience and Versatility

The US oat market is primarily fueled by convenience and versatility that appeal to the busy lives of modern consumers. Due to its flexibility, oats can be utilized to produce a broad variety of quick and ready-to-eat products, such as granola bars, instant oatmeal cups, and breakfast substitutes that can be consumed on the go. Such products benefit consumers seeking healthy meals with minimal preparation time. In order to marry convenience and familiarity, Quaker Oats, for instance, introduced a line of instant oatmeal in popular cereal flavors such as Cinnamon Toast Crunch and Lucky Charms. Additionally, oats are a basic ingredient in a broad assortment of culinary products because of the ability of oats to fit into a variety of meal uses such as savory and baked foods.

Plant-Based Diet Adoption

The US oat market is significantly impacted by the trend towards plant-based food consumption, particularly through the growing demand for oat-based products such as oat milk. Oat milk's neutral flavor, smooth texture, and eco-friendliness have been popular dairy alternatives. It is a better option for individuals concerned with the environment since it takes less water to produce than almond milk and produces fewer emissions than dairy milk. Oat milk is also a good option for individuals with dietary limitations since it is lactose-free, soy-free, and nut-free, thus making it safe for individuals with allergies. Oats have become a staple in vegetarian diets across the country thanks to the growth of veganism, flexitarianism, and lactose intolerance, which has further boosted demand for oat-based products.

Challenges in the United States Oats Market

Climate Sensitivity

One of the biggest obstacles facing the US oat sector is climate sensitivity. For optimum growth, oats need a range of temperatures and sufficient rainfall. Oat yields and quality can be significantly impacted by weather pattern variability, such as droughts, heavy rains, and unseasonable temperature swings. These erratic circumstances are growing more common as a result of climate change, which makes it challenging for farmers to sustain steady output. Unfavorable weather-related crop losses cause supply shortages and price volatility, which impacts both farmers and consumers. The entire expansion of the U.S. oat market is seriously threatened by this climate sensitivity, which restricts the stability and scalability of oat farming.

Trade and Tariffs

The United States' reliance on imported oats, especially from Canada, makes trade and tariffs a major obstacle to the country's oat industry. Trade policy changes, such the levying of tariffs or export restrictions, can cause supply chain disruptions, raise manufacturing costs, and weaken market stability. Oat-based products are frequently more expensive as a result of these disruptions, which impacts both manufacturers and consumers. The market is still susceptible to global trade tensions since domestic oat supply cannot keep up with demand. This reliance on imports emphasizes the necessity of solid trade agreements and varied sourcing to guarantee steady supply and price.

Recent Developments in United States Oats Industry

- In November 2023, NFL legend Eli Manning and chef Carla Hall have partnered with Quaker, the NFL's official oatmeal sponsor, to encourage children to eat healthily. They have started the Quaker Pregrain Tour, which includes a digital Quaker Playbook with 32 team-inspired dishes and a tailgate truck that visits specific NFL stadiums. A division of PepsiCo, Quaker sells a range of goods, such as Quaker Chewy Granola Bars and Quaker Oats. GENYOUth is committed to advancing the health and well-being of young people.

- In June 2023, A novel cereal using repurposed oat protein powder was introduced by SunOpta and Seven Sundays. SunOpta's OatGold, a byproduct of the manufacture of oat milk, is used to make the cereal, which is marketed as Oat Protein Cereal. The collaboration seeks to develop a sustainable solution for oat protein powder while also reducing food waste. The cereal is Non-GMO Project Verified, gluten-free, and comes in four flavors. It is available for purchase directly from the Seven Sundays website and at major retailers across the country.

United States Oats Market Segmentation:

Type

- Rolled Oats

- Whole Oats

- Steel Cut

- Instant Oats

- Others

Application

- Animal Feed

- Food & Beverage

- Personal Care & Cosmetics

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- General Mills

- B&G Foods Inc

- Kellanova

- Marico Ltd

- PepsiCo Inc

- Nestle SA

- Blue Lake Milling

- Avena Foods

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, and Application |

| Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Oats Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Application

7. Type

7.1 Rolled Oats

7.2 Whole Oats

7.3 Steel Cut

7.4 Instant Oats

7.5 Others

8. Application

8.1 Animal Feed

8.2 Food & Beverage

8.3 Personal Care & Cosmetics

8.4 Others

9. Porter’s Five Forces Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Key Players Analysis

11.1 General Mills

11.1.1 Overviews

11.1.2 Key Person

11.1.3 Recent Developments

11.1.4 Revenue

11.2 B&G Foods Inc.

11.2.1 Overviews

11.2.2 Key Person

11.2.3 Recent Developments

11.2.4 Revenue

11.3 Kellanova

11.3.1 Overviews

11.3.2 Key Person

11.3.3 Recent Developments

11.3.4 Revenue

11.4 Marico Ltd

11.4.1 Overviews

11.4.2 Key Person

11.4.3 Recent Developments

11.4.4 Revenue

11.5 PepsiCo Inc.

11.5.1 Overviews

11.5.2 Key Person

11.5.3 Recent Developments

11.5.4 Revenue

11.6 Nestle SA

11.6.1 Overviews

11.6.2 Key Person

11.6.3 Recent Developments

11.6.4 Revenue

11.7 Blue Lake Milling

11.7.1 Overviews

11.7.2 Key Person

11.7.3 Recent Developments

11.7.4 Revenue

11.8 Avena Foods

11.8.1 Overviews

11.8.2 Key Person

11.8.3 Recent Developments

11.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com