Global Ammunition Market – Industry Forecast 2025–2033

Buy NowAmmunition Market Size and Forecast 2025-2033

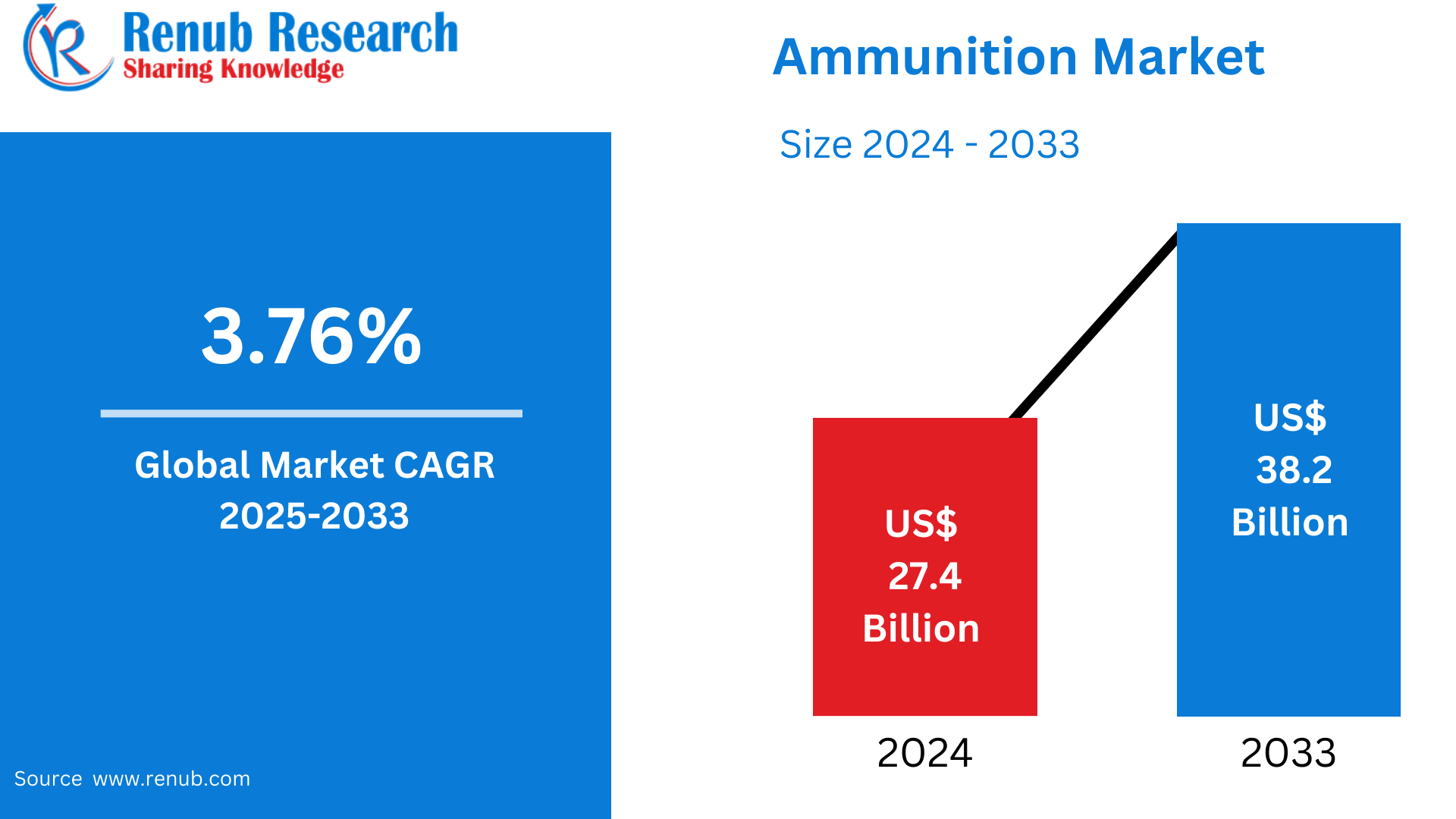

Ammunition Market is expected to reach US$ 38.2 billion by 2033 from US$ 27.4 billion in 2024, with a CAGR of 3.76% from 2025 to 2033. Technological developments and shifting military needs are causing a major upheaval in the ammunition sector. The development of advanced ammunition with improved lethality, range, and precision while minimizing collateral damage is the main emphasis of major defense companies.

Ammunition Global Market Report by Caliber (Small Caliber, Large Caliber, Medium Caliber, Rockets, Missiles & Other), Product (Rimfire, Centerfire), End Use (Civil & Commercial, Defense), Countries and Company Analysis, 2025-2033.

Global Ammunition Industry Overview

Government initiatives and collaborations to support munitions technology research and innovation are driving the market's expansion. Additionally, countries are still encouraged to emphasize self-sufficiency by geopolitical difficulties, while cross-border cooperation improve industrial capacity and bring in technical experience. Since the need for defense products is still high worldwide, these changes point to a clear transition towards autonomous, robust defense supply chains and improved regional collaboration, setting up the ammunition industry for robust growth in the years to come. Additionally, nations are aggressively funding initiatives to improve technology advancements in their defense industries and fortify ammunition supply networks. As countries increase their capacity for domestic manufacturing to improve defense readiness, the market is seeing a sharp increase in demand for products.

