Global Radio Frequency Components Market Size and Growth Trends nd Forecast Report and Companies Analysis 2025-2033

Buy NowRadio Frequency Components Market Size and Forecast 2025-2033

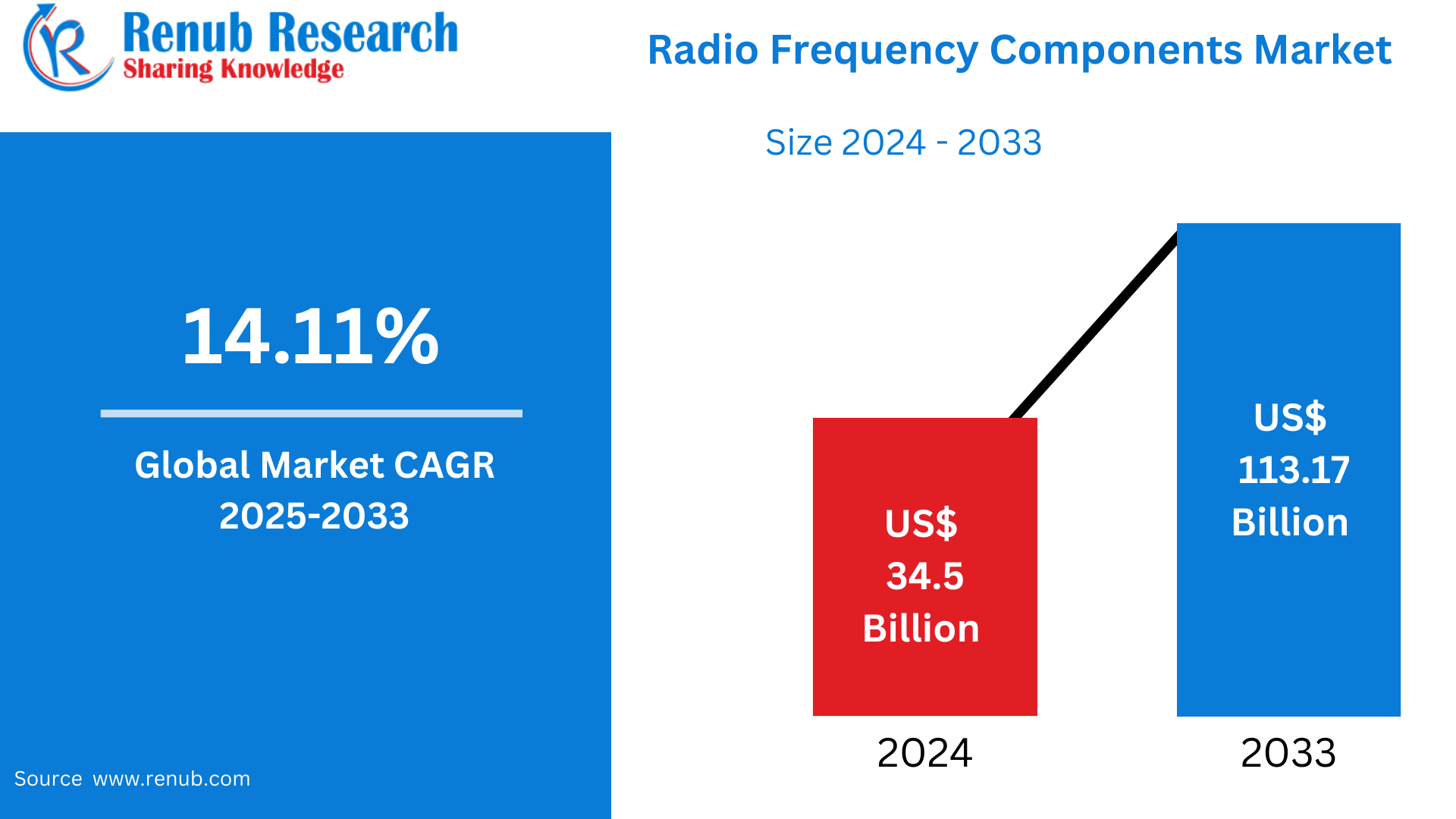

Radio Frequency Components Market is expected to reach US$ 113.17 billion by 2033 from US$ 34.5 billion in 2024, with a CAGR of 14.11% from 2025 to 2033. The introduction of fifth generation (5G) networks, new advancements in radio frequency (RF) technology, the growing usage of wireless communication technologies, and the growing use of RF components across a range of sectors, including aerospace, military, and automotive, are the main factors propelling the market.

Radio Frequency Components Global Market Report by Product (Filters, RF Amplifiers, RF Switches, Modulators & Demodulators, Duplexers, Mixers & Synthesizers, Others), Application (Consumer Electronics, Automotive, Military, Wireless Communication, Others), Countries and Company Analysis, 2025-2033.

