France Furniture Market, Size, Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowFrance Furniture Market Outlook

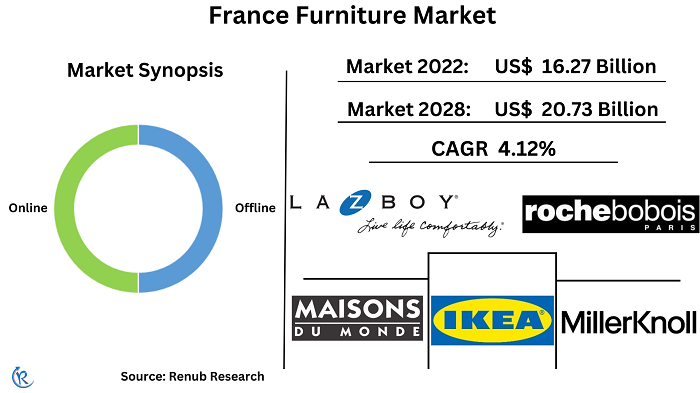

France Furniture Market will capture US$ 20.73 Billion by 2028 it is expected to grow by 4.12% CAGR during the forecast period 2022-2028, according to Renub Research. France, ranked as the third-largest furniture production market in Europe and the seventh-largest in the world, is a prominent player in the international furniture industry and is taking a leadership role in post-pandemic Europe. With a rich history of craftsmanship and high-quality design, the furniture industry is a significant sector in French economy, encompassing a diverse range of manufacturers ranging from small, independent artisans to large multinational corporations.

French country style is globally popular due to its comfortable and casual elegance, characterized by a blend of rustic and refined decor inspired by the homes in the French countryside. The French government actively supports the furniture industry through various initiatives, such as research and development programs, financial assistance for small and medium-sized enterprises, and tax incentives for sustainable production practices. According to this research report, France Furniture Industry was US$ 16.27 Billion by 2022.

Online Sales is Growing in the Market

The popularity of online furniture sales is on the rise in France, with customers opting for the convenience of shopping online over visiting physical stores. With the widespread use of smartphones and increased internet penetration, consumers can now browse and purchase products from anywhere, anytime. This trend has led many vendors to shift their business operations to online platforms.

Online home decor vendors also offer hassle-free home delivery options, adding to the convenience factor for customers. The availability of detailed product catalogs and defined categories on e-commerce platforms, along with the ease and comfort of online shopping, are expected to drive the growth of this market in the foreseeable future. In France, three major furniture players dominate the industry, collectively accounting for almost half of the furniture market. The largest market share is held by Ikea, followed by Conforama and But.

Despite the growing trend of online sales in the furniture industry in France, offline sales continue to hold significant importance. Offline sales refer to in-person transactions that occur in brick-and-mortar retail locations. For many consumers, the ability to physically see and feel furniture before making a purchase is crucial, and offline sales allow retailers to display their products and offer top-notch customer service. Therefore, offline sales remain a valuable aspect of the furniture industry in France.

Living Room Furniture is creating more demand in France

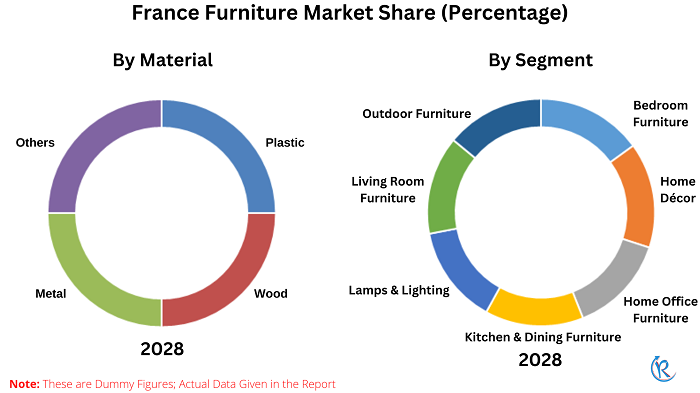

The furniture market in France is segmented into various categories, including Bedroom Furniture, Home Décor, Home Office Furniture, Kitchen & Dining Furniture, Lamps & Lighting, Living Room Furniture, and Outdoor Furniture. Among these categories, the living room furniture industry in France is a crucial component of the overall furniture sector. This category encompasses furniture items such as sofas, armchairs, coffee tables, entertainment units, and other pieces designed to furnish living rooms or family rooms. In recent times, there has been an increasing inclination towards eco-friendly and sustainable living room furniture, as consumers becomes increasingly aware of their impact on the environment.

The kitchen and dining furniture industry forms a significant segment of the larger furniture sector in France. This industry boasts of diversity, with several manufacturers and retailers offering a wide range of styles and designs, ranging from traditional to modern and contemporary. One of the primary drivers of growth in the kitchen and dining furniture industry in France is the rising demand for eco-friendly and sustainable products.

