Saudi Arabia OTC Artificial Tears Market – Demand & Forecast 2025–2033

Buy NowSaudi Arabia OTC Artificial Tears Market Size and Forecast 2025-2033

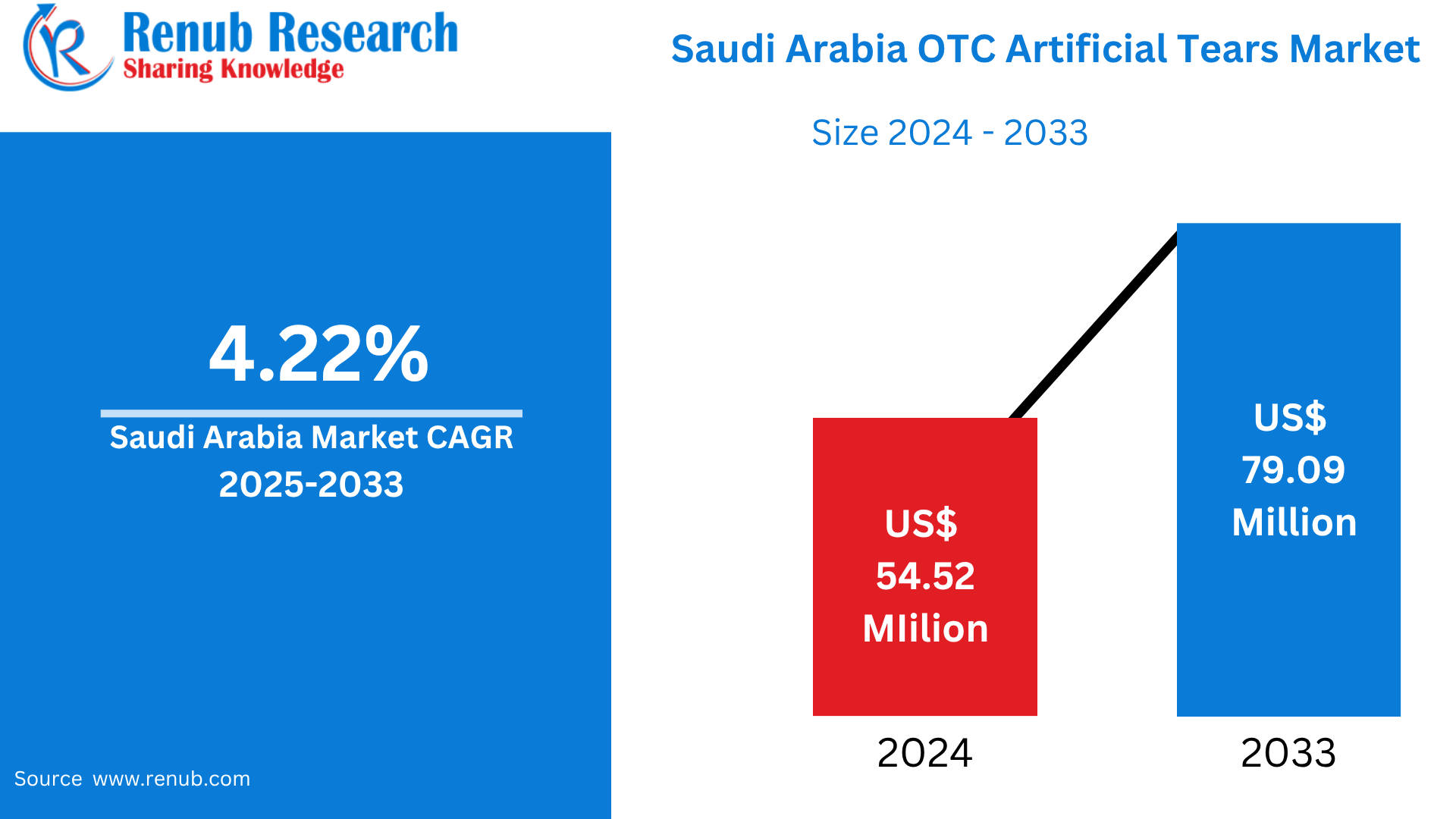

Saudi Arabia OTC Artificial Tears Market is expected to reach US$ 79.09 million by 2033 from US$ 54.52 million in 2024, with a CAGR of 4.22% from 2025 to 2033. The growing elderly population, rising incidence of dry eye syndrome, increased usage of screens, improving awareness of eye health, increasing number of retail pharmacies, favorable healthcare policies, and the improving demand for convenient, non-prescription eye drops are all contributing factors to the growth of the OTC artificial tears market in Saudi Arabia.

Saudi Arabia OTC Artificial Tears Market Report by Product Type (Solution, Ointment, Emulsion, Gel, Spray Solution, Suspensions), Application (Dry Eye Syndrome, Allergies, Infections, UV and Blue Light Protection, Contact Lens Moisture Retention, Others), Distribution Channel (Drugstores & Supermarkets, Online Pharmacies, Retail Pharmacies, Others) and Company Analysis 2025-2033.

Saudi Arabia OTC Artificial Tears Market Overview

Over-the-counter (OTC) artificial tears in the form of non-prescription eye drops treat dryness and irritation caused by the insufficient production of tears. They moisten and lubricate the eye surface by mimicking natural tears. Artificial tears, which are commonly employed for burning, itching, and grittiness in the eyes, are employed for the treatment of dry eye syndrome, computer vision syndrome, environmental irritation, and contact lens irritation. They come in a range of formulations, such as preservative-free versions for sensitive eyes. Over-the-counter (OTC) artificial tears without a prescription are an easy first-line treatment option for mild, moderate, and even more severe dry eye symptoms and can be easily accessed in pharmacies and retail stores.

