United States Full Service Restaurants Market Share Analysis and Size - Growth Trends and Forecast Report 2025-2033

Buy NowUnited States Full Service Restaurants Market Size

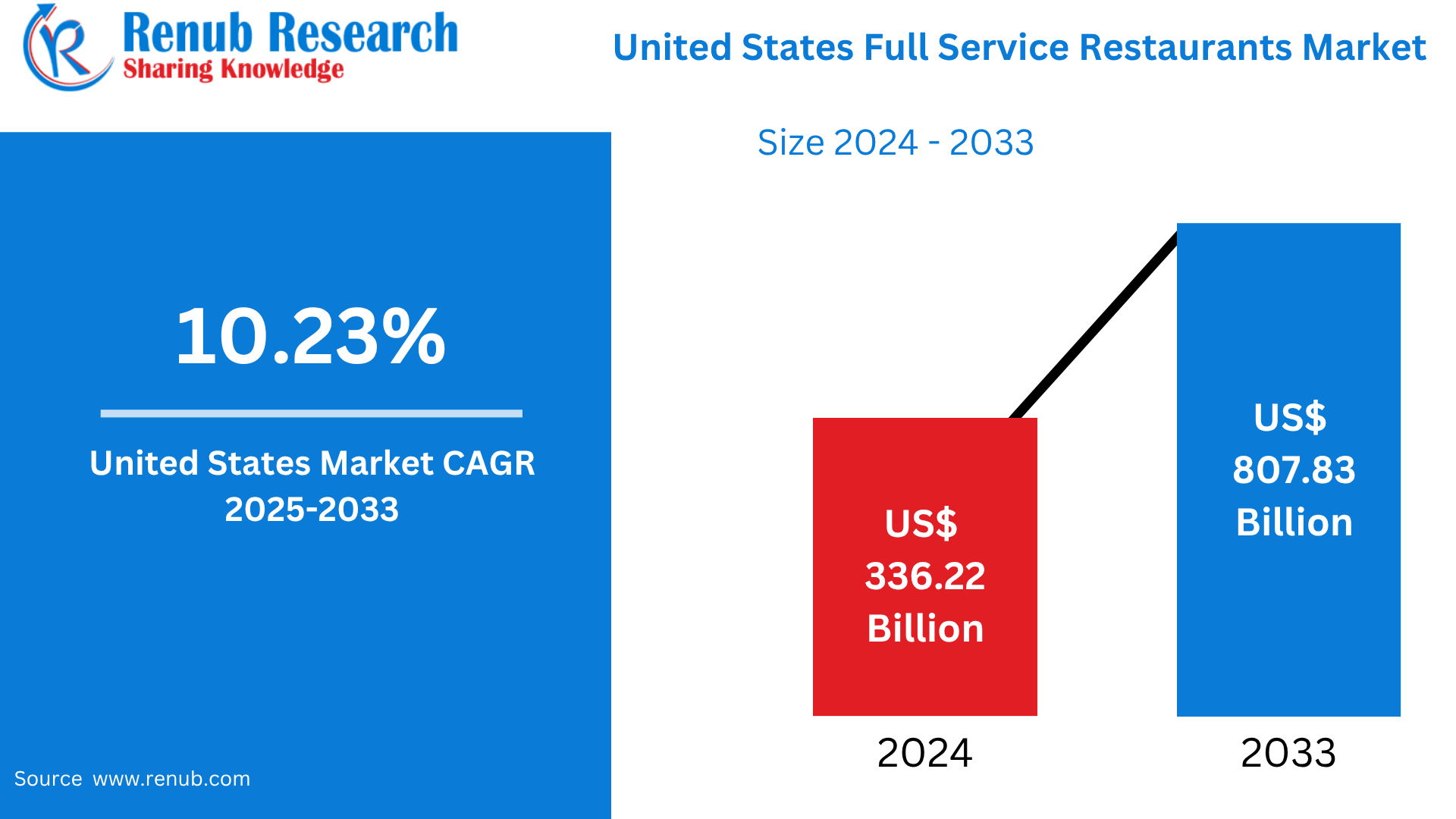

United States Full Service Restaurants Sector is likely to expand significantly, growing from USD 336.22 billion in 2024 to USD 807.83 billion by 2033, with a CAGR of 10.23% from 2025 to 2033. Drivers of growth include shifting consumer behavior in dining, rising demand for personalized culinary experiences, and expanding offerings in multiple cuisines. Enhanced service, ambiance, and experiential dining also continue to drive the growth curve of the sector across the country.

