Global Sugar Market Size, Share, Trends, and Forecast 2025-2033 – Industry Analysis by Renub Research

Buy NowGlobal Sugar Market Size and Forecast 2025-2033

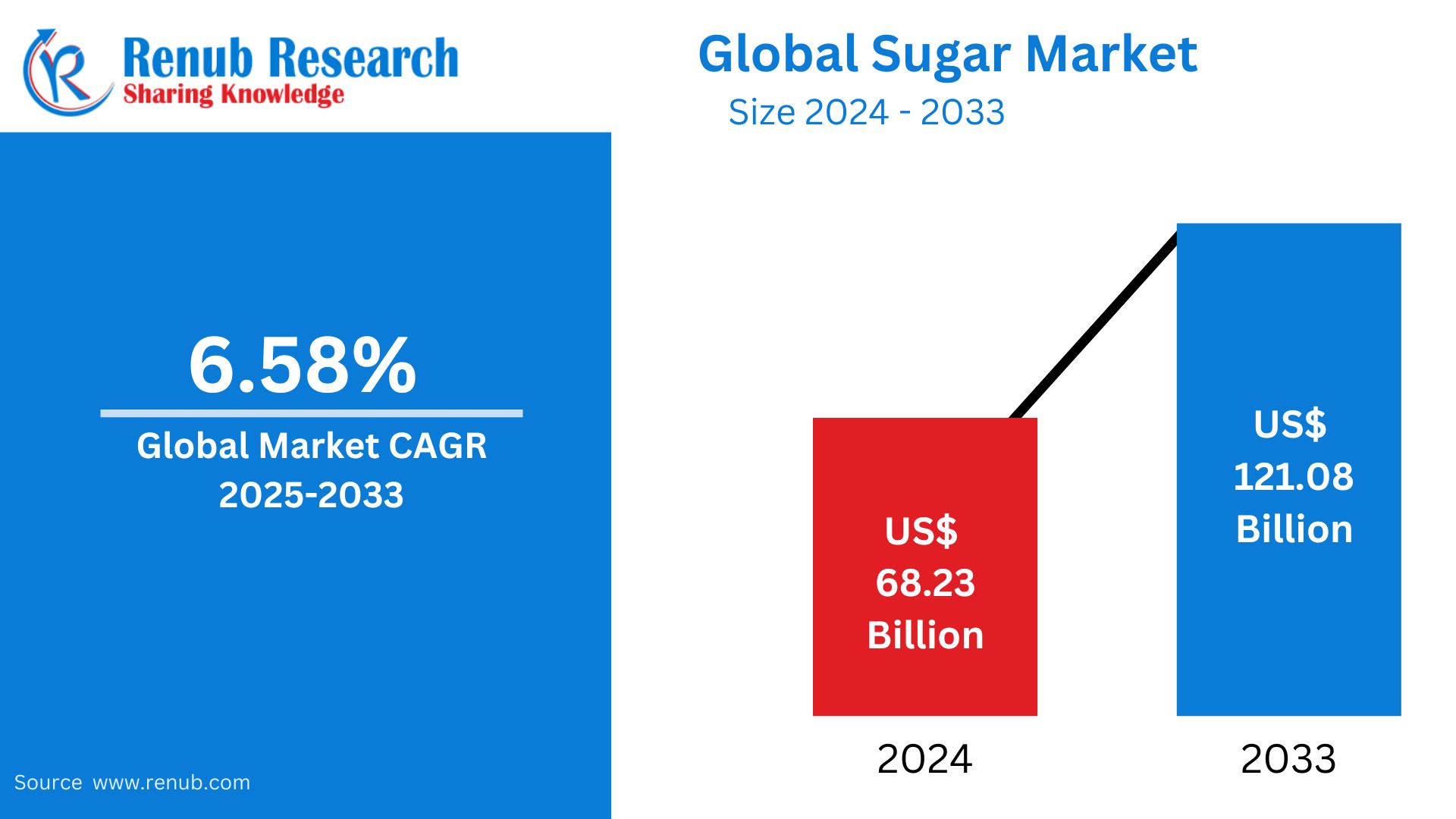

Sugar Market is expected to reach US$ 121.08 billion 2033 from US$ 68.23 billion in 2024, with a CAGR of 6.58% from 2025 to 2033. Some of the main drivers supporting the market's growth in Brazil include the expanding availability of different processed food products through a variety of distribution channels, the growing usage of these products in the pharmaceutical industry, and the growing consumption of these products by individuals.

