Thailand Fertilizer Market Forecast 2025–2033

Buy NowThailand Fertilizer Market Size

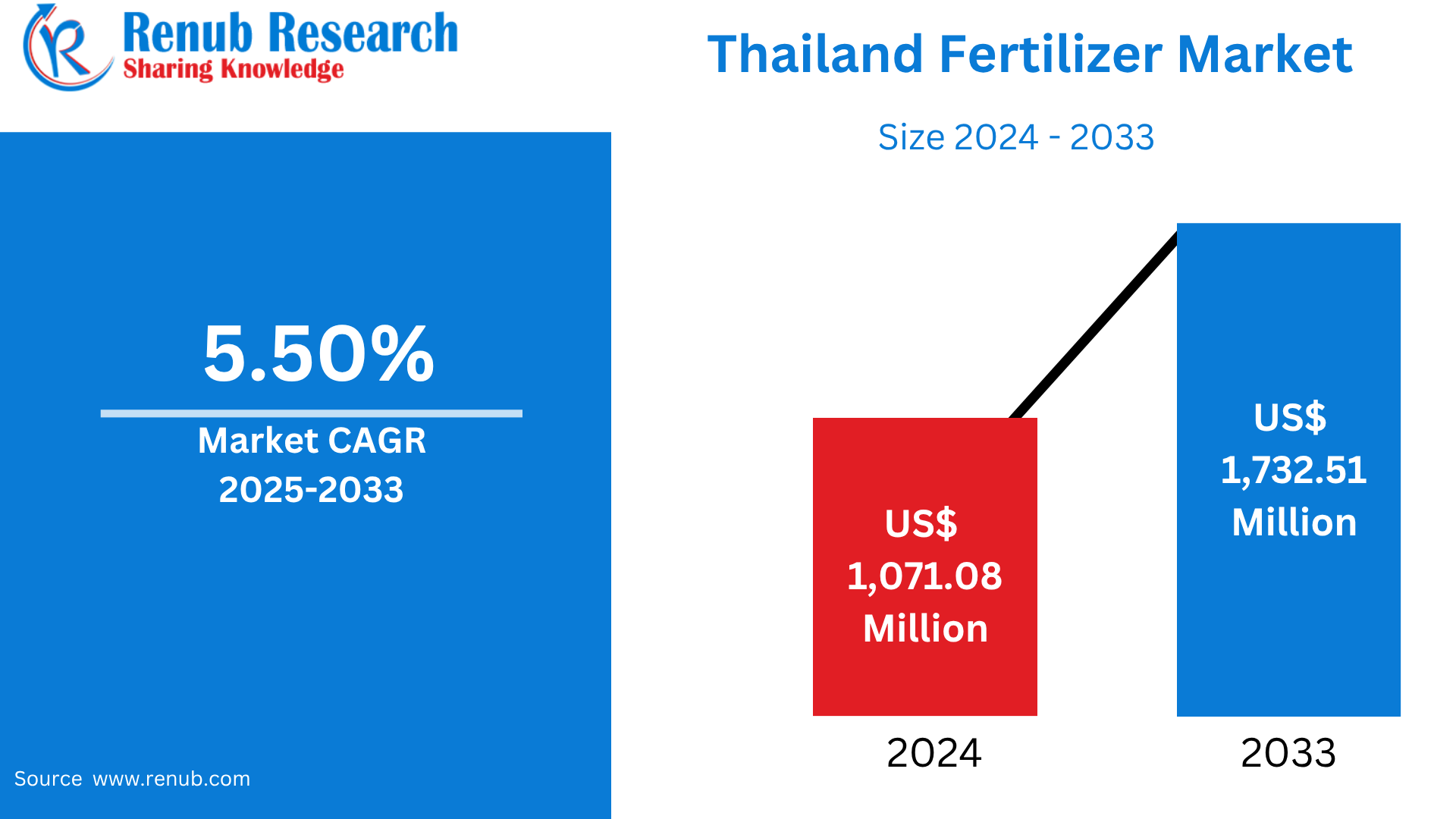

Thailand Fertilizer Market is expected to reach US$ 1,732.51 million by 2033 from US$ 1,071.08 million in 2024, with a CAGR of 5.50% from 2025 to 2033. Growths in agricultural demand, government subsidies, increasing consumption of food, the employment of improved farming practices, export-oriented crops, and farmers' increasing knowledge of soil health, productivity, and the benefits of balanced fertilizer application all contribute to driving Thailand's fertilizer market's growth.