United States Full Service Restaurants Market by Cuisine (Asia, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), Outlet (Chained Outlets, Independent Outlet), Location (Leisure, Lodging, Retail, Standalone, Travel), Region (West, South, Midwest, Northeast)¸Countries and Company Analysis, 2025-2033.

United States Full Service Restaurants Market Outlooks

Full service restaurants (FSRs) are popular establishments in the United States that offer table service, a range of menu choices, and focus on customer experience. They range from casual dining to fine restaurants and are characterized by wait staff, served meals, and at times an environment conducive to longer, relaxed dining. FSRs are favored for all types of occasions—family meal, business get-together, celebration, or a casual gathering—providing an essential social and gastronomic experience.

In the U.S., FSRs enjoy widespread popularity due to the country’s diverse population and culinary tastes. Many restaurants specialize in regional cuisines, international dishes, or gourmet offerings, catering to a wide demographic. The popularity is further supported by a culture that values eating out as both a leisure and lifestyle activity. The integration of technology, such as digital reservations and touchless payments, has also enhanced their appeal. With higher disposable incomes and greater interest in food culture, full service restaurants continue to be on the rise across the nation.

Growth Drivers for United States Full Service Restaurants Market

Rising Consumer Spending and Dining Culture

The rising disposable income among U.S. consumers has led to higher spending on eating out, most notably at full service restaurants. Millennials and Gen Z are particularly at the forefront, focusing on experiences and ambiance over quick dining. Growth in popularity of food tourism, date-night dining, and family dining experiences supports solid demand for full service restaurants. When economic conditions stabilize, more consumers eat out, fueling solid FSR market growth. March 2025, Personal income rose $194.7 billion (0.8%) in February, reports the U.S. Bureau of Economic Analysis. Disposable personal income increased by $191.6 billion (0.9%), and personal consumption expenditures increased by $87.8 billion (0.4%).

Growth of Delivery and Online Reservation Platforms

Technology in the form of delivery apps and online reservation platforms has greatly enhanced the customer experience. Sites like DoorDash, OpenTable, and Uber Eats have expanded the reach of full service restaurants beyond their physical space. These systems support increased volume of sales as well as efficient table turn and enhanced management of customer data, which enable restaurants to reduce complexity and effort in offering and marketing, as well as become more responsive and agile in handling customer expectations. Feb. 2025, Paytronix, restaurant and convenience store guest engagement innovator, introduced Paytronix Catering, the latest addition to its Online Ordering solution. With this, restaurants can handle catering orders simply while integrating into Paytronix loyalty. By leveling third- and first-party ordering, Paytronix Catering allows brands to convert third-party customers into first-party customers, maximizing cater revenue.

Menu Innovation and Healthy Options

Consumers' demand for healthier, sustainable, and ethically sourced food is pushing full-service restaurants to shift their menus. The inclusion of plant-based foods, gluten-free options, and locally sourced ingredients is appealing to more consumers. Restaurants that adapt these forms of diets find themselves becoming more competitive, increasing customer loyalty and brand reputation. It strongly corresponds with national health movements and contributes to ongoing market expansion.

Challenges in United States Full Service Restaurants Market

Labor Shortages and Higher Wage Costs

Staffing is among the biggest challenges full service restaurants encounter. Labor shortages after the pandemic and rising minimum wages have translated into increased operating expenses. The majority of businesses struggle to attract and retain seasoned chefs, waiters, and kitchen personnel. The shortage could lower the level of services and increase waiting time, affecting profitability and customer satisfaction.

High Operating Expenses and Inflationary Pressures

The cost of supplies, rent, utilities, and insurance have accelerated in recent years. With disruptions in supply chains, these factors have narrowed margins for profits on most full-service restaurants. Reluctant customer spending due to inflation has also led restaurants to offset price increases without alienating customers. Keeping these fiscal tensions in check will be the key to long-term sustainability.

United States Asian Cuisine Full Service Restaurants Market

Asian cuisine is a favorite in the U.S. full service category on the strength of growing consumer interest in international food. From traditional Chinese and Japanese to modern Thai and Korean fusion, Asian FSRs draw strength from rich culinary heritage and creative experimentation. Growing popularity of sushi bars, ramen houses, and Korean BBQs—with experiential dining—is extremely appealing for this segment. Food flexibility during meals and healthy ingredients like seafood and vegetables entice health-conscious diners as well.

