Global Industrial Enzymes Market Size & Forecast 2025-2033

Buy NowIndustrial Enzymes Market Size and Forecast 2025-2033

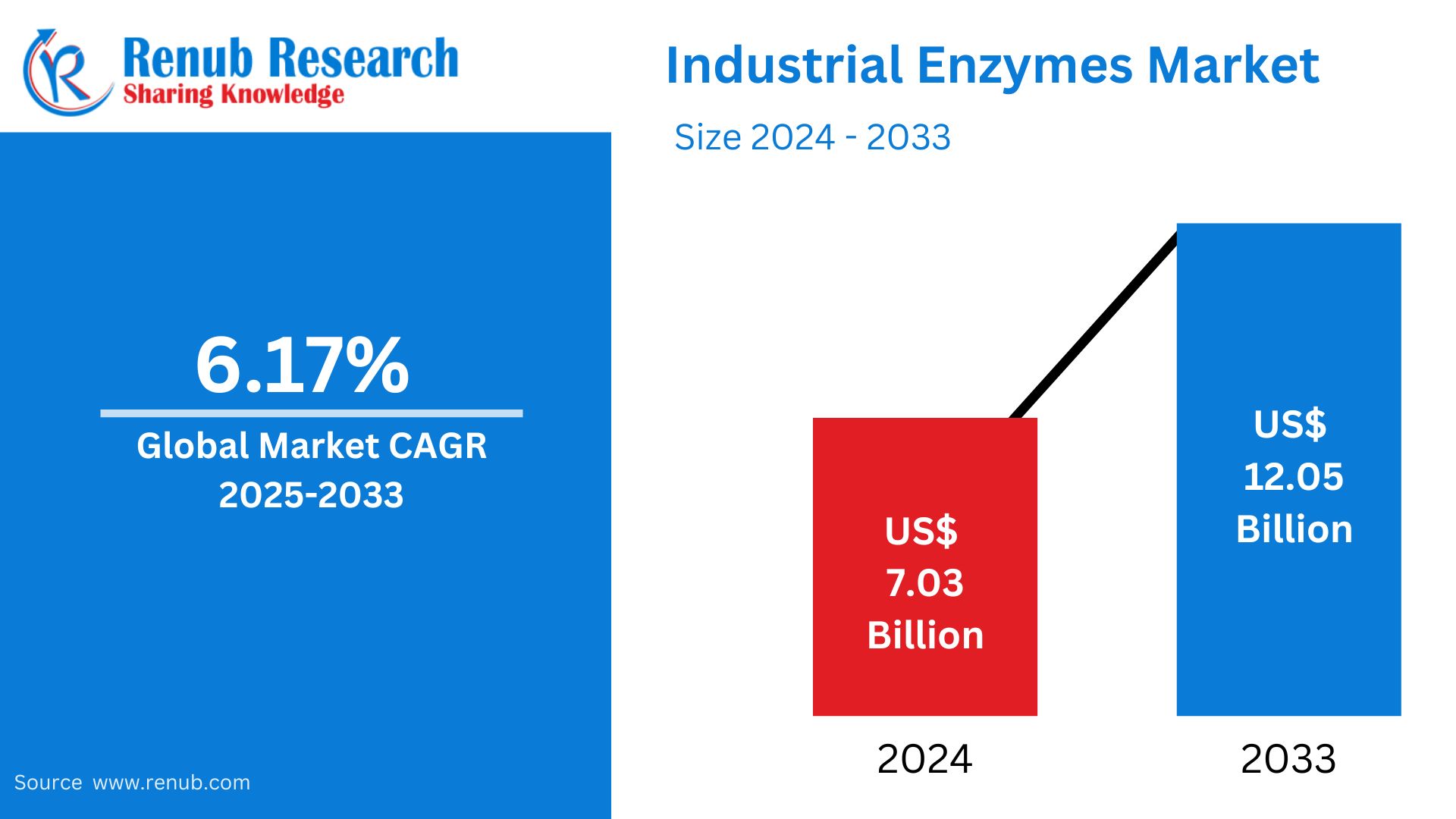

The global industrial enzymes market is expected to grow from US$ 7.03 billion in 2024 to US$ 12.05 billion by 2033, with a compound annual growth rate of 6.17% between 2024 and 2030. This increase is attributed to the demand for enzymes in food and beverages, pharmaceuticals, biofuels, and detergents. The growth is further driven by the advancement of enzyme technology, sustainability trends, and increasing focus on eco-friendly production methods that provide new growth opportunities.

