Online Gambling Market – Global Trends, Regulation & Forecast 2025–2033

Buy NowOnline Gambling Market Size and Forecast 2025-2033

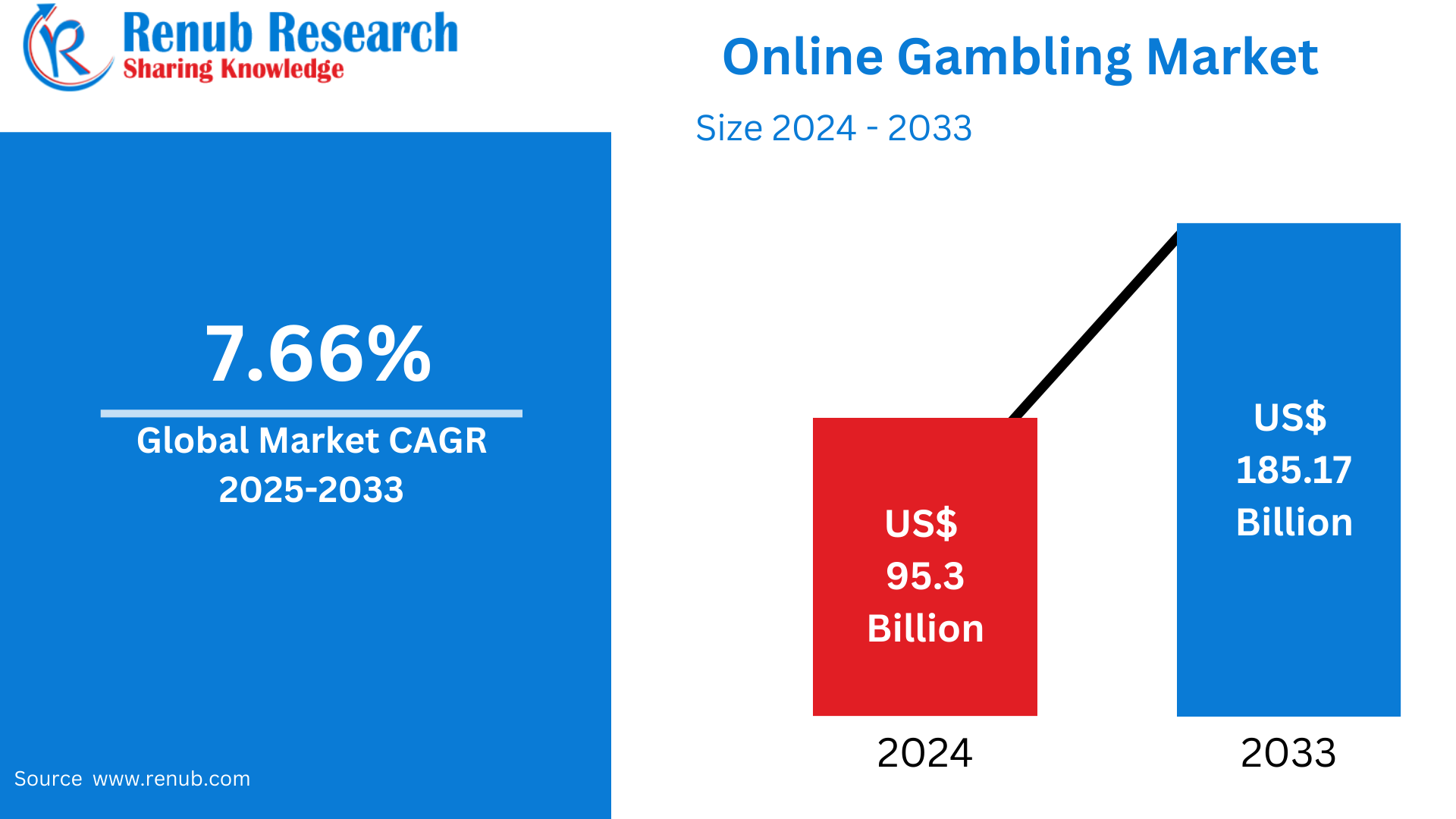

Global Online Gambling Market accounted for US$ 95.3 billion in 2024 and is anticipated to reach US$ 185.17 billion by 2033, with a CAGR of 7.66% from 2025 to 2033. This growth is driven by rising smartphone penetration, increasing internet access, and legalization of online betting sites in most regions, which is improving user experience and increasing industry revenues worldwide.

Online Gambling Market Forecast Report by Type (Sports Betting, Casinos, Bingo, Poker, Others), Device (Desktop, Mobile, Others), Country and Company Analysis 2025-2033.