Thailand Fertilizer Market Report by Category (Organic, Inorganic), Product Type (Nitrogen Fertilizers ((Ammonia (N), Ammonium Nitrate (N), Ammonium Phosphate (N), Ammonium Sulphate (N), Calcium Ammonium Nitrate (N), Potassium Nitrate (N), Urea (N), Urea Ammonium Nitrate (N), NK (N), NPK (N), NP (N), Others)), Phosphate Fertilizers, Potash Fertilizers), Microorganism (Azospirillum, Cyanobacteria, Phospate-Solublizing Bacteria, Azolla, Aulosira, Rhizobium, Azotobacter, Other), Organic Residues (Farm Yard Manure, Crop Residue, Green Manure, Other Products), Application (Agriculture, Horticulture, Gardening, Others), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others), Form (Dry, Liquid) and Company Analysis 2025-2033.

Thailand Fertilizer Industry Overview

Fertilizers are chemicals applied to plants or soil to deliver essential nutrients that ensure healthy growth and increase crop yields. They may be artificial (inorganic), prepared by chemical processes, or organic, such as manure and compost. Besides secondary and micronutrients, fertilizers typically contain basic nutrients like nitrogen (N), phosphorous (P), and potassium (K), or NPK. Fertilizers stimulate plant growth, increase food production, and ensure sustainable agriculture through the replenishment of soil fertility. Agricultural success over the long term, nevertheless, is contingent on judicious and balanced use since overload or misapplication may lead to environmental issues like soil degradation and water pollution.

Increased agricultural needs, technology advancements, and favorable government policies are also the contributing factors for the growth of Thailand's fertilizer market. Farmers are being motivated towards the use of fertilizers for increased yields by initiatives from the government, like subsidies and favorable support for sustainable agricultural practices. The demand for specialized fertilizers that are appropriate to specific crop and soil conditions is boosted by the development of precision agriculture and other advanced practices. Fertilizer application is additionally facilitated by increasing knowledge of balanced fertilizer nutrition management and soil health. Increasing productivity per hectare is also necessary in Thailand because of increasing population and finite levels of arable land. Market expansion is also highly supported by the country's strong agricultural export sector and the revolution in agriculture through technology.

Growth Drivers for the Thailand Fertilizer Market

Technological Advancements

The fertilizer industry of Thailand is hugely driven by technological advancements, which enhance agricultural efficiency and sustainability. Variable-rate application and GPS-guided equipment are two precision farming technologies that enable customized use of fertilizers, enhancing nutrient delivery and reducing wastage. Artificial intelligence (AI) integration assists in precise pest management and fertilizer application through real-time monitoring and predictive analysis. In addition, the deployment of automated systems and drones makes fertilizer distribution easier, improving coverage, while reducing labor costs. These trends advance sustainable farming practices and assist the fertilizer industry in its expansion in alignment with Thailand's Bio-Circular-Green (BCG) economic model.

Increasing Awareness about Soil Health

Among the most influential factors driving the growth of the fertilizer industry in Thailand is increasing concern over soil health. In a bid to enhance soil fertility and reduce their use of chemical inputs, farmers are adopting sustainable practices such as crop rotation, conservation tillage, and organic fertilization. Initiatives such as Thailand's Volunteer Soil Doctors Program supported by the Land Development Department aim to educate farmers on organic farming practices and soil conservation. The country's Bio-Circular-Green (BCG) Economy Model, supportive of sustainable agriculture, aligns with this shift toward cleaner approaches. Consequently, there has been increased demand for bio-based and organic fertilizers, which is facilitating market expansion. These developments indicate the rising awareness that soil health plays a vital role in both environmental sustainability and farm production.

Government Support

Thailand's fertilizer industry is expanding thanks in great measure to government support, which is designed to boost farm output and ensure farmer affordability. The government of Thailand introduced a co-payment scheme in June 2024 for over 4 million individuals that cultivate rice with fertilizer cost. The scheme makes financing assistance readily accessible by applying the Bank for Agriculture and Agricultural Cooperatives mobile app. Fertilizer suppliers will be requested to collaborate to harmonize prices to help stabilize the market and assuage long-standing concerns regarding price fluctuations. In addition, infrastructural upgrades, soft loans, and government subsidies encourage fertilizer use and sustainable agriculture. The initiatives advance farmers' livelihoods, encourage market growth, and enhance environmentally friendly farming in accordance with Thailand's wider Bio-Circular-Green (BCG) Economy Model.