Wood Furniture will hold Maximum Market

By Material, The France Furniture Market was classified into Plastic, Wood, Metal and Others. The wood furniture industry plays a crucial role in the overall furniture sector in France, encompassing a diverse array of wood-based products, including tables, chairs, cabinets, and bed frames. French wood furniture is celebrated for its superior quality, longevity, and refinement.

An emerging trend in the wood furniture industry in France is the adoption of sustainable and eco-friendly materials. Numerous manufacturers are sourcing wood from responsibly managed forests and incorporating other environmentally friendly materials like natural oils and finishes into their products. Ready-to-assemble and multi-functional wooden products are also making significant contributions to enhancing home interiors.

Increasing Demand for Office Furniture is driving the Market

The furniture industry is segmented by type into residential and commercial categories. The increasing number of startups is expected to significantly drive the demand for commercial furniture during the forecast period. Commercial furniture includes desks, chairs, storage cabinets, and other items commonly used in workplaces. The demand for multi-functional office furniture has risen due to shrinking office spaces and the high cost of commercial leases.

Furthermore, customized office furniture is becoming more popular as some organizations prefer to have interiors that reflect their theme and work culture. The rising popularity of online furniture stores and increased mergers and acquisitions are expected to further boost market growth in the forecast period.

The residential segment of the furniture market holds a significant share, mainly due to the high demand for sofa sets and chairs among residential customers to meet their seating requirements in homes and backyards. Moreover, the increasing rate of urbanization and the growing number of nuclear families worldwide are also contributing to the growth of this segment.

Key Industry Players

Roche Bobois, IKEA, Maisons du Monde, MillerKnoll, Inc. and La-Z-Boy Inc. are among the major market players in the France furniture market.

- In June 2022, Roche Bobois Antibes, the flagship store of the South Region, reopened its doors to the public after undergoing a complete renovation. The store spans over 1,800 square meters and boasts a revamped interior architecture that fully showcases the brand's international design codes.

- In June 2022, Herman Miller and Studio 7.5 collaborated to launch a new office chair named Zeph, which draws inspiration from the iconic Eames design. Zeph is an ergonomic and customizable chair available in a range of vibrant colors, suitable for any workspace.

Renub Research report titled “France Furniture Market & Forecast by Ordering Method (Online Furniture Market, Offline Furniture Market), by Segments (Bedroom Furniture Home Décor, Home Office Furniture, Kitchen & Dining Furniture, Lamps & Lighting, Living Room Furniture, Outdoor Furniture), By Material (Plastic, Wood, Metal, Others), By Type (Residential, Commercial), Companies (Roche Bobois, IKEA, Maisons du Monde, MillerKnoll, Inc. and La-Z-Boy Inc.)” provides a complete analysis of furniture industry in France.

Ordering Method - Market Breakup from 2 viewpoints

1. Online

2. Offline

Segment - Market Breakup from 7 viewpoints

1. Bedroom Furniture

2. Home Décor

3. Home Office Furniture

4. Kitchen & Dining Furniture

5. Lamps & Lighting

6. Living Room Furniture

7. Outdoor Furniture

Material - Market Breakup from 4 viewpoints

1. Plastic

2. Wood

3. Metal

4. Others

Type - Market Breakup from 2 viewpoints

1. Residential

2. Commercial

All companies covered from 3 viewpoints

• Overviews

• Recent Developments

• Revenues

Company - Market Breakup from 5 viewpoints

1. Roche Bobois

2. IKEA

3. Maisons du Monde

4. MillerKnoll, Inc.

5. La-Z-Boy Inc.

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Ordering Method, Segment, Material, and Type |

| Companies Covered | Roche Bobois, IKEA, Maisons du Monde, MillerKnoll, Inc. and La-Z-Boy Inc. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Market Drivers

4.2 Challenges

5. Porter’s Five Forces

5.1 Bargaining Power of Buyers

5.2 Bargaining Power of Suppliers

5.3 Degree of Competition

5.4 Threat of New Entrants

5.5 Threat of Substitutes

6. France Furniture Market & Forecast

7. Market Share – France Furniture Analysis

7.1 By Ordering Method

7.2 By Segment

7.3 By Material

7.4 By Type

8. Ordering Method – France Furniture Market

8.1 Online Furniture Market

8.2 Offline Furniture Market

9. Segment - France Furniture Market

9.1 Bedroom Furniture

9.2 Home Décor

9.3 Home Office Furniture

9.4 Kitchen & Dining Furniture

9.5 Lamps & Lighting

9.6 Living Room Furniture

9.7 Outdoor Furniture

10. Material - France Furniture Market

10.1 Plastic

10.2 Wood

10.3 Metal

10.4 Others

11. Type – France Furniture Market

11.1 Residential

11.2 Commercial

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Import Regulations

14. Mergers & Acquisitions

15. Company Analysis

15.1 Roche Bobois

15.1.1 Overview

15.1.2 Recent Developments

15.1.3 Revenue Analysis

15.2 IKEA

15.2.1 Overview

15.2.2 Recent Developments

15.2.3 Revenue Analysis

15.3 Maisons du Monde

15.3.1 Overview

15.3.2 Recent Developments

15.3.3 Revenue Analysis

15.4 MillerKnoll, Inc.

15.4.1 Overview

15.4.2 Recent Developments

15.4.3 Revenue Analysis

15.5 La-Z-Boy Inc.

15.5.1 Overview

15.5.2 Recent Developments

15.5.3 Revenue Analysis

List of Figures:

