Morocco Water Desalination Market Forecast 2025–2033

Buy NowMorocco Water Desalination Market Size and Forecast 2025-2033

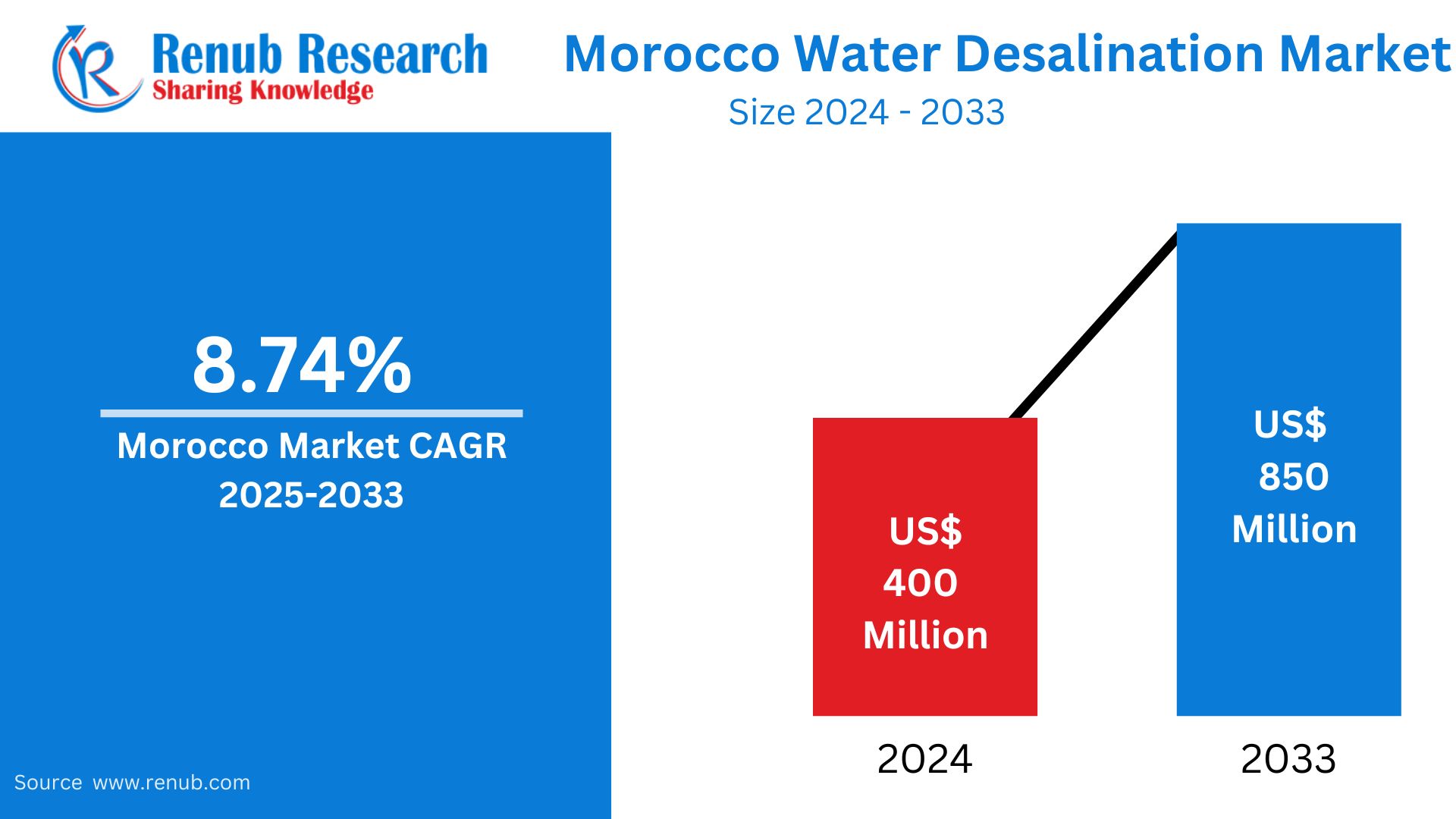

Morocco Water Desalination Market is expected to reach US$ 850 million by 2033 from US$ 400 million in 2024, with a CAGR of 8.74% from 2025 to 2033. Growing water scarcity, government investments, the integration of renewable energy, technical breakthroughs, and the demand for sustainable water supplies for metropolitan areas are the main factors propelling Morocco's water desalination industry.

Morocco Water Desalination Market Report by Technology (Reverse Osmosis, Multi-stage flash (MSF) Distillation, Multi-effect (MED) distillation, Others), Application (Municipal, Industrial, Others), Water Source (Seawater, Brackish Water, River Water, Others), Region (East, West, North, South) and Company Analysis, 2025-2033.

