European Office Furniture Market Trends and Forecast 2025–2033

Buy NowEuropean Office Furniture Market Size and Forecast

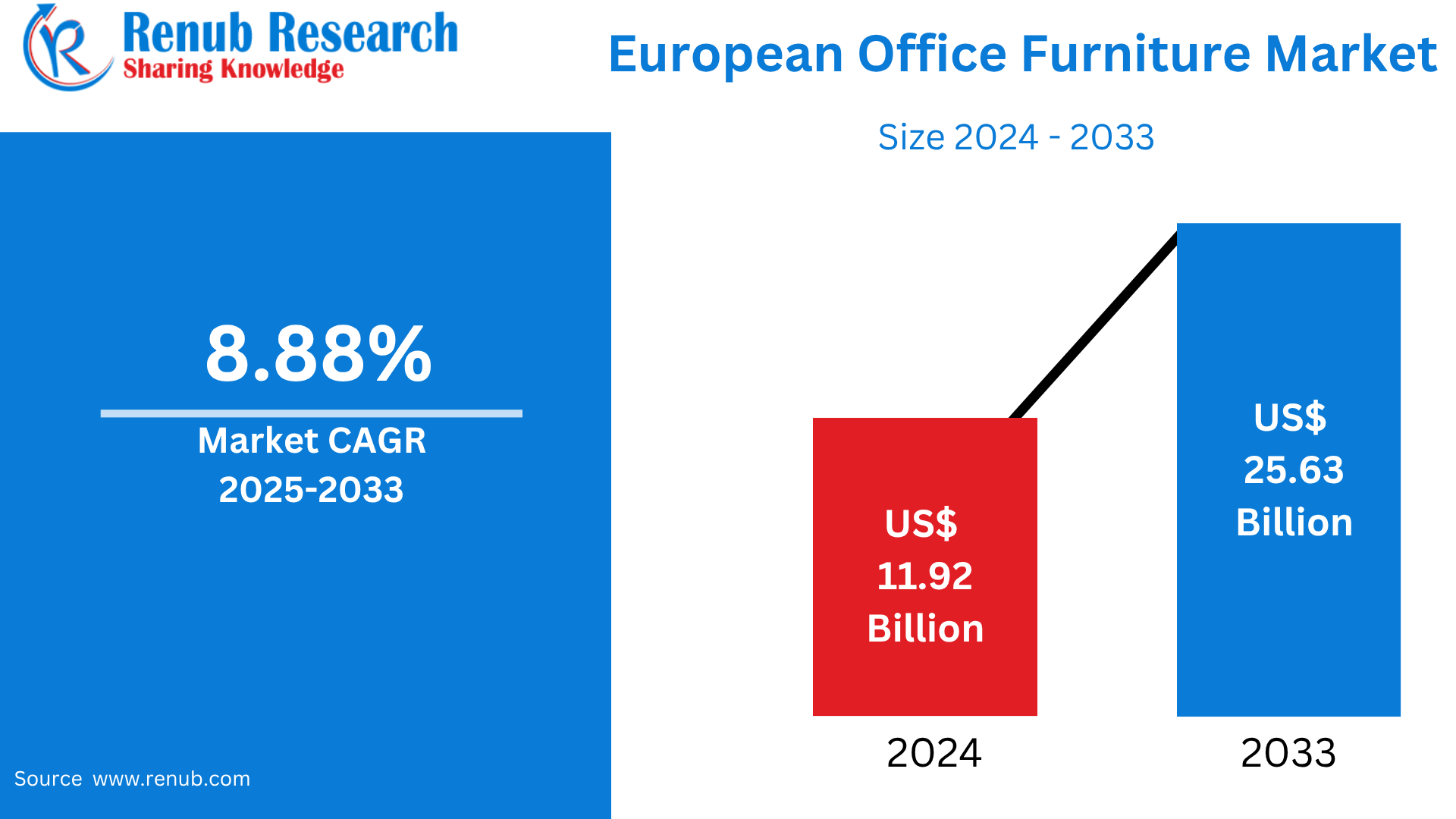

European Office Furniture Market is expected to reach US$ 25.63 billion by 2033 from US$ 11.92 billion in 2024, with a CAGR of 8.88% from 2025 to 2033. Hybrid work trends, ergonomic awareness, the need for sustainable design, and rising investment in home office settings are driving the European office furniture industry and encouraging innovation in modular, eco-friendly, and space-efficient furniture solutions throughout the area.