Figure-01: France – Furniture Market (Billion US$), 2018 – 2022

Figure-02: France – Forecast for Furniture Market (Billion US$), 2023 – 2028

Figure-03: Ordering Method – Online Furniture Market (Billion US$), 2018 – 2022

Figure-04: Ordering Method – Forecast for Online Furniture Market (Billion US$), 2023 – 2028

Figure-05: Ordering Method – Offline Furniture Market (Billion US$), 2018 – 2022

Figure-06: Ordering Method – Forecast for Offline Furniture Market (Billion US$), 2023 – 2028

Figure-07: Segment – Bedroom Furniture Market (Billion US$), 2018 – 2022

Figure-08: Segment – Forecast for Bedroom Furniture Market (Billion US$), 2023 – 2028

Figure-09: Segment – Home Décor Market (Billion US$), 2018 – 2022

Figure-10: Segment – Forecast for Home Décor Market (Billion US$), 2023 – 2028

Figure-11: Segment – Home Office Furniture Market (Million US$), 2018 – 2022

Figure-12: Segment – Forecast for Home Office Furniture Market (Million US$), 2023 – 2028

Figure-13: Segment – Kitchen & Dining Furniture Market (Billion US$), 2018 – 2022

Figure-14: Segment – Forecast for Kitchen & Dining Furniture Market (Billion US$), 2023 – 2028

Figure-15: Segment – Lamps & Lighting Market (Billion US$), 2018 – 2022

Figure-16: Segment – Forecast for Lamps & Lighting Market (Billion US$), 2023 – 2028

Figure-17: Segment – Living Room Furniture Market (Billion US$), 2018 – 2022

Figure-18: Segment – Forecast for Living Room Furniture Market (Billion US$), 2023 – 2028

Figure-19: Segment – Outdoor Furniture Market (Billion US$), 2018 – 2022

Figure-20: Segment – Forecast for Outdoor Furniture Market (Billion US$), 2023 – 2028

Figure-21: Material – Plastic Market (Billion US$), 2018 – 2022

Figure-22: Material – Forecast for Plastic Market (Billion US$), 2023 – 2028

Figure-23: Material – Wood Market (Billion US$), 2018 – 2022

Figure-24: Material – Forecast for Wood Market (Billion US$), 2023 – 2028

Figure-25: Material – Metal Market (Billion US$), 2018 – 2022

Figure-26: Material – Forecast for Metal Market (Billion US$), 2023 – 2028

Figure-27: Material – Others Market (Billion US$), 2018 – 2022

Figure-28: Material – Forecast for Others Market (Billion US$), 2023 – 2028

Figure-29: Type – Residential Market (Billion US$), 2018 – 2022

Figure-30: Type – Forecast for Residential Market (Billion US$), 2023 – 2028

Figure-31: Type – Commercial Market (Billion US$), 2018 – 2022

Figure-32: Type – Forecast for Commercial Market (Billion US$), 2023 – 2028

Figure-33: Roche Bobois – Global Revenue (Million US$), 2018 – 2022

Figure-34: Roche Bobois – Forecast for Global Revenue (Million US$), 2023 – 2028

Figure-35: IKEA – Global Revenue (Billion US$), 2018 – 2022

Figure-36: IKEA – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-37: Maisons du Monde – Global Revenue (Billion US$), 2018 – 2022

Figure-38: Maisons du Monde – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-39: MillerKnoll, Inc. – Global Revenue (Billion US$), 2018 – 2022

Figure-40: MillerKnoll, Inc. – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-41: La-Z-Boy Inc. – Global Revenue (Billion US$), 2018 – 2022

Figure-42: La-Z-Boy Inc. – Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: France – Furniture Market Share by Ordering Method (Percent), 2018 – 2022

Table-02: France – Forecast for Furniture Market Share by Ordering Method (Percent), 2023 – 2028

Table-03: France – Furniture Market Share by Segment (Percent), 2018 – 2022

Table-04: France – Forecast for Furniture Market Share by Segment (Percent), 2023 – 2028

Table-05: France – Furniture Market Share by Material (Percent), 2018 – 2022

Table-06: France – Forecast for Furniture Market Share by Material (Percent), 2023 – 2028

Table-07: France – Furniture Market Share by Type (Percent), 2018 – 2022

Table-08: France – Forecast for Furniture Market Share by Type (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com