Morocco Water Desalination Market Overview

Morocco's water desalination sector is quickly becoming a key remedy for the nation's escalating water shortage issues. Morocco has made desalination a strategic priority in response to protracted droughts, diminishing groundwater levels, and rising demand from urban and agricultural populations. By greatly increasing desalination capacity, the government has laid forth ambitious objectives to improve water security and lessen dependency on conventional water sources. New desalination plants are being developed in major coastal towns including Casablanca, Agadir, and Safi to supply water for homes, businesses, and farms.

A more sustainable desalination industry is largely shaped by the nation's geographic advantage and investments in renewable energy, especially solar and wind. Morocco is attempting to reduce the process's operating expenses and environmental impact by using sustainable energy into desalination operations. Moroccan plants are increasingly using reverse osmosis, a technique that delivers high efficiency in salt removal. Initiatives like the Agadir saltwater desalination plant, which is among the biggest in Africa, demonstrate the nation's dedication to using cutting-edge technology to ensure a steady supply of water.

Additionally, public-private partnerships are crucial in financing and building infrastructure in Morocco's desalination sector, which is drawing both domestic and foreign investment. These cooperative methods provide access to clean drinking water in desert and coastal areas while fostering innovation and operational effectiveness. High initial capital expenditures, the requirement for technical know-how, and guaranteeing fair access to desalinated water in various locations are still obstacles, nevertheless. Morocco is in the forefront of desalination development in Africa despite these obstacles thanks to its proactive attitude and incorporation of sustainable methods. Given the growing severity of water shortages and the pressing need for robust, long-term solutions, the sector is well-positioned for future growth.

The National Programme for Potable Water Supply and Irrigation 2020-2027 (Programme national d'approvisionnement en eau potable et d'irrigation, or PNAEPI) was introduced by the Moroccan government in 2020 as part of its National Water Plan (PNE or Plan national de l'eau) for 2020–2050. By increasing investments to increase the water supply for drinking and irrigation needs, the PNAEPI seeks to diversify the sources of supply, ensure water security, and lessen the effects of climate change. The government raised the program's funding to $14.3 billion in May 2023.

Growth Drivers for the Morocco Water Desalination Market

Government Initiatives

By making significant expenditures in desalination infrastructure, the Moroccan government is aggressively tackling the country's water scarcity issues. The Casablanca-Settat saltwater desalination plant is a showpiece project that is expected to grow to be the biggest of its kind in Africa. Approximately 7.5 million people in Greater Casablanca, Settat, Berrechid, and Bir Jdid will benefit from this project, which is situated in the Lamharza Essahel commune close to El Jadida and has the capacity to generate up to 300 million cubic meters of drinkable water annually.

On a 50-hectare plot of land, the project is being constructed in two stages. By the end of 2026, the first phase should be operational, with a daily capacity of 548,000 cubic meters. With facilities for agricultural usage, the second phase, which is slated for mid-2028, intends to raise capacity to 822,000 cubic meters per day.

With a total expenditure of 143 billion dirhams, King Mohammed VI inaugurated Morocco's larger National Drinking Water Supply and Irrigation Program (2020–2027), which includes this effort. The Casablanca-Settat plant is being created through a public-private partnership and is expected to cost 6.5 billion dirhams. In keeping with Morocco's dedication to sustainable development, the facility will make use of reverse osmosis technology and run entirely on renewable energy.

Technological Advancements

In Morocco, technological developments are greatly increasing desalination's effectiveness and affordability. The most popular desalination technique, reverse osmosis, has seen advancements that have reduced energy usage, enhanced membrane performance, and extended operating lifespans, making the process more economical and environmentally friendly. Furthermore, improvements in automation, energy recovery systems, and pre-treatment technologies have simplified plant operations, lowering maintenance requirements and enhancing the quality of water production. To increase efficiency and scalability, Morocco is progressively implementing this cutting-edge technology in new projects, including the Casablanca-Settat desalination plant. These developments are essential as the nation increases its desalination capacity to satisfy rising water demands while attempting to keep consumer pricing reasonable and coordinating operations with national sustainability objectives.

Renewable Energy Integration

The incorporation of renewable energy is revolutionizing Morocco's desalination sector. Desalination facilities are increasingly being powered by renewable energy sources like solar and wind as the nation develops its solar and wind energy capabilities. This makes the process more economical and ecologically friendly. Morocco aligns its water policy with wider climate goals by lowering its reliance on fossil fuels, which also decreases operating costs and greenhouse gas emissions. This change is best illustrated by initiatives like Agadir's solar-powered desalination plant, which shows how renewable energy can fuel effective, large-scale water production. In an area where energy and water security are major issues, this combination of renewable energy and desalination enhances Morocco's ability to withstand water shortages and fosters long-term sustainability.

Challenges in the Morocco Water Desalination Market

Changing Consumer Preferences

The coffee industry in Austria is changing due to shifting customer tastes, which offers firms both possibilities and problems. There is a discernible trend toward healthier options, such organic or additive-free coffee, plant-based milk substitutes, and low-sugar drinks. Younger customers are also looking for contemporary and distinctive coffee experiences, such as nitro coffee, cold brew, and specialty beverages with international flavors. Cafés and coffee businesses must constantly develop and modify their products to satisfy these changing needs if they want to remain relevant. It's a tricky balance to achieve this without offending regular customers who like traditional Austrian coffee methods and the coffeehouse's cultural experience. It takes ingenuity, consumer awareness, and careful menu diversity to successfully negotiate this dynamic and satisfy both traditional and modern tastes.

