Global Spice Market – Consumption Trends & Forecast 2025–2033

Buy NowGlobal Spices Market Size and Forecast 2025-2033

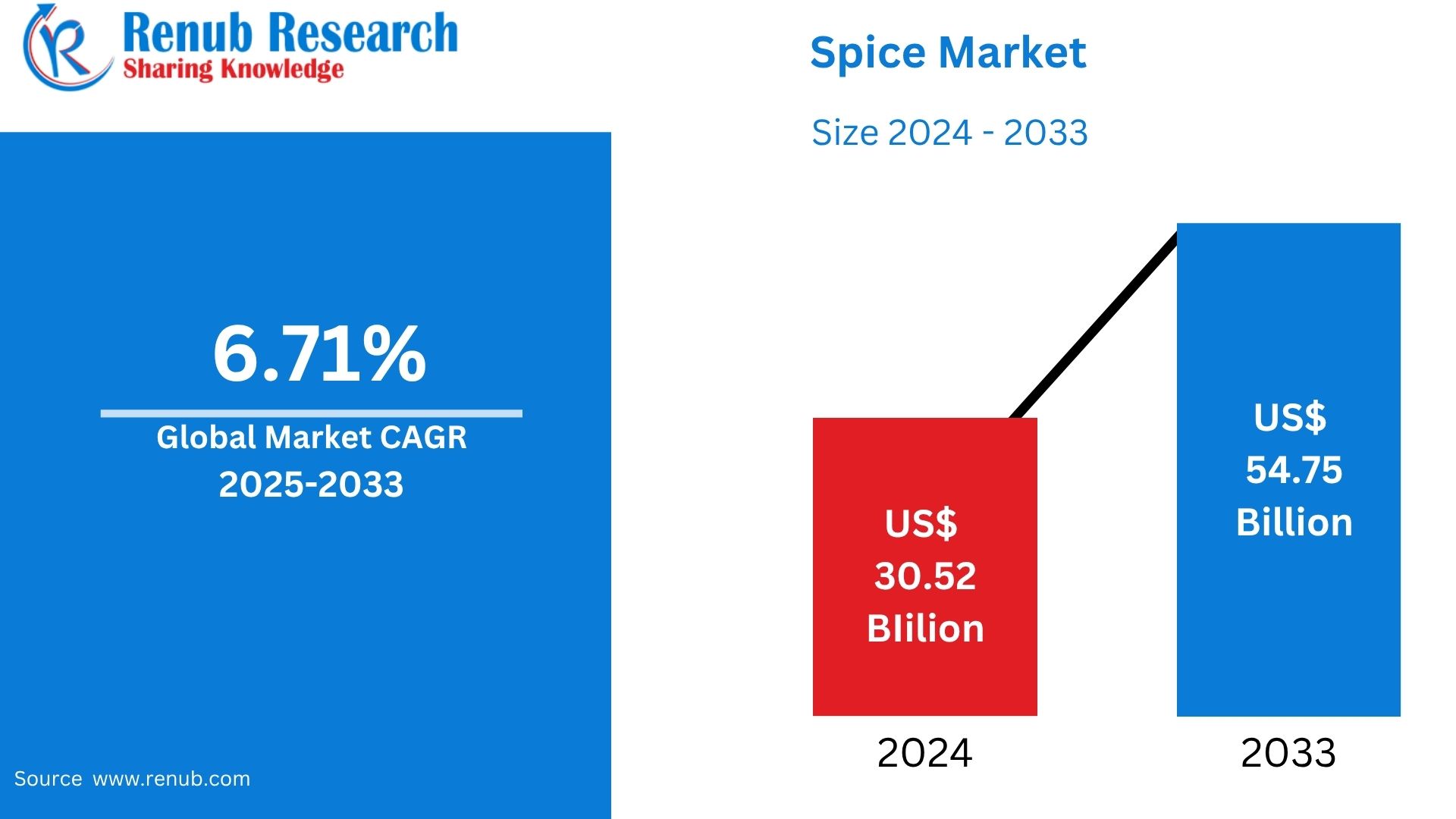

The size of the Global Spices Market was US$ 30.52 billion in 2024 and is anticipated to progress with a CAGR of 6.71% during the forecast period of 2025-2033 and reach an estimated US$ 54.75 billion in 2033. The growth is driven by the increasing need for ethnic foods, rising awareness of the health benefits associated with spices, and their rising applications in food processing and pharmaceuticals globally.

