United States Lobster Market – Consumption Patterns & Forecast 2025–2033

Buy NowUnited States Lobster Market Size and Forecast 2025-2033

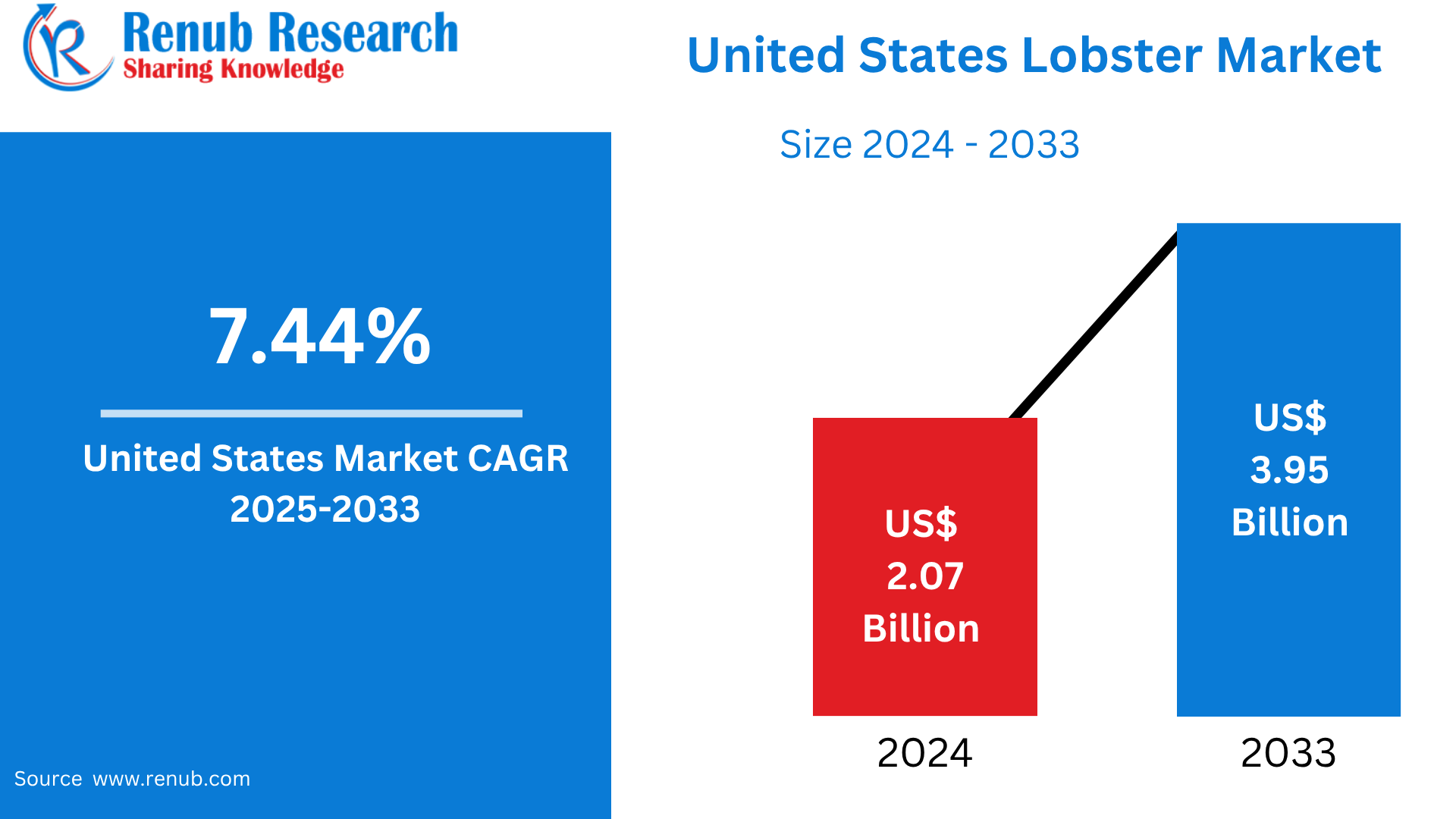

United States Lobster Market is expected to reach US$ 3.95 billion by 2033 from US$ 2.07 billion in 2024, with a CAGR of 7.44% from 2025 to 2033. Strong consumer demand, growing seafood consumption, and growing export prospects are the market's main drivers. Sustainable fishing methods, improvements in cold storage, and rising demand in the retail and catering industries are important considerations.

