India Spice Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowIndia Spice Market Trends & Summary

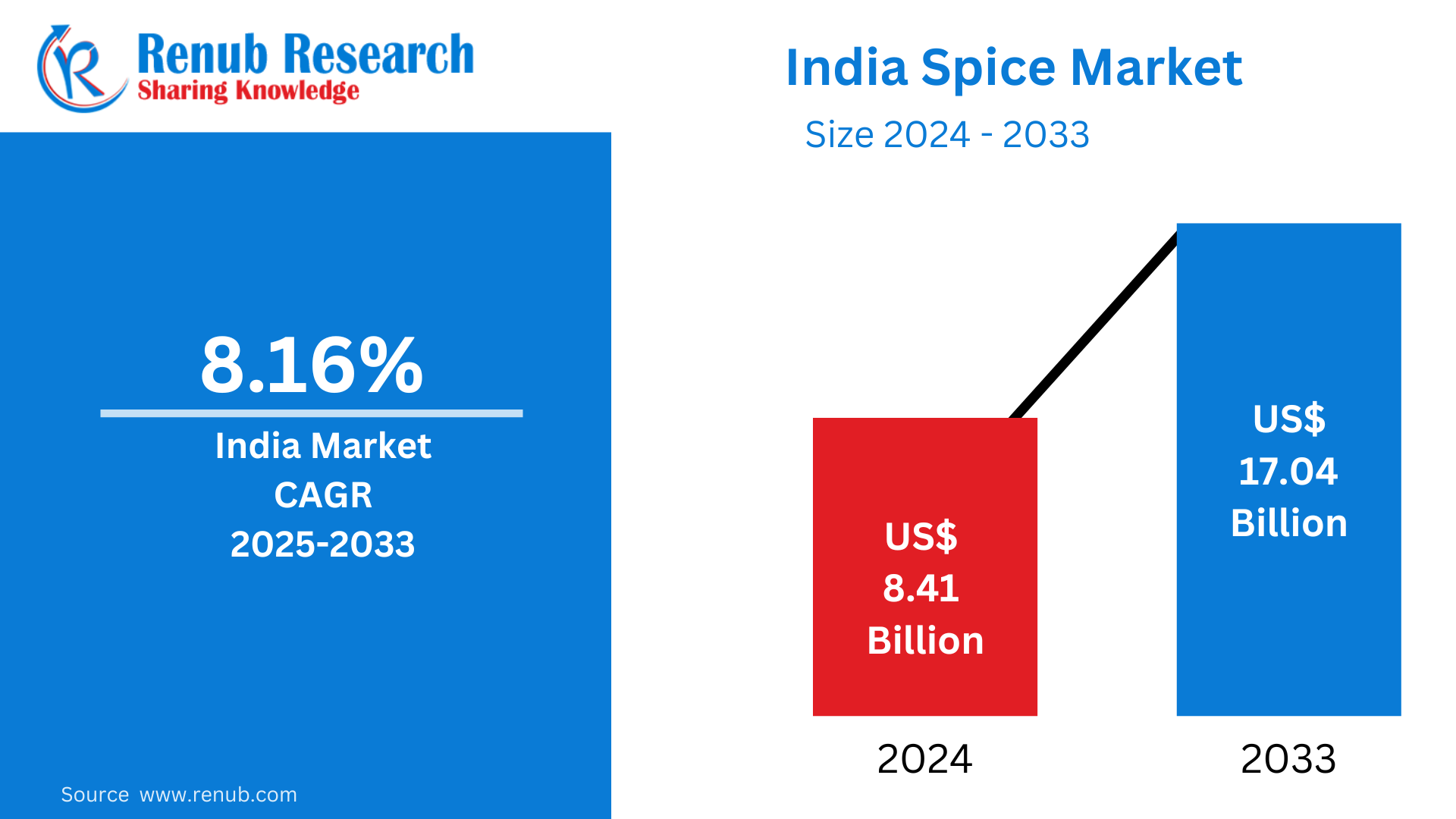

India Spice market is expected to reach US$ 17.04 billion by 2033 from US$ 8.41 billion in 2024, with a CAGR of 8.16% from 2025 to 2033. Some of the main reasons driving the market include the expanding demand for products in the food and beverage (F&B) industry, the widespread use of spices for medicinal purposes, government backing, sustainable sourcing, ongoing innovation, and the launch of new mixes.

