Malaysia Agriculture Equipment Market Size and Growth Trends and Forecast Report 2025-2033

Buy NowMalaysia Agriculture Equipment Market Size and Forecast 2025-2033

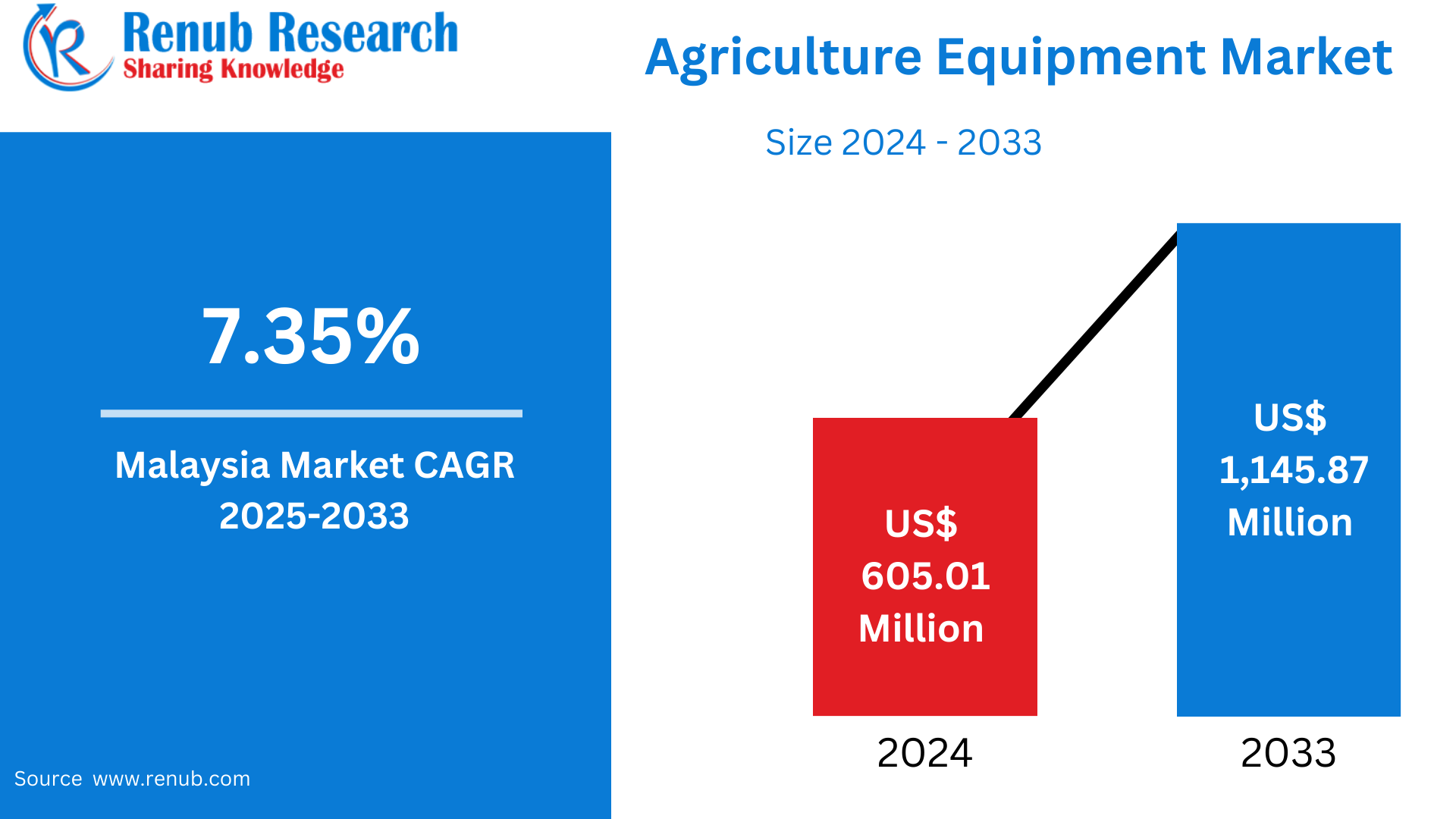

Malaysia Agriculture Equipment Market is expected to reach US$ 1,145.87 Million by 2033 from US$ 605.01 Million in 2024, with a CAGR of 7.35% from 2025 to 2033. Growing automation in the agricultural sector and rising farmer incomes are anticipated to be the main drivers of growth. It is also assumed that favorable weather for food production and government assistance through loan waiver programs for farmers across all income levels will promote market expansion.