Global Radio Frequency Components Industry Overview

A vital area of the electronics and telecommunications market, the worldwide radio frequency (RF) components business supports wireless communication systems in a variety of industries. In gadgets like smartphones, base stations, and satellite systems, these parts—which include amplifiers, filters, antennae, and oscillators—are crucial for signal transmission and reception. The expansion of mobile networks, the emergence of 5G technology, the growing need for connected devices, and the spread of IoT applications are the main factors propelling market growth. RF components are becoming essential to next-generation communication systems due to ongoing innovation in efficiency and downsizing as well as increased investments in telecom infrastructure.

Advanced radio frequency (RF) technologies for satellite communications (SATCOM) will become more and more necessary in both the military and the commercial sector. One especially ambitious project that calls for sophisticated RF engineering is SpaceX's global Wi-Fi project, which calls for the launch of over 42,000 satellites into orbit in order to provide wireless internet to people worldwide until 2020. These spacecrafts will use Ku and Ka-band frequencies between 10 and 30 GHz.

Additionally, the industry is driven by telecom's deployment of front-end modules. Ericsson estimates that 1903 million 5G mobile subscriptions will be made by 2024. Higher-end RF front-end modules and power amplifiers will be necessary for 5G base stations and smartphones to fulfill the demands of ever-more complex and effective communication performances. Compared to 4G models, the volumes of transceiver filters, RF switches, and PA devices required for 5G phones would increase tremendously. Additionally, compared to sub-6GHz versions, mmWave 5G smartphones would require more RF equipment, which will increase demand for AiP (antenna in the package) technology that can block mmWave signal interference.

Key Factors Driving the Radio Frequency Components Market Growth

Growth of Smart Devices and IoT

According to the GSMA's Mobile Economy 2024 research, there were around 3.5 billion licensed cellular IoT connections in 2023; by 2030, that number is expected to rise by 8% to surpass 5.8 billion. The demand for smart devices, such as lighting, industrial sensors, smart refrigerators, and thermostats, has skyrocketed with the introduction of the Internet of Things. These devices primarily use radio frequency (RF) components for wireless connection and data exchange. The rise of smart cities, home automation, and sophisticated industrial processes is driving up demand for RF components. For reliable communication and device interoperability, these industries need RF components that are small, effective, and long-lasting.

Growing Need for Connectivity and Data Transmission

Over 5.5 billion people, or over 69% of the world's population, had a mobile service subscription in 2023. Since 2015, this figure has risen by 1.6 billion. Similarly, in 2023, there were 4.7 billion mobile internet users, or 58% of the total population. Over the past eight years, there has been a 2.1 billion growth in the number of internet mobile users. Global consumer demand for improved connection and data transfer is driving the demand for effective and high-performing radio frequency components. These elements provide the best possible connectivity needed for a range of digital applications, such as cloud computing, streaming services, and remote work options. The most current edition of the Ericsson Mobility Report projects that by 2028, the average monthly data traffic per smartphone would have increased by 16% to 62 gigabytes. In the upcoming years, this trend is expected to increase demand for dependable and superior RF components, driving the market toward ongoing innovation and growth.

Wireless Communication Technology Adoption Is Growing

A major component of wireless communication systems is radio frequency (RF). They are widely utilized to offer excellent signal reception and transmission. To ensure a constant wireless connection, RF components are also used in Internet of Things (IoT) devices, smartphones, tablets, and home automation systems. Consequently, there will be a commensurate increase in demand for RF components. The need for RF components is being further bolstered by consumer demands for more bandwidth, enhanced network reliability, and decreased latency. The E7515W UXM Wireless Connectivity Test Platform for Wi-Fi, for example, was released by Keysight Technologies, Inc. to facilitate testing for devices that use Wi-Fi 7 technology, including 4x4 MIMO 320 MHz bandwidth. Without the need for extra equipment, this turnkey system can simulate hundreds of clients at once, which is three times more than current options.

Challenges in the Radio Frequency Components Market

Thermal Management Issues

In the market for radio frequency (RF) components, thermal management is a significant concern, especially when devices run at greater frequencies and power levels. During operation, RF components like transceivers, amplifiers, and filters can produce a significant amount of heat. Ineffective heat dissipation may result in decreased component lifespan, performance deterioration, or outright failure. Because there is less room for cooling systems in small or closely packed devices, controlling this heat becomes much more difficult. Furthermore, too much heat can raise power consumption and compromise signal integrity. Manufacturers must spend money on sophisticated thermal management designs and materials, such integrated cooling systems, heat sinks, and thermal interface materials, to solve this problem. However, doing so might increase the cost of products and complicate their development.