Due to significant expenditures in domestic production and growing defense activities, the US industry is seeing a profitable expansion in demand. To satisfy both local and foreign demands, major regional players are actively growing their manufacturing and establishing alliances. In September 2024, for example, Saab announced plans to build a new munitions complex in Grayling, Michigan, with an emphasis on precision fire systems and shoulder-fired munitions assembly. The purpose of this facility is to assist national security goals and greatly increase the capability of the United States to produce munitions. These events highlight the nation's strategic focus on increasing munitions production while meeting needs for global security.

Key Factors Driving the Ammunition Market Growth

Growing Interest in Precision-Guided Weapons (PGMs)

Combat solutions are being revolutionized by smart ammunition, which is outfitted with state-of-the-art technology like GPS, sensors, and data linkages. Because of their capacity to communicate with launch platforms and other systems, these bombs may alter their trajectory while in flight, increasing their accuracy and agility in changing combat scenarios. It is also anticipated that the use of automation and digitization into ammunition management would open up new development prospects for market players. For example, police in Odisha, India, introduced an electronic module for managing ammunition and weapons inventories in August 2024. Senior officers can keep an eye on the number of weapons in store in each of the state's police districts thanks to the e-module.

Additionally, 155 mm smart ammunition is being developed by the Indian Institute of Technology Madras in partnership with Munitions India, a defense public sector company. The goal is to make sure the ammunition has a 50% higher accuracy and a longer range than current rounds. These developments show a move toward more advanced, effective, and digitalized ammunition solutions, which is in line with major market trends for ammunition.

Growing Investments in R&D

Key manufacturers have made large expenditures in R&D projects, which presents opportunities for market expansion. Neighboring countries continue to take proactive steps by investing in defense infrastructure and enhancing their capacities to defend their borders as states demonstrate their military might to protect their sovereignty. Purchasing ammunition and weapon systems has taken up a significant amount of these defense expenditures. In an effort to boost its military sector, the European Union Commission set aside USD 537.2 million as of March 2024 to increase ammunition manufacturing. Around the world, this story is accurate, and it has given the munitions business more momentum.

These expenditures are motivated by the growing need to fulfill shifting needs, guarantee product accuracy, and gain a competitive edge in technical breakthroughs. For example, in order to meet local demand, enhance defense capabilities, and promote economic growth and jobs, Adani launched the biggest ammunition and missile complex in South Asia in February 2024 in Kanpur, India. The market demand is influenced by the growing requirement for more lethality, enhanced performance, and reduced weight in military and law enforcement applications. In addition, major firms' substantial R&D expenditures will support market expansion in the years to come.

Developments in Technology

Growing worldwide security concerns, especially in light of terrorism and continuing wars, are a major driver propelling the ammunition market's expansion. Governments are placing a higher priority on military readiness as countries struggle with the growing risks posed by insurgencies, cross-border conflicts, and internal instability. Defense budgets have increased as a result, which has increased demand for specialist weaponry and cutting-edge ammunition. Because precision-guided munitions (PGMs) reduce collateral damage and increase operating efficiency, there is an increasing need for high-performance, accurate, and dependable projectiles. PGMs consist of guided bombs and missiles with sophisticated targeting systems. The Israel Ministry of Defense placed an order with Elbit Systems in July 2024 for precision-guided mortar missiles valued at about USD 220 million. Using both immune GPS and laser guiding technology, these weapons are made to precisely kill targets. These advancements demonstrate the growing dependence on PGMs for precise and successful military operations.

Challenges in the Ammunition Market

Limited Political Instability and Market Uncertainty

Since demand is extremely unpredictable due to shifting geopolitical landscapes and fluctuating military expenditures, political instability and market uncertainty pose serious problems to the ammunition industry. Global crises, diplomatic changes, or domestic economic constraints can cause government priorities to alter quickly, leading to sudden increases or drops in procurement. For manufacturers, who have to balance production capacity with unpredictable future demands, this instability makes long-term planning challenging. Political unrest may also affect global trade regulations and erect obstacles to the import or export of raw materials and weaponry. In such a volatile climate, investors could be reluctant to make financial commitments, which would restrict innovation and growth. In order to manage this volatility, businesses in the munitions industry must continue to be flexible, keep a careful eye on world events, and have flexible production plans.

Supply Chain Disruptions

Disruptions to the supply chain are a big problem for the ammunition industry because they have a big effect on the price and availability of vital raw materials like lead, brass, and gunpowder. International logistics networks have been stressed by trade restrictions, pandemics, and international conflicts, which has resulted in shortages, delays, and higher shipping costs. Because so many firms depend on a small number of suppliers, the system is susceptible to regional volatility and bottlenecks. Production schedules might be hampered, productivity can be decreased, and businesses may have to pay more for alternative suppliers as a result of these delays. Additionally, long-term planning and inventory management are made more difficult by shifting material availability. Businesses are increasingly looking into alternate materials, strategic storage, and localized supply chains as ways to reduce these risks, although these approaches also present their own operational and financial difficulties.

