Japan Flexible Packaging Market Outlook 2025–2033

Buy NowJapan Flexible Packaging Market Size and Forecast

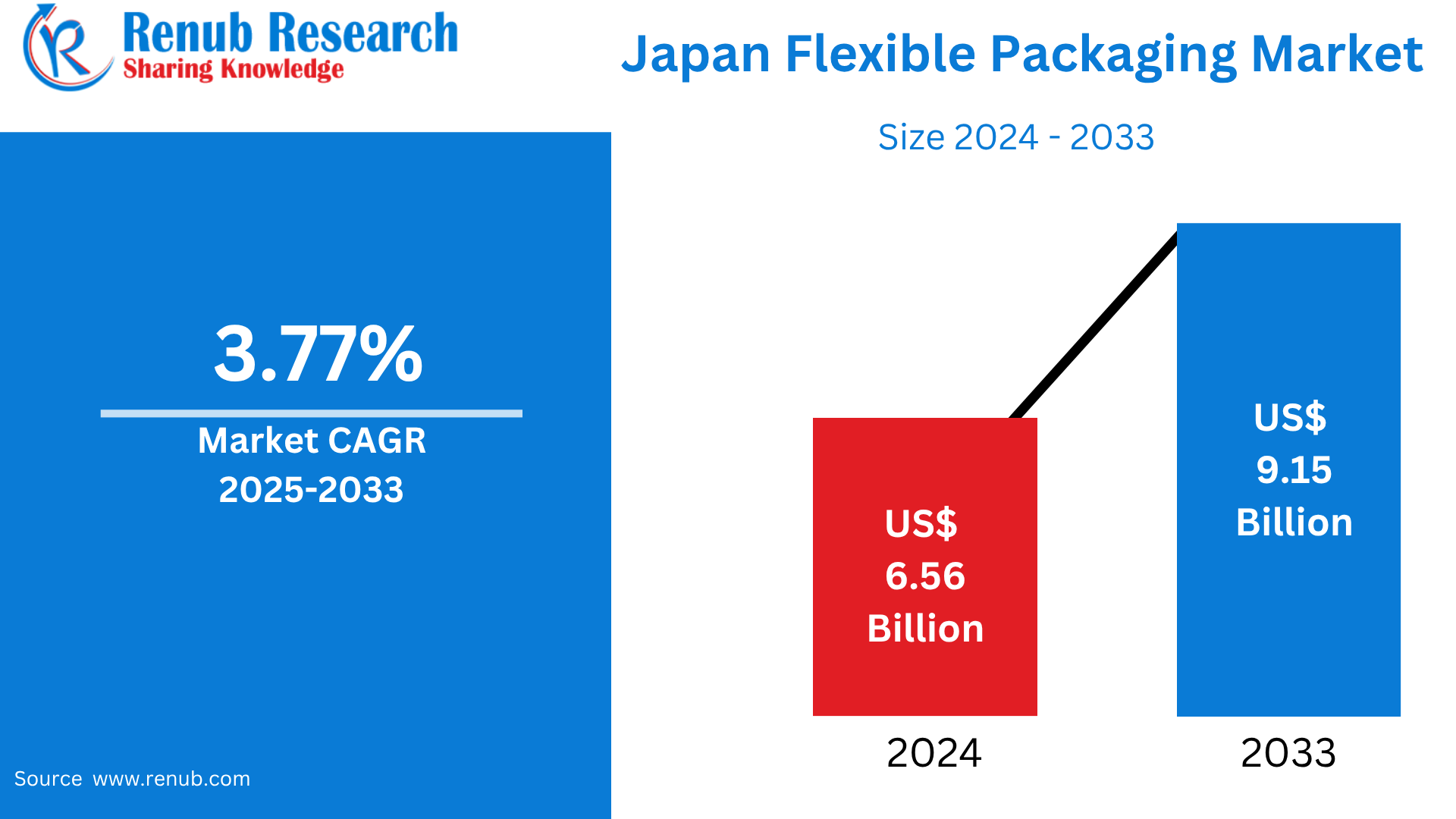

Japan Flexible Packaging Market is expected to reach US$ 9.15 billion by 2033 from US$ 6.56 billion in 2024, with a CAGR of 3.77% from 2025 to 2033. The demand for sustainable materials, the expansion of the food and e-commerce industries, consumer convenience preferences, barrier technology developments, and growing desire in aesthetically pleasing, adaptable packaging solutions are the main drivers of Japan's flexible packaging market.

Japan Flexible Packaging Market Report by Application (Food & Beverage, Personal Care, Pharmaceutical, Household Care, Industrial, Others), Packaging Type (Stand-up Pouch, Films, Bag-in-Box, Others), Material (Paperboard, Plastic, Aluminum Foil, PET Film, Others) and Company Analysis, 2025-2033.

Japan Flexible Packaging Industry Overview

The rising need for easy, lightweight, and ecological packaging solutions in the food, healthcare, and personal care sectors is driving the fast evolution of Japan's flexible packaging business. Product shelf life and customer appeal are being improved by advancements in barrier technology and biodegradable and recyclable materials. Japan's strong emphasis on quality and technology further helps the sector by providing high-performance packaging solutions that can be customized to meet a variety of applications. Additionally, the need for robust and effective packaging formats such pouches and wraps is growing due to urban lifestyles and an increase in e-commerce activity. In general, the market shows a balance between customer convenience, environmental responsibility, and functionality.

The creation of materials with recycled content is essential to efforts to increase sustainability in flexible packaging. Through the promotion of circular economy initiatives and the use of recyclable and reusable packaging, this approach aligns with worldwide goals to reduce plastic waste. For instance, in October 2024, TOPPAN Holdings Inc., RM Tohcello Co., Ltd., and Mitsui Chemicals, Inc. gathered, de-inked, and repurposed film waste into pellets to create a recycled BOPP film that was suitable for mass manufacturing. This effort aims to increase the horizontal recycling of flexible packaging film by 2025 and is in line with Japan's 2025 objective for reusable and recyclable plastics.

