Europe Food Enzymes Market: Industry Trends, Growth, Share & Forecast 2025-2033

Buy NowEurope Food Enzymes Market Size and Forecast 2025-2033

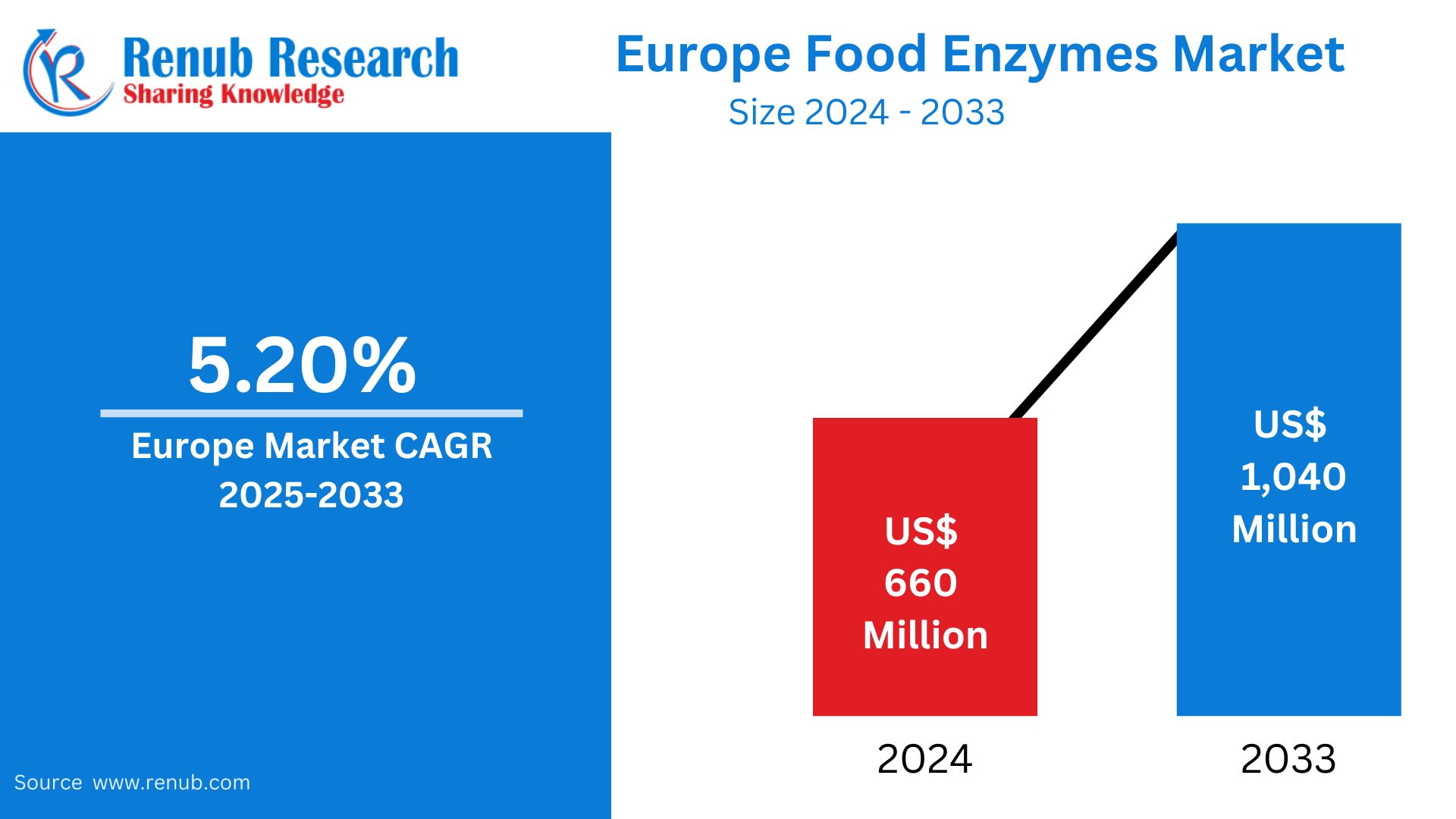

Europe Food Enzymes Market is expected to reach US$ 1,040 Million by 2033 from US$ 660 Million in 2024, with a CAGR of 5.20% from 2025 to 2033. The European market for food enzymes is expanding due to increasing consumer awareness about nutrition and health concerns, a shift towards natural and clean-label products, and an increase in demand for processed and packaged foods. Government support and advancements in enzyme synthesis also drive market growth.