United States European Cuisine Full Service Restaurants Market

Full service European restaurants in the United States continue to hold strong popularity on the strength of their association with high-end dining and heritage. French bistros, Italian trattorias, and Spanish tapas bars serve authenticity that finds favor among residents and visitors. Quality ingredients, refined presentation, and wine-pairing opportunities enhance the dining experience. As Americans are generally looking for upscale and recreational dining meals, European cuisine FSRs are positioned at the premium sector of the market.

United States Chained Outlets Full Service Restaurants Market

Chained full service restaurants like Olive Garden, Red Lobster, and Applebee's dominate enormous market share by means of consistency, national advertising, and ubiquity. They have supply chain efficiencies and standardized menus to provide dependability to consumers. They maintain customer repeat business through their loyalty programs and technology integration (apps, online ordering, rewards). During economic recession, chained FSRs will outperform independents through leveraging corporate support and responsive pricing.

United States Full Service Restaurants Market in Leisure

Full service restaurants that cater to the growing demand for experiential dining—where entertainment and food are combined—meet this demand. These include restaurants with live music, themed decor, in-house games, or co-located cinemas. They attract groups and families looking for something beyond a meal. With consumers looking more and more for social experiences and out-of-home entertainment, this category is expanding, especially in urban and tourist areas. Strategic partnerships and event hosting add to revenue streams.

United States Retail Full Service Restaurants Market

Full-service restaurants located in or near shopping malls benefit from high foot traffic and established bases of customers. FSRs in shopping venues serve impulse stops, customer exhaustion, and convenience. The more retail is positioned as a destination lifestyle, full-service dining serves as an anchor tenant. Retail-driven operations will react quicker to seasonal menu change, promotion tie-ins, with shopping incentives or holiday specials that drive participation and average ticket.

West United States Full Service Restaurants Market

The Western United States—California, Washington, and Oregon—is a rich soil for FSR growth due to its multicultural base and openness to food innovation. The West Coast is at the forefront of plant-based and organic food trends, sustainable supply chains, and fusion cuisines. With thriving tourism, tech-savvy urban centers, and affluent eaters, the region is conducive to upscale and health-focused restaurants. Friendly regulations promoting green practices also encourage environmental-friendly operations and marketing.

South United States Full Service Restaurants Market

Southern markets like Texas, Florida, and Georgia have a strong culinary heritage, which includes Cajun and Creole, BBQ, and soul food. Restaurants in these markets that are full service draw emphasis to comfort, hospitality, and community. The strong population growth in the region, reduced operating costs, and tourist draw make the area attractive for new restaurant concepts. Local festivals and seasonal activity drive traffic and brand loyalty in the Southern FSR market.

Midwest United States Full Service Restaurants Market

Midwestern FSRs attract a largely suburban, family-oriented clientele that wants good food at reasonable prices. Renowned for hearty American food and regional specialties, these restaurants thrive by serving generous portions and an inviting, communal atmosphere. Urban centers like Chicago also boast a developed fine dining scene. Although a little slower to adopt the latest culinary fashions, the Midwest displays steady growth through stable customer bases and economic stability.

United States Full Service Restaurants Market Segmentation

Cuisine

- Asia

- European

- Latin American

- Middle Eastern

- North American

- Other FSR Cuisines

Outlet

- Chained Outlets

- Independent Outlet

Location

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Region

- West

- South

- Midwest

- Northeast

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis

- BJ's Restaurants Inc.

- Texas Roadhouse Inc.

- Bloomin' Brands Inc.

- Darden Restaurants Inc.

- Brinker International Inc.

- Cracker Barrel Old Country Store Inc.

- The Cheesecake Factory Restaurants Inc

- DFO LLC

- Dine Brands Global Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Cuisine, Outlet, Location and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Full Service Restaurants Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Cuisine

6.2 By Outlet

6.3 By Location

6.4 By Region

7. Cuisine

7.1 Asia

7.2 European

7.3 Latin American

7.4 Middle Eastern

7.5 North American

7.6 Other FSR Cuisines

8. Outlet

8.1 Chained Outlets

8.2 Independent Outlet

9. Location

9.1 Leisure

9.2 Lodging

9.3 Retail

9.4 Standalone

9.5 Travel

10. Region

10.1 West

10.2 South

10.3 Midwest

10.4 Northeast

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 BJ's Restaurants Inc.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Texas Roadhouse Inc.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Bloomin' Brands Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Darden Restaurants Inc.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Brinker International Inc.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Cracker Barrel Old Country Store Inc.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 The Cheesecake Factory Restaurants Inc.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 DFO LLC

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 Dine Brands Global Inc.

13.9.1 Overviews

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com