Europe Corn Starch Market – Application Trends & Forecast 2025–2033

Buy NowEurope Corn Starch Market Size and Forecast 2025-2033

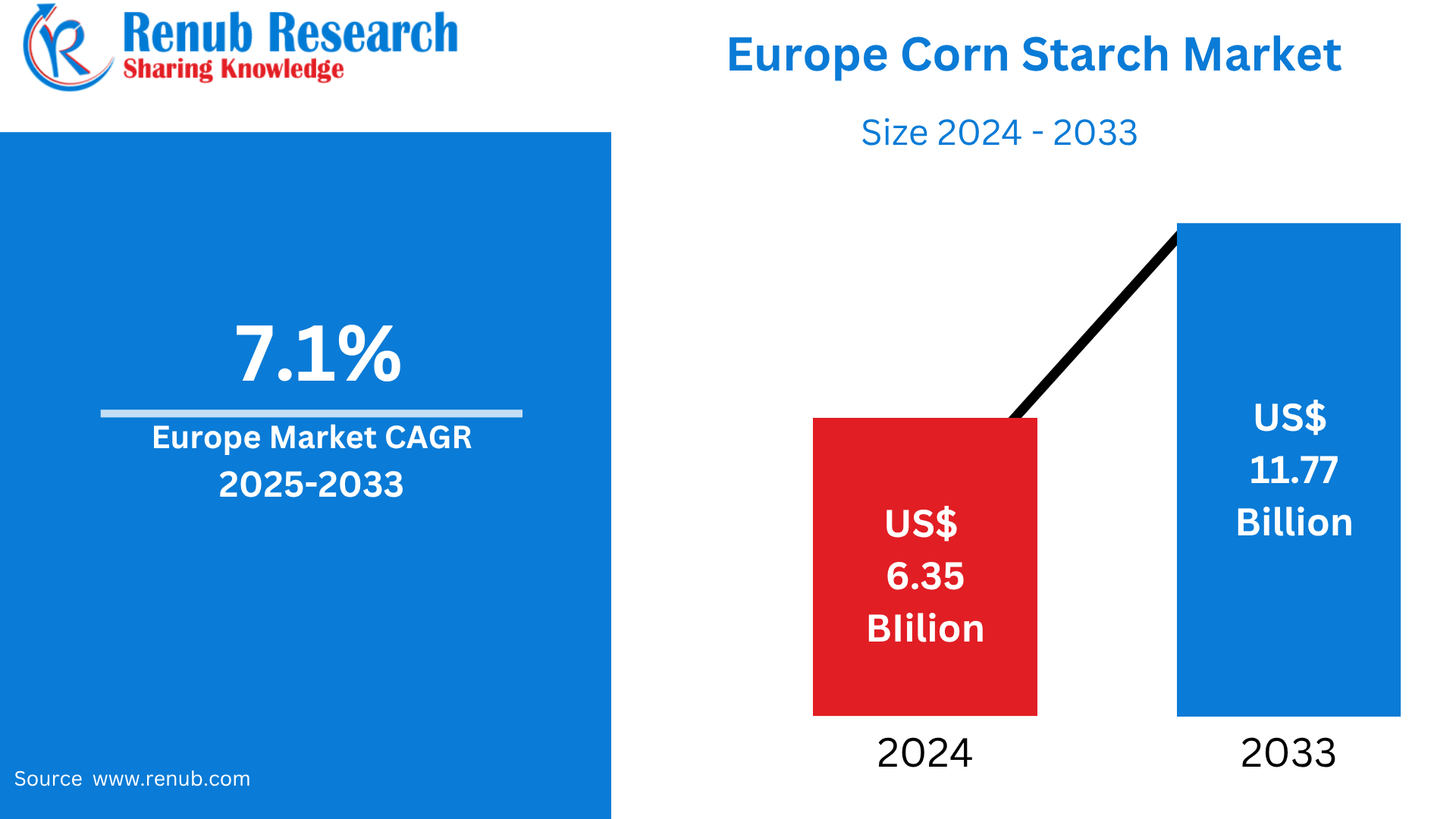

Europe Corn Starch Market is expected to reach US$ 11.77 billion by 2033 from US$ 6.35 billion in 2024, with a CAGR of 7.1% from 2025 to 2033. Growing consumer demand for gluten-free goods, expanding applications in pharmaceuticals and textiles, rising demand in food processing, and technical developments in starch extraction and modification procedures are the main factors propelling the corn starch market in Europe.

Europe Corn Starch Market Report by Type (Native, Modified, Sweeteners), Form (Powder, Liquid), End Use (Food and beverage, Animal feed, Paper and Board, Others), Countries and Company Analysis, 2025-2033.