The market for over-the-counter artificial tears is increasingly expanding due to various significant causes. The increasing prevalence of dry eye syndrome, spurred on by aging populations, greater use of screens, and environmental conditions such as dry climate and pollution of the air, is a strong contributory factor. There are more people using over-the-counter solutions for simple, self-administered treatment now that awareness of eye health is greater. Formulations are becoming safer and more appealing through innovation, such as preservative-free and biocompatible options, particularly for sensitive individuals. OTC artificial tears are also gaining popularity and ease of use with improved packaging and delivery systems and greater availability through retail and online pharmacies.

Growth Drivers for the Saudi Arabia OTC Artificial Tears Market

Rising Prevalence of Dry Eye Conditions

Increased incidence of dry eye disorders is one of the key drivers fueling the Saudi Arabian market for over-the-counter artificial tears. Based on a 2022 survey known as the Twaiq Mountain Eye Study, 16.4% of Saudi individuals with DED have severe symptoms, and 49.5% of them had the disease in general. Dryness of the ocular surface is exacerbated by the country's dry climate, excessive air pollution, and widespread air conditioning use, among other contributing factors. Additionally, 39.76% of Saudi Arabian students of health sciences who were involved in a PubMed study indicated symptoms such as dry eyes caused by digital eye strain. These findings validate the increasing reliance of consumers on non-prescription eye care products like artificial tears.

Consumer Preference for Non-Prescription Solutions

The Saudi Arabian market for non-prescription artificial tears is expanding primarily because of consumer preference for non-prescription remedies. To relieve mild to moderate eye irritation, an increasing number of individuals are reaching for over-the-counter remedies due to growing self-care information and awareness of the eye. OTC artificial tears, which dispense with the need for prescription medication and visits to clinics, are easy and affordable, which makes them a contributing factor. Moreover, customers are looking for quick, convenient solutions because of the embarrassment surrounding repeated doctor visits for minor illnesses. E-commerce stores and retail drugstores enable this trend by providing a wide array of artificial tears products conveniently accessible. This shift is in line with wider trends in consumer health emphasizing proactive wellness management and self-reliance.

Expansion of Retail and Online Distribution Channels

The Saudi Arabian market for non-prescription artificial tears is expanding rapidly due to the expansion of retail and online channels for distribution. The number and range of pharmacies and optical stores distributing eye care products have increased tremendously due to the country's Vision 2030 initiative, which has led to huge investments in the retail sector. For both urban and rural areas, the expansion enhances consumer convenience to eye care items, including artificial tears. Secondly, the rise of e-commerce sites has transformed the retail market by allowing customers to easily purchase eye care products from home. The sector is expanding due to the fact that online pharmacies often offer a broader product array, competitive prices, and detailed product information.

Challenges in the Saudi Arabia OTC Artificial Tears Market

Regulatory Hurdles

One major obstacle in the Saudi Arabian market for over-the-counter artificial tears is regulatory barriers. The distribution and certification of eye care goods, including artificial tears, are subject to stringent rules. Local health regulations must be followed by manufacturers, which can be expensive and time-consuming. Furthermore, delays in product releases or modifications to packaging and labeling may result from periodic changes in regulatory requirements. Both domestic and foreign firms wishing to enter the market may encounter obstacles due to these regulatory complications, which could limit product variety and raise consumer costs. In the long run, these difficulties can impede innovation and market growth.

High Competition

In the Saudi Arabian market for over-the-counter artificial tears, fierce competition is a major obstacle. Due to the abundance of local and foreign brands on the market, there is fierce competition for consumers' attention. To stand out, businesses must make significant investments in price, product uniqueness, and marketing as a result of this saturation. Additionally, it may be challenging for new or smaller businesses to acquire momentum when there are well-known, worldwide brands present. Competition is heightened by consumers' price sensitivity, as companies compete to provide the best value without sacrificing product quality. This pressure from competitors may reduce profit margins and impede market expansion.

Saudi Arabia OTC Artificial Tears Market Segments:

Product Type

- Solution

- Ointment

- Emulsion

- Gel

- Spray Solution

- Suspensions

Application

- Dry Eye Syndrome

- Allergies

- Infections

- UV and Blue Light Protection

- Contact Lens Moisture Retention

- Others

Distribution Channel

- Drugstores & Supermarkets

- Online Pharmacies

- Retail Pharmacies

- Others

All companies have been covered from 4 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- Sales Analysis

Key Players Analysis

- AbbVie Inc.

- Akorn Inc.

- Alcon

- Bausch Health Companies Inc.

- Johnson & Johnson

- Nicox S.A.

- Novartis AG

- Santen Pharmaceutical Co. Ltd.

- Sun Pharmaceutical Industries Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By Product Type, By Application and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia OTC Artificial Tears Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Application

6.3 By Distribution Channel

7. Product Type

7.1 Solution

7.2 Ointment

7.3 Emulsion

7.4 Gel

7.5 Spray Solution

7.6 Suspensions

8. Application

8.1 Dry Eye Syndrome

8.2 Allergies

8.3 Infections

8.4 UV and Blue Light Protection

8.5 Contact Lens Moisture Retention

8.6 Others

9. Distribution Channel

9.1 Drugstores & Supermarkets

9.2 Online Pharmacies

9.3 Retail Pharmacies

9.4 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 AbbVie Inc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Akorn Inc.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Alcon

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Bausch Health Companies Inc.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Johnson & Johnson

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Nicox S.A.

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Novartis AG

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Santen Pharmaceutical Co. Ltd.

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Sun Pharmaceutical Industries Ltd.

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com