United Kingdom E-Commerce Payment Market is Forecasted to be more than US$ 203.08 Billion by the end of year 2026

01 Apr, 2021

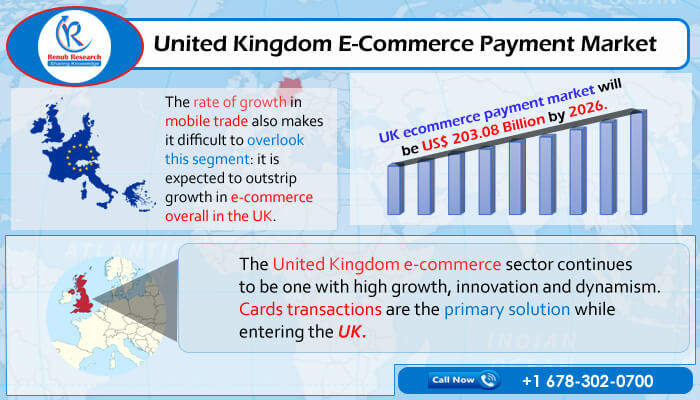

According to the latest report by Renub Research, titled "United Kingdom E-Commerce Payment Market & Forecast, by Category (Clothes & Sports, Travel, Electronics, Others), Payment Method (Bank Transfer, Card, D-Wallet, & Others), Bank Analysis" This form of electronic payment, which does not include the use of cheques or cash, is classified as an e-commerce electronic payment mechanism and is often referred to as an online or mobile payment network. If an individual buys goods and services online, they pay for them via an electronic platform. By and paperwork, shipping costs, and labour costs, paperless e-commerce systems has revolutionized payment collection. These platforms are often user-friendly, require less time than manual processes, and allow businesses to broaden their consumer base. The most frequently used e-commerce payment systems are credit/debit cards, smart cards, money payments, mobile, or online banking. According to Renub Research Report, the United Kingdom Ecommerce Payment Market is projected to hit US$ 203.08 Billion by 2026.

The e-commerce market in the United Kingdom continues to witness fast growth, dynamism with innovation. In the UK, the most popular option for shoppers is to use a credit card. Cards (both debit and credit) continue to be the most common payment form in the e-commerce world. The growth rate in mobile commerce makes it impossible to neglect this sector. It is expected to outpace total e-commerce growth in the United Kingdom.

Due to advanced technologies and a dynamic payments industry, the UK is, without a doubt, a big e-commerce market that tends to set standards for others to follow. The widespread and increasing customer adoption of technology and smart devices is driving this growth. In the United Kingdom, more than 95% of households today have a cell phone. Companies in the United Kingdom seek to make payment systems more user-friendly so that users do not feel intimidated when shopping on the internet by reducing the number of fraudulent purchases with advanced security features.

COVID-19's Effect on United Kingdom E-Commerce Payment Market

This pandemic had a considerable impact on the UK's eCommerce payment market. In the year 2020, online sales of food and grocery products are projected to rise dramatically. People were hesitant to leave their house due to the coronavirus, so they focused more on home delivery of products through online ordering.

Market Summary:

By Category: This research report covers the market of Travel and Holiday Accommodation, Tickets for Events, Clothes & Sports Goods, Books/ Magazines/ Newspapers, Computer Software, Household Goods, Food/ Groceries, Films and Music, Electronic Equipments, Computer Hardware, Medicines, Others.

By Payment Method: The market of Digital Wallets, Bank Transfer, Cash, Card, Direct Debit and Others are covered in this research report.

By Digital Wallet: This research report covers the analysis of AmazonPay Paypal, SamsungPay, & GooglePay in this report.

By Bank Analysis: Company Overview, Products/Initiatives and Financial Insight of Barclays, HSBC, Royal Bank of Scotland & Santander, Lioyd Banking Group are given in this research report.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com