Global Spectrum Analyzer Market Size and Growth Trends nd Forecast Report and Companies Analysis 2025-2033

Buy NowSpectrum Analyzer Market Size and Forecast 2025-2033

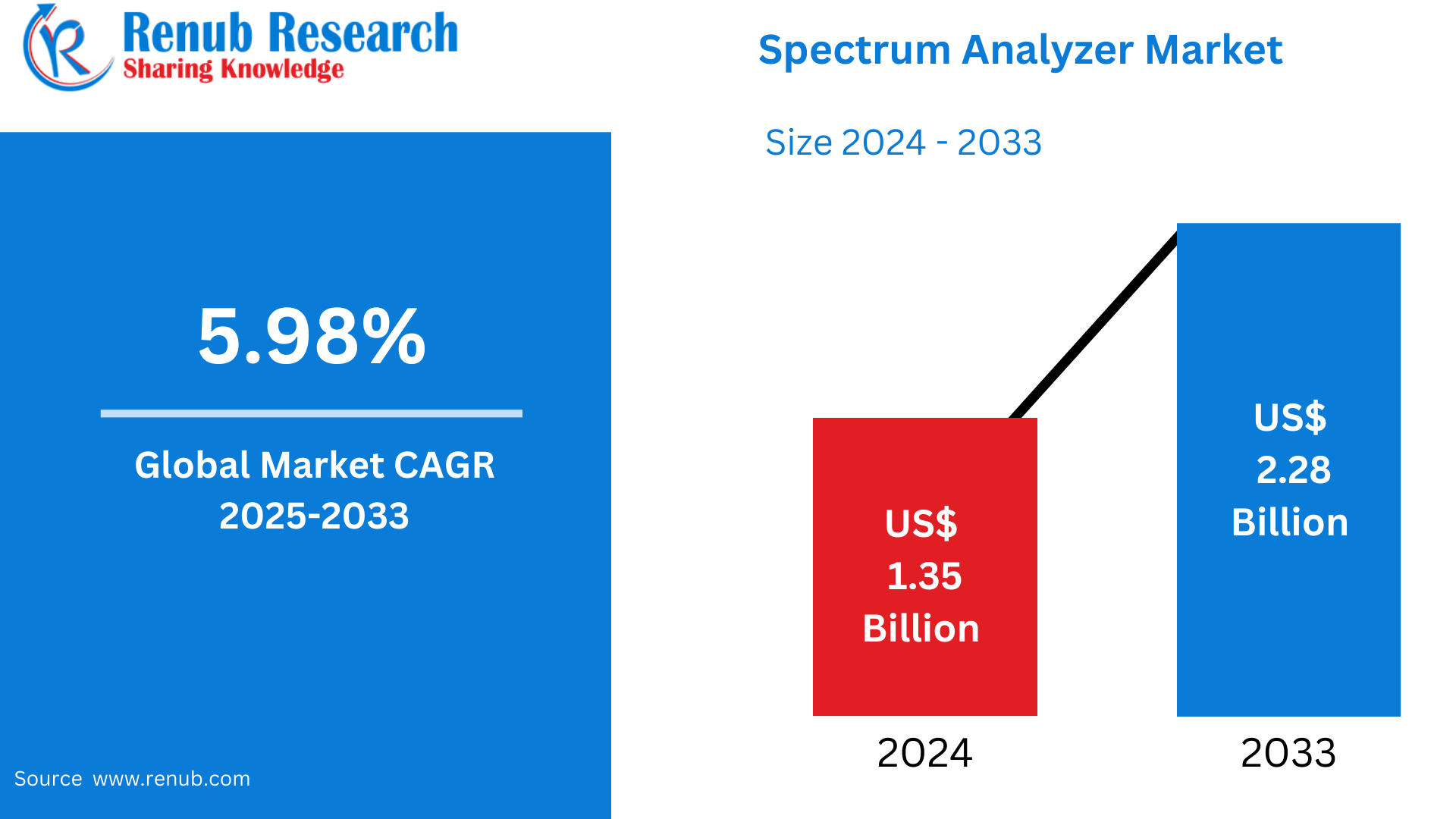

Global Spectrum Analyzer Market is expected to reach US$ 2.28 billion by 2033 from US$ 1.35 billion in 2024, with a CAGR of 5.98% from 2025 to 2033. The increased emphasis on bolstering the military and defense sector, the growing telecommunications sector and availability of 5G connections, and the growing need for high frequency electronic equipment are all contributing factors to the market's continuous rise.

Spectrum Analyzer Global Market Report by Offering (Hardware, Software), Form Factor (Handheld spectrum Analyzer, Portable Spectrum Analyzer, Benchtop Spectrum Analyzer), Network Technology (Wired, Wireless), Application (Telecom, Optical Communication, Radar & Radio Processing, Digital Signal Processing, Networks, Others), Countries and Company Analysis, 2025-2033.