Online Gambling Market Outlooks

Online gambling involves betting or wagering on chance or skill games over the internet. Online gambling comprises sports book bets, web casinos, poker, lotteries, and virtual slots. Desktops, tablets, or mobile phones can be used for play, with deposits and payouts made and received digitally. Online gambling popularity has increased worldwide because it is convenient, accessible, and provides an immersive experience. Technological innovations such as live dealer games, mobile platforms, and secure payment systems have increased user interaction. Also, 24/7 accessibility, bonuses, and a large range of gaming opportunities draw users of all age groups.

Legalization in a number of countries and advancements in internet infrastructure have also contributed to the growth of the market. Online betting has also been highly popular among young audiences looking for entertainment and quick money. Nevertheless, it also creates anxiety regarding addiction and responsible gaming, leading to tighter regulations and campaigns by governments and platforms. Its popularity grows at a high rate despite challenges.

Growth Drivers in the Online Gambling Market

Growth in Smartphone Penetration and Mobile Connectivity

The world's growth in smartphone adoption and cheap mobile data plans has opened up online gambling more than ever. Gamblers are now able to bet on mobile devices, anywhere and at any time. Young people, in particular, are drawn to such convenience and mobile-friendly entertainment. Mobile-optimized gambling apps also provide a tailored experience for users, push notifications, and quick deposits and withdrawals. With instant access to lotteries, casino games, and sports betting, mobile technology is at the heart of market growth. October 2023, More than half (54%) of the population of the world, or 4.3 billion, own a smartphone, the GSMA's 2023 State of Mobile Internet Connectivity Report found. By 2022, 32% (2.6 billion people) had been reached by a 5G network. The average download speeds have almost trebled in five years, rising from 12.0Mbps in 2017 to 33.9Mbps in 2022, while data affordability keeps on getting better, powering data consumption growth.

Legalization and Regulation Across Regions

Governments across the globe are increasingly acknowledging the revenue opportunities offered by online gambling. Consequently, many of them have started legalizing and regulating the industry. Regulatory frameworks facilitate consumer protection, safer gambling, and gaming fairness, increasing user confidence. The creation of regulated markets, as in certain areas of the U.S. and Europe, has prompted leading operators to roll out more services, spend on marketing, and form local alliances—fueling market expansion. iGaming industry consultant Ciaran McEneaney recommends that players in the States first verify whether iGaming is legal in their state. While most states have no direct legislation, the industry falls into a gray zone that provides access to overseas regulated sites. For others who want a greater variety of games, it is possible to learn how to avoid GamStop and find casinos that do not fall under this self-exclusion program.

Technological Innovations and Improvements in User Experience

Advances such as live dealer gaming, virtual reality (VR), artificial intelligence (AI), and blockchain are transforming the online gambling experience. Live streaming simulates true casino settings, AI offers tailored game suggestions, and blockchain guarantees security and transparency. These features increase player retention and engagement by designing immerse, transparent, and extremely interactive sites. As technology continues to improve, consumers are more likely to opt for digital gambling compared to conventional forms, rendering innovation a key growth driver. July 2024, Golden Matrix Group revealed the launch of an AI-based casino game recommender by its subsidiary, Meridianbet, designed to maximize user engagement and improve the gaming experience.

Challenges in the Online Gambling Market

Regulatory and Legal Uncertainty

While increasing acceptance, online gambling is still hampered by regulatory challenges in many nations. Unclear laws, bans, or ambiguous laws can restrict market entry and operations. Unpredictable gambling law alterations or taxation policy reforms also pose operator compliance challenges. These vagaries render it challenging to grow globally or invest smartly in developing markets, reducing overall expansion.

Addiction and Responsible Gambling Concerns

Ease of accessibility of online gambling creates serious concerns regarding mental health and addiction. The anonymity and 24/7 accessibility of online platforms can contribute to compulsive behavior. Governments and regulatory bodies insist on platforms having responsible gaming features like spending limits, self-exclusion tools, and awareness campaigns. If these issues go unresolved, they result in public outcry, damage to reputation, and stringent regulations, which can harm the market.

Online Sports Betting Industry

Sports betting over the internet is among the fastest-growing online gambling sectors. It enables users to bet on a number of sporting events, such as football, basketball, cricket, and horse racing. The market is driven by real-time betting, competitive odds, and rising sports consumption. Enhanced data analytics, live streaming, and mobile compatibility add to the betting experience. The legalization of sports betting in nations such as the U.S. has created substantial revenue opportunities, drawing international operators and spurring innovation.