European Office Furniture Market Report by Material Type (Wood, Metal, plastic and Fiber, Glass, Others), Product Type (Seating, Systems, Tables, Storage Units and File Cabinets, Overhead Bins, Others), Distribution Channel (Online Stores, Flagship Stores, Specialty Stores, Home Centers, Other Distribution Channels), Countries (France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Russia, Poland, Greece, Norway, Romania, Portugal, Rest of Europe) and Company Analysis, 2025-2033.

European Office Furniture Industry Overview

The continuously changing work environments, design trends, and environmental goals are all influencing the European office furniture market. Demand for adaptable, ergonomic, and multipurpose furniture that supports both home and traditional office environments has increased as a result of the growth of hybrid and remote work models. Businesses are spending money on space-efficient and collaborative solutions to improve worker well-being and productivity. Another important factor is environmental concerns, which push manufacturers to use circular design principles and eco-friendly materials. The sector serves a variety of markets in Western and Eastern Europe and consists of both well-known companies and creative newcomers. The European office furniture market continues to prioritize flexibility, aesthetic appeal, and sustainable development methods in response to shifting workplace demands.

As workplaces change and economic situations vary, the European office furniture market is changing as well. The IMF predicts that Europe's total growth will be 1.5% in 2024, with advanced economies growing from 0.7% to 1.2% and developing European economies recovering more sharply from around 1% to roughly 3%. A solid basis for the growth of business furniture is being established by the European Central Bank's decision to keep interest rates constant and the slow recovery of consumer spending power. Renovating and refurbishing business premises is being driven by the current economic climate, especially in metropolitan areas where modernizing workplaces is a top concern.

Key Factors Driving the European Office Furniture Market Growth

Growth of Remote and Hybrid Work Models

The need for office space has changed throughout Europe as a result of the move toward remote and hybrid work arrangements. The need for adaptable, ergonomic office furniture is rising as businesses restructure workspaces to suit remote workers and flexible schedules. While corporate workplaces look for flexible solutions that facilitate social separation and cooperation, home office settings need small, practical furnishings. Innovation in space-saving storage units, ergonomic seats, and flexible workstations is fueled by this shift. As businesses strive to combine employee comfort, productivity, and safety, office furniture's versatility has emerged as a key market driver. The market's consistent growth is mostly due to the rising significance of designing productive, healthful workspaces.

Increasing Knowledge of Employee Wellness and Ergonomics

Recognizing that ergonomic furniture lowers pain and boosts productivity, European businesses are placing a greater emphasis on the health and wellbeing of their employees. The demand for desks, chairs, and other items that improve posture, lessen strain, and encourage movement during working hours is fueled by this understanding. Employers are encouraged to invest in high-quality office furniture by governments and workplace safety rules, which also promote ergonomic standards. Knowledge workers and computer-heavy businesses are particularly fond of ergonomic designs. As a result, producers concentrate on creating furniture that is supporting, flexible, and adaptable in order to satisfy changing workplace health regulations, which fuels market expansion.

Eco-Friendly and Sustainable Design

The market for office furniture in Europe is being significantly shaped by sustainability, as businesses and customers look for more ecologically friendly items. Manufacturers are using circular economy concepts like modularity and recyclability, as well as environmentally friendly materials like recycled metal, plastic, and wood. Consumer trust and brand reputation are enhanced by certifications and adherence to environmental norms. Aiming to reduce waste and carbon footprints, this green shift is a reflection of larger European legal frameworks and societal awareness. The sector attracts environmentally concerned customers by incorporating sustainability into design and production, which promotes long-term market expansion and innovation.

Challenges in the European Office Furniture Market

Changing Dynamics at Work and Unpredictable Demand

Accurate demand forecasting has become difficult for suppliers and manufacturers due to the rapid changes in workplace paradigms, such as the emergence of remote and hybrid working. Traditional office furniture requirements have changed, leading to inventory imbalances, even if demand for home office furniture has increased. Large-scale procurement is slowed down and corporate investment decisions are complicated by post-pandemic uncertainty around office space use. Furthermore, the trend toward adaptable, multifunctional furniture necessitates ongoing product innovation, which may raise development expenses. Businesses are under pressure to balance production, inventory control, and innovation in an uncertain demand environment, which has an impact on long-term planning and profitability.

Market saturation and intense competition

There are many well-known brands and up-and-coming companies fighting for market share in the fiercely competitive and fragmented European office furniture industry. Price competitiveness is heightened by this saturation, which reduces profit margins and growth prospects. When several businesses provide comparable ecological and ergonomic solutions, differentiation becomes challenging. Additionally, conventional distribution channels are being challenged by the rise of direct-to-consumer and internet merchants, which forces businesses to modify their marketing and sales tactics. Businesses must constantly innovate and make expensive investments in brand positioning if they want to remain competitive. To keep a competitive edge in the crowded market, strategic attention must be paid to value-added services or specialized markets.

European Office Furniture Market Overview by Regions

The need for office furniture in Europe varies by area; corporate hubs in Western Europe drive demand, while economic growth and the growing use of contemporary workplace solutions in Eastern Europe indicate considerable potential. The following provides a market overview by region:

Germany Office Furniture Market

Germany boasts one of Europe's most developed and technologically sophisticated office furniture markets. The nation's robust business sector and emphasis on worker well-being are the main drivers of the steady demand for high-quality, ergonomic office furniture. Furniture that promotes comfort, productivity, and adherence to safety and health standards is given top priority by businesses. In order to comply with strict environmental regulations, businesses are embracing eco-friendly products and the concepts of the circular economy. The need for flexible and modular furniture solutions that can adjust to shifting workplace setups has risen due to the emergence of hybrid work patterns. Germany is a vital center in the larger European office furniture scene because of its strong manufacturing base and innovation-driven sector, which support consistent market development.

France European Office Furniture Market

The French office furniture industry is distinguished by a fusion of contemporary design and traditional workmanship, which reflects the nation's strong emphasis on aesthetics and rich cultural legacy. Manufacturers concentrate on producing furniture solutions that meet a variety of workplace requirements while being aesthetically pleasing, ergonomic, and useful. A major trend is sustainability, as demand for environmentally friendly products and manufacturing techniques rises. The industry has been further impacted by the emergence of remote and hybrid work models, which has increased consumer demand for furniture designs that are flexible and take up less room. Additionally, customization is becoming more popular as companies look for furniture that complements their company culture and brand identity. All things considered, the French office furniture industry is still developing, striking a balance between innovation and heritage to satisfy the shifting needs of contemporary workplaces.

Italy Vitamin Market

Italy's office furniture industry is well known for fusing modern design with traditional workmanship, which reflects the nation's emphasis on aesthetics and rich cultural legacy. Manufacturers concentrate on producing furniture solutions that meet a variety of workplace requirements while being aesthetically pleasing, ergonomic, and useful. A major trend is sustainability, as demand for environmentally friendly products and manufacturing techniques rises. The industry has been further impacted by the emergence of remote and hybrid work models, which has increased consumer demand for furniture designs that are flexible and take up less room. Additionally, customization is becoming more popular as companies look for furniture that complements their company culture and brand identity. All things considered, the Italian office furniture industry is still developing, striking a balance between innovation and heritage to satisfy the shifting needs of contemporary workplaces.

United Kingdom Vitamin Market

Growing workplace dynamics and increased awareness of employee well-being are driving considerable change in the UK office furniture sector. The need for adaptable, ergonomic, and space-efficient furniture solutions that operate in both home and office settings has grown as a result of the popularity of remote and hybrid working models. Businesses and consumers are placing a high priority on sustainability, giving eco-friendly materials and circular design techniques top priority. The industry is also being impacted by technological developments, which have resulted in the incorporation of modular designs and smart furnishings that facilitate flexible and cooperative work environments. The need for contemporary office furniture is also being fueled by the expansion of commercial real estate and workplace renovations. In general, the market for office furniture in the UK is changing to accommodate the shifting demands of modern workplaces.

Market Segmentations

Material Type

- Wood

- Metal

- plastic and Fiber

- Glass

- Others

Product Type

- Seating

- Systems

- Tables

- Storage Units and File Cabinets

- Overhead Bins

- Others

Distribution Channel

- Online Stores

- Flagship Stores

- Specialty

- Home Centers

- Other Distribution Channels

Regional Outlook

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

All the Key players have been covered

- Overviews

- Key Person

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Steelcase

- Kinnarps

- Nowy Styl

- Ahrend Group

- Haworth Europe

- Herman Miller Europe

- Narbutas

- Sedus Stoll

- Senator

- Vitra

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Material Type, Product Type, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. European Office Furniture Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Material Type

6.2 By Product Type

6.3 By Distribution Channel

6.4 By Countries

7. Material Type

7.1 Wood

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Metal

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

7.3 Plastic and Fiber

7.3.1 Market Analysis

7.3.2 Market Size & Forecast

7.4 Glass

7.4.1 Market Analysis

7.4.2 Market Size & Forecast

7.5 Others

7.5.1 Market Analysis

7.5.2 Market Size & Forecast

8. Product Type

8.1 Seating

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Systems

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Tables

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

8.4 Storage Units and File Cabinets

8.4.1 Market Analysis

8.4.2 Market Size & Forecast

8.5 Overhead Bins

8.5.1 Market Analysis

8.5.2 Market Size & Forecast

8.6 Others

8.6.1 Market Analysis

8.6.2 Market Size & Forecast

9. Distribution Channel

9.1 Online Stores

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Flagship Stores

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

9.3 Specialty Stores

9.3.1 Market Analysis

9.3.2 Market Size & Forecast

9.4 Home Centers

9.4.1 Market Analysis

9.4.2 Market Size & Forecast

9.5 Other Distribution Channels

9.5.1 Market Analysis

9.5.2 Market Size & Forecast

10. Countries

10.1 France

10.1.1 Market Analysis

10.1.2 Market Size & Forecast

10.2 Germany

10.2.1 Market Analysis

10.2.2 Market Size & Forecast

10.3 Italy

10.3.1 Market Analysis

10.3.2 Market Size & Forecast

10.4 Spain

10.4.1 Market Analysis

10.4.2 Market Size & Forecast

10.5 United Kingdom

10.5.1 Market Analysis

10.5.2 Market Size & Forecast

10.6 Belgium

10.6.1 Market Analysis

10.6.2 Market Size & Forecast

10.7 Netherlands

10.7.1 Market Analysis

10.7.2 Market Size & Forecast

10.8 Russia

10.8.1 Market Analysis

10.8.2 Market Size & Forecast

10.9 Poland

10.9.1 Market Analysis

10.9.2 Market Size & Forecast

10.10 Greece

10.10.1 Market Analysis

10.10.2 Market Size & Forecast

10.11 Norway

10.11.1 Market Analysis

10.11.2 Market Size & Forecast

10.12 Romania

10.12.1 Market Analysis

10.12.2 Market Size & Forecast

10.13 Portugal

10.13.1 Market Analysis

10.13.2 Market Size & Forecast

10.14 Rest of Europe

10.14.1 Market Analysis

10.14.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 Steelcase

14.2 Kinnarps

14.3 Nowy Styl

14.4 Ahrend Group

14.5 Haworth Europe

14.6 Herman Miller Europe

14.7 Narbutas

14.8 Sedus Stoll

14.9 Senator

14.10 Vitra

15. Key Players Analysis

15.1 Steelcase

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Kinnarps

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Nowy Styl

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 Ahrend Group

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Haworth Europe

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Herman Miller Europe

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Narbutas

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 Sedus Stoll

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Senator

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Vitra

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com