Global Fertilizers Market is Forecasted to be more than USD 93.9 Billion by the end of year 2027

05 Oct, 2021

According to the latest report by Renub Research, titled "Global Fertilizer Market by Segments, Region, Company Analysis & Forecast" As per Renub Research findings, Global Fertilizers Market will reach US$ 93.9 Billion by 2027. The global fertilizer industry has played a pivotal support role in the global agricultural sector. The growth in the use of chemical fertilizers amongst the farmers has been the source of nationwide agrarian development in many countries. Further, the fertilizers industry is distributed worldwide between three major sectors: private sector undertakings, public sector, and cooperative societies. The governments of numerous nations have also subsidized fertilizers to ensure that fertilizers are readily available to farmers and the countries remain self-sufficient in agriculture.

Additionally, an increase in agricultural product prices has led to increasing demand for fertilizers globally. Correspondingly, fertilizer raw materials such as natural gas, phosphate rock and potash faced rapidly growing realm market prices. Hence, the enduring trend has been the shift in consumption. Overall, the global fertilizer market comprises three primary nutrients, which all have essential and complementary roles in the ecological processes of plants. Amongst the three, nitrogen is the most crucial nutrient in the world. The other two primary nutrients hold phosphorus and potassium.

While nitrogen fertilizers are manufactured undeviatingly via chemical processes, the production of phosphate and potash fertilizers involves digesting and mining activities. Two critical raw materials for nitrogen fertilizers are natural gas, widely obtainable in multiple parts of the world, and air. Still, all nitrogen fertilizers are contrived from ammonia, processed directly from natural gas. The availability of raw materials advances the manufacture of ammonia, and thus nitrogen fertilizers are possible in various locations.

In addition, the global phosphorus fertilizer consumption includes phosphoric acid-based fertilizers and non-phosphoric acid-based fertilizers. The non-phosphoric acid-based fertilizers include phosphate in nitric acid-based fertilizers and superphosphate. The demand for phosphorus fertilizers has been increasing due to the growing population and rising food demand. Increasing milk and meat consumption has necessitated a large feed volume that has increased the demand for maximum forage production.

On the other hand, potassium fertilizers are generally applied on vegetables, rice, sugar, fruits, soybean, palm oil, and cotton owing to their capability to enhance crop productivity, crop yield, increase nutrient value, and resistance from diseases and harmful parasites. The rise in cattle feed consumption and increasing purchasing power worldwide are expected to contribute to potassium fertilizer market growth. Our research suggests that Worldwide Fertilizer Market was US$ 83.5 Billion in 2020, and it is estimated to grow with a CAGR of 1.69% during the forecast period (2020-2027).

Fertilizer Consumption Increased rapidly, especially in China and India

Remarkably, fertilizer consumption has remained constant in Western Europe and North America but increased rapidly, especially in China and India. It is anticipated that the increase in world fertilizer consumption will soon come from East Asia, South Asia, and Latin America shortly. These changes in demand patterns significantly influence fertilizer trade flows, firms' investment decisions and thus, regional and global competition.

The Indian fertilizer market is mainly dependent on imports from various countries, especially potash fertilizers in South Asia. There is a deficit of raw materials in the country, and the consequent dependency on imports leads to volatile prices in the fertilizer industry. However, the new policies will help in stabilizing the raw material prices during the coming years.

Moreover, variations in crop soil and climate conditions in different regions are not effective on some crops or soils, resulting in less demand. It is expected that Potassium demand would grow most rapidly, owing to promising prospects in China, India, Brazil and Indonesia, and a rebound in Belarus. Phosphorus demand would expand more moderately, as drops in Turkey, Pakistan, and Germany partly offset increases elsewhere.

Companies Performance

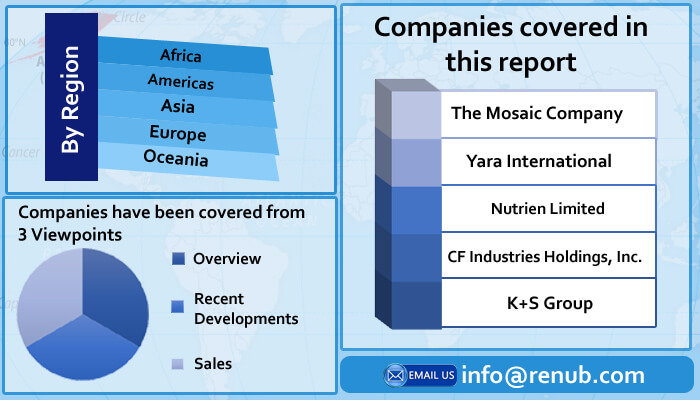

The Global Fertilizers Market is fragmented, with the top international players like The Mosaic Company, Yara International, Nutrien Limited, CF Industries Holdings, Inc and K+S Group capturing the overall market. Our analysis suggests that companies studied now better compete with the giants in the fertilizer market. Intense global competition also forces large firms to examine their business practices and evaluate how to meet the global challenges in the industry.

Notwithstanding, the biggest challenges can compete with the world's leading fertilizer companies in terms of profitability and growth. As per our analysis, it can be concluded that the top firms are also hard-pressed to become more efficient in this profoundly competitive industry. Hence, in the coming years, the changing consumption patterns of fertilizers open opportunities for structural changes in the markets.

COVID-19-related Interruption to Global Production and Supply Chains remains the most prominent risk:

During 2020, COVID-19 led to sharp, short-term price rises in the fertilizers market at the farm gate. However, rural demand and needs have been buoyed and promising despite the coronavirus pandemic and macroeconomic uncertainty. This has translated into improving the underlying macros for the global fertilizer industry.

For instance, agricultural operations in India have been well-placed and have grown backed by a bumper Rabi harvest and good monsoon during the Kharif season. Additionally, with the forecast of normal monsoons and the COVID vaccination program's rollout, the global market expects the economic activities to normalize during FY22. From that standpoint, the consumption and the growth in demand for fertilizers are currently set to continue.

Market Summary:

Segment– We have covered market &volume of the following fertilizers like Ammonia, Phosphorus and Potassium.

Ammonia Fertilizer – This report studies the market &volume by region of Africa, Americas (North America and Latin America), Asia (West Asia, South Asia and East Asia), Europe (Central Europe, West Europe and Rest of Europe) and Oceania.

Phosphorus Fertilizer – This report covers the market &volume by region of Africa, Americas (North America and Latin America), Asia (West Asia, South Asia and East Asia), Europe (Central Europe, West Europe and Rest of Europe) and Oceania.

Potassium Fertilizer – This report covers the market &volume by region of Africa, Americas (North America and Latin America), Asia (West Asia, South Asia and East Asia), Europe (Central Europe, West Europe and Rest of Europe) and Oceania.

Key Players – We have studied the company by overviews, recent developments and revenue of the following companies The Mosaic Company, Yara International, Nutrien Limited, CF Industries Holdings, Inc and K+S Group.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com