Global Spices Market Report by Products Types (Pure Spices, Blended Spices), Application (Meat and Poultry Products, Bakery and Confectionery, Frozen Foods, Snacks and Convenience Foods, Others), Form (Powder, Whole, Crushed, Chopped) and Company Analysis 2025-2033.

Global Spices Market Outlooks

Spices are natural plant material employed primarily to flavor, color, or preserve food. Common spices include turmeric, cinnamon, cumin, black pepper, cardamom, and cloves. Spices, which are derived from seeds, roots, bark, fruits, and flowers, have been an integral part of global culinary culture for centuries. Apart from cooking, they offer medical, cosmetic, and preservative benefits. Their antibacterial, antioxidant, and anti-inflammatory properties make them beneficial in traditional and modern medicine.

Demand for spices has gone up globally since there is greater interest in multicultural food, especially Asian and Middle Eastern cuisine, and increased demand for natural ingredients consumed in food as well as wellness products. Food tourism, globalization, and health-conscious lifestyles have driven their demand in domestic homes as well as the food industry. In addition, food gourmet cultures and e-commerce sites have made consumption of more varieties of global spices possible, leading to higher market growth and popularity.

Growth Drivers of the Global Spices Market

Growing Health Consciousness and Demand for Natural Ingredients

Consumers are increasingly looking for natural alternatives of artificial additives and preservatives. Spices, being antioxidant, anti-inflammatory, and antimicrobial in nature, are predominantly on demand in health-concerned diets. Turmeric, ginger, cinnamon, and garlic are already household names for their medicinal benefits. The movement of organic and functional foods is also influencing spice consumption, both domestically and in food enterprises. As consumers worldwide become increasingly health- and immunity-aware, the demand for naturally-sourced spices is going to remain robust, driving steady market expansion. Mar 2023, VAHDAM India, a wellness international company, has forayed into the spice industry with the introduction of VAHDAM Spices. Keeping with their culture of innovation and wellness, they partner with Indian farmers to provide high-quality, pure spices to seekers of wellness.

Growing Globalization of Food and Cuisine

Global travel, media, and cultural exchange have led to rising demand for global and ethnic cuisines. Spices, an essential part of Asian, Middle Eastern, and Latin American cuisine, have gained popularity globally. Restaurants and pre-packaged foods are introducing global flavors to their repertoire, boosting the demand for other spice blends. This multiculturalism is not restricted to urbanized zones but is growing in suburban and rural regions. With shifting consumer preferences, the global demand for ubiquitous as well as exotic spices continues to increase, which provides a push factor for significant market growth.

Emergence of E-commerce and Packaged Brand Spices

The rapid development of e-commerce has made it easy for consumers to access an immense range of spices, from exotic to organic spices. Small-scale spice producers are now accessing global markets easily through online platforms. In addition, standardized quality branded packaged spices with emphasis on labeling and small pack sizes have increased consumer confidence and convenience. Such ease of access combined with increasing urbanization and stressful lifestyles is propelling sales of individual spices as well as mixed spice blends through online shopping sites. Jan 2025, KRBL launches consumer-driven packaging for premium rice, plans to venture into spices.

Challenge in the Global Spices Market

Volatility of Raw Material Costs and Supply Chain Disruptions

Spices depend heavily on farm output and weather conditions. Climate change, natural disasters, and pest infestation affect crop yields and supply chain disruption. Price volatility of raw spices like cardamom, black pepper, and saffron affects processors' and retailers' margins. Logistics limitations, especially in the Third World, also impact the delivery and quality of the spices within reasonable times. These factors pose risks to dependable availability and price, which are challenges to the long-term sustainability of the market.

Adulteration and Quality Problems

The spice business is constantly plagued by adulteration of the products, which destroys consumer confidence. Some manufacturers mix fillers, dyes, or old stocks to reduce cost or extend shelf life. Failure to exercise regulation in certain countries contributes to the challenge. Traceability and certification for food safety are increasingly demanded by international buyers. As consumers' awareness continues to rise, market participants have to guarantee quality standards and transparency, including technology and regulation protection that may be costly for small-scale operators.