Challenges in the Thailand Fertilizer Market

Price Volatility

Thailand's fertilizer market is severely impacted by volatility, mainly because of its high reliance on imported raw materials. Fertilizer prices are directly impacted by global variables such energy price surges, currency volatility, and geopolitical conflicts. For example, the Russia-Ukraine conflict has caused supply chain instability and higher pricing. Farmers' budgets are strained by these erratic price fluctuations, which lower fertilizer affordability and consumption, particularly for smallholders. Long-term planning and agricultural investment are similarly impacted by this unpredictability. Policy measures including strategic reserves, diversified sourcing, and support programs are necessary to address this problem in order to stabilize prices and safeguard the farming community.

Climate Variability

Thailand's fertilizer business faces significant challenges due to climate fluctuation, which impacts both supply and demand. Droughts, floods, and erratic rainfall caused by El Niño and other irregular weather patterns interrupt agricultural cycles and decrease the effectiveness of fertilizer application. Farmers may be reluctant to purchase fertilizers as a result of these circumstances since they may cause nutrient runoff, reduced soil fertility, and decreased crop yields. Extreme weather conditions can also cause distribution delays and infrastructural damage. Demand consequently becomes erratic, which affects the stability of the market. Adaptive farming methods, climate-resilient infrastructure, and weather-informed fertilizer programs are crucial for maintaining agricultural productivity in order to reduce these hazards.

Recent Developments in Thailand Fertilizer Industry

- August 2024: In Thailand, Sojitz Corporation has formed Sojitz Kaset Dee X Co., Ltd. (KDX) as a subsidiary of its agricultural platform. In the fall of 2024, Sojitz intends to start offering and selling farming services to cassava farmers through KDX, its entry into the agricultural platform industry. By developing KDX's farming services, Sojitz hopes to improve farming sustainability and efficiency, which will ultimately increase farmer wealth.

Thailand Fertilizer Market Segments:

Category

- Organic

- Inorganic

Mode of Application

- Nitrogen Fertilizers

- Ammonia (N)

- Ammonium Nitrate (N)

- Ammonium Phosphate (N)

- Ammonium Sulphate (N)

- Calcium Ammonium Nitrate (N)

- Potassium Nitrate (N)

- Urea (N)

- Urea Ammonium Nitrate (N)

- NK (N)

- NPK (N)

- NP (N)

- Others

- Phosphate Fertilizers

- Potash Fertilizers

Microorganism

- Azospirillum

- Cyanobacteria

- Phospate-Solublizing Bacteria

- Azolla

- Aulosira

- Rhizobium

- Azotobacter

- Other

Organic Residues

- Farm Yard Manure

- Crop Residue

- Green Manure

- Other Products

Application

- Agriculture

- Horticulture

- Gardening

- Others

Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Form

- Dry

- Liquid

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- Yara International ASA

- NFC Public Company Limited

- Chai Thai Co. Ltd

- Thai Central Chemical Public Company Limited

- Haifa Group

- SAKSIAM GROUP

- ICL Group Ltd

- Rayong Fertilizer Trading Company Limited (UBE Group)

- Grupa Azoty S.A. (Compo Expert)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Category, Product Type, Application, Crop Type and Form |

| Application Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Thailand Fertilizers Market