Global Spectrum Analyzer Industry Overview

The increasing need for sophisticated testing and measuring tools in the electronics, defense, aerospace, and telecommunications industries is driving the steady growth of the worldwide spectrum analyzer market. In order to examine signal frequencies and make sure wireless systems are operating efficiently and legally, spectrum analyzers are necessary. Key factors propelling market expansion include the introduction of 5G, the rise of IoT applications, and the expansion of consumer electronics. Spectrum analyzers that are software-based, smaller, and more portable are the result of technological breakthroughs. Although market share is dominated by North America and Asia-Pacific, usage is rising in emerging nations. The future of the industry is being shaped by ongoing innovation and integration with cloud platforms and artificial intelligence.

The market for spectrum analyzers has also been driven by the rise in the usage of electronic devices in a number of sectors. Modern testing and measuring tools are required to guarantee the functioning of more intricate and complex electrical systems. In order to preserve the high quality and dependability of electrical equipment, spectrum analyzers are widely used in manufacturing to find and fix any flaws or issues.

One major factor preventing the industry from growing is the high cost of spectrum analyzers. Small and medium-sized enterprises want more access to spectrum analyzers because of their high cost and knowledge requirements. Furthermore, the growing usage of software-defined radios and other software-based signal analysis technologies is expected to provide long-term challenges to the spectrum analyzer industry.

China is increasing its 5G network presence, according to a March 2023 announcement from the Ministry of Industry and Information Technology. Additionally, the nation is developing a plan for 6G research and development and is pushing local governments to accelerate industrial uses allowed by 6G. By 2030, China anticipates the commercial introduction of 6G systems.

Key Factors Driving the Spectrum Analyzer Market Growth

Developments in Technology

The market is expanding due to continuous developments in spectrum analyzer technology, including better real-time analysis, higher resolution, and wider frequency ranges. This approach is also being influenced by advancements in software-defined radio and digital signal processing. For example, the market share of spectrum analyzers increased in June 2021 when Signal Hound, a maker of RF test and measurement equipment, unveiled the BB60D, a six GHz real-time spectrum analyzer that significantly outperformed the industry standard BB60C.

Emergence of 5G Networks

The market is growing as a result of the rollout of 5G networks. For example, throughout 2023, 5G became available throughout India. In only one year, 5G availability jumped from around 28% in Q1 to 52% in Q4 2023, a gain of 23.9 percentage points. Spectrum analyzers are necessary for testing and improving new equipment when 5G networks are widely deployed. These gadgets provide signal integrity, frequency allocation management, and network performance enhancement. In the upcoming years, these factors are anticipated to drive the spectrum analyzer market.

Defense and Aerospace Needs

To guarantee the operation and security of vital systems including communication networks, radar, navigation, and electronic warfare instruments, the military and aerospace industries mainly depend on accurate and trustworthy signal analysis. In order to detect interference, maintain secure communication channels, and maximize system performance, spectrum analyzers are essential tools for detecting, measuring, and analyzing electromagnetic signals. Accurate spectrum monitoring is crucial in military operations since any disturbance in the signal might jeopardize the effectiveness of the mission. Radar and navigation systems in aircraft applications also need to function perfectly in a variety of environmental circumstances. The need for sophisticated spectrum analyzers in these high-stakes sectors is still being driven by the complexity of contemporary military technology and the expanding usage of wireless communication in strategic operations.

Challenges in the Spectrum Analyzer Market

High Cost of Advanced Equipment

The high price of sophisticated, high-frequency devices is one of the main obstacles facing the spectrum analyzer business. These gadgets frequently include state-of-the-art capabilities like wide bandwidth coverage, real-time analysis, and greater resolution, which raises their cost considerably. For small and mid-sized firms or university research organizations, investing in such pricey equipment might be financially demanding. The price generally includes extra software, upkeep, and training in addition to the gadget itself. This limits access for many groups who may benefit from such technologies but lack the resources to acquire them. As a result, the market sees delayed adoption in budget-conscious sectors, despite increased demand for signal analysis in various applications.

Complexity of Operation

Spectrum analyzers, particularly the more sophisticated types, are extremely complex devices that need specific skills to operate and interpret data correctly. It takes extensive training and experience to install these devices, interpret the data, and resolve problems since they examine a wide variety of signals. This becomes a major obstacle to utilize for companies without qualified staff. Inaccurate measurements or overlooked interference problems might emerge from improper usage, which compromises the validity of test results. This lack of technical know-how can cause projects to be delayed or increase dependency on outside services in industries where accuracy is crucial, such as telecommunications, aerospace, or military. Manufacturers are creating more user-friendly interfaces in an effort to remedy this, but many end users still find the learning curve difficult to overcome.