Europe Food Enzymes Market Report by Types (Carbohydrase, Lipase, Prostate, and Others), Source (Microorganisms, Plants, and Animals), Application (Beverages, Bakery Products, Dairy Products, and Others), Countries and Company Analysis 2025-2033.

Europe Food Enzymes Market Overview

Food enzymes are dietary supplements that facilitate the breakdown of complex nutrients into easier forms of digestion. Food products have these enzymes in them to extend their shelf life and help maintain their nutrients. Some of the most accessible food enzymes are cellulase, lipase, amylase, and protease. These enzymes are used in foods with vegetable and high-sugar oils and baked foods. Food and beverage companies extensively utilize carbohydrase, an amylase enzyme, to prepare imitation sweeteners, wines, and fruit juices and vegetable juices.

The considerable growth of the food and beverages industry, in addition to a rise in the demand for bakery, packaged foods, and pre-prepared meals, are primarily driving the European food enzyme industry. Also, the market is growing because of customers' increasing food quality awareness. Food enzymes are often utilized for enhancing food quality. In this regard, they are commonly used in Europe, one of the world's largest producers of meat, to process meat and make it more supple. Also, the market is growing because of the increased demand for organic nutraceuticals produced by high-quality natural enzymes. The market also has an impact from changing diets and lifestyles of customers, together with increasing demand for high-performance food products.

Growth Drivers for the Europe Food Enzymes Market

Advancements in technology

The food enzyme market in Europe is growing largely because of advances in technology. Advances enhance product quality and production efficacy while responding to consumer needs for sustainable and healthier options. A notable example is the introduction by DSM-Firmenich in June 2023 of Maxilact®Next. In contrast to previous solutions, this advanced lactase enzyme accelerates lactose hydrolysis by 25% to produce lactose-free milk products faster without compromising taste. These technological innovations help manufacturers reduce costs, simplify processes, and respond to the increasing demand for lactose-free products.

Sustainability Initiatives

With consumers and manufacturers giving more importance to green practices, sustainability efforts are driving the growth of the European food enzyme market. By consuming less energy, generating less waste, and needing fewer artificial additives, enzymes facilitate sustainable food processing. They enable cleaner production methods and make it possible to utilize raw materials more efficiently, which is aligned with legal and environmental goals.

To supply animal protein producers with top-performing enzyme solutions, BASF and Cargill expanded their partnership in January 2023. With the supply of enzyme-based offerings that enhance feed efficiency and reduce environmental footprints, this collaboration reflects their mutual commitment to innovation and sustainability. Such programs highlight the significance of enzymes in developing a more robust and sustainable food system, which drives higher consumer demand.

Consumer Demand for Natural Ingredients

The European food enzyme market is growing largely because of increasing consumer demand for natural ingredients. Enzymes are being employed by food manufacturers as clean-label processing aids to meet demand from health-aware consumers seeking fewer chemical additives. As well as providing shelf life and freshness extension and maintaining quality, enzymes ensure that consumers' demand for fewer processed foods, with greater transparency, is met.

Top Danish producers of enzymes and food ingredients, Novozymes and Chr. Hansen, made a merger in December 2022 to enhance their positions in the global enzymes market, fueling this trend. Likewise, to further meet the need for natural and functional ingredients in food and nutrition, AB Biotek Ingredients acquired the Spanish enzyme producer DR Healthcare España in May 2021, expanding its portfolio with Diamine Oxidase (DAO).

Challenges in the Europe Food Enzymes Market

Raw Material Availability

One major issue facing the European food enzymes market is the availability of raw materials. The manufacturing of enzymes depends on certain microbial strains or agricultural inputs, which are impacted by climate change, seasonal fluctuations, and interruptions in global supply chains. Supply delays, higher expenses, and irregular production might result from fluctuating availability. In order to maintain continuous output and satisfy market needs, firms are under pressure to invest in alternative raw material methods and secure steady sourcing.