Overview of the Industrial Enzymes Market

Industrial enzymes are proteins that catalyze chemical reactions in various manufacturing processes. They are of natural origin, such as microorganisms, plants, or animals. These enzymes are crucial in helping improve efficiency, reduce energy consumption, and enhance quality in a range of industrial applications. In the food and beverage area, amylases, lipases, proteases, and others are found in baking, brewing, dairy, and fruit juice production, where they breakdown starches, fats, and proteins to improve their texture, flavor, and shelf life. In biofuel, cellulases, xylanases, help break down plant biomass to fermentable sugars, contributing to an increase in biofuel production. The detergent industry makes use of enzymes such as proteases, lipases, and amylases for stain removal and the better cleaning effectiveness of laundry detergents. The pharmaceutical sector also heavily depends on enzymes in drug synthesis, such as antibiotic and vaccine production. Industrial enzymes are crucial for modern industries as they enable better manufacturing processes, reduced waste output, and more environmentally friendly processes.

Industrial Enzymes Industry Growth Drivers

Increasing Demand for Sustainable and Eco-friendly Solutions

The primary growth driver in the industrial protein market is the increasing demand for sustainable and eco-friendly solutions across various industries. Industrial enzymes offer a more environmentally friendly alternative to traditional chemical processes by reducing energy consumption, waste generation, and harmful emissions. Industry applications range from food and beverages to biofuels, and textiles, driven by more environmentally friendly production lines against an increasingly environmentally concerned, stricter regulatory backdrop. Therefore, the drive toward green manufacturing is one reason significant growth in industrial enzyme applications can be expected.

Technology advancement in enzymes

Rapid development in protein technology is the other main driver of growth in the industrial enzymes market. New and improved formulations of enzymes with higher stability, specificity, and efficiency are developed. This makes them perform better across a wide range of applications and increases their value and usability for food processing, biofuels, and pharmaceuticals. The advances in enzyme production by genetic engineering and biotechnology also broaden the applications of enzymes and hence increase demand and lead to further expansion of the market.

Food & Beverage Sector

Growth in the food and beverage sector is a prominent factor in the industrial enzymes industry. Enzymes are extensively used in the food processing industry to enhance texture, flavor, and shelf life of bread, dairy products, beverages, and other processed foods. Increasing demands for convenience, healthier foods, and better-quality foods have boosted the usage of enzymes in this industry. With changing consumer preferences toward natural and clean-label ingredients, enzymes are integral in enhancing food quality and improving efficiency in production. Therefore, the market will see growth in the food industry.

Industrial Enzymes Carbohydrases Market

The carbohydrate product category holds the largest share of the industrial enzymes market. Industrial enzymes carbohydrateases market has several applications, which include pharmaceuticals, animal feed, and food and drinks. They are carbohydrate-hydrolyzing enzymes, converting fructose and glucose into sugar syrup, and have become popular in the pharmaceutical, food, and beverage industries. Proteases also increase their market share in the organic catalyst market. They are used in various applications in the food, pharmaceutical, detergent, animal feed, chemical, and photography industries to break down proteins.

Industrial Enzyme Detergent Market

Detergents are expected to be the largest application segment in the market. Protease enzymes are most commonly used in laundry detergents. They help in removing protein stains like grass, blood, eggs, and human sweat. Lipases are also widely used for removal of greasy stains such as salad oil, frying fats, butter, lipstick, and tough stains on collars, cuffs, and sauces. However, the demand for biofuels is also anticipated to increase due to the depletion of fossil fuels and the requirement for green alternatives.

Industrial Enzyme Microorganism Market

The microorganism source segment is expected to grow substantially during the forecast period. There are three types of microorganism-based enzymes: bacterial, fungal, and yeast. Industrial enzymes from mushrooms include phenol oxidases, esterases, and hydrolases. Bacillus is the general origin of bacterial enzymes. The main markets of industrial enzymes are detergents, pharmaceuticals, and food and beverage industries. Most of the fungal enzymes find many applications and are used for various food manufacturing and preparation products, such as beer, soy sauce, dairy, processed fruits, and bakery products.

United States Industrial Enzymes Market

The United States industrial enzymes market is highly emerging with increased demand across diverse industries, such as the food and beverages, biofuels, pharmaceuticals, and detergents sectors. The use of enzymes optimizes production efficiency, diminishes energy consumption, and enables more sustainable processes to take place. Enzymes in the food sector will increase flavor, texture, and shelf life. Additionally, biofuels help degrade biomass into fermentable sugars. The growing emphasis on sustainable manufacturing and eco-friendly practices also fuels market growth. As technology evolves, the U.S. industrial protein market is expected to grow, with innovation being a driving force behind the demand for specialized enzyme solutions.