Additionally, the flexible packaging sector is adopting cutting-edge digital inkjet technology to facilitate the effective production of a range of package kinds. These developments satisfy the increasing need for adaptable and economical methods, especially for small-batch orders in the packaging of food and home goods. For example, Fujifilm Corporation unveiled the Jet Press FP790, its first digital inkjet presses for flexible packaging that uses water, in March 2024. Its high productivity and versatility enable it to fulfill the growing need for flexibility by efficiently manufacturing a variety of packaging, including food and household goods, even for small orders.

Key Factors Driving the Japan Flexible Packaging Market Growth

Sustainability Initiatives

Due to changing consumer attitudes and legal requirements, sustainability has emerged as a major subject in the Japanese packaging sector. To promote the recycling and reuse of packaging materials, the government implements laws such as the Containers and Packaging Recycling Law. Furthermore, Japan encourages the creation and use of environmentally friendly products including paper-based substitutes, recycled plastics, and bioplastics. This proactive approach lessens the nation's ecological imprint and is in line with international environmental goals. Additionally, consumers are playing a crucial role by selecting products that exhibit environmental stewardship. Because of this, businesses who invest in sustainable packaging not only satisfy legal requirements but also attract eco-aware consumers, improving their brand recognition and ability to compete in a green-minded market.

E-Commerce Expansion

The need for flexible packaging is significantly influenced by Japan's thriving e-commerce industry. The demand for packaging that is affordable, strong, and lightweight has increased as online shopping continues to expand in areas like groceries, gadgets, and cosmetics. These requirements are successfully met by flexible packaging, which provides strong product protection during travel, lowers shipment weight, and lowers logistical expenses. Additionally, it works well for branding and customization, both of which are essential in the cutthroat world of e-commerce. Flexible formats are perfect for direct-to-consumer channels because of their tamper-evident and resealable characteristics, which further improve user experience and security. In Japan's digital economy, the combination of packaging innovation and the expansion of online retail is revolutionizing the way firms’ package and distribute their goods.

Consumer Preferences for Convenience

Convenient, user-friendly packaging solutions are in high demand in Japan due to changing demographics and urban lifestyles, especially the growth in single-person homes. This change is accommodated by flexible packaging options that provide portion control, ease of storage, and reduced waste, such as pouches, sachets, and resealable bags. Additionally, these forms fit in nicely with the trends of ready-to-eat meals and on-the-go consumption, which are becoming more and more common among busy customers. Flexible packaging is more appealing since it is simple to open, reseal, and dispose of, particularly in small urban spaces where efficiency and space are important considerations. Because of this, producers are using flexible packaging to satisfy contemporary consumers' demands for functionality without sacrificing the quality or freshness of their products.

Challenges in the Japan Flexible Packaging Market

Environmental Concerns and Waste Management

Despite its numerous advantages, flexible packaging has serious problems with waste management and the environment. Due to their complex composition, flexible materials—particularly multi-layer plastics—are challenging to recycle, which results in poor recycling rates and adds to the problem of plastic pollution. In Japan, strict government laws and increased consumer awareness of environmental issues place a strong emphasis on sustainability and waste reduction. Manufacturers are under a lot of pressure to innovate and create packaging solutions that are really recyclable or biodegradable without sacrificing functionality because of these concerns. One of the primary challenges is still striking a balance between eco-friendliness, functionality, and longevity. In order to develop flexible packaging that satisfies environmental regulations and supports Japan's circular economy objectives while preserving market competitiveness, businesses must invest in research and cooperation.

Competition from Alternative Packaging

Alternative packaging formats, especially rigid packaging and new sustainable choices like paper-based and biodegradable materials, are becoming a bigger threat to Japan's flexible packaging sector. Some consumer sectors find rigid packaging, such glass and hard plastics, appealing because they are thought to be more resilient and recyclable. Compostable and biodegradable packaging options that reduce their negative effects on the environment are becoming more and more popular as eco-consciousness grows. The market share of flexible packaging is under threat from these substitutes, particularly as companies work to satisfy customer demands for greener products and environmental objectives. Manufacturers of flexible packaging must innovate to be competitive by enhancing recyclability, using sustainable materials, and informing customers about the advantages of flexible forms for the environment and functioning over alternatives.

Market Segmentations

Application

- Food & Beverage

- Personal Care

- Pharmaceutical

- Household Care

- Industrial

- Others

Packaging Type

- Stand-up Pouch

- Films

- Bag-in-Box

- Others

Material

- Paperboard

- Plastic

- Aluminum Foil

- PET Film

- Others

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Amcor plc

- Berry Global Group, Inc

- Sealed Air

- DS Smith Plc

- Huhtamaki PPL Limited

- Graphic Packaging holding

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Application, Packaging Type and Material |

| Application Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Japan Flexible Packaging Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 Application

6.2 Packaging Type

6.3 Material

7. Application

7.1 Food & Beverage

7.2 Personal Care

7.3 Pharmaceutical

7.4 Household Care

7.5 Industrial

7.6 Others

8. Packaging Type

8.1 Stand-up Pouch

8.2 Films

8.3 Bag-in-Box

8.4 Others

9. Material

9.1 Paperboard

9.2 Plastic

9.3 Aluminum Foil

9.4 PET Film

9.5 Others

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Amcor plc.

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Berry Global Group, Inc.

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Sealed Air

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 DS Smith Plc.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Huhtamaki PPL Limited

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Graphic Packaging holding

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com