Malaysia Agriculture Equipment Market Report by Machinery Type (Irrigation Machinery, Tractors, Ploughing and Cultivation Machinery, Harvesting Machinery, Haying and Forage Machinery, Planting Machinery, Sprayer), Irrigation Machinery (Gravity Irrigation, Miro-Irrigation, Sprinkler), Tractors by Engine Power (Less than 40 HP, 41 to 100 HP, More than 100 HP), Ploughing and Cultivation Machinery (Cultivators and Tillers, Harrows, Ploughs, Others), Harvesting Machinery (Combine Harvesters, Harvesting Robots, Self-Propelled Forage Harvesters), Haying and Forage Machinery (Mowers, Balers, Tedders and Rakes, Forage Harvesters), Countries and Company Analysis, 2025-2033.

Malaysia Agriculture Equipment Industry Overview

Malaysia's agricultural equipment market is developing gradually as the nation prioritizes updating its farming methods. With the help of government regulations that encourage the use of technology in farming, the sector is moving away from manual labor and toward more automated solutions. In addition to tackling issues like aging farmer populations and a shortage of workers, this change aims to increase production and lessen dependency on labor. However, Malaysia's agricultural landscape is dominated by smallholder farmers, and their meager financial resources frequently prevent them from implementing new technology.

Tractors, harvesters, irrigation systems, and planting equipment are among the automated solutions that are becoming more and more in demand. Farmers looking for increased efficiency without the need for large-scale machinery have come to favor agricultural equipment that is appropriate for smaller plots and a variety of terrain. Government initiatives to expand access to machinery through funding assistance and training programs promote this trend. In order to ensure compatibility with Malaysia's varied agricultural settings and crop kinds, manufacturers and suppliers are also modifying their goods to fit local farming requirements.

The sector still confronts significant obstacles in spite of these advancements. The main barriers to the general adoption of contemporary equipment are high initial investment prices, restricted access to cheap financing, and a lack of technical expertise. Growth is further hampered by fragmented land ownership and a lack of scalable solutions for smaller farms. The industry must keep concentrating on creating affordable and easy-to-use equipment, increasing technical training, and strengthening after-sales support networks in order to promote the wider and more sustainable application of agricultural technology.

Growth Drivers for the Malaysia Agriculture Equipment Market

Government Support and Policies

Through a number of laws and assistance initiatives, the Malaysian government has played a significant role in encouraging the use of contemporary agricultural equipment. One such endeavor, the Agrofood Policy 2021–2030, is to increase mechanization in the industry to boost production and lessen dependency on human labor. By means of this program, the government makes innovative machinery more available to farmers, especially smallholders, by offering subsidies, grants, and financial support. These programs support the shift to farming methods that are more scalable, sustainable, and efficient. In addition to increasing agricultural output, the government's encouragement of automation helps Malaysia's agricultural industry expand and modernize over the long run, making it competitive in the global market.

Technological Advancements in Equipment

Farmers may now embrace cutting-edge solutions for increased production thanks to the creation of more effective and user-friendly equipment sparked by the ongoing growth of agricultural technology. Higher yields, improved accuracy, and improved resource management are provided by innovations like GPS-guided tractors, automated harvesters, and intelligent irrigation systems. By lessening environmental effects like water waste and soil deterioration, these innovations not only improve agricultural procedures but also support sustainable practices. Malaysian farmers are progressively using these tools into their operations as accessibility and cost of technology increase. Farmers can improve their methods, increase crop yields, and maintain their competitiveness in a fast changing global agricultural scene thanks to the increasing affordability of innovative agricultural technology.

Rising Demand for Productivity and Efficiency

Mechanization has emerged as a key remedy as Malaysia's agricultural industry deals with growing demands for increased production and food security. Tractors, harvesters, and irrigation systems are examples of contemporary agricultural equipment that farmers are increasingly using to increase productivity and lower labor costs. These automated systems offer a number of benefits, including increased agricultural operations' speed and consistency, improved land management, and resource optimization. The need for sophisticated technology is rising in industries where high productivity is crucial, such as rice farming, rubber, and palm oil. Farmers may increase yields and boost operational effectiveness by implementing automated solutions, guaranteeing that Malaysia satisfies its export and domestic food needs.

Challenges in the Malaysia Agriculture Equipment Market

High Initial Costs and Financial Accessibility

The high starting cost of contemporary gear is one of the primary obstacles facing the Malaysian farm equipment business. Tractors, harvesters, and irrigation systems are examples of advanced farming equipment that many smallholder farmers cannot afford due to their high capital costs. Even though the government offers financial aid and subsidies, many farmers still have trouble finding reasonably priced loans or financing choices. Farmers face financial obstacles, especially in rural regions, as a result of the high upfront expenditures as well as the requirement for maintenance and operations expenses. Smaller farmers are also frequently unable to make the investments in the machinery required to increase output, which slows the nation's general adoption of cutting-edge agricultural technology.

