Europe Electric Vehicle Charging Infrastructure Market Report 2025–2033

Buy NowEurope Electric Vehicle Charging Infrastructure Market Size and Forecast

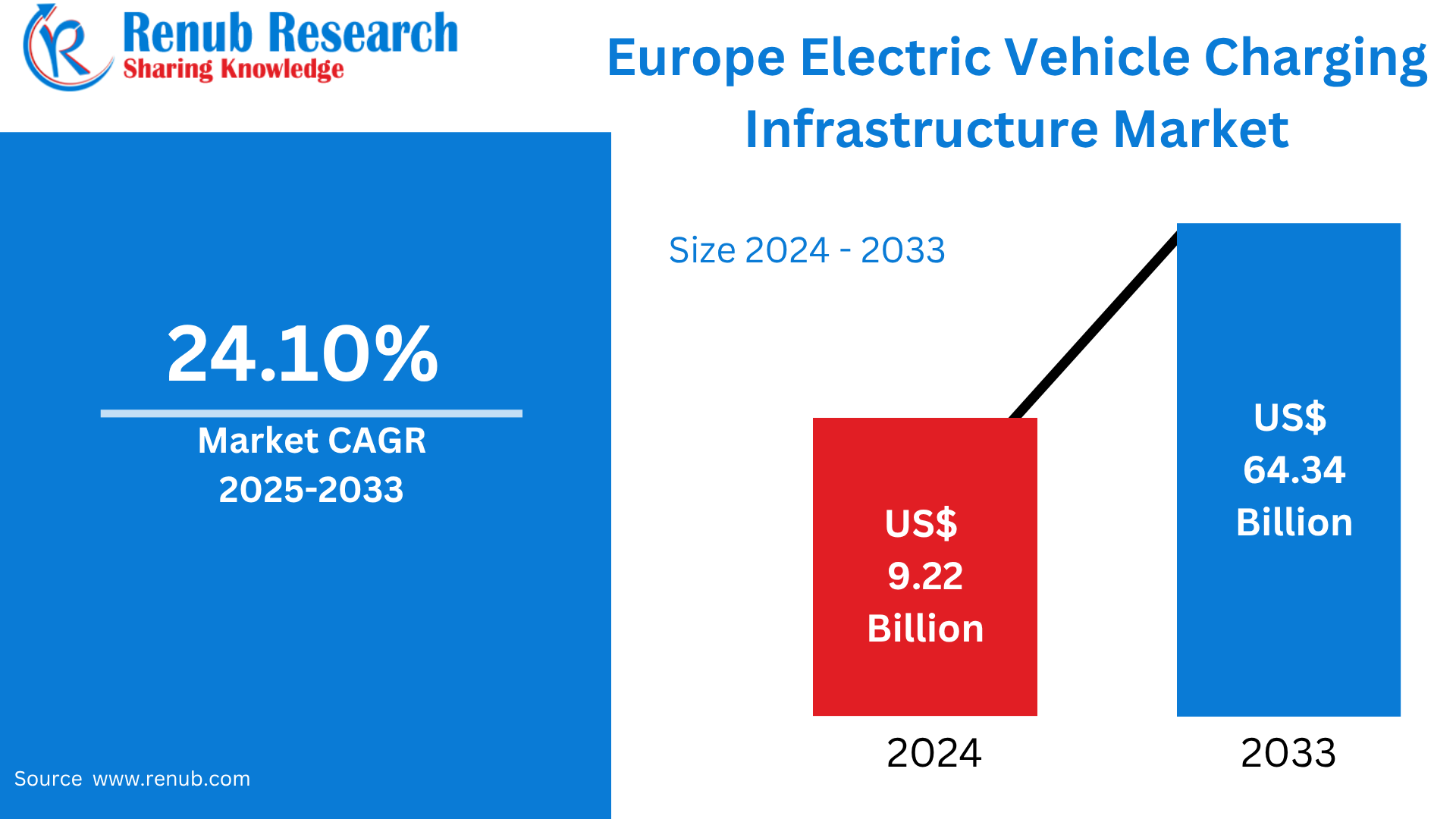

Europe Electric Vehicle Charging Infrastructure Market is expected to reach US$ 64.34 Billion by 2033 from US$ 9.22 Billion in 2024, with a CAGR of 24.10% from 2025 to 2033. Due to the region's strong government stimulus, rapid EV growth, extensive infrastructure expenditure, urbanization, and the presence of important EV production facilities that support the country's continuous charging network expansion, the region dominates the market.