Pepper Spices Market

Black pepper is one of the globe's most traded and consumed spices. Black pepper is highly flavored and has desirable health effects like digestive and anti-inflammatory properties. Black pepper is in firm demand for domestic cooking and industrial food processing, especially in processed meats, sauces, and spice mixtures. India, Vietnam, and Indonesia are major producers. Unstable crop yields, nevertheless, can affect world prices. Organic farming and sustainable sourcing technologies are also helping meet demand from premium food manufacturers and health-conscious consumers.

Market for Ginger Spices

Ginger is a prime position in global spice markets due to its dual role as a culinary spice and medicinal herb. It is used extensively in Middle Eastern, Asian, and Western cuisine, herbal teas, health drinks, and pharmaceuticals. Its anti-inflammatory and immunostimulant properties have resulted in surge in usage during flu seasons and the COVID-19 pandemic. Fresh and dried chilies are widely consumed. The trend of using natural remedies and functional food will make this segment continue on a high growth pace.

Chilies Spices Market

Chilies are a staple in most global cuisines, from Mexican salsas to Indian curries. The market varies from fresh, dried, and powdered to flaked chili products, which are used for varying levels of heat and cooking functions. Increasing global demand for spicy food, especially Mexican and youth, is fueling this segment. Mexican chilies are also figure-top in capsaicin, a metabolically active pigment that also eases pain, and thus their marketability synchronizes with health food categories. Chilies are being manufactured predominantly in India, China, and Thailand, and food chains around the world keep the demand continuous.

Meat and Poultry Spices Market

Spices intended for meat and poultry food have seen a rise in demand, particularly with the barbeque culture, grilled food, and ready-to-cook items. Tandoori masala, steak rub, and Cajun spice are some of the widely used mixes both in restaurants and at home cooking. This segment gains advantage from rising protein diets and meal kits made of meat. Spicy flavor blends for regional cuisines and ethnic flavors also power innovation and differentiation in this market segment, especially in Europe and North America.

Spices Powder Market

Turmeric, cumin, coriander, and paprika spices in powdered form dominate the supermarket shelves due to ease of use and long shelf life. These are a foodservice and household standard. With convenience and ready-to-cook food gaining traction, powdered spices ensure consistent flavoring and make their entry into packaging considerations with hygiene and brand name. The trend is also shifting towards consumers buying organic and additive-free spice powders, which is opening up room for innovation on the part of companies through clean labeling and sustainable sourcing.

Whole Spices Market

Whole spices are increasingly gaining favor with improved aroma, extended shelf life, and perceived purity. These consumers prefer grinding spices afresh at home in order to gain the fullest flavour and health benefits. This segment has greatest success where conventional cooking practices prevail, i.e., India, the Middle East, and parts of Africa. Whole cloves, cinnamon sticks, cardamom pods, and star anise are case in point. This segment also appeals to bulk purchasers like restaurants and spice blenders who require quality base ingredients.

United States Spices Market

The US spice market is growing robustly due to multi-cultural drives and the demand for global cuisine. Mexican, Indian, Thai, and Middle Eastern spices are in high demand. Organic and non-GMO spice demands are rising as consumers seek them as well. The popularity of meal kits, gourmet food, and cooking shows further stimulates the consumption of spices. Spice companies and specialty food firms are embarking on aggressive diversification of their spice portfolios, meeting demand for quality, diversity, and convenient packaging. the United States alone imported turmeric over $50 million during 2023, which clearly indicates demand for health-oriented spices. The market also favors innovation by companies like McCormick, and Kerry Group, who are creating new seasoning blends and promoting healthier alternatives, such as sodium-reduction solutions.

France Spices Market

The French spice market is characterized by gourmet food preparation, herbal blends, and high-end imports. French culinary tradition revolves around subtleties in flavor, which generates demand for both everyday and exotic spices. The market includes herbs de Provence, saffron, peppercorns, and foreign imports like turmeric and curry blends. Growing ethnic diversity and an appetite for global cuisine are expanding the market base. Organic and fair-trade spice items also are gaining popularity among socially and environmentally conscious consumers.