Strict Regulatory Framework

The market for food enzymes is severely hampered by Europe's stringent regulatory environment. For enzyme approvals, the European Food Safety Authority (EFSA) demands thorough safety assessments and thorough paperwork, which frequently results in drawn-out and expensive approval procedures. These strict rules can hinder innovation and reduce the region's market's potential for overall growth by delaying product launches, raising compliance costs, and erecting obstacles for new competitors.

Germany Food Enzymes Market

The market for food enzymes in Germany is expanding steadily due to a booming processed food sector, growing consumer demand for clean-label and non-GMO products, and growing health consciousness. The use of enzymes in baking, dairy, and beverage applications is increasing as consumers choose healthier foods. With the widespread usage of enzymes like lipases, amylases, and proteases to improve texture and shelf life, the baking industry in particular makes a significant contribution. Additionally, producers are creating enzyme solutions devoid of genetic alteration in response to consumers' increasing need for clear and natural ingredients. BASF SE, DuPont, AB Enzymes, ADM, and Chr. Hansen A/S are important companies in the German market that make significant investments in sustainable solutions and innovation.

France Food Enzymes Market

The market for food enzymes in France is expanding steadily due to growing consumer awareness of nutrition and health issues as well as increased demand for processed foods. The manufacture of cheese, fruit juice, dairy products, brewing, and baked goods are important businesses that use enzymes. Enzymes such as lipases and lactase are essential in the dairy industry for creating lactose-free and high-value goods. The usage of enzymes improves dough texture, volume, and shelf life, which benefits the baking industry as well. Advanced enzyme solutions are being introduced by businesses to improve product efficiency and satisfy clean-label requirements. Among the prominent companies in the French market are Novozymes, DuPont, Chr. Hansen, BASF SE, Kerry Group, and Corbion. The industry is still growing across a number of food categories thanks to ongoing innovation and customer preferences for natural ingredients.

United Kingdom Food Enzymes Market

The market for food enzymes in the UK is expanding significantly due to rising consumer demand for clean-label and natural products and a focus on sustainability in food production. Enzymes are used extensively in the bakery, dairy, beverage, and bioenergy industries to improve the quality, texture, and shelf life of products. A growing emphasis on healthier, more transparent food options supports the need for enzymes in these industries. Leading businesses in the industry are coming up with new ideas and offering innovative solutions to satisfy these changing customer demands.

Europe Food Enzymes Market Segment Analysis by Type and Application

Type

- Carbohydrase

- Lipase

- Protease

- Others

Application

- Beverages

- Bakery Products

- Dairy Products

- Others

Source

- Microorganisms

- Plants

- Animals

Countries

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

All companies have been covered from 4 viewpoints:

- Overview

- Key Persons

- Recent Development

- Financial Insights

Company Analysis

- Archer Daniels Midland Co.

- DuPont de Nemours, Inc

- Kerry Inc.

- AB Enzymes

- Cargill Inc.

- Novozymes A/S

- Associated British Foods Plc.

- Dyadic International, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Application, Source and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Food Enzymes Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Europe Food Enzymes Market Share Analysis

6.1 By Type

6.2 By Application

6.3 By Source

6.4 By Countries

7. Type

7.1 Carbohydrase

7.2 Lipase

7.3 Protease

7.4 Others

8. Application

8.1 Beverages

8.2 Bakery Products

8.3 Dairy Products

8.4 Others

9. Source

9.1 Microorganisms

9.2 Animals

9.3 Plants

10. Countries

10.1 France

10.2 Germany

10.3 Italy

10.4 Spain

10.5 United Kingdom

10.6 Belgium

10.7 Netherlands

10.8 Russia

10.9 Poland

10.10 Greece

10.11 Norway

10.12 Romania

10.13 Portugal

10.14 Rest of Europe

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Archer Daniels Midland Co.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments & Strategies

13.1.4 Revenue Analysis

13.2 DuPont de Nemours, Inc

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments & Strategies

13.2.4 Revenue Analysis

13.3 Kerry Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments & Strategies

13.3.4 Revenue Analysis

13.4 AB Enzymes

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments & Strategies

13.4.4 Revenue Analysis

13.5 Cargill Inc.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments & Strategies

13.5.4 Revenue Analysis

13.6 Novozymes A/S

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments & Strategies

13.6.4 Revenue Analysis

13.7 Associated British Foods Plc.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments & Strategies

13.7.4 Revenue Analysis

13.8 Dyadic International, Inc.

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments & Strategies

13.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com