5.1 Historical Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Category

6.2 By Product Type

6.3 By Application

6.4 By Crop Type

6.5 By Form

7. Category

7.1 Organic

7.1.1 Historical Trends

7.1.2 Market Forecast

7.2 Inorganic

7.2.1 Historical Trends

7.2.2 Market Forecast

8. Product Type

8.1 Nitrogen Fertilizers

8.1.1 Ammonia (N)

8.1.1.1 Historical Trends

8.1.1.2 Market Forecast

8.1.2 Ammonium Nitrate (N)

8.1.2.1 Historical Trends

8.1.2.2 Market Forecast

8.1.3 Ammonium Phosphate (N)

8.1.3.1 Historical Trends

8.1.3.2 Market Forecast

8.1.4 Ammonium Sulphate (N)

8.1.4.1 Historical Trends

8.1.4.2 Market Forecast

8.1.5 Calcium Ammonium Nitrate (N)

8.1.5.1 Historical Trends

8.1.5.2 Market Forecast

8.1.6 Potassium Nitrate (N)

8.1.6.1 Historical Trends

8.1.6.2 Market Forecast

8.1.7 Urea (N)

8.1.7.1 Historical Trends

8.1.7.2 Market Forecast

8.1.8 Urea Ammonium Nitrate (N)

8.1.8.1 Historical Trends

8.1.8.2 Market Forecast

8.1.9 NK (N)

8.1.9.1 Historical Trends

8.1.9.2 Market Forecast

8.1.10 NPK (N)

8.1.10.1 Historical Trends

8.1.10.2 Market Forecast

8.1.11 NP (N)

8.1.11.1 Historical Trends

8.1.11.2 Market Forecast

8.1.12 Others

8.1.12.1 Historical Trends

8.1.12.2 Market Forecast

8.2 Phosphate Fertilizers

8.2.1 Historical Trends

8.2.2 Market Forecast

8.3 Potash Fertilizers

8.3.1 Historical Trends

8.3.2 Market Forecast

8.4 Microorganism

8.4.1 Azospirillum

8.4.1.1 Historical Trends

8.4.1.2 Market Forecast

8.4.2 Cyanobacteria

8.4.2.1 Historical Trends

8.4.2.2 Market Forecast

8.4.3 Phospate-Solublizing Bacteria

8.4.3.1 Historical Trends

8.4.3.2 Market Forecast

8.4.4 Azolla

8.4.4.1 Historical Trends

8.4.4.2 Market Forecast

8.4.5 Aulosira

8.4.5.1 Historical Trends

8.4.5.2 Market Forecast

8.4.6 Rhizobium

8.4.6.1 Historical Trends

8.4.6.2 Market Forecast

8.4.7 Azotobacter

8.4.7.1 Historical Trends

8.4.7.2 Market Forecast

8.4.8 Other

8.4.8.1 Historical Trends

8.4.8.2 Market Forecast

8.5 Organic Residues

8.5.1 Farm Yard Manure

8.5.1.1 Historical Trends

8.5.1.2 Market Forecast

8.5.2 Crop Residue

8.5.2.1 Historical Trends

8.5.2.2 Market Forecast

8.5.3 Green Manure

8.5.3.1 Historical Trends

8.5.3.2 Market Forecast

8.5.4 Other Products

8.5.4.1 Historical Trends

8.5.4.2 Market Forecast

9. Application

9.1 Agriculture

9.1.1 Historical Trends

9.1.2 Market Forecast

9.2 Horticulture

9.2.1 Historical Trends

9.2.2 Market Forecast

9.3 Gardening

9.3.1 Historical Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Historical Trends

9.4.2 Market Forecast

10. Crop Type

10.1 Cereals & Grains

10.1.1 Historical Trends

10.1.2 Market Forecast

10.2 Oilseeds & Pulses

10.2.1 Historical Trends

10.2.2 Market Forecast

10.3 Fruits & Vegetables

10.3.1 Historical Trends

10.3.2 Market Forecast

10.4 Others

10.4.1 Historical Trends

10.4.2 Market Forecast

11. Form

11.1 Dry

11.1.1 Historical Trends

11.1.2 Market Forecast

11.2 Liquid

11.2.1 Historical Trends

11.2.2 Market Forecast

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Yara International ASA

14.1.1 Key Persons

14.1.2 Overview

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 NFC Public Company Limited

14.2.1 Key Persons

14.2.2 Overview

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 Chai Thai Co. Ltd

14.3.1 Key Persons

14.3.2 Overview

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 Thai Central Chemical Public Company Limited

14.4.1 Key Persons

14.4.2 Overview

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Haifa Group

14.5.1 Key Persons

14.5.2 Overview

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 SAKSIAM GROUP

14.6.1 Key Persons

14.6.2 Overview

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 ICL Group Ltd

14.7.1 Key Persons

14.7.2 Overview

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 Rayong Fertilizer Trading Company Limited (UBE Group)

14.8.1 Key Persons

14.8.2 Overview

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

14.9 Grupa Azoty S.A. (Compo Expert)

14.9.1 Key Persons

14.9.2 Overview

14.9.3 Recent Development & Strategies

14.9.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com