India Spices Market

India is the largest producer and consumer of spices globally. The spice industry is deeply rooted in the country's food, medicinal, and cultural lifestyle. Major spices include turmeric, cumin, coriander, cardamom, and chili. Regional cuisine sustains domestic demand, and exports are on the rise due to foreign demand for Indian spices. Government schemes, improved processing technology, and certification programs are making India more competitive in the international market and promoting sustainable farming. August 2024: Spices Board launched the SPICED scheme to boost spice export and enhance the productivity of cardamom in India. With an outlay of ₹422.30 crore till FY 2025-26, it aims at post-harvest quality, value addition, and sustainability. The scheme aims at farmers, FPOs, SMEs, and exporters and the Northeast area specifically.

Saudi Arabia Spices Market

Saudi Arabian spice market is growing due to a robust food culture where rice, meat, and spiced stews like mandi and kabsa are consumed regularly. Urbanization and globalization of foods are creating demand for a variety of spices. The nation is nearly fully reliant on imports, so it is a significant market for exporters. Convenience foods like pre-mix spice blends and premium seasonings are increasingly popular, especially among young consumers and expats. October 2024, Saudi Arabia has announced a grand plan to be among the world's leading producers of saffron, better known 'red gold' for its extremely valuable and one of the world's most expensive spices.

Market Segmentation

Products Types

1. Pure Spices

- Chilies

- Ginger

- Cumin

- Pepper

- Turmeric

- Coriander

- Others (Cardamom, etc.)

2. Blended Spices

Application

- Meat and Poultry Products

- Bakery and Confectionery

- Frozen Foods

- Snacks and Convenience Foods

- Others

Form

- Powder

- Whole

- Crushed

- Chopped

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Key Players Analysis

- Ajinomoto Co. Inc.

- ARIAKE JAPAN Co. Ltd.

- Associated British Foods plc.

- Baria Pepper Co. Ltd.

- Döhler

- EVEREST Food Products Pvt. Ltd.

- The Kraft Heinz Company

- Kerry Group plc.

- McCormick & Company

- Olam International

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Products,By Application, By Form and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Spices Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Products

6.2 By Application

6.3 By Form

7. Products Types

7.1 Pure Spices

7.1.1 Chilies

7.1.2 Ginger

7.1.3 Cumin

7.1.4 Pepper

7.1.5 Turmeric

7.1.6 Coriander

7.1.7 Others (Cardamom, etc.)

7.2 Blended Spices

8. Application

8.1 Meat and Poultry Products

8.2 Bakery and Confectionery

8.3 Frozen Foods

8.4 Snacks and Convenience Foods

8.5 Others

9. Form

9.1 Powder

9.2 Whole

9.3 Crushed

9.4 Chopped

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 Ajinomoto Co. Inc.

13.1.1 Overviews

13.1.2 Key Persons

13.1.3 Recent Developments

13.1.4 Revenue Analysis

13.2 ARIAKE JAPAN Co. Ltd.

13.2.1 Overviews

13.2.2 Key Persons

13.2.3 Recent Developments

13.2.4 Revenue Analysis

13.3 Associated British Foods plc.

13.3.1 Overviews

13.3.2 Key Persons

13.3.3 Recent Developments

13.3.4 Revenue Analysis

13.4 Baria Pepper Co. Ltd.

13.4.1 Overviews

13.4.2 Key Persons

13.4.3 Recent Developments

13.4.4 Revenue Analysis

13.5 Döhler

13.5.1 Overviews

13.5.2 Key Persons

13.5.3 Recent Developments

13.5.4 Revenue Analysis

13.6 EVEREST Food Products Pvt. Ltd.

13.6.1 Overviews

13.6.2 Key Persons

13.6.3 Recent Developments

13.6.4 Revenue Analysis

13.7 The Kraft Heinz Company

13.7.1 Overviews

13.7.2 Key Persons

13.7.3 Recent Developments

13.7.4 Revenue Analysis

13.8 Kerry Group plc.

13.8.1 Overviews

13.8.2 Key Persons

13.8.3 Recent Developments

13.8.4 Revenue Analysis

13.9 McCormick & Company

13.9.1 Overviews

13.9.2 Key Persons

13.9.3 Recent Developments

13.9.4 Revenue Analysis

13.10 Olam International

13.10.1 Overviews

13.10.2 Key Persons

13.10.3 Recent Developments

13.10.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com