Technological Obsolescence

The market for RF components faces a serious problem with technological obsolescence since communication technologies are developing so quickly that new ideas must be developed constantly. Manufacturers are compelled to regularly update their products to satisfy new performance criteria, such as higher frequencies, faster data rates, and reduced latency, as a result of the 4G to 5G transition and the rise of 6G research. In order to build components that are compatible with changing network needs, a significant investment in research and development is necessary. Businesses that don't innovate run the danger of creating antiquated goods that don't satisfy consumer needs. This problem is further complicated by shorter product lifecycles and demand to shorten time-to-market. Accurately predicting future technological trends, adaptability, and ongoing learning are necessary to remain competitive.

Radio Frequency Components Market Overview by Regions

The market for radio frequency components is expanding rapidly in several important locations. North America is at the forefront of 5G rollout and sophisticated telecom infrastructure. Asia-Pacific comes next, propelled by growing mobile usage and electronics production. Demand is stable in Europe, but there is new opportunity in the Middle East and Africa. The following provides a market overview by region:

United States Radio Frequency Components Market

Rapid developments in wireless communication technologies, including 5G, the Internet of Things (IoT), and smart gadgets, are propelling the market for radio frequency (RF) components in the United States. The nation is a major center for the development of RF components because of its extensive telecommunications infrastructure, emphasis on innovation, and early acceptance of new technologies. For better connection, performance, and automation, key industries including consumer electronics, automotive, aerospace, and military are depending more and more on radio frequency (RF) technology. Market expansion is sustained by sustained investment in R&D as well as a robust ecosystem of manufacturers and IT firms. The United States continues to lead the world in RF innovation, impacting global market dynamics and forming global trends.

United Kingdom Radio Frequency Components Market

The market for radio frequency (RF) components in the United Kingdom is expanding rapidly due to the development of wireless communication technologies and the rising need for linked devices. The need for high-performance radio frequency (RF) components is being driven by the growth of 5G networks and the spread of Internet of Things (IoT) applications in a variety of industries, including as consumer electronics, healthcare, and automotive. Since radio frequency (RF) components are necessary for radar systems, satellite communications, and electronic warfare applications, the UK's significant aerospace and military industries also support the market's growth. Furthermore, the market's prospects are improved by government backing for infrastructural expansion and technical innovation. The UK is in a strong position to continue to be a major participant in the global market for RF components because of its emphasis on research and development.

India Radio Frequency Components Market

The market for radio frequency (RF) components in India is expanding quickly as a result of rising demand for sophisticated wireless communication systems. The extensive use of 5G networks, the proliferation of IoT devices, and the expansion of consumer electronics are some of the factors propelling the industry. To improve the performance of communication equipment, essential parts including switches, amplifiers, and RF filters are required. The government's encouragement of homegrown innovation and manufacture has also contributed to market growth. The industry must build a qualified workforce and deal with issues including spectrum congestion and technological improvements. The market is anticipated to continue developing with substantial investment and development possibilities in spite of these challenges.

United Arab Emirates Radio Frequency Components Market

The market for radio frequency (RF) components in the United Arab Emirates is growing quickly due to the rising need for cutting-edge communication technologies including satellite systems, 5G, and the Internet of Things. great-performance radio frequency (RF) components, such as filters, amplifiers, and switches, are in great demand to improve wireless communication networks as the United Arab Emirates positions itself as a technology powerhouse in the Middle East. Significant investments in digital infrastructure and smart city projects, which mostly rely on state-of-the-art radio frequency technology, further strengthen the industry. The expansion of industries like consumer electronics, defense, and telecommunications is also a major factor in increasing the need for RF components, indicating a vibrant and competitive market going forward.

Market Segmentations

Product

- Filters

- RF Amplifiers

- RF Switches

- Modulators & Demodulators

- Duplexers

- Mixers & Synthesizers

- Others

Application

- Consumer Electronics

- Automotive

- Military

- Wireless Communication

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Analog Devices, Inc

- Broadcom, Inc.

- Fujitsu Limited

- Gotmic AB

- IQE plc

- Knowles Corporation

- MACOM Technology Solutions Holdings, Inc.

- Marki Microwave, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product, By Application and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Radio Frequency Components Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Radio Frequency Components Market Share Analysis

6.1 By Product

6.2 By Application

6.3 By Countries

7. Product

7.1 Filters

7.2 RF Amplifiers

7.3 RF Switches

7.4 Modulators & Demodulators

7.5 Duplexers

7.6 Mixers & Synthesizers

7.7 Others

8. Application

8.1 Consumer Electronics

8.2 Automotive

8.3 Military

8.4 Wierless Communication

8.5 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Analog Devices, Inc

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Broadcom, Inc.

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Fujitsu Limited

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Gotmic AB

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 IQE plc

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Knowles Corporation

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 MACOM Technology Solutions Holdings, Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 Marki Microwave, Inc.

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com