Germany Industrial Enzymes Market

The German industrial enzymes industry is rapidly growing, with increased demand across sectors such as food and beverages, detergents, biofuels, and pharmaceuticals. One major reason for market growth is the advanced manufacturing of Germany and a strong approach to sustainable practices. Food manufacturers in the food processing industries utilize enzymes such as amylases and proteases for improving the product's texture, flavor, and shelf life. For biofuel, enzymes assist by breaking down biomass that gets transformed into fuel. An environmentally friendly and efficient method of production is also seen in the increased demand for industrial enzymes. New technological development in enzymes and a heightened need for sustainability will continue driving the German market forward; new applications and innovations from various industries will emerge to expand the market.

Indian Industrial Enzymes Market

The Indian industrial enzymes sector is growing rapidly, fuelled by the increased demands across the food and beverage, textile, biofuels, and pharmaceutical segments. The increasing manufacturing sector in India, along with the increasing interest in sustainable and energy-efficient solutions, is promoting the use of enzymes in various processes. In the food industry, amylases, proteases, and lipases improve product quality, increase shelf life, and optimize processing. In the biofuel industry, enzymes break down plant materials into fermentable sugars for fuel production. In the pharmaceutical sector, enzymes are used in drug manufacturing. As awareness of the environmental benefits and cost-effectiveness of industrial enzymes grows, their adoption is expected to increase, contributing to the overall market expansion in India. The government's focus on biotechnology and sustainable development further supports the country's industrial enzymes market growth.

Saudi Arabia Industrial Enzymes Market

The Saudi Arabia industrial enzymes segment is witnessing significant growth, driven by the increasing demand for enzymes in food and beverages, biofuels, detergents, and pharmaceuticals. The country’s growing focus on diversification of its economy, especially in the non-oil sectors, has led to a rise in manufacturing activities, thereby boosting enzyme usage. In the food industry, enzymes enhance flavor, texture, and shelf life of products like baked goods, dairy, and beverages. Biofuel in Saudi Arabia is also moving to adopt enzymes to increase efficiency in the production of biofuels. In addition, the market is supplemented by Saudi Arabia's commitment to sustainability and embracing environmental-friendly production practices. The demand for industrial enzymes will increase with technological advancement to improve operational efficiency and minimize environmental impact across different industries. The market is poised for growth, with innovation in enzyme technologies and increased focus on sustainable manufacturing driving future developments.

Industrial Enzymes Market Segmentation

Types

- Carbohydrase

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

Application

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Personal Care & Cosmetics

- Agriculture

- Others

Sources – Market breakup in 3 viewpoints:

- Microorganisms

- Plants

- Animals

Regional Insights:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Developments

• Revenue Analysis

Key Players and Competitive Landscape

- BASF SE

- Advanced Enzyme Technologies

- Novozymes

- DuPont Danisco

- DSM

- Kerry Group PLC

- Dyadic International Inc.

- Associated British Foods Plc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Lead Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Industrial Enzymes Market

6. Market Share

6.1 By Types

6.2 By Applications

6.3 By Source

6.4 By Countries

7. Types

7.1 Carbohydrase

7.2 Proteases

7.3 Lipases

7.4 Polymerases & Nucleases

7.6 Other Types

8. Application

8.1 Food & Beverages

8.2 Detergents

8.3 Animal Feed

8.4 Biofuels

8.5 Textiles

8.6 Personal Care & Cosmetics

8.7 Agriculture

8.8 Others

9. Source

9.1 Microorganism

9.2 Plant

9.3 Animal

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 BASF SE

13.1.1 Overviews

13.1.2 Recent Developments

13.1.3 Revenues

13.2 Advanced Enzyme Technologies

13.2.1 Overviews

13.2.2 Recent Developments

13.2.3 Revenues

13.3 Novozymes

13.3.1 Overviews

13.3.2 Recent Developments

13.3.3 Revenues

13.4 DuPont Danisco

13.4.1 Overviews

13.4.2 Recent Developments

13.4.3 Revenues

13.5 DSM

13.5.1 Overviews

13.5.2 Recent Developments

13.5.3 Revenues

13.6 Kerry Group PLC

13.6.1 Overviews

13.6.2 Recent Developments

13.6.3 Revenues

13.7 Dyadic International Inc.

13.7.1 Overviews

13.7.2 Recent Developments

13.7.3 Revenues

13.8 Associated British Foods Plc

13.8.1 Overviews

13.8.2 Recent Developments

13.8.3 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com