Sugar Market Global Report by Product Type (White, Brown, Liquid), Form (Granulated, Powdered, Syrup), Source (Sugarcane, Sugar Beet), End User (Food and Beverages, Pharma and Personal Care, Household), Countries and Company Analysis 2025-2033.

Sugar Market Overview

Numerous foods, including fruits, vegetables, and dairy products, naturally contain sugar, a type of carbohydrate. For commercial purposes, it is frequently produced from sugarcane and sugar beet and refined into syrup, granulated sugar, and other forms. Glucose, which is produced from sugar, is used by the body as fuel. It is frequently used as a sweetener in baked goods, processed meals, and beverages.

The rising use of processed foods and beverages is one of the main factors driving the sugar market. Sugar is an ingredient in numerous products, including soft beverages, confections, baked goods, and snacks. Since most of these items depend on sugar for flavor and preservation, the demand for sugar has increased as a result of population growth, particularly in urban areas, and a shift in diet from traditional meals to junk food and convenience food. The growth of the food service industry, especially in emerging nations where the need for sugar is continually rising, is another element taken into account. In the case of sugar, demand is quite sensitive to other patterns of consumption that favor luxuries and sweet foods and beverages.

Growth Drivers of the Sugar Market

An increase in personal care product sales

The industry is expanding as a result of consumers' growing demand for natural components in personal care products that don't damage skin or trigger allergies. Because sugar helps to provide smooth and moisturized skin while decreasing the indications of aging, there is an increase in demand for it in scrubs. By keeping hair from becoming limp, it also helps to remove dead cell layers from the skin and give it a velvety texture. The market is expanding as a result of this and the growing use of sugar to lighten and brighten skin tones. Due to its exfoliating and moisturizing qualities, sugar is a crucial ingredient in skincare and haircare products, and the trend toward natural cosmetic components is having a growing impact on the worldwide sugar industry.

Broad accessibility via several modes of delivery

Sugar is currently widely available through a variety of distribution channels, which is supporting the market's expansion. Additionally, sugar is affordable and widely accessible, offering comfort and convenience to people everywhere. The NIH estimates that Americans consume almost 300% of the daily recommended amount of sugar. Accordingly, it is a necessary product that is used on a daily basis and comes in a variety of colors, shapes, and textures to appeal to a broad range of customers. In addition, the industry is expanding due to the increased sales of sugar on internet marketplaces worldwide. Additionally, statistics from the sugar sector emphasize how improved distribution methods, an increase in online sales, and consumer accessibility have contributed to the steady growth of the market.

Growing beverage consumption

One major factor driving the sugar market is the rising use of beverages, especially sweet ones. Sugar is becoming a more important element as the demand for energy drinks, soft drinks, and other sweetened beverages develops worldwide, particularly in emerging nations. Higher sugar consumption is also a result of the growing popularity of flavored juices, bottled waters, and ready-to-drink beverages. These drinks' widespread appeal encourages sugar consumption in spite of health risks, which propels market expansion.

Challenges in the Sugar Market

Volatile raw material prices

The sugar market is severely hampered by fluctuating raw material prices. Weather, crop yields, and interruptions in the global supply chain are some of the factors that have a significant impact on sugar prices. Price swings may result from unforeseen circumstances such as floods, droughts, or modifications to governmental regulations in important sugar-producing nations. The sugar industry's producers and customers are ultimately impacted by these price fluctuations, which make it challenging for them to maintain steady pricing and profit margins.

Growing Consumer Awareness of the Negative Health Effects of High Sweets Consumption Will Restrain Market Growth

The industry's expansion is significantly impacted by the rising incidence of lifestyle-related diseases including diabetes and obesity linked to excessive sugar intake. The Global Diabetes Community in the United Kingdom estimates that 415 million individuals worldwide were diagnosed with diabetes in 2018, and by 2040, that figure is predicted to increase to 642 million people. Low-GI, low-carb, and reduced-sugar diets are popular among consumers who want to avoid these disorders and preserve their general health. Therefore, it is anticipated that during the projection period, the growing number of people with illnesses including diabetes and cardiovascular diseases will slow the growth of the market as a whole. Furthermore, the market's growth is anticipated to be significantly hampered by the expanding availability of sugar substitutes that are thought to be healthier, such as honey, stevia, and jaggery.