Spectrum Analyzer Market Overview by Regions

North America leads the spectrum analyzer market thanks to its robust technical infrastructure and the demand from the telecom and defense industries. Asia-Pacific grows quickly as a result of the deployment of 5G and growing electronics. Industrial applications in Europe sustain consistent demand, but growing digital use and investment in emerging countries indicate promise. The following provides a market overview by region:

United States Spectrum Analyzer Market

Due to its significant presence in the electronics, telecommunications, defense, and aerospace industries, the US market for spectrum analyzers plays a significant role in the worldwide test and measurement industry. Market development is supported by the increasing need for accurate signal monitoring in sophisticated communication systems, such as 5G and IoT technologies. Another important player is the U.S. defense sector, which depends on spectrum analyzers for electronic warfare systems, radar performance, and secure communication. The market is still being shaped by technological innovation, as seen by the move toward software-based and real-time analyzers that increase speed and flexibility. The United States continues to be at the forefront of spectrum analyzer development and application across a variety of high-tech industries because to its well-established infrastructure, highly qualified workforce, and top technological companies.

United Kingdom Spectrum Analyzer Market

The market for spectrum analyzers in the UK is expanding steadily due to developments in the electronics, defense, and telecommunications industries. The need for accurate spectrum analysis tools has increased due to the growing rollout of 5G networks and the proliferation of Internet of Things (IoT) devices. These gadgets are necessary for regulating frequency allocations, maximizing network performance, and guaranteeing signal integrity. Market expansion is further fueled by the UK's strict regulatory standards for spectrum management and significant emphasis on research and development. Furthermore, spectrum analyzers' capabilities are being improved by the use of artificial intelligence, which provides more accurate and efficient evaluations. In order to satisfy the changing demands of many sectors, major companies in the UK market are concentrating on innovation and technical developments. The UK is positioned as a major contributor to the European spectrum analyzer industry due to this dynamic terrain.

India Spectrum Analyzer Market

The market for spectrum analyzers in India is expanding significantly due to developments in the electronics, defense, and telecommunications industries. The need for accurate spectrum analysis tools has increased due to the quick development of 5G networks and the growing use of Internet of Things devices. These gadgets are necessary for regulating frequency allocations, maximizing network performance, and guaranteeing signal integrity. By promoting local production and technical innovation, the Indian government's programs, such "Digital India" and "Atmanirbhar Bharat," are further driving the market. The need for sophisticated testing apparatus is also being fueled by increased investments in R&D across a range of businesses. As a result, India's spectrum analyzer market is expected to rise steadily, making the nation a major force in the worldwide test and measurement sector.

United Arab Emirates Spectrum Analyzer Market

The market for spectrum analyzers in the United Arab Emirates is expanding significantly due to developments in the electronics, defense, and telecommunications industries. The need for accurate spectrum analysis tools has increased due to the quick development of 5G networks and the growing use of Internet of Things (IoT) devices. These gadgets are necessary for regulating frequency allocations, maximizing network performance, and guaranteeing signal integrity. Market expansion is further fueled by the UAE's strict regulatory standards for spectrum management and significant emphasis on research & development. Furthermore, spectrum analyzers' capabilities are being improved by the use of artificial intelligence, which provides more accurate and efficient evaluations. In order to satisfy the changing demands of many sectors, major companies in the UAE market are concentrating on innovation and technical developments.

Recent Developments in Spectrum Analyzer Industry

- In September 2024, Aaronia AG stated that it will be showcasing waveguide-based real-time spectrum analyzers at the European Microwave Week (EuMW) in Paris.

- The Site Master MS2085A Cable and Antenna Analyzer and the MS2089A with Integrated Spectrum Analyzer were introduced by Anritsu Corporation, a producer of test and measurement solutions, in May 2024.

Market Segmentations

Offering

- Hardware

- Software

Form Factor

- Handheld spectrum Analyzer

- Portable Spectrum Analyzer

- Benchtop Spectrum Analyzer

Network Technology

- Wired

- Wireless

Application

- Telecom

- Optical Communication

- Radar & Radio Processing

- Digital Signal Processing

- Networks

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- ADVANTEST CORPORATION

- AVCOM

- B&K Precision Corporation

- Cobham Limited

- Fortive Corporation

- Rohde & Schwarz

- Teledyne Technologies

- Yokogawa Electric Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Offering, By Form Factor, By Network Technology, By Application and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Spectrum Analyzer Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Spectrum Analyzer Market Share Analysis

6.1 By Offering

6.2 By Form Factor

6.3 By Network Technology

6.4 By Application

6.5 By Countries

7. Offering

7.1 Hardware

7.2 Software

8. Form Factor

8.1 Handheld spectrum Analyzer

8.2 Portable Spectrum Analyzer

8.3 Benchtop Spectrum Analyzer

9. Network Technology

9.1 Wired

9.2 Wireless

10. Application

10.1 Telecom

10.2 Optical Communication

10.3 Radar & Radio Processing

10.4 Digital Signal Processing

10.5 Networks

10.6 Others

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 ADVANTEST CORPORATION

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 AVCOM

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 B&K Precision Corporation

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 Cobham Limited

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Fortive Corporation

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 Rohde & Schwarz

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 Teledyne Technologies

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 Yokogawa Electric Corporation

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com