Ammunition Market Overview by Regions

Regional differences exist in the ammunition business, with North America and Europe leading the way in both defense expenditure and technical development. While the Middle East and Africa have varying demand due to regional crises and instability, Asia-Pacific exhibits strong development as a result of growing military modernization. The following provides a market overview by region:

United States Ammunition Market

Ammunition for military, law enforcement, and civilian applications is a well-established and extremely varied industry in the United States. The market is driven by a strong culture of gun ownership and consistent defense spending, and it is always shifting to suit new needs. An important influence on product offers is civilian use, especially for hunting, shooting, and self-defense. As interest in clever and eco-friendly solutions grows, technological advancements are also having an impact on munitions creation. The market also has the advantages of a strong local industrial base, despite persistent obstacles such supply chain vulnerabilities, legal revisions, and regulatory monitoring. The American ammunition market is nevertheless robust and flexible overall, reacting to both local and international developments.

With more than 2.26 million soldiers, the nation has one of the biggest armed forces in the world. For a variety of tasks, the US military's deployment in more than 150 nations requires a steady supply of ammunition. A number of factors, like as military modernization initiatives, training needs, and involvement in NATO missions, influence the nation's demand for ammunition.

Germany Ammunition Market

Due to more defense spending and a greater emphasis on military modernization, Germany's ammunition industry is expanding significantly. To improve its defense capabilities, the nation is making large investments in cutting-edge weapons and ammunition. The development of precision-guided weapons and the growth of industrial facilities are examples of this tendency. Additionally, the need for civilian ammunition is rising, especially for recreational shooting and hunting. Small-caliber and large-caliber ammunition are among the various uses that define the German market, which serves both military and civilian purposes. With an emphasis on environmentally safe and biodegradable munitions solutions, the sector is also seeing technical breakthroughs. All things considered, the ammunition market in Germany is expected to continue expanding due to strategic investments and changing defense needs.

India Ammunition Market

Rising defense requirements and a focus on indigenous production are driving a continuous shift in India's ammunition business. Public and private sector involvement in ammunition research and supply has increased as a result of the government's emphasis on self-reliance in defense industry. A vast variety of goods, such as small, medium, and large-caliber ammunition for a range of military uses, are available on the market. Innovation in design and manufacturing efficiency are being propelled by modernization initiatives and technological breakthroughs. In order to lessen reliance on imports, there is also increased interest in fortifying the domestic supply chain. Although there are still issues with quality control, legal restrictions, and the demand for trained workers, the Indian ammunition industry is generally expected to develop steadily in the face of shifting defense and strategic goals.

United Arab Emirates Ammunition Market

Strategic defense spending and an emphasis on domestic production are driving the ammunition market's steady expansion in the United Arab Emirates. Modernization of the UAE's military industry is underway, with a focus on sophisticated artillery systems and precision-guided bombs. Both small and big caliber ammunition are in greater demand as a result of government efforts to strengthen regional influence and national security. The UAE has been actively working with international military corporations and investing in local manufacturing facilities in keeping with its goal of enhancing domestic capabilities. This strategy seeks to promote domestic technology developments and lessen dependency on imports. Because of this, the UAE ammunition market is expected to grow further, demonstrating the country's dedication to bolstering its defense capabilities.

Recent Developments in Ammunition Industry

- An MOU was signed in October 2024 between Hanwha and Ultra Intelligence & Communications (Ultra I&C) to enhance global defense capabilities. Through creative command and control architectures, the collaboration will combine Hanwha's K239 Chunmoo rocket launcher with Ultra I&C's ADSI C2 gateway, facilitating Five Eyes interoperability and CJADC2 projects.

- In August 2024, BAE Systems said that they had secured a USD 493 million deal to manufacture M992A3 ammunition carriers and M109A7 self-propelled howitzers. As the US Army continues to carry out its artillery modernization plan, the manufacture will continue until July 2026.

Market Segmentations

Caliber

- Small Caliber

- Large Caliber

- Medium Caliber

- Rockets, Missiles & Other

Product

- Rimfire

- Centerfire

End Use

- Civil & Commercial

- Defense

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- BAE Systems plc

- Rheinmetall AG

- Elbit Systems Ltd.

- KNDS N.V.

- General Dynamics Corporation

- Nammo AS

- RUAG Group

- Denel SOC Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Caliber, By Product, By End Use and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Ammunition Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Ammunition Market Share Analysis

6.1 By Caliber

6.2 By Product

6.3 By End Use

6.4 By Countries

7. Caliber

7.1 Small Caliber

7.2 Large Caliber

7.3 Medium Caliber

7.4 Rockets, Missiles & Other

8. Product

8.1 Rimfire

8.2 Centerfire

9. End Use

9.1 Civil & Commercial

9.2 Defense

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 South Africa

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 BAE Systems plc

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Rheinmetall AG

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Elbit Systems Ltd.

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 KNDS N.V.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 General Dynamics Corporation

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Nammo AS

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 RUAG Group

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Denel SOC Ltd.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com