Sugar Market Size by Region and Country

China and India are two of the biggest consumers in the Asia-Pacific region, which dominates the sugar market. Demand is stable in North America and Europe, however consumption is impacted by health-conscious tendencies. Africa's market is expanding as a result of rising demand and population expansion, while Latin America—especially Brazil—leads the world in production and exports.

United States Sugar Market

Due to the strong demand in the food and beverage industries, the US sugar industry is among the biggest in the world. Soft drinks, baked goods, snacks, and processed foods all include sugar. Sugar is still a common ingredient even with the rise of low-calorie substitutes and growing health concerns. Both imports and indigenous production—mainly from sugar beet and cane—have an impact on the market. The market is also impacted by government actions, such as initiatives to support the price of sugar. But as people become more conscious of the negative health effects of consuming too much sugar, they are moving toward healthier options and consuming less.

Germany Sugar Market

Consistent demand in the food and beverage industries, especially in baked goods, soft drinks, and confections, is what defines the German sugar market. However, there has been a move toward sweeteners and substitutes with less sugar due to rising health consciousness and efforts to reduce sugar intake. Trade agreements and sugar quotas are two examples of EU policies that have a significant impact on the market. Furthermore, the demand for natural and organic sugars is being driven by Germany's emphasis on sustainability and clean-label products, which is also impacting consumer preferences and production trends.

India Sugar Market

Due to a high local demand for sugar in food, drinks, and confections, India has one of the biggest sugar markets in the world. India, the second-largest producer of sugar in the world, depends mostly on the production of sugarcane. To encourage sustainable sugarcane production methods, Hyderabad's NSL Sugars and Mumbai-based UPL Sustainable Agriculture Solutions (UPL SAS) inked a Memorandum of Understanding (MoU) in August 2023. Through this agreement, the sector's sustainability will be improved and sugarcane yield per acre will rise by 15%, or 5 metric tonnes. Government regulations, subsidies, and weather-related output fluctuations can influence the market. Organic and lower-sugar products are becoming more popular as people become more conscious of the health effects.

Saudi Arabia Sugar Market

The food and beverage industry's strong demand, especially for processed meals, soft drinks, and sweets, is driving the Saudi Arabian sugar market. Sugar continues to be a mainstay in the diet of the area despite rising health concerns and the trend toward low-sugar substitutes. With an emphasis on satisfying the demands of an expanding population and developing urbanization, the market is impacted by both domestic production and imports. Furthermore, market dynamics are being impacted by government policies and programs that encourage the adoption of healthier options by lowering sugar consumption through levies and public awareness campaigns.

Global Sugar Market Segmentation

Product Type

- White

- Brown

- Liquid

Form

- Granulated

- Powdered

- Syrup

Source

- Sugarcane

- Sugar Beet

End User

- Food and Beverages

- Pharma and Personal Care

- Household

Region and Country

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insight

Top Players in the Global Sugar Market

- Archer Daniels Midland

- Tate and Lyle

- General Mills, Inc.

- MGP Ingredients Inc.

- Kerry Group

- Südzucker AG

- Tereos

- Cosan SA

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Form, Source, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Sugar Market

6. Market Share Analysis

6.1 Product Type

6.2 Form

6.3 Source

6.4 End User

6.5 Countries

7. Product Type

7.1 White

7.2 Brown

7.3 Liquid

8. Form

8.1 Granulated

8.2 Powdered

8.3 Syrup

9. Source

9.1 Sugarcane

9.2 Sugar Beet

10. End User

10.1 Food and Beverages

10.2 Pharma and Personal Care

10.3 Household

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1.1 Strength

13.1.2 Weakness

13.1.3 Opportunity

13.1.4 Threat

14. Key Players Analysis

14.1 Archer Daniels Midland

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Financial Insight

14.2 Tate and Lyle

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Financial Insight

14.3 General Mills, Inc.

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Financial Insight

14.4 MGP Ingredients Inc.

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Financial Insight

14.5 Kerry Group

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Financial Insight

14.6 Südzucker AG

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Financial Insight

14.7 Tereos

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Financial Insight

14.8 Cosan SA

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com