Europe Electric Vehicle Charging Infrastructure Market Report by Charger Type (Slow Charger, Fast Charger), Charging Type (AC Charging, DC Charging), Installation Type (Fixed, Portable), Connector (CHAdeMO, CCS, Others), Level of Charging (Level 1, Level 2, Level 3), Connectivity (Non-connected Charging Stations, Connected Charging Stations), Deployment (Private, Public), Application (Commercial, Residential), Countries and Company Analysis, 2025-2033.

Europe Electric Vehicle Charging Infrastructure Industry Overview

The fast growth of Europe's electric vehicle (EV) charging infrastructure is being fueled by national policies and ambitious EU objectives to reduce carbon emissions. There were around 700,000 public charging stations in the EU as of the end of 2023, with a notable rise in both AC and DC chargers across the board from the year before. The European Commission has set a target of 3.5 million charging stations by 2030; however, this increase is insufficient, thus installation rates must be significantly accelerated.

Supportive governmental regulations, improvements in charging technology, and the growing popularity of electric vehicles throughout the continent are the main forces behind this spread. Norway has the most charging stations per person, and nations like the Netherlands, Germany, and Norway are setting the standard. In line with environmental objectives, the incorporation of renewable energy sources, such wind and solar, into charging infrastructure is also accelerating. Even with these developments, there are still obstacles to overcome, such as the requirement for large financial outlays, regulatory cooperation, and the creation of intelligent charging systems to guarantee that the infrastructure can accommodate the rising demand.

Investments and activities supporting the installation of EV charging stations in the area will be boosted by the high carbon reduction objectives established by a number of programs and policies, including as the European Union Green Deal and the Fit for 55 packages. For example, in February 2025, more than 3,500 enterprises that supply EV charging solutions agreed to quadruple their workforce in order to increase electric mobility throughout the area. This means that over 162,000 jobs will be created between 2025 and 2030.

The industry picture is being complemented by the growing implementation of higher emission standards as well as collaborations and agreement to construct EV charging stations around the area. For instance, in February 2025, a collaboration including E.ON, Eldrive, and ZSE was established with the goal of deploying over 1,400 charging stations across 13 countries in the area by 2027 with a total expenditure of over USD 47 million. These are anticipated to lead to the construction of medium and fast charging stations, which will contribute to the expansion of industry.

Key Factors Driving the Europe Electric Vehicle Charging Infrastructure Market Growth

Growing Private Sector Investment

An increase in private sector participation is helping the European market for EV charging infrastructure. Large energy providers, automakers, and IT firms are making significant investments in the creation and growth of charging networks. The adoption of both public and commercial charging systems is accelerated by the financial resources, technological know-how, and inventiveness contributed by these players. In order to promote their EV lineups and increase consumer loyalty and charging accessibility, automakers are now setting up private charging networks. Public-private partnerships (PPPs) are also growing in popularity, particularly for major infrastructure projects that need coordinated administration and finance. In order to serve Europe's expanding fleet of electric cars, a more unified and extensive charging network is made possible by these partnerships, which are crucial in filling up infrastructure gaps in both urban and rural locations.

Sustainability Goals and Emission Targets

The expansion of EV charging infrastructure is mostly being driven by Europe's dedication to sustainability and climate action. Regulations and incentives to phase out internal combustion engine cars have been prompted by the European Union's ambitious aims to achieve carbon neutrality by 2050. With future restrictions on gasoline and diesel vehicles promised by nations like Germany, France, and the UK, the transition to electric transportation seems unavoidable. A strong, easily available charging network is essential to facilitating this shift. In order to meet national and EU-wide goals for lowering greenhouse gas emissions from the transportation sector, charging infrastructure is essential. As a result, infrastructure development is being prioritized by both public and commercial organizations as a key component of long-term environmental policy.

