Food Safety Testing Market, Size, Global Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowGlobal Food Safety Testing Market Outlook

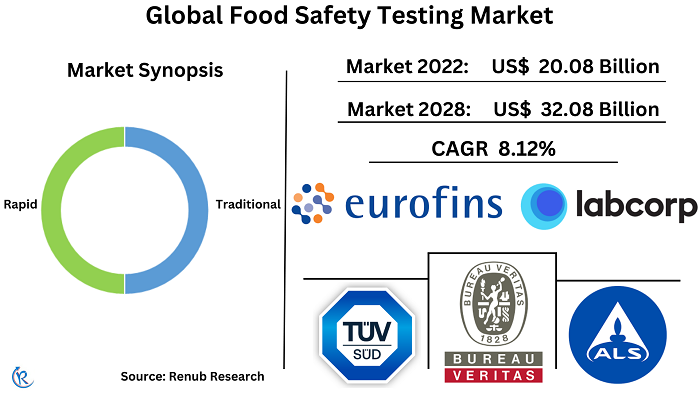

Global Food Safety Testing Market will reach US$ 32.08 Billion in 2028, according to Renub Research. Food safety testing offers several benefits, including safeguarding public health by detecting and preventing the spread of foodborne illnesses involving testing food products for harmful pathogens, such as bacteria and viruses, and other contaminants that can cause infections and diseases. Additionally, many countries have laws that mandate food safety testing to ensure food products are safe for human consumption. Complying with these regulations can prevent businesses from facing hefty fines, product recalls, and damage to their reputation.

Furthermore, food safety testing can help companies ensure that their products are consistently high quality by identifying and addressing potential problems with contaminants and other quality issues before they become widespread. When consumers perceive that a business is dedicated to food safety testing, it can increase their confidence in the products they buy, leading to improved customer loyalty and repeat business.

Global Food Safety Testing Market shall expand at a CAGR of 8.12% from 2022 to 2028

Food safety testing can help enterprises manage their supply chains more effectively by pinpointing potential issues and taking corrective action to prevent future problems. By monitoring the safety of ingredients and other inputs, companies can ensure that their products meet stringent quality and safety standards.

As the food supply becomes more globalized, with products from around the world, there is a greater need for testing to ensure that imported food products meet local safety standards. In addition, developing new testing technologies has made it easier and more cost-effective to test food products for contaminants, which has helped drive industry growth.

Furthermore, as more consumers seek organic and natural food products, there has been a growing need for testing to ensure that these products are free from harmful contaminants. In addition, governments worldwide have implemented stricter regulations for food safety testing, which has led to increased demand for testing services. Hence, the market value for the Global food safety testing market was US$ 20.08 Billion in 2022.

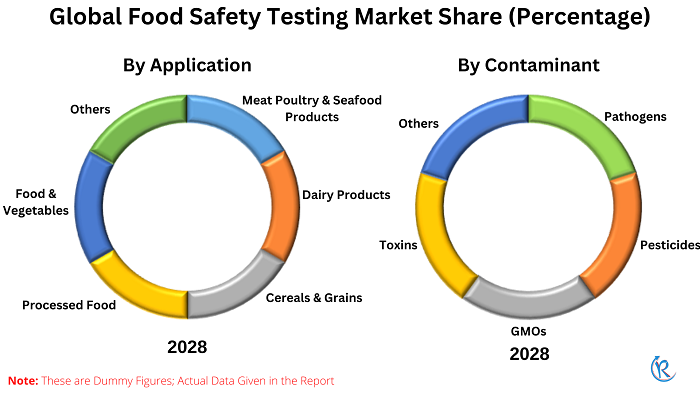

Life-threatening aspect of Pathogens adds to their dominance

Based on the contaminant, there are five divisions- Pathogens, Pesticides, GMOs, Toxins, and Others (food allergens, chemical residue). Pathogens in food can cause life-threatening illnesses, making it crucial to prevent their spread. They are common in raw or minimally processed food, necessitating pathogen testing to ensure food safety. For food businesses to operate, it is essential to adhere to regulations that require the testing of pathogens such as E. coli, Salmonella, and Listeria. Consumer demand for safe food products has also increased, especially after high-profile outbreaks of foodborne illnesses.

Prevalence and Severity of Illness drive the hegemony of Salmonella in the Food Safety Testing Industry

Salmonella, Listeria, E-Coil, Campylobacter, and Others, are the different types of pathogen food testing techniques used in the food safety testing industry. Salmonella infections are severe, particularly for vulnerable populations, making testing a priority for public health protection. Consumers are aware of foodborne illness risks, and demand for Salmonella-tested products has increased, with companies showing commitment to food safety enjoying increased consumer trust. In addition, technological advances have been made testing more specific and cost-effective, driving focus toward Salmonella testing.

Listeria testing has grown due to regulations in many countries requiring testing for the pathogen in certain food products. Listeria can cause severe illness, particularly in vulnerable populations, which has increased the importance of testing. High-profile outbreaks have also raised public awareness and pressured food companies to implement more rigorous testing protocols.

Dairy Industry growth is due to dairy products' High Perishability and Consumers' increasing demand for Safe and high-quality Food Products

The application of food safety testing is prevalent in Meat, Poultry & Seafood products, Dairy products, Cereals & Grains, Processed food, Food & Vegetables, and Others. Dairy products are perishable and susceptible to contamination, leading to strict safety regulations and increased demand for testing services. The consumption of Dairy products is global, making their safety and quality a top priority for manufacturers and regulators. In addition, advances in testing technologies have made Dairy testing more cost-effective, contributing to industry growth. Increased consumer concern for food safety and quality has also driven demand for testing services in the dairy industry.