Europe Corn Starch Market Overview

Due to its numerous uses in the food, pharmaceutical, paper, and textile sectors, maize starch accounts for a sizeable portion of the European starch market. Extracted from the endosperm of corn kernels, corn starch finds widespread application in food processing as a thickening, stabilizing, and gelling agent. Its use in clean-label and gluten-free goods is encouraging its uptake, particularly as consumers place a higher value on healthier and allergy-free options. The demand for maize starch in the food and beverage industry is further increased by its use as a sugar replacement in the form of high-fructose corn syrup.

The efficiency of maize starch manufacturing and the variety of derivative goods, such as sweeteners and modified starches, have been strengthened by technological breakthroughs. Because of their well-established agro-processing industries and advantageous legislative frameworks, nations like Germany, France, and the Netherlands are home to significant industrial facilities. The usage of bio-based goods is also encouraged by the European Union's agricultural subsidies and environmental goals, which support the growth of corn starch applications in green chemicals and biodegradable packaging. Consistent output may be hampered by changes in maize prices and supplies, which are mostly caused by weather patterns and import dependence.

The market is anticipated to keep rising in the future due to advancements in starch modification and increased uses in non-food industries such bioplastics, adhesives, and medicines. It is projected that increased R&D expenditures would improve maize starch's performance in industrial applications and provide novel functional ingredients. Furthermore, the industry's future is being shaped by persistent changes in eating patterns, growing urbanization, and a proactive attitude toward sustainable production methods. With the help of both established applications and new developments in green technology, the maize starch market in Europe is still robust and flexible overall.

Key Factors Driving the Europe Corn Starch Market Growth

Rising Demand in the Food & Beverage Industry

Because of its many uses as a thickening, stabilizing, and texture-enhancing ingredient, corn starch is essential to the food and beverage industry. It is frequently found in processed foods such baked products, soups, sauces, gravies, ready meals, and desserts. The demand for packaged and processed foods is rising as more and more European consumers choose quick and easy meal choices. Corn starch greatly improves product quality and shelf stability by assisting producers in meeting standards for flavor, texture, and uniformity. Its popularity is also being bolstered by the increased emphasis on clean-label and plant-based formulations, since maize starch is seen as a natural and less processed component that appeals to customers who are concerned about their health and the environment.

Increasing Popularity of Gluten-Free Products

Corn starch is a crucial component of product formulations because of the significant demand for gluten-free food alternatives brought on by the increased knowledge of celiac illness and gluten sensitivity. Corn starch is frequently utilized in baked goods, snacks, and processed foods for those with gluten sensitivity since it is a naturally gluten-free carbohydrate. The European food business has seen innovation as a result of the rise in health-conscious consumers, especially those who choose to adopt gluten-free diets. In order to satisfy this expanding market, producers are repurposing conventional goods, utilizing corn starch instead of wheat flour to preserve desired textures and structures. In addition to increasing demand, the growing gluten-free market promotes premium pricing and product differentiation, opening up new growth prospects for the corn starch sector.

Expanding Industrial Applications

The use of corn starch goes well beyond food; it is highly valued in many different industrial areas. It ensures efficient drug administration in pharmaceuticals by acting as a crucial binder and disintegrant in tablet formulations. Through coating and sizing applications, maize starch enhances the strength and surface quality of paper in the paper industry. It is used in the textile industry to finish fabrics, giving them more roughness and rigidity. Corn starch is also essential for the synthesis of biodegradable polymers and adhesives, which include environmentally acceptable packaging options. The European maize starch market is robust and able to see long-term, sustainable growth because of its wide range of uses across several sectors, which guarantees steady demand and reduces dependence on a single industry.

Challenges in the Europe Corn Starch Market

Sustainability and Environmental Concerns

Even though maize starch is a bio-based product, its manufacture is associated with a number of environmental issues brought on by extensive corn farming. Common problems with large-scale corn production include high water consumption, extensive use of chemical fertilizers and pesticides, and soil damage. The EU's sustainability goals are at odds with these practices as they lead to increased greenhouse gas emissions, water pollution, and biodiversity loss. The corn starch sector is coming under more and more scrutiny as customers and regulators become more conscious of environmental issues. The European Union's stricter environmental and agricultural laws could force producers to use more environmentally friendly farming and processing practices, which could increase operating expenses. These worries may also have an impact on public opinion, particularly among environmentally concerned buyers looking for more sustainable product options.

Consumer Shift Toward Whole and Natural Foods

There is a discernible trend toward minimally processed, whole, and natural foods as European consumers place a greater emphasis on health and wellness. Given that maize starch is frequently perceived as a processed product or addition, this development poses a threat to the corn starch business. Although it is still frequently found in processed and convenience meals, consumers who are health-conscious and looking for "clean label" products—those with straightforward, identifiable ingredients and little processing—are becoming less interested in it. Food makers may investigate more natural-seeming thickening and stabilizing additives like agar or chia seeds as a result of this shifting viewpoint. As a result, unless the corn starch business can better conform to changing clean label and transparency rules, it may experience a decline in demand in luxury food categories.