Online Poker Gambling Market

Online poker enables customers to engage in variants such as Texas Hold'em and Omaha via online media. It retains elements of skill and probability, appealing to amateur and experienced gamblers alike. Tournaments, multi-table play, and real-money tournaments drive the market. Social communication via chat functionalities and worldwide pools of players heightens appeal. Sectors like the World Series of Poker Online have made this segment even more popular. Technological advancements and safe payment gateways have made the experience a regular money earner.

Online Mobile Gambling Market

Mobile gambling has transformed the use of online betting and casino sites. Thanks to the ease and portability of smartphones, mobile gambling owns a huge chunk of the market. Gaming applications are performance-optimized, provide in-app purchases, and accommodate a range of payment methods. Mobile-first designs, gamification features, and push notifications to keep people engaged. Sports betting, slots, or poker, mobile sites offer an effortless and personalized gambling experience that is well-received across demographics.

Online Desktop Gambling Market

While mobile gaming is on the rise, desktop gaming is still vital, especially for those who favor big screens, high-level graphics, and detailed interfaces. Desktops accommodate sophisticated features like multi-window gaming, live dealer games, and analytical applications for professional gamblers. Desktop gaming is preferred in virtual casinos and online poker, where users value improved control and stability. Desktop gaming has a strong user base, particularly with the older generation and professional gamblers.

United States Online Gambling Market

The U.S. online gambling market is growing strongly, fueled by the legalization of sports betting in many states. Large operators are establishing partnerships with domestic casinos and sports leagues to provide regulated platforms. Consumer demand for sports betting, poker, and casino games is increasing, spurred by digital advertising and mobile app development. Strict regulatory adherence, secure payment platforms, and responsible gaming tools are fundamental to the U.S. market. Expansion is likely to proceed with further states legalizing online gambling. May 2025, Caesars Entertainment, Inc. has introduced its first proprietary online game, Caesars Palace Signature Multihand Blackjack Surrender, on Caesars Palace Online Casino in New Jersey. Powered by the internal studio Empire Creative™, the game provides a tailored player experience with new features and a brand-centered approach.

France Online Gambling Market

France's online gambling market is controlled by ARJEL (currently ANJ) and consists of sports betting, poker, and horse racing. The market is underpinned by good digital infrastructure and high internet penetration. French consumers consistently express interest in legal online gambling websites, particularly during big sporting events. Operators must adopt responsible gambling strategies and meet tough advertisement regulations. Taxation is still very high, yet the regulated platform guarantees protection of users and promotes trust, supporting stable market performance. Oct 2024, According to France 24, a report says that the government is working on regulating the iGaming market so that online casinos are legalized in the nation.

India Online Gambling Market

India's online gambling industry is growing, fueled by mobile penetration, a youthful population, and growing internet penetration. The most popular activities are fantasy sports, online rummy, and betting on cricket. Although the regulatory environment is still patchy—regulated by state—interest is still rising among investors and consumers. International operators tend to collaborate with domestic companies to manage regulatory complexity. Knowledge of responsible gambling and online payments is increasing, making India a key emerging market.

Saudi Arabia Online Gambling Market

In accordance with Islamic law, Saudi Arabia forbids online gambling and tightens internet censorship to uphold it. An underground market does exist, although it is small in scale, with customers using VPNs to reach overseas sites. Legal restrictions and sensitivity to culture limit the state of the undeveloped market, which is also extremely risky for operators. There are unlikely attempts towards regulating or legalizing online gambling in the near future. Despite that, sports and digital entertainment interest points toward potential demand if regulations improve.

Market Segmentation

Type

- Sports Betting

- Casinos

- Bingo

- Poker

- Others

Device

- Desktop

- Mobile

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Betsson AB

- Kindred Group PLC

- Entain PLC

- Bet365

- Flutter Entertainment PLC

- Mgm Resorts International

- Draftkings Inc.

- Super Group (sghc Limited)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Device and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Online Gambling Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Online Gambling Market Share Analysis

6.1 By Type

6.2 By Device

6.3 By Countries

7. Type

7.1 Sports Betting

7.2 Casinos

7.3 Bingo

7.4 Poker

7.5 Others

8. Device

8.1 Desktop

8.2 Mobile

8.3 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Thailand

9.3.6 Malaysia

9.3.7 Indonesia

9.3.8 Australia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Betsson AB

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development & Strategies

12.1.4 Revenue Analysis

12.2 Kindred Group PLC

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development & Strategies

12.2.4 Revenue Analysis

12.3 Entain PLC

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development & Strategies

12.3.4 Revenue Analysis

12.4 Bet365

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Revenue Analysis

12.5 Flutter Entertainment PLC

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Revenue Analysis

12.6 Mgm Resorts International

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Revenue Analysis

12.7 Draftkings Inc.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Revenue Analysis

12.8 Super Group (sghc Limited)

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development & Strategies

12.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com