Safety in the adoption of Traditional Technology benefits

Technologies used in food safety testing are Traditional and Rapid. Adopting traditional technology in the food safety testing industry has increased for several reasons. First, regulatory agencies widely accept the reliability and accuracy of proven methods such as culture-based techniques. Moreover, traditional methods are often more cost-effective and accessible than newer, high-tech options, making them a practical choice for smaller food businesses. Additionally, traditional methods are still the best option when newer methods are unsuitable. Furthermore, the ability of conventional methods to detect and identify a wide range of pathogens has made them an essential tool in ensuring food product safety.

North America holds the Lion's Share in the Food Safety Testing Market

North America, Europe, Asia-Pacific, and the Rest of the world are the regions that comprise the food safety testing market. The North American food industry has strict safety standards and regulations, leading to a high demand for testing services due to public health concerns and consumer awareness. In addition, the region's competitive food safety testing industry has been aided by a culture of innovation and technological advancement, resulting in new and improved testing methods and technologies. Asia-Pacific's food safety testing industry has grown due to a rise in foodborne illnesses, increasing demand for high-quality and safe food, a more complex food supply chain, stricter government regulations, and advancements in testing technologies.

Key Players Analysis

SGS SA, Eurofins Scientific, Intertek Group plc (UK), Bureau Veritas SA (France), ALS Limited, TÜV SÜD, TÜV Nord Group, AsureQuality Ltd, and Laboratory Corporation of America Holdings are significant companies competing in the market.

- In July 2022: A new food analysis laboratory was launched by SGS in Mexico to aid the Mexican food industry in quality control and regulatory compliance. The location of the laboratory is located in Naucalpan.

- In May 2022: Bureau Veritas opened its third microbiology laboratory in the US, Reno, Nevada. The facility is focused on conducting quick pathogen testing and microbiology indicator examination for the agri-food sector and provides laboratory testing, inspection, and certification services.

Contaminant – Market breakup from 5 Viewpoints:

1. Pathogens

2. Pesticides

3. GMOs

4. Toxins

5. Others (food allergens, chemical residue)

Pathogen food testing – Market breakup from 5 Viewpoints:

1. Salmonella

2. Listeria

3. E-Coil

4. Campylobacter

5. Others

Application – Market breakup from 7 Viewpoints:

1. Meat Poultry & Seafood Products

2. Dairy Products

3. Cereals & Grains

4. Processed food

5. Food & Vegetables

6. Others

Technology – Market breakup from 2 Viewpoints:

1. Traditional

2. Rapid

Region – Market breakup from 4 Viewpoints:

1. North America

2. Europe

3. Asia-Pacific

4. Rest of the World

Company have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

1. SGS SA

2. Eurofins Scientific

3. Intertek Group plc (UK)

4. Bureau Veritas SA (France)

5. ALS Limited

6. TÜV SÜD

7. TÜV Nord Group

8. AsureQuality Ltd

9. Laboratory Corporation of America Holdings

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Contaminant, Pathogen Food Testing, Application, Technology, and Region |

| Region Covered | North America, Europe, Asia Pacific, Rest of the World |

| Companies Covered | SGS SA, Eurofins Scientific, Intertek Group plc (UK), Bureau Veritas SA (France), ALS Limited, TÜV SÜD, TÜV Nord Group, AsureQuality Ltd, and Laboratory Corporation of America Holdings |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Porter’s Five Forces

5.1 Bargaining Power of Buyers

5.2 Bargaining Power of Suppliers

5.3 Degree of Competition

5.4 Threat of New Entrants

5.5 Threat of Substitutes

6. Global Food Safety Testing Market

7. Global Food Safety Testing Market Share Analysis

7.1 By Contaminant

7.2 By Pathogen Food Testing

7.3 By Application

7.4 Technology

7.5 By Regions

8. Contaminant

8.1 Pathogens

8.2 Pesticides

8.3 GMOs

8.4 Toxins

8.5 Others (Food allergens, chemical residue)

9. Pathogens

9.1 Salmonella

9.2 Listeria

9.3 E-Coil

9.4 Campylobacter

9.5 Others

10. Application

10.1 Meat, Poulty, & Seafood Products

10.2 Dairy Products

10.3 Cereals & Grains

10.4 Processed Food

10.5 Fruits & Vegetables

10.6 Others

11. Technology

11.1 Traditional

11.2 Rapid

12. Regions

12.1 North America

12.2 Europe

12.3 Asia-Pacific

12.4 Rest of the world

13. Companies Profile

13.1 SGS SA

13.1.1 Overview

13.1.2 Resent Development

13.1.3 Revenue

13.2 Eurofins Scientific

13.2.1 Overview

13.2.2 Resent Development

13.2.3 Revenue

13.3 Intertek Group plc (UK)

13.3.1 Overview

13.3.2 Resent Development

13.3.3 Revenue

13.4 Bureau Veritas SA (France)

13.4.1 Overview

13.4.2 Resent Development

13.4.3 Revenue

13.5 ALS Limited

13.5.1 Overview

13.5.2 Resent Development

13.5.3 Revenue

13.6 TÜV SÜD

13.7.1 Overview

13.7.2 Resent Development

13.7.3 Revenue

13.7 TÜV Nord Group

13.7.1 Overview

13.7.2 Resent Development

13.7.3 Revenue

13.8 AsureQuality Ltd

13.8.1 Overview

13.8.2 Resent Development

13.8.3 Revenue

13.9 Laboratory Corporation of America Holdings

13.9.1 Overview

13.9.2 Resent Development

13.9.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com