United States Lobster Market Report by Species (American Lobster, European Lobster, Spiny Lobster, Rock Lobster), Weight (0.5 – 0.75 lbs, 0.76 – 3.0 lbs, over 3 lbs), Product Types (Whole Lobster, Lobster Tail, Lobster Meat), Distribution Channel (Food Service, Retail) and Company Analysis, 2025-2033.

United States Lobster Market Overview

Growing consumer demand for premium seafood, particularly in the fine dining, retail, and export segments, is driving the lobster business in the United States. The market is expanding due to rising demand for high-protein diets and rising disposable income. In December 2024, personal income climbed by $92.0 billion (0.4%), while disposable personal income increased by $79.7 billion (0.4%), according to data released by the Bureau of Economic Analysis (BEA). Spending on personal consumption increased by $133.6 billion (0.7%). At a 3.8% saving rate, personal savings totaled $843.2 billion. The PCE price index grew by 0.3% on a monthly basis. Restaurants and seafood franchises that specialize in lobster-based cuisine are part of the significant foodservice industry. Consumer trust is growing as a result of the use of sustainable harvesting methods and certification schemes, which raises demand for lobster that is supplied ethically. Technological developments in processing, storage, and transportation enhance product quality and prolong shelf life.

One of the primary drivers of development is still the demand for exports, especially from China, Europe, and Canada. International sales are impacted by market dynamics that are influenced by trade agreements and tariff reductions. Lobster populations are impacted by climate change and changes in water temperatures, which leads to changes in regulations and restrictions on seasonal harvesting. Wider market penetration is supported by the move toward frozen and value-added lobster goods, such as flesh and tails.

For example, in order to grow its lobster and snow crab operations, Phillips Foods, a significant supplier of crabmeat in the United States, said in March 2024 that it would acquire two processing facilities in Canada, located on Prince Edward Island and Nova Scotia. At Seafood Expo North America, the business will introduce new chilled pasteurized lobster flesh products and a frozen crab toast appetizer. Online seafood markets and direct-to-consumer sales increase accessibility while accommodating changing customer tastes and buying habits.

Key Factors Driving the United States Lobster Market Growth

Growth in Export Markets

Strong demand from important overseas markets, particularly China, Europe, and Canada, is the primary reason for the healthy growth of the U.S. lobster export business. European demand for lobster is rising, especially in upscale dining establishments and retail chains, while China's middle class is developing and its consumption of premium seafood has expanded the market for U.S. lobster. The Food and Agriculture Organization reports that US live lobster shipments to China increased 69% in volume and 55% in value from Q2 2022 to 830 tons valued at USD 16.25 million in Q2 2023. In the face of economic uncertainty, tighter supply and high demand might result in price increases even with stable EU imports. In addition to the local supply, U.S. lobster is a major trading partner of Canada. Both trade agreements and tariff reductions are crucial tools for enhancing exporters' market accessibility and bolstering export dynamics. The growth of U.S. lobster is being driven by both overseas sales and the rising demand for seafood abroad.

Rising Demand for Premium Seafood

In the US, there is a growing consumer demand for premium, sustainably farmed lobster. Restaurants, shops, and internet platforms are giving priority to lobster that is obtained sustainably as customers grow more conscious of the effects their food choices have on the environment. Red Lobster, for example, unveiled a redesigned menu in November 2024 that includes seven new dishes and the return of the popular hush puppies. With a 20% reduction in total size, the new menu hopes to appeal to seafood enthusiasts. Lobsterfest will still give visitors an improved experience even though the well-liked Ultimate Endless Shrimp promotion has ended. Customers seeking ethically sourced products are becoming more and more interested in sustainability certifications and traceability initiatives. Seafood companies are responding by highlighting low-impact fishing methods and approved traps as examples of sustainable harvesting practices. This is further demonstrated by the increased demand for premium lobster goods from eateries, specialty shops, and internet marketplaces that cater to affluent customers prepared to shell out more money for superior, eco-friendly seafood.