Fragmented Land Holdings and Small-Scale Farming

Small-scale, dispersed landholdings dominate Malaysia's agricultural industry, which makes it difficult for large-scale technology to be widely adopted. It is challenging to defend the high cost of buying sophisticated machinery like big tractors and harvesters due to the fragmented character of the land. Furthermore, the usefulness of such gear may be limited by its incompatibility with smaller land parcels. Because of this, a large number of smallholder farmers still use labor-intensive and ineffective conventional farming practices. The extensive adoption of automation is further restricted by the absence of economies of scale and the inability to pool resources or equipment with other farms, which slows the market's general expansion for agricultural equipment.

Malaysia Agriculture Equipment Market Segments

Machinery Type

- Irrigation Machinery

- Tractors

- Ploughing and Cultivation Machinery

- Harvesting Machinery

- Haying and Forage Machinery

- Planting Machinery

- Sprayer

Irrigation Machinery

- Gravity Irrigation

- Miro-Irrigation

- Sprinkler

Tractors by Engine Power

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

Ploughing and Cultivation Machinery

- Cultivators and Tillers

- Harrows

- Ploughs

- Others

Harvesting Machinery

- Combine Harvesters

- Harvesting Robots

- Self-Propelled Forage Harvesters

Haying and Forage Machinery

- Mowers

- Balers

- Tedders and Rakes

- Forage Harvesters

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Product Portfolio

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- John Deere's

- CNH Industrial

- AGCO Corporation.

- KUBOTA Corporation.

- Titan Machinery Inc.

- CLASS

- Lindsay Corporation

- ALAMO GROUP INC.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Machinery Type, Irrigation Machinery, Tractor by Power Engine, Ploughing and Cultivation, Harvesting Machinery and Haying and Forage Machinery |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Source

2.1.2 Secondary Source

2.2 Research Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Malaysia Agricultural Equipment Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Machinery Type

6.1.1 Irrigation Machinery

6.1.2 Tractor by Power Engine

6.1.3 Ploughing and Cultivation

6.1.4 Harvesting Machinery

6.1.5 Haying and Forage Machinery

7. Machinery Type

7.1 Irrigation Machinery

7.2 Tractors

7.3 Ploughing and Cultivation Machinery

7.4 Harvesting Machinery

7.5 Haying and Forage Machinery

7.6 Planting Machinery

7.7 Sprayer

8. Irrigation Machinery

8.1 Gravity Irrigation

8.2 Miro-Irrigation

8.3 Sprinkler

9. Tractors by Engine Power

9.1 Less than 40 HP

9.2 41 to 100 HP

9.3 More than 100 HP

10. Ploughing and Cultivation Machinery

10.1 Cultivators and Tillers

10.2 Harrows

10.3 Ploughs

10.4 Others

11. Harvesting Machinery

11.1 Combine Harvesters

11.2 Harvesting Robots

11.3 Self-Propelled Forage Harvesters

12. Haying and Forage Machinery

12.1 Mowers

12.2 Balers

12.3 Tedders and Rakes

12.4 Forage Harvesters

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1.1 Strength

14.1.2 Weakness

14.1.3 Opportunity

14.1.4 Threat

15. Key Players Analysis

15.1 John Deere's

15.1.1 Overview

15.1.2 Key Persons

15.1.3 Product Portfolio

15.1.4 Recent Development & Strategies

15.1.5 Revenue Analysis

15.2 CNH Industrial

15.2.1 Overview

15.2.2 Key Persons

15.2.3 Product Portfolio

15.2.4 Recent Development & Strategies

15.2.5 Revenue Analysis

15.3 AGCO Corporation.

15.3.1 Overview

15.3.2 Key Persons

15.3.3 Product Portfolio

15.3.4 Recent Development & Strategies

15.3.5 Revenue Analysis

15.4 KUBOTA Corporation.

15.4.1 Overview

15.4.2 Key Persons

15.4.3 Product Portfolio

15.4.4 Recent Development & Strategies

15.4.5 Revenue Analysis

15.5 Titan Machinery Inc.

15.5.1 Overview

15.5.2 Key Persons

15.5.3 Product Portfolio

15.5.4 Recent Development & Strategies

15.5.5 Revenue Analysis

15.6 CLASS

15.6.1 Overview

15.6.2 Key Persons

15.6.3 Product Portfolio

15.6.4 Recent Development & Strategies

15.6.5 Revenue Analysis

15.7 Lindsay Corporation

15.7.1 Overview

15.7.2 Key Persons

15.7.3 Product Portfolio

15.7.4 Recent Development & Strategies

15.7.5 Revenue Analysis

15.8 ALAMO GROUP INC.

15.8.1 Overview

15.8.2 Key Persons

15.8.3 Product Portfolio

15.8.4 Recent Development & Strategies

15.8.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com