Labor and Operational Costs

Austria's coffee business has a lot of challenges due to rising labor and operating expenses, especially for traditional coffee shops that prioritize atmosphere and service quality. Maintaining profitability becomes more challenging, particularly for smaller, independent operations, as salaries rise and demands for skilled workers stay high. These companies frequently depend on individualized care and a well-planned client experience, both of which require more expensive overhead and trained staff. Furthermore, operating budgets are being further strained by rising rent, electricity, and raw material expenses. The inability of small cafés to absorb these costs without boosting prices, in contrast to bigger chains that may take advantage of economies of scale, may drive away price-conscious patrons. To be competitive in the face of this financial strain, effective management and creative approaches are required.

East Morocco Water Desalination Market

Seawater desalination infrastructure is expanding significantly in Morocco's eastern area in order to alleviate the country's ongoing water shortage, which is being made worse by population pressures and climate change. The Nador desalination plant, which began operations in February 2025 and has an annual capacity of 250 million cubic meters, is one of the major projects. It serves the demands of Nador and the neighboring areas' agriculture and urban areas. Furthermore, the region's capacity will be further increased by a significant agreement with China's Lipu Industry to build a facility that can produce 548,000 tons of desalinated water per day. Morocco intends to increase its desalination capacity to about 1.5 billion cubic meters per year by 2030 as part of a larger effort to improve water resilience.

West Morocco Water Desalination Market

Significant progress is being made in seawater desalination in Morocco's western area to alleviate the country's water scarcity issues. One of the major projects is the Casablanca desalination plant, which will help over 7.5 million people in the Greater Casablanca area by producing up to 300 million cubic meters of water a year when it is finished in 2028. The Safi desalination plant, which is currently being built, is anticipated to have a daily capacity of 86,400 cubic meters. These projects are a component of Morocco's larger plan to increase desalination capacity to around 1.5 billion cubic meters per year by 2030. The goal of incorporating renewable energy sources into these projects is to improve sustainability and save costs.

Morocco Water Desalination Market Segments

Technology

- Reverse Osmosis

- Multi-stage flash (MSF) Distillation

- Multi-effect (MED) distillation

- Others

Application

- Municipal

- Industrial

- Others

Water Source

- Seawater

- Brackish Water

- River Water

- Others

Region

- East

- West

- North

- South

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Developments

- Revenue

Company Analysis:

- International Development Enterprises (iDE)

- DowDuPont

- Doosan Group

- Ovivo

- Aquatech

- Veolia

- Guangzhou KangYang Seawater Desalination Equipment Co.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Technology, Application, Water Source and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.2.1 Top-down Approach

2.2.2 Bottom-up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Morocco Water Desalination Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Technology

6.2 By Application

6.3 By Water Source

6.4 By Region

7. Technology

7.1 Reverse Osmosis

7.1.1 Historical Market Trends

7.1.2 Market Forecast

7.2 Multi-stage flash (MSF) Distillation

7.2.1 Historical Market Trends

7.2.2 Market Forecast

7.3 Multi-effect (MED) distillation

7.3.1 Historical Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Historical Market Trends

7.4.2 Market Forecast

8. Application

8.1 Municipal

8.1.1 Historical Market Trends

8.1.2 Market Forecast

8.2 Industrial

8.2.1 Historical Market Trends

8.2.2 Market Forecast

8.3 Others

8.3.1 Historical Market Trends

8.3.2 Market Forecast

9. Water Source

9.1 Seawater

9.1.1 Historical Market Trends

9.1.2 Market Forecast

9.2 Brackish Water

9.2.1 Historical Market Trends

9.2.2 Market Forecast

9.3 River Water

9.3.1 Historical Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Historical Market Trends

9.4.2 Market Forecast

10. Region

10.1 North

10.1.1 Historical Market Trends

10.1.2 Market Forecast

10.2 South

10.2.1 Historical Market Trends

10.2.2 Market Forecast

10.3 East

10.3.1 Historical Market Trends

10.3.2 Market Forecast

10.4 West

10.4.1 Historical Market Trends

10.4.2 Market Forecast

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 International Development Enterprises (iDE)

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Developments

13.1.4 Revenue Analysis

13.2 DowDuPont

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Developments

13.2.4 Revenue Analysis

13.3 Doosan Group

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Developments

13.3.4 Revenue Analysis

13.4 Ovivo

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Developments

13.4.4 Revenue Analysis

13.5 Aquatech

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Developments

13.5.4 Revenue Analysis

13.6 Veolia

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Developments

13.6.4 Revenue Analysis

13.7 Guangzhou KangYang Seawater Desalination Equipment Co.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Developments

13.7.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com