Urbanization and Smart City Development

Integrating EV charging infrastructure into the larger urban ecology is becoming more and more important as European towns continue to urbanize and embrace smart city concepts. The installation of EV chargers is strongly related to smart cities' emphasis on digital connection, sustainable transportation, and economical energy consumption. To accommodate the expanding EV population, smart, grid-connected charging stations are being installed in more and more residential complexes, business districts, and public transportation hubs. These systems frequently incorporate renewable energy, demand response capabilities, and energy management techniques. By emphasizing clean, connected urban transportation, EV infrastructure is certain to remain a crucial component of city planning, speeding up rollout and enhancing accessibility throughout metropolitan areas.

Challenges in the Europe Electric Vehicle Charging Infrastructure Market

Uneven Infrastructure Deployment

The unequal distribution of charging stations around the continent is one of the main issues confronting the European EV charging infrastructure industry. With extensive networks of slow and fast chargers, nations like the Netherlands, Germany, and Norway have made significant strides. On the other hand, because to lower EV adoption rates, fewer official assistance, and financial limitations, many Eastern and Southern European countries continue to face infrastructural challenges. The ecosystem becomes fractured as a result of this discrepancy, undermining the ease and trust required for broad EV use. Additionally, it makes cross-border travel more challenging, which makes long-distance travel challenging for EV owners. Coordination of EU-wide policies and investment incentives is necessary to close this gap and guarantee a more standardized and easily accessible infrastructure throughout all member states.

High Installation and Maintenance Costs

It costs a lot of money to set up EV charging infrastructure, especially high-capacity fast chargers. The requirement for civil engineering work, grid improvements, and the purchase of suitable sites—particularly in remote or low-traffic areas—raise costs. Furthermore, the installation procedure frequently has to adhere to strict environmental and municipal standards, which can cause delays and complexity. Costs associated with customer service, energy management, and continuing maintenance are also high when the business is up and running. These costs may discourage local governments and private investors from growing networks, especially in places where EV adoption is minimal. In order to improve infrastructure viability and long-term sustainability, governments and private players must work together to develop cost-sharing models and investigate creative funding strategies.

Europe Electric Vehicle Charging Infrastructure Market Overview by Regions

With extensive networks in Germany, the Netherlands, and France, Western Europe dominates the market for EV charging infrastructure, whereas Eastern and Southern Europe trail behind because of slower EV uptake and less government funding. The following provides a market overview by region:

United Kingdom Electric Vehicle Charging Infrastructure Market

Strong government efforts, environmental regulations, and growing consumer demand for greener transportation are all contributing to the UK's EV charging infrastructure market's steady rise. The UK is making significant investments to develop public and commercial charging networks as part of a well-defined plan to phase out internal combustion engine cars. Along with promoting home and office charging options, efforts are concentrated on expanding the number of fast and ultra-fast chargers that are available in cities and along roads. Regional differences and access issues in rural regions are still problematic, though. Additionally, the private sector is becoming more involved in the market, which is fostering innovation, better user experiences, and the incorporation of renewable energy sources into charging networks.

Germany Electric Vehicle Charging Infrastructure Market

The market for electric vehicle (EV) charging infrastructure in Germany is expanding significantly due to strong government efforts and rising consumer demand for environmentally friendly modes of transportation. With the goal of installing more than a million charging stations by 2030, the German government has set high goals to grow the EV charging network. Numerous financial initiatives and incentives are in place to assist this growth, which aims to stimulate both public and private investments in charging infrastructure. The private sector is also becoming more involved, with automakers and energy providers helping to create a wide-ranging and easily accessible network of charging stations. Notwithstanding these initiatives, issues like regional differences in the accessibility of charging stations and the requirement for grid modernization still exist, calling for ongoing cooperation between governmental organizations, business interests, and local communities to guarantee fair access to EV charging stations nationwide.

Italy Electric Vehicle Charging Infrastructure Market

As the use of electric transportation increases, Italy is aggressively developing its infrastructure for EV charging. Government programs are promoting the establishment of charging stations all around the nation, including financial incentives and regulatory actions. Businesses that invest in the creation and growth of charging networks demonstrate the importance of the private sector's engagement. These initiatives seek to improve EV charging's usability and accessibility by addressing important aspects such charging speed, availability, and user experience. The need for ongoing investment, stakeholder cooperation, and resolving regional differences in infrastructure availability are some of the obstacles that still need to be overcome in spite of these developments. Italy's dedication to developing its EV charging network, however, is an essential step in reaching its sustainability and environmental objectives.

France Electric Vehicle Charging Infrastructure Market

In order to facilitate the increasing use of electric transportation, France is aggressively developing its infrastructure for EV charging. Financial incentives and regulatory measures are among the initiatives the government has put in place to promote the installation of charging stations. The private sector is also heavily involved, as businesses invest in the creation and growth of nationwide charging networks. By addressing important aspects including charging speed, availability, and user experience, these initiatives seek to improve EV charging's accessibility and convenience. Notwithstanding these developments, there are still issues to be resolved, such as the requirement for ongoing funding, stakeholder cooperation, and resolving regional differences in infrastructure accessibility. However, a key step in accomplishing its environmental and sustainability objectives is France's dedication to developing its EV charging infrastructure.

Market Segmentations

Charger Type

- Slow Charger

- Fast Charger

Charging Type

- AC Charging

- DC Charging

Installation Type

- Fixed

- Portable

Connector

- CHAdeMO

- CCS

- Others

Level of Charging

- Level 1

- Level 2

- Level 3

Connectivity

- Non-connected Charging Stations

- Connected Charging Stations

Deployment

- Private

- Public

Application

- Commercial

- Residential

Regional Outlook

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- ABB Ltd.

- ChargePoint, Inc.

- Blink Charging Co.

- Eaton Corporation

- Tesla Inc.

- Webasto Group

- Schneider Electric, Inc.

- Siemens

- Delta Electronics, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Charger Type, Charging Type, Installation Type, Connector, Level of Charging, Connectivity, Deployment, Application and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Electric Vehicle Charging Infrastructure Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Charger Type

6.2 By Charging Type

6.3 By Installation Type

6.4 By Connector

6.5 By Level of Charging

6.6 By Connectivity

6.7 By Deployment

6.8 By Application

6.9 By Countries

7. Charger Type

7.1 Slow Charger

7.2 Fast Charger

8. Charging Type

8.1 AC Charging

8.2 DC Charging

9. Installation Type

9.1 Fixed

9.2 Portable

10. Connector

10.1 CHAdeMO

10.2 CCS

10.3 Others

11. Level of Charging

11.1 Level 1

11.2 Level 2

11.3 Level 3

12. Connectivity

12.1 Non-connected Charging Stations

12.2 Connected Charging Stations

13. Deployment

13.1 Private

13.2 Public

14. Application

14.1 Commercial

14.2 Residential

15. Countries

15.1 France

15.2 Germany

15.3 Italy

15.4 Spain

15.5 United Kingdom

15.6 Belgium

15.7 Netherlands

15.8 Russia

15.9 Poland

15.10 Greece

15.11 Norway

15.12 Romania

15.13 Portugal

15.14 Rest of Europe

16. Porter’s Five Forces Analysis

16.1 Bargaining Power of Buyers

16.2 Bargaining Power of Suppliers

16.3 Degree of Rivalry

16.4 Threat of New Entrants

16.5 Threat of Substitutes

17. SWOT Analysis

17.1 Strength

17.2 Weakness

17.3 Opportunity

17.4 Threat

18. Key Players Analysis

18.1 ABB Ltd.

18.1.1 Overviews

18.1.2 Key Person

18.1.3 Recent Developments

18.1.4 Revenue

18.2 ChargePoint, Inc.

18.2.1 Overviews

18.2.2 Key Person

18.2.3 Recent Developments

18.2.4 Revenue

18.3 Blink Charging Co.

18.3.1 Overviews

18.3.2 Key Person

18.3.3 Recent Developments

18.3.4 Revenue

18.4 Eaton Corporation

18.4.1 Overviews

18.4.2 Key Person

18.4.3 Recent Developments

18.4.4 Revenue

18.5 Tesla Inc.

18.5.1 Overviews

18.5.2 Key Person

18.5.3 Recent Developments

18.5.4 Revenue

18.6 Webasto Group

18.6.1 Overviews

18.6.2 Key Person

18.6.3 Recent Developments

18.6.4 Revenue

18.7 Schneider Electric, Inc.

18.7.1 Overviews

18.7.2 Key Person

18.7.3 Recent Developments

18.7.4 Revenue

18.8 Siemens

18.8.1 Overviews

18.8.2 Key Person

18.8.3 Recent Developments

18.8.4 Revenue

18.9 Delta Electronics, Inc.

18.9.1 Overviews

18.9.2 Key Person

18.9.3 Recent Developments

18.9.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com