Europe Corn Starch Market Overview by Regions

Because of its sophisticated food processing businesses, Western Europe dominates the corn starch industry, with France and Germany playing major roles. Growing industrialization and expanding processed food consumption are driving demand in Eastern Europe. The following provides a market overview by region:

United Kingdom Corn Starch Market

The UK's thriving food and beverage sector, high demand for gluten-free goods, and growing consumer desire for quick and clean-label food alternatives all influence the country's corn starch market. Its consistent market presence is supported by the extensive usage of corn starch in processed meals, sauces, soups, and baked goods. Furthermore, the UK's emphasis on health-conscious eating has prompted food producers to use corn starch as a useful, gluten-free component. In addition to food, corn starch is used in paper, biodegradable packaging, and medicines, all of which support the nation's sustainability objectives. However, reliance on imported maize and the complexity of post-Brexit commerce may provide logistical issues that affect price and supply chains. Despite these obstacles, market resilience and development are nonetheless supported by innovation and expanding industrial application.

Germany Corn Starch Market

The market for maize starch is essential to Germany's industrial and food processing industries. Because of its many uses in the food business, such as thickening, binding, and stabilizing, corn starch is crucial for products like soups, sauces, and baked goods. Corn starch is also used in the paper, textile, and pharmaceutical sectors for its binding and stiffening properties. Interest in utilizing maize starch for biodegradable packaging and bioplastics has increased as a result of Germany's dedication to sustainability. Nevertheless, the market is confronted with obstacles including price swings for raw materials and competition from other suppliers of starch. Notwithstanding these obstacles, the market for maize starch in Germany is still expanding due to consumer desire for natural and eco-friendly components.

Italy Corn Starch Market

With important uses in food, medicine, textiles, and biodegradable materials, Italy's corn starch market is essential to the country's diverse industrial environment. Because of its thickening, stabilizing, and gelling qualities, corn starch is primarily used in food processing to improve the texture and shelf life of a variety of goods. Corn starch is used in the textile business to finish fabrics, giving them rigidity and enhancing weaving techniques, and in the pharmaceutical industry as a binder and disintegrant in tablet formulations. Additionally, the usage of maize starch in biodegradable packaging and bioplastics has expanded as a result of the increased focus on sustainability. The Italian corn starch industry is thriving due to innovation and the need for environmentally friendly substitutes, even in the face of obstacles including price swings for raw materials and environmental issues related to extensive corn cultivation.

France Corn Starch Market

A sizeable portion of France's industrial sector, the corn starch market finds uses in food, medicine, textiles, and biodegradable materials. The major user is still the food sector, which uses maize starch for its gelling, thickening, and stabilizing qualities in goods including soups, sauces, and baked goods. Corn starch is also used in textiles and pharmaceuticals for its binding and strengthening properties. Corn starch is being used more often in biodegradable packaging and bioplastics as a result of the rising focus on sustainability. Nevertheless, the market is confronted with obstacles including price swings for raw materials and competition from other suppliers of starch. Notwithstanding these obstacles, the French corn starch industry is still expanding due to consumer desire for natural and eco-friendly components.

Market Segmentations

Type

- Native

- Modified

- Sweeteners

Form

- Powder

- Liquid

End Use

- Food and beverage

- Animal feed

- Paper and Board

- Others

Regional Outlook

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Russia

- Poland

- Greece

- Norway

- Romania

- Portugal

- Rest of Europe

All the Key players have been covered

- Overview

- Key Persons

- Recent Developments

- Revenue Analysis

Company Analysis:

- Cargill Inc.

- Ingredion Inc.

- Archer Daniels Midland Company

- Tate and Lyle

- Associated British Foods plc

- Tereos Group

- Sudzucker AG

- Global Bio-Chem Technology Group Company Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021- 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Form, By End Use and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Europe Corn Starch Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Form

6.3 By End Use

6.4 By Countries

7. Type

7.1 Native

7.2 Modified

7.3 Sweeteners

8. Form

8.1 Powder

8.2 Liquid

9. End Use

9.1 Food and beverage

9.2 Animal feed

9.3 Paper and Board

9.4 Others

10. Countries

10.1 France

10.2 Germany

10.3 Italy

10.4 Spain

10.5 United Kingdom

10.6 Belgium

10.7 Netherlands

10.8 Russia

10.9 Poland

10.10 Greece

10.11 Norway

10.12 Romania

10.13 Portugal

10.14 Rest of Europe

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players Analysis

13.1 Cargill Inc.

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Ingredion Inc.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Archer Daniels Midland Company

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Tate and Lyle

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Associated British Foods plc.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Tereos Group

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Sudzucker AG

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Global Bio-Chem Technology Group Company Ltd.

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com