The report Indian Spice Market & Forecast covers by Product Types (Pure Spices (Chilies, Ginger, Cumin, Pepper, Turmeric, Coriander, and Others (Cardamom, etc.)), and Blended Spices), Application (Meat and Poultry Products, Bakery and Confectionery, Frozen Foods, Snacks and Convenience Foods, and Others), Form (Powder, Whole, Crushed, and Chopped) and Company Analysis 2025-2033.

Indian Spice Industry Overview

Growing India's rich history, varied agricultural geography, and rising demand for spices in both internal and foreign markets have made it one of the world's largest and most dynamic spice marketplaces. India continues to be a major producer and exporter of spices, accounting for more than 70% of global exports. It is the birthplace of numerous spices, such as black pepper, cardamom, turmeric, cumin, and cloves. A large variety of goods that serve a broad range of culinary and therapeutic purposes define the market. The Indian spice business has grown significantly in recent years due to rising customer demand for organic and health-promoting spices. Demand has been further stimulated by the internationalization of Indian food and the growing acceptance of plant-based diets. Customers now find it simpler to add spices to their regular meals because to the growing availability of processed and ready-to-use spice blends.

Strong export demand, especially from North America, Europe, and the Middle East, helps the market. The business is becoming more globally competitive as a result of the Indian government's efforts to encourage spice exports through programs like the Spice Board of India and investments in spice processing and packaging. But issues like quality control, labor shortages, and climate change continue to affect both supply and cost. In spite of this, the Indian spice market continues to be a major force behind the agriculture industry.

Throughout the forecast period, rising e-commerce sales of consumer goods are anticipated to support market expansion. Online shopping is preferred by customers for a variety of reasons, including great flexibility, discounts, and a wide selection of products. For example, statistics from the India Brand Equity Foundation (IBEF) from October 2022 projects that the country's e-commerce business will grow to US$111 billion by 2024 and US$200 billion by 2026.

Growth Drivers for the Indian Spice Market

Rising Global Demand

One major factor propelling the market's expansion is the growing demand for Indian spices worldwide. With substantial shipments to North America, Europe, and the Middle East, India continues to be the world's top exporter of spices. Traditional spices like turmeric, cumin, coriander, and cardamom have seen an increase in demand due to the growing appeal of Indian food, which is renowned for its rich and varied flavors. Further driving the demand for Indian spices in the retail and catering industries is the growing interest of customers worldwide in unusual and exotic flavors. India's spice export industry is expanding due in part to the growing trend of ethnic food consumption and a growing awareness of the health advantages of some spices, such ginger and turmeric.

Urbanization and Changing Lifestyles

India's spice business is expanding significantly due to urbanization and shifting lifestyles. The demand for convenience foods, such as processed and ready-to-use spice blends, has increased as more people move to cities. Due to hectic urban lifestyles and time limits for cooking, people are choosing quick, simple solutions that nonetheless taste like traditional spices. Spice kits, instant masalas, and ready-to-use spice mixtures are increasingly widely accessible, satisfying the increasing demand from customers who want convenience without sacrificing flavor. Another factor contributing to this change is the rise in dual-income households and working professionals who place a higher value on meal preparation convenience. The rising blending of convenience and traditional cooking methods in urban environments is reflected in the tendency toward processed spices.

Increased Awareness of Organic Products

India's spice business is expanding due to growing consumer awareness of organic products. The demand for organic and chemical-free spices has increased as people who are concerned about their health become more conscious of the possible health hazards linked to chemical pesticides and additives. These customers are increasingly looking for certified organic, sustainably sourced spices because they believe they are safer and healthier options. Turmeric, cumin, and coriander are among the organic spices that are becoming more and more popular both domestically and internationally. Growing consumer education, government programs encouraging organic farming, and the emergence of eco-friendly businesses all contribute to this trend toward organic products. In response, producers and retailers are increasing the selection of organic spices they offer, which is driving the market's expansion in this sector.

Challenges in the Indian Spice Market

Climate Change and Weather Variability

Given how sensitive spices are to climatic factors, climate change and weather fluctuation pose significant problems to the Indian spice sector. Crop yields and quality can be significantly impacted by erratic climate patterns, such as erratic rainfall, droughts, and floods. For instance, severe dry spells or heavy rains might hinder the growth of important spices like turmeric, cardamom, and black pepper. Variations in temperature can also impact the cycles of flowering and maturation, resulting in spices of inferior quality. Both producers and consumers find it challenging to plan and budget as a result of these climate-related disturbances, which frequently lead to supply shortages and price variations. Weather unpredictability makes agricultural planning even more difficult, particularly for small-scale farmers who do not have the means to reduce these risks, which could affect the stability of the market as a whole.

Competition from Other Countries

India continues to be the world's top producer and exporter of spices, although competition from nations like China, Vietnam, and Indonesia is growing, particularly in international export markets. These countries are developing their capacity to produce spices, providing premium goods at competitive prices. For example, Indonesia is emerging as a major rival in the production of spices like cloves and nutmeg, and Vietnam is gaining ground in the global pepper market. With its expanding agricultural output and capacity to fulfill global demand at reasonable prices, China is also becoming a major exporter of a variety of spices. Indian producers are under pressure to preserve their market share by emphasizing quality, sustainability, and cost-effectiveness while negotiating the changing dynamics of international trade as customers throughout the world look for alternate sources for their spice needs.

Growing Interest in Spice Blends

The surge in demand for blended spices propels the Indian Spice market. Blended spice mixes appeal to consumers with comfort, consistency, and the ability to enhance dish effects. These blends combine herbs, spices, and seasonings to create a balanced taste profile, elevating culinary creations. For instance, Tata Sampann added its Blended Spice range, which covered Puliyogare, Malabar chicken, Sambar masala, and Masala rice blend in Karnataka in 2023. This trend caters to trendy purchasers' busy lifestyles, driving market boom and prompting manufacturers to innovate product offerings to satisfy evolving preferences.

The market for organic and natural spices is expanding

The growing preference of purchasers for natural spices over artificial ones because of fitness awareness is a crucial boom driver in the India spice market. This mirrors a broader trend towards fitness-conscious intake, with people prioritizing organic substances. According to a survey by ASSOCHAM, there is a ninety-five percent growth in organic produce purchases in cities, with 62% of metropolitans buying organic. Natural spices are perceived as healthier because they lack artificial components, prompting producers to emphasize product purity and authenticity. This is fueling an increase in the natural spice segment.

Increase in E-Commerce Sales of Consumer Products

The surge in e-commerce sales of consumer products in India substantially drives the spice market's growth. The comfort of online buying platforms fuels this growth. FMCG Gurus' record predicts online FMCG sales will hit US$ 1 Trillion by 2023, amplifying the market's accessibility. Nielsen forecasts e-trade to represent 11% of FMCG sales by 2030, eightfold from the present stages, mandating robust systems. PwC reveals that almost 75% of customers purchase FMCG online, especially millennials and Gen Z. E-commerce no longer broadens entry to Indian spices but satisfies global demand. Leveraging advanced logistics, e-trade guarantees freshness. This boosts patron delight and demand, thus revolutionizing the India spice market dynamics.

Development in the Food Processing Industry

The increasing food processing industry drives tremendous growth within the India spice market. This is because spices are increasingly demanded for flavor enhancement, upkeep, and product differentiation. These crucial substances cater to numerous patron choices regionally and globally. Advanced food processing technologies include spices in diverse processed foods, like snacks, ready-to-consume foods, sauces, and condiments, amplifying the spice demand. This symbiotic relationship among the food processing and spice markets fosters innovation and enlargement to satisfy evolving industry desires, propelling the market boom.

India Chilies Spice Market

India's chilies spice market is in a commanding position with the extensive culinary usage and strong consumer demand for spicy food. India is among the largest producers and exporters of chilies in the world. Regional cuisines are dependent on whole and powdered chilies, which creates constant demand. The market is supported by assorted varieties like Byadgi, Guntur, and Kashmiri, accommodating different heat and color preferences. Increased packaged food, ready-to-eat, and growing exports are also boosting the market growth. Growing concern over organic and pesticide-free spices is influencing premium product demand. October 2023, Indian spice brand Suhana Masala has rolled out its new marketing campaign for its recently introduced offering Chilli Powder. With this campaign, the company hopes to take their spice line in Gujarat to the next level. According to the company, it hopes to challenge the Gujarat spice market and to accomplish this, the brand has spent time with seasoned cooks to get to know the Gujarati palate in depth and handpick particular spice powders.

India Pepper Spice Market

India's pepper spice industry is driven by its long history as an internationally traded spice and the benefits to health. Kerala, Karnataka, and Tamil Nadu are the primary regions of production. Pepper has a very wide use in Indian cuisine and Ayurvedic medicine because of its warm, digestive, and antibacterial quality. Its market is experiencing increasing demand from food processing industries, restaurants, and spice exporters. Black pepper is the most favored type, although white and green pepper types also catch up. Volatile prices because of crop production, weather, and overseas demand determine market forces. Growing demand for high-end and organic pepper places an additional premium. 2024, Subway S'pore introduced new menu items, such as black pepper chicken nuggets, chicken, and steak subs, which are a nod to black pepper lovers. These affordable fares are now available at every Subway restaurant, giving the consumer the irresistible black pepper flavors.

India Ginger Spice Market

The Indian ginger spice market is underpinned by the spice's universal usage in Indian homes and extensive use in herbal treatments. India is the major producer of ginger, with Kerala, Karnataka, and Odisha contributing significantly. Ginger is utilized in powdered, dried, and fresh states in domestic preparations as well as industrial food processing. It is also a prized item in Ayurvedic and natural health foods. With increasing health awareness, there has been greater demand for organic and unprocessed ginger. Export avenues are still on the rise due to international awareness of ginger's health properties and functional application in immunity-enhancing products. March 2023, VAHDAM® India, the international wellness brand and industry leader in organic, premium Indian teas, today announced the launch of VAHDAM® Spices, a new product line for the company with the aim to revolutionize the spices business.

India Meat and Poultry Products Spice Market

The spice market for poultry and meat in India is fueled by increasing food consumption of non-vegetarian dishes and regional meat dishes such as kebabs, tandoori, and curries. Chicken, mutton, and fish-specific spice mixtures are in great demand for home cooking as well as for restaurants. Some common ingredients of these mixes are chili, turmeric, coriander, cloves, and black pepper. Increase in online food ordering, quick-service restaurants, and frozen meat foods also increases the use of spices further. Usage preference for pre-mix marinades and masalas also contributes to the segment. Newer flavor profiles and healthier spice blends open the opportunity for market growth. Licious, everything-meat brand declared its entry into the spice category with the introduction of its new line of Meat Masalas. Dec 2022, With this new category extension, the brand has launched professionally prepared eight traditional masalas for consumers, providing meat enthusiasts with the ideal pairing for meat - leading to their favorite meat foods. The recent launch is the result of extensive research & development in Licious, with the brand introducing a series of masalas not just a 100% perfect match for meat but would also provide a better cooking experience to consumers.

India Snacks and Convenience Foods Spice Market

Spices in the snacks and convenience food industry in India are crucial to flavor creation and consumer attraction. Spices like chili powder, cumin, asafoetida, and masala mix are used extensively in conventional and contemporary snack recipes. Accelerating urbanization, busy lifestyles, and rising working population are driving the consumption of spicy and flavorful ready-to-eat and packaged foods. Large FMCG players are innovating with local spice blends to meet localized taste requirements. The market is also experiencing a turn toward low-sodium and organic spice alternatives, which are attractive to health-oriented consumers and opening up a new movement in demand.

India Spice Powder Market

India's spice powder market is growing fast because of convenience, longer storage life, and quality consistency. Common powdered spices like turmeric, chili, coriander, cumin, and garam masala are used extensively. These powders are integral to Indian cuisine and are found in both conventional and contemporary retail forms. Demand is increasing in urban and rural markets alike, aided by rising disposable incomes, changing food habits, and greater culinary awareness. Branded and packaged spice powders are becoming more popular than loose forms because of hygiene and authenticity issues. Export of spice powders, especially in ready-to-cook segments, is also fueling market growth. Apr 2024, iD Fresh Foods has revealed that his food products firm has begun making efforts to bring out its own brand of masalas and spices.

India Spice Crushed Market

India's crushed spice market serves both domestic and industrial food uses. Crushed spices such as chili flakes, crushed black pepper, cumin, and garlic are being used more and more in fusion foods, fast foods, and packaged food. These spices provide better texture and visual beauty to food. Increased adoption in the HoReCa (Hotel, Restaurant, and Catering) segment and increasing popularity of Western foods in India are driving demand. Premium quality and artisanal ground spices are also being sought by consumers, hence the drive in packaging and flavor variation. Urbanization and changing tastes among young populations are key growth drivers.

India Chopped Spice Market

The India chopped spice market is catching on with the urban homes and food processing companies due to the convenience and time-saving factor. Chopped onion, garlic, ginger, and green chilies are readily found in frozen or ready-to-cook packs. This is a big hit in metros where working couples opt for quicker meal preparation. Rising demand from ready meal makers and cloud kitchens also fuel this segment. With increasing hygiene, shelf life, and packaging technology, chopped spice products are likely to become more mainstream. Retail infrastructure growth and the emergence of cold chain logistics also aid growth in the segment.

India Spice Market Segments

Product Types – India Spice Market breakup in 2 viewpoints:

1. Pure Spices

1.1 Chilies

1.2 Ginger

1.3 Cumin

1.4 Pepper

1.5 Turmeric

1.6 Coriander

1.7 Others (Cardamom, etc.)

2. Blended Spices

Application – India SpiceMarket breakup in 5 viewpoints:

1. Meat and Poultry Products

2. Bakery and Confectionery

3. Frozen Foods

4. Snacks and Convenience Foods

5. Others

Forms – India SpiceMarket breakup in 4 viewpoints:

1. Powder

2. Whole

3. Crushed

4. Chopped

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Aachi Spices & Foods Pvt Ltd

2. Badshah Masala

3. Eastern Condiments Private Limited

4. Mahashian Di Hatti Private Limited

5. MTR Foods Pvt Ltd.

6. PatanjaliAyurved Limited

7. DS Group (Catch)

8. Ushodaya Enterprises Pvt. Ltd. (Priya)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Application and Forms |

| Application Covered | 1. Meat and Poultry Products 2. Bakery and Confectionery 3. Frozen Foods 4. Snacks and Convenience Foods 5. Others |

| Companies Covered | 1. Aachi Spices & Foods Pvt Ltd 2. Badshah Masala 3. Eastern Condiments Private Limited 4. Mahashian Di Hatti Private Limited 5. MTR Foods Pvt Ltd. 6. PatanjaliAyurved Limited 7. DS Group (Catch) 8. Ushodaya Enterprises Pvt. Ltd. (Priya) |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the India Spice Market by 2033?

-

What is the expected CAGR of the Indian spice industry from 2025 to 2033?

-

What key factors are driving the growth of the Indian spice market?

-

How does India's spice export industry contribute to its global dominance?

-

What impact does urbanization have on the demand for spices in India?

-

Why is there an increasing consumer preference for organic spices?

-

What challenges does the Indian spice industry face due to climate change?

-

How is e-commerce influencing spice sales in India?

-

What role does the food processing industry play in the expansion of the spice market?

-

Who are the key players in the Indian spice market, and what strategies are they adopting to maintain market growth?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Spices Market

6. Market Share

6.1 By Products

6.2 By Application

6.3 By Form

7. Products Types

7.1 Pure Spices

7.1.1 Chilies

7.1.2 Ginger

7.1.3 Cumin

7.1.4 Pepper

7.1.5 Turmeric

7.1.6 Coriander

7.1.7 Others (Cardamom, etc.)

7.2 Blended Spices

8. Application

8.1 Meat and Poultry Products

8.2 Bakery and Confectionery

8.3 Frozen Foods

8.4 Snacks and Convenience Foods

8.5 Others

9. Form

9.1 Powder

9.2 Whole

9.3 Crushed

9.4 Chopped

10. Porter’s Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

12.1 Aachi Spices & Foods Pvt Ltd

12.1.1 Overviews

12.1.2 Recent Developments

12.2 Badshah Masala

12.2.1 Overviews

12.2.2 Recent Developments

12.3 Eastern Condiments Private Limited

12.3.1 Overviews

12.3.2 Recent Developments

12.4 Eastern Condiments Private Limited

12.4.1 Overviews

12.4.2 Recent Developments

12.5 Mahashian Di Hatti Private Limited

12.5.1 Overviews

12.5.2 Recent Developments

12.6 MTR Foods Pvt Ltd.

12.6.1 Overviews

12.6.2 Recent Developments

12.7 PatanjaliAyurved Limited

12.7.1 Overviews

12.7.2 Recent Developments

12.8 DS Group (Catch)

12.8.1 Overviews

12.8.2 Recent Developments

12.9 Ushodaya Enterprises Pvt. Ltd. (Priya)

12.9.1 Overviews

12.9.2 Recent Developments

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com