Rising E-Commerce and D2C Sales

The expansion of the U.S. lobster market is being transformed by e-commerce and direct-to-consumer sales. According to the Census Bureau, retail e-commerce sales in the United States reached $300.1 billion in Q3 2024, increasing 7.4% year over year and 2.6% from Q2 2024. With $1,849.9 billion in total retail sales, Q3 saw a 1.3% gain over Q2. 16.2% of the quarter's total revenues came from e-commerce. Without using the conventional retail route, customers can purchase fresh, frozen, or value-added lobster goods straight from producers through online seafood platforms. In addition to saving time, this increases product variety and transparency in pricing. With cutting-edge packing that preserves product quality, direct shipping services guarantee a quicker delivery. The demand for premium lobster offers through these digital channels keeps rising as more customers look for gourmet seafood experiences at home. The growing desire for individualized purchasing and easy access to sustainable sourcing methods lend credence to this.

Challenges in the United States Lobster Market

Regulatory and Sustainability Pressures

Stricter laws, including as fishing quotas, size restrictions, and seasonal limitations, have been implemented in response to growing worries about the sustainability of lobster populations. These actions can reduce the number of lobsters accessible for collection, even though they are essential to maintaining the long-term health of lobster stocks and safeguarding marine ecosystems. In order to stay profitable, fisherman must contend with increased operating expenses and increasingly difficult logistical problems. The financial resources of lobster harvesting companies, particularly smaller ones, may be strained as a result of the substantial investments needed to comply with these requirements, set up monitoring systems, and adopt sustainable techniques. One of the industry's biggest challenges is still striking a balance between sustainability and profitability.

Trade Barriers and Tariffs

Despite the increase in U.S. lobster exports, trade restrictions and taxes remain a problem. For example, U.S. lobster export volumes to this important market have decreased since tariffs were imposed on the product during the U.S.-China trade war. The dynamics of international commerce are still unstable despite initiatives to negotiate trade agreements and lower tariffs in some areas. International trade policy changes, including abrupt tariffs or export prohibitions, can impact long-term market stability and cause anxiety for exporters. Due to these trade restrictions, the sector finds it challenging to forecast demand and create appropriate plans, which may limit the ability for U.S. lobster to expand in international markets.

Market Segmentations

Species

- American Lobster

- European Lobster

- Spiny Lobster

- Rock Lobster

Weight

- 0.5 – 0.75 lbs

- 0.76 – 3.0 lbs

- Over 3 lbs

Product Types

- Whole Lobster

- Lobster Tail

- Lobster Meat

Distribution Channel

- Food Service

- Retail

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Boston Lobster

- Clearwater Seafoods

- High Liner Foods Incorporated

- Thai Union Manufacturing Company Ltd

- East Coast Seafood Group

- Geraldton Fishermen’s Co-operative

- PESCANOVA ESPAÑA SL

- Supreme Lobster

- Tangier Lobster

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Species, By Weight, By Product Type and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Lobster Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Species

6.2 By Weight

6.3 By Product Type

6.4 By Distribution Channel

7. Species

7.1 American Lobster

7.2 European Lobster

7.3 Spiny Lobster

7.4 Rock Lobster

8. Weight

8.1 0.5 – 0.75 lbs

8.2 0.76 – 3.0 lbs

8.3 Over 3 lbs

9. Product Types

9.1 Whole Lobster

9.2 Lobster Tail

9.3 Lobster Meat

10. Distribution Channel

10.1 Food Service

10.2 Retail

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Boston Lobster

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Clearwater Seafoods

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 High Liner Foods Incorporated

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Thai Union Manufacturing Company Ltd

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 East Coast Seafood Group

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.6 Geraldton Fishermen’s Co-operative

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.7 PESCANOVA ESPAÑA SL

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.8 Supreme Lobster

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.9 Tangier Lobster

13.9.1 Overviews

13.9.2 Key